You Want To Avoid Required Minimum Distributions

Heres another rule that applies to a 401 but not a Roth IRA: required minimum distributions, or RMDs.

The IRS requires all 401 owners to withdraw a minimum amount from their accounts each year beginning in the year they turn 72. The exact amount depends on your balance, your age, and a life-expectancy variable determined by the IRS.

With a Roth IRA, that money has already been taxed, so RMDs are not required.

Avoiding Penalties And Interest On Roth 401k Rollovers

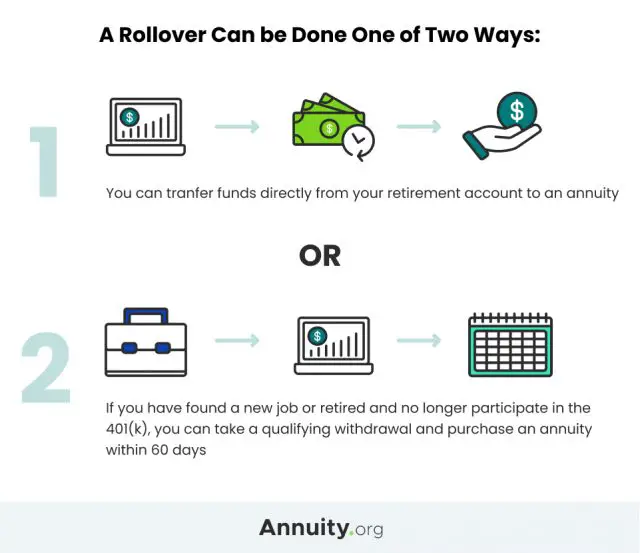

With a Roth 401k to a Roth IRA rollover, you will not need to pay any taxes as you make the conversion, and you can avoid the penalties as long as you complete the process within the 60-day deadline. If you miss it, the IRS will consider it an early withdrawal, and you will pay the 10% penalty as well as pay any taxes owed. It is important to be prepared for this if you do miss the deadline. Additionally, you will not be able to put the money back into a tax-sheltered retirement account because the contribution limits will then apply to that money.

