Is There An Income Limit For Contributing To A 401

Not exactly. If you have access to a 401 plan at work, you can put money into it no matter how high or how low your salary is. But listen up, high-income earners: The IRS does limit how much of your salary and compensation is eligible for a 401 match.

For 2021, the compensation limit contributions and matches) is limited to $290,000. So keep that in mind! In 2022, the compensation limit increases to $305,000.7

Heres how it works. Lets say you make $500,000 in 2022 and your company offers a 4% match on your 401 contributions. You contribute $20,500the maximum amount youre allowed to put into your 401 in 2022. But instead of matching that $20,500 , your employer only contributes $12,200. Why? Because your employer is only allowed to apply your match on up to $305,000 of your compensation, and 4% of $305,000 is $12,200.

Noit doesnt really make sense. But dont let that stop you from using all the tools you have to build wealth for the future!

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .

Recommended Reading: Should I Rollover My 401k When I Retire

Tips On Saving For Retirement

- If youre looking for hands-on guidance to plan for retirement, a financial advisor could help you create a financial plan for your needs and goals. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To maximize your retirement savings, you may want to open other retirement accounts like IRAs. An IRA is an individual retirement account, which means that youre responsible for opening and funding the account. A Roth IRA is a variety that backloads the tax benefits so you get tax-free growth and retirement income rather than an upfront tax deduction.

- Want to make sure youre on track for a secure retirement? SmartAssets retirement calculator can help you determine how much youll need for retirement.

Read Also: What Age Do You Have To Draw From 401k

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

Dont Miss: How To Sell 401k Stock

Roth Ira And Traditional Ira Maximum Annual Contribution Limits

| 2021 |

| Less than $10,000 | Less than $10,000 |

11. The limit is generally the lesser of the dollar amount shown, or your taxable compensation for the year. For more information about IRA contributions, please see IRS Publication 590-A or consult your tax advisor.

12. If you will have attained at least age 50 during the tax year, you can contribute an additional amount to your IRA each year.

13. Married can use the limits for single individuals if they have not lived with their spouse at any time during the year.

14. As of 2010, there is no income limit for taxpayers who wish to convert a traditional IRA to a Roth IRA.

You May Like: How To Borrow Against 401k Fidelity

What Is The 401 Contribution Limit For 2022

A 401 is a common type of retirement account thats available through an employer. For the most part, these accounts are funded with pre-tax dollars. As a result, you typically wont pay taxes on that money until you withdraw it in retirement. These accounts also come in a Roth variation, which is the opposite of the aforementioned setup. More specifically, a Roth 401 allows you to avoid taxes in retirement by paying for them upfront.

The IRS imposes a cap on how much you can contribute to your 401 on an annual basis. This is called the 401 contribution limit. Here are the rules for 2022. We also compare them with 2021/2020 limits:

| 401 Contribution Limits: 2022 vs.2021/2020 | |

| Type of Contribution | |

| Catch-up contributions | $6,500 |

| $14,000 | $13,500 |

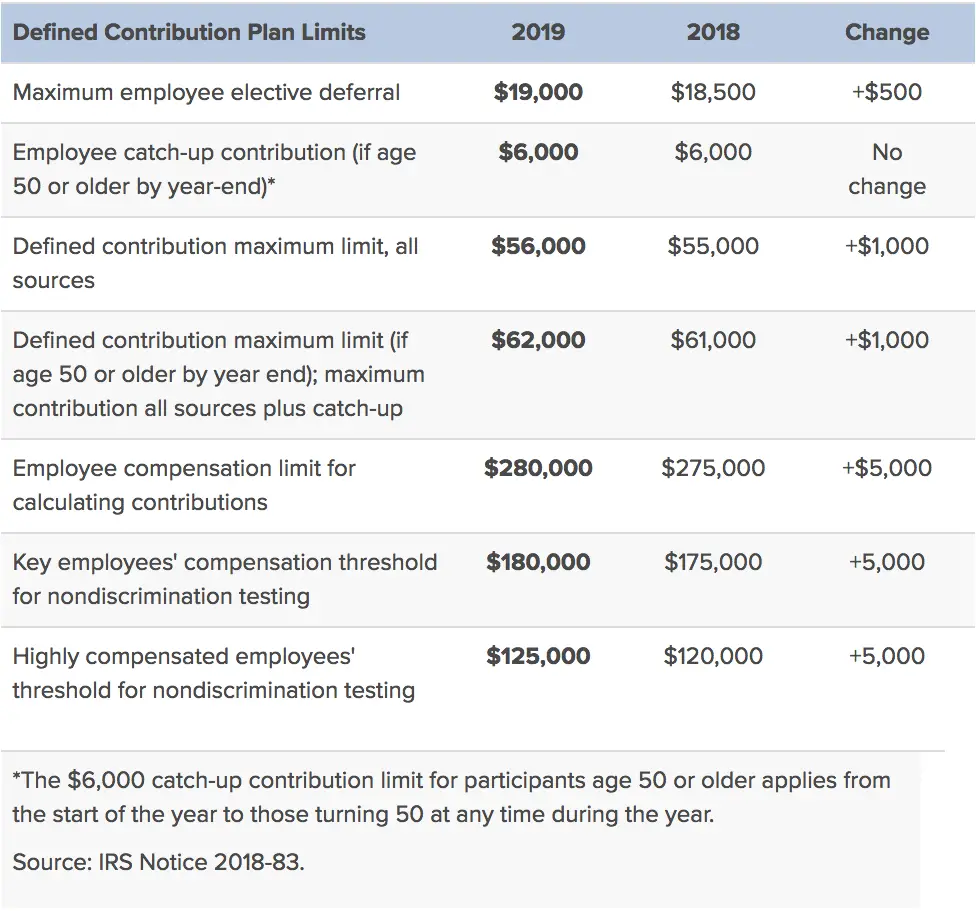

As the table above illustrates, the 2022 IRS limit for employee 401 contributions jumped $1,000 from the 2021 mark to $20,500. Contribution limits tend to increase during years where inflation rates also climb. This has been the case since 2009, as the rate has either increased or stayed put each year since then.

The catch-up contributions listed in the table only apply to employees who are 50 or older. For these individuals, the IRS permits an extra $6,500 in contributions each year. Thats again up $500 from the 2019 limit of $6,000. So anyone whos at least 50 years old and enrolled in a 401 can contribute as much as $27,000 to their 401 in 2022.

Contribution Limits For Governmental 457 Plans

| 2021 |

| Double limit catch-up contributions 10 | $19,500 | $20,500 |

9. The limit is the lesser of the dollar amount shown, or 100% of your includible compensation for the taxable year. This limit includes contributions to all 457 plans at all employers during your taxable year, including any employer contributions that vest during the year. Contributions to non-457 plans and 403 plans) are disregarded. Roth contributions cannot be made to a nongovernmental 457 plan.

10. Eligibility occurs during the three taxable years ending before the employee attains “normal retirement age” as defined by the plan. Eligibility requires the availability of an “underutilized amount” based on plan contributions in preceding years. Roth contributions cannot be made to a nongovernmental 457 plan.

Recommended Reading: Can I Access My 401k If I Lose My Job

Save For Health Care Costs

Contributing to a health savings account can reduce out-of-pocket cost for expected and unexpected health care expenses. For 2022, eligible individuals can contribute up to $3,650 pre-tax dollars for an individual plan or up to $7,300 for a family plan.

The money in this account can be used for qualified out-of-pocket medical expenses such as copays for doctor visits and prescriptions. Another option is to leave the money in the account and let it grow for retirement. Once you reach age 65, the funds are tax-free when you use them for qualified medical expenses. If you spend the funds in other ways, they are taxed as income with no penalties.

How Are 415 Violations Corrected

When annual additions exceed the 415 limit, the issue must be corrected by using one of the correction programs under the IRS Employee Plans Compliance Resolution System . Most plans can self-correct the issue using the Self-Correction Program .

Section 6.06 of the current EPCRS Procedure prescribes the following order for distributing the excess amount:

The amount distributed represents taxable income for the participant. The 10% tax on early distributions under IRC Section 72 does not apply. The participant cannot roll their distribution to another qualified plan or IRA.

The amount forfeited can be used to reduce future employer contributions.