What Are The Benefits Of A Roth Individual Retirement Account

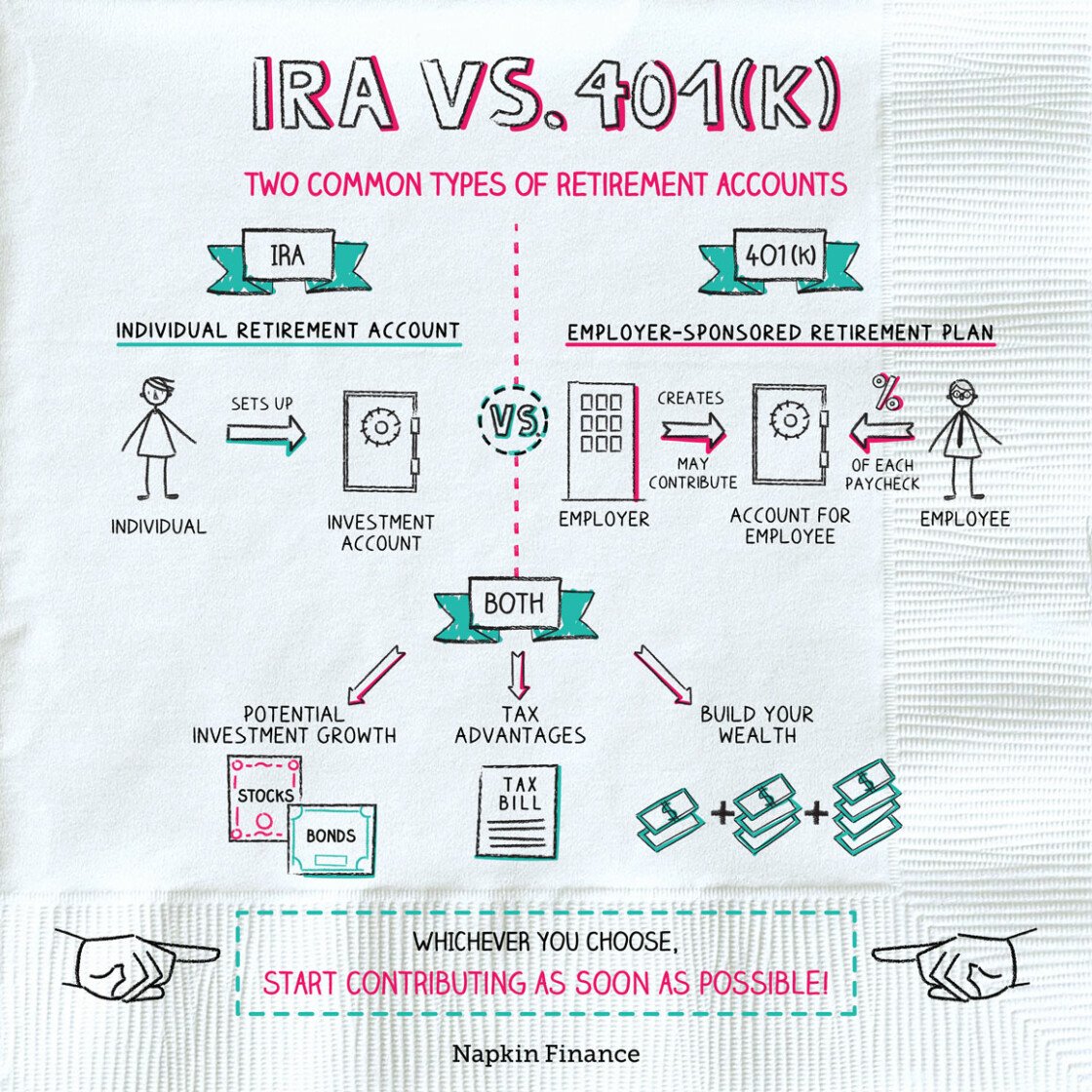

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Read Also: How To Use 401k For Home Purchase

How To Roll A 401 Into An Ira

Heres how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If youre not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

You May Like: How To Set Up A Solo Roth 401k

What Amounts May I Roll Over In An In

If your plan allows it, you can roll over any vested plan balance, including earnings, to a designated Roth account, even if these amounts cant be distributed to you. You can make an in-plan Roth rollover of:

- elective deferrals,

- after-tax employee contributions and

- earnings on the above contributions.

The plan can specify which of these amounts are eligible for in-plan Roth rollovers and how often these rollovers can be done.

Don’t Miss: How Do I Look Up My 401k

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

You Prefer Convenience Over Control

Perhaps you opened an IRA with the intention of putting together a diverse portfolio and actively managing your investments. However, youre now finding that you dont have the time or energy to devote to your portfolio and feel that youre in over your head. Rolling over your IRA to a 401 and giving up some control may better fit your needs as an investor.

Read Also: Can I Borrow From My 401k To Buy Investment Property

Is A Distribution From My Designated Roth Account For Reasons Beyond My Control A Qualified Distribution Even Though It Doesn’t Meet The Criteria For A Qualified Distribution

No, if you have not held the account for more than 5 years or if the distribution is not made after death, disability, or age 59 ½, then the distribution is not a qualified distribution. However, you could roll the distribution over into a designated Roth account in another plan or into your Roth IRA. A transfer to another designated Roth account must be made through a direct rollover.

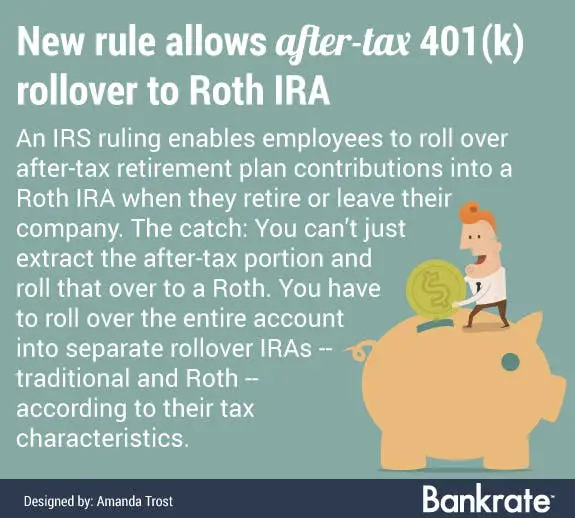

Rollover To A Roth Ira Or A Designated Roth Account

Are you eligible to receive a distribution from your 401, 403 or governmental 457 retirement plan?

You can roll over eligible rollover distributions from these plans to a Roth IRA or to a designated Roth account in the same plan .

You may want to note the differences between Roth IRAs and designated Roth accounts before you decide which type of account to choose. For example, when you reach age 70 1/2, you may have to take required minimum distributions from designated Roth accounts, but not from Roth IRAs.

Roth IRAs and designated Roth accounts only accept rollovers of money that has already been taxed. You will likely have to pay income tax on the previously untaxed portion of the distribution that you rollover to a designated Roth account or a Roth IRA.

Withdrawals from a Roth IRA or designated Roth account, including earnings, will be tax-free if you:

- have held the account for at least 5 years, and

Also Check: What Happens To 401k When You Get Fired

Be Sure To Understand The Tax Consequences Before Making The Change

If you are considering leaving a job and have a 401 plan, then you need to stay on top of the various rollover options for your workplace retirement account. One of those options is rolling over a traditional 401 into a Roth individual retirement account . This can be a very attractive option, especially if your future earnings will be high enough to knock into the ceiling placed on Roth account contributions by the Internal Revenue Service .

Regardless of the size of your earnings, you need to do the rollover strictly by the rules to avoid an unexpected tax burden. Since you havent paid income taxes on that money in your traditional 401 account, you will owe taxes on the money for the year when you roll it over into a Roth IRA. Read on to see how it works and how you can minimize the tax bite.