Also Check: What Investment Is Better Than 401k

Contribution Limits In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Contribution Limits In 2021 And 2022

For 2022, the 401 limit for employee salary deferrals is $20,500, which is above the 401 2021 limit of $19,500. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $61,000 in 2022, up from $58,000 in 2021.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $185,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | +$5,000 |

Also Check: How To Take Money Out Of 401k Without Penalty

How Much You Should Contribute With The New Contribution Limits

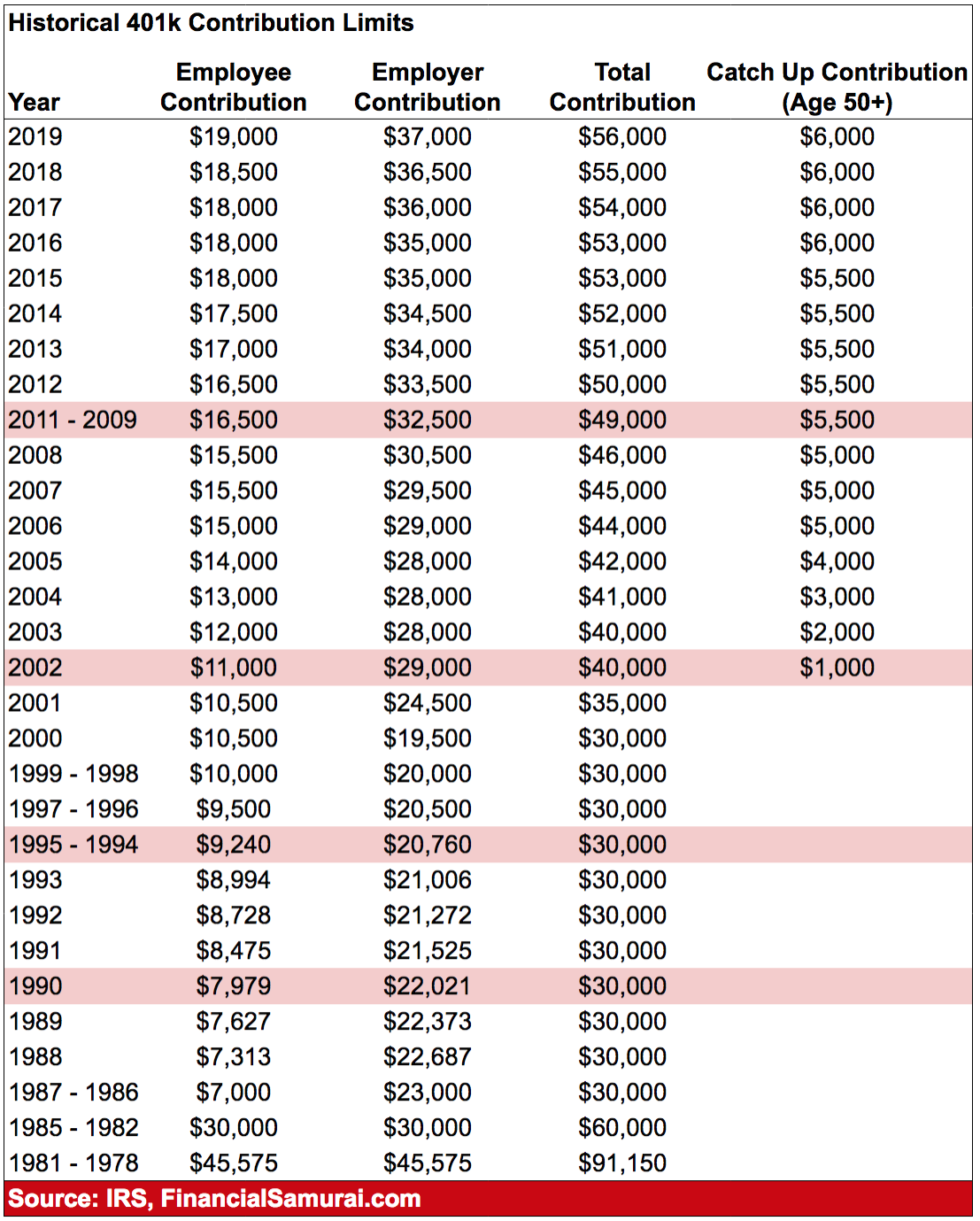

The IRS determines whether or not to increase its contribution limits based on an annual basis. Sometimes changes in the Consumer Price Index have been very small, like on the order of 2% per year. Congress prefers to increase contributions in increments of at least $500, which they did this year.

With the ability to increase your contributions by $500 in 2020, you may be wondering if you should. My answer is a resounding yes.

If you divide that amount into monthly contributions, youre making only slightly smaller payments which will benefit you in the long run. Continuing to max out your 401k at this level is an ideal strategy,

The Contribution Limit For 2022

Pretty much all retirement accounts ‘s, IRA’s, 403’s, etc.) have specific contribution limits that change almost every year due to cost of living adjustments. A lower contribution limit can feel like there’s a little less leg work to be done to max out the account.