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Read Also: Can I Convert My 401k To Gold

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

Roth Ira Conversions Explained

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

shapecharge / Getty Images

A rollover of a 401 to a Roth IRA is the movement of funds from a 401 into a new or existing Roth IRA account. Many people consider making a Roth IRA conversion after they leave an employer to consolidate retirement accounts and take advantage of the benefits of a Roth IRA, which include tax-free investment growth and no required minimum distributions.

Additionally, if you are in a period of earning less income than usual or believe your income will be higher in the future, there are tax benefits to converting an old 401 to a Roth IRA in a low-income year. Converting a 401 to a Roth IRA involves a few, easy steps between your former workplace 401 administrator and the financial institution where your Roth IRA account is located.

With the information below, youll have a better understanding of what a Roth IRA rollover is, what advantages it provides, the steps it takes, and alternative rollover options.

Read Also: How To Enroll In 401k

Is There A Limit On How Much I May Contribute To My Designated Roth Account

Yes, the combined amount contributed to all designated Roth accounts and traditional, pre-tax accounts in any one year for any individual is limited ). The limit is $20,500 in 2022 , plus an additional $6,500 in 2020, 2021 and 2022 if you are age 50 or older at the end of the year. These limits may be increased in later years to reflect cost-of-living adjustments.

Is Income Tax Withholding Required On In

There is no income tax withholding required on an in-plan Roth direct rollover. However, if you receive a distribution from your plan, the plan must withhold 20% federal income tax on the untaxed amount even if you later roll over the distribution to a designated Roth account within 60 days. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Read Also: Can The Irs Garnish Your 401k

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover and then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Is A Distribution From My Designated Roth Account For Reasons Beyond My Control A Qualified Distribution Even Though It Doesnt Meet The Criteria For A Qualified Distribution

No, if you have not held the account for more than 5 years or if the distribution is not made after death, disability, or age 59 ½, then the distribution is not a qualified distribution. However, you could roll the distribution over into a designated Roth account in another plan or into your Roth IRA. A transfer to another designated Roth account must be made through a direct rollover.

Also Check: Can My Wife Get My 401k In A Divorce

K Vs Roth 401k: Which One Is Better For You

The 401k plan comes in two varieties, the Roth 401k and the traditional 401k. Each offers a different type of tax advantage, and choosing the right plan is one of the biggest questions workers have about their 401k. It can be a surprisingly complicated choice, but many experts prefer the Roth 401k because you’ll never pay taxes again on withdrawals. However, the choice depends a lot on your financial situation. Here’s what you need to know about each type and why one might be better for your needs.

Roth accounts are popular retirement savings options for many. Roth IRAs and Roth 401k accounts can both be options for some investors. What’s the difference between these two types of accounts?

Can You Rollover A 401k Without Leaving Your Job

Most people roll over 401 savings into an IRA when they change jobs or retire. But, the majority of 401 plans allow employees to roll over funds while they are still working. A 401 rollover into an IRA may offer the opportunity for more control, more diversified investments and flexible beneficiary options.

Read Also: How Do You Invest Your 401k

Influential Yet Often Overlooked Roth 401 Plan Design Features

In 2001, Roth 401 benefits came into existence.1 Since then, this option has become a trendy, low-cost, and easy to implement plan design feature, available in over 80% of available retirement plans.2

As opposed to a traditional 401, which is pre-tax, a Roth 401 offers an after-tax contribution option with tax-free withdrawals provided they are qualified distributions made after a 5-taxable-year period of participation and are either made on or after the date participants attain age 59½, made after death, or attributable to a participant being disabled. For plan sponsors, a Roth option opens another design feature that allows participants to take advantage of an additional, often overlooked, tax strategy – the In-plan Roth Conversion. Lets take a deeper dive into Roth 401 plans and their benefits.

Can A Plan Automatically Enroll Me To Make Designated Roth Contributions If I Fail To Decline Participation

Yes, a plan can provide that your employer will automatically withhold elective deferrals from your pay unless you decline participation. If the plan has both traditional, pre-tax elective contributions and designated Roth contributions, the plan must state how the employer will allocate your automatic contributions between the pre-tax elective contributions and designated Roth contributions.

Read Also: Can I Move My 401k Into Stocks

Does Time Of Year Matter

Converting earlier in the year generally gives you more time to pay taxes. Taxes arent due until the tax deadline of the following year, so you may have more than 15 months to pay the taxes on your converted balances.

But there are also some advantages to converting later in the year:

- You can still start the clock on the 5-year rule as of the beginning of the year. This IRS rule requires a waiting period of 5 years before withdrawing converted balances or you may pay a 10% penalty. But the clock starts on January 1 of the year you do the conversionno matter when during the year it actually happened. The 5-year rule is counted separately for each conversion.

- Youll have more information about your income for the year. Since the amount you convert is considered taxable income, you may want to consider converting only the amount that would bring you to the top of your current tax bracket.

A conversion must be completed by December 31 to be included in that years taxable income. Managing the tax impact of a Roth IRA conversion requires careful analysis. A review with a financial or tax advisor is always a good idea.