According to the IRS, you can contribute up to $20,500 to your 401 for 2022. By comparison, the contribution limit for 2021 was $19,500. This number only accounts for the amount you defer from your paycheck your employer matching contributions don’t count toward this limit.

Some companies provide a dollar-for-dollar match on your 401 contributions, up to a certain percentage of your total salary, usually between 3% and 7% . So let’s say you contribute 7% of every paycheck to your 401, which works out to be $200 per paycheck. If your company matches your contributions dollar-for-dollar up to 7%, that means your employer is giving you an additional $200 per paycheck into your 401. If you get paid twice per month, that works out to be a total 401 contribution of $800 per month, or $9,600 per year.

In this scenario, you can still contribute beyond 7% of your paycheck, but anything beyond 7% will not be matched by your employer. You’ll need to double check with your HR department if you aren’t sure how much of a match your company provides.

Read Also: How Much Can I Withdraw From My 401k

Staying Out Of Trouble Is Easy With The Right Help

The 415 limit is straightforward for most 401 participants. However, it can get complicated fast when the contributions to multiple retirement plans or refunds due to failed annual testing must be considered.

The good news? A skilled 401 provider will know how to account for these complicating factors making it easy for employers to stay out of trouble.

Want to suggest a blog topic you’d like me to talk about? Request it here.

Tax And Investment Benefits Of A 401

The most notable benefit of a 401 is that all contributions are tax-deferred. Your plan is funded directly from your paycheck, with the money coming out before its subject to income taxes. By reducing your taxable income, youre essentially taking a tax deduction, for now. Furthermore, because less of your paycheck is going towards taxes, youre able to contribute more to your retirement funds.

With a 401, youll have a choice of investing in multiple types of investments. These often include some combination of mutual funds, exchange-traded funds , index funds, bond funds and various market capitalization funds. Many 401 plans provide access to investments called target-date funds, which automatically rebalance your portfolio to reduce riskiness as you approach your target retirement age.

Read Also: Can An Individual Open A 401k

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

Recommended Reading: How Do You Draw From Your 401k

Maximum 401 Company Match Limits

The employee and employer match limits for 401s fluctuate each year to account for inflation. Since inflation is projected to rise, the 401 max contribution is increasing as well.

According to the IRS, the employee contribution amount 401 limits per year include:

Therefore, in 2022, an employee can contribute up to $20,500 toward their 401. The employer can match the employee contribution, as long as it doesnt exceed the separate $61,000 employer-employee matching limit.

Since matching $20,500 in full would only total $41,000, most employees dont have to worry about this dilemma. This problem typically arises for individuals who are contributing to more than one employer-matched 401 plan or have switched or are switching to a new employer within the year. Employers should continue to communicate limits with employees each year to avoid misunderstandings.

If you have employees who are aged 50 or older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2021 and 2022.

The key employees compensation threshold increased from 2021 to 2022, from $185,000 to $200,000. Known as the nondiscrimination testingthreshold, these limits apply to specific individuals within a company to ensure they remain within specific 401 contribution limits.

Key employees are defined as any employee who:

The Contribution Limits Also Apply To Roth 401 Contributions

Contribution limits for Roth 401 contributions are the same as they are for traditional 401 contributions. That means you can contribute up to $19,500 per year to either a regular 401 plan, or a Roth 401 plan.

More likely, you will want to contribute to both, in which case youll have to allocate how much of the $19,500 limit will go into each part of your 401.

Not coincidentally, the 401 limits are virtually the same as the limits for both the 403 plan and the Thrift Savings Plan .

In addition, any employer matching contributions to the plans are not included in the employee contribution limits listed above.

Your employer can contribute a matching contribution that exceeds the $19,500 regular contribution limit, or even the combined $26,000 limit if you are age 50 or older. It is always a good idea to figure out whether a Roth 401k vs Roth IRA is best for you.

Read Also: How To Transfer Your 401k From One Company To Another

Maxing Out Your Retirement Contribution

Maxing out your retirement contribution is good financial advice, but it does require you to understand contribution limits so you don’t under- or over-fund your accounts. As long as you meet IRS guidelines, contributing to a 401 plan, traditional IRA or Roth IRA can offer you tax advantages that will help your nest egg grow.

How Do IRA Rollovers Work?

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Personal credit report disputes cannot be submitted through Ask Experian. To dispute information in your personal credit report, simply follow the instructions provided with it. Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address.

Resources

Get the Free Experian app:

Experian’s Diversity, Equity and Inclusion:

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.