Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

You May Like: How Do I Close My 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Move Your Old 401 To Your New Employers Plan

If you are moving to a new job and you are offered another 401 plan, regardless of whether or not you are eligible to contribute funds out of your paycheck, you should be able to roll your existing 401 balance into the plan. This will be a tax-free event, and you will have to select new funds out of the lineup your plan sponsor offers. You likely will have to call your previous 401 company to initiate this rollover, and in many cases, there is paperwork involved. This allows you to consolidate your assets into one 401 plan for potentially better continuity in your investments.

The downside is that fees may not be lower than your previous plan and the investment lineup will also be different. You could have fewer choices than your last plan, as well, so you will want to do a full side-by-side comparison of each plans investment options, expenses, and documentation to assure that this is the best option for you.

You May Like: When Can You Take Out Your 401k

Can I Cash Out My 401 While Still Working

One of the most common questions I get asked is whether or not you can cash out your 401 while still working. The answer is yes, but there are some important things to keep in mind before you do.

- First, you will likely have to pay taxes on the money you withdraw.

- Second, you may be hit with a 10% early withdrawal penalty if you are younger than 59 ½.

- And finally, remember that once you cash out your 401, the money is gone for good you cant put it back in.

With that said, there are some situations where cashing out your 401 while still working makes sense. For example, if you are facing financial hardship and need the money to cover essential expenses, or if you leave your job and dont want to roll your 401 into a new employers plan. Just be sure to weigh all of your options carefully before making a decision.

How To Search For Unclaimed 401 Retirement Assets

You can take a few steps to search for your unclaimed 401 retirement benefits. The first step is to gather as much information as you can about your former employers. If your employer is still in regular operation, theres a chance that your 401 is still in the account that you had when you were with the company.

If you need to do a bit more digging, here are some further steps you can take:

Don’t Miss: Can I Use 401k To Pay Off Credit Card Debt

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Recommended Reading: How To Find Fidelity 401k Fees

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

I Cant Find My 401 Now What

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Were all chasing the almighty dollar, but sometimes we leave behind a few hard-earned ones along the way.

In fact, billions of dollars are left in forgotten 401 plans in the United States that are waiting to be claimed by their rightful owners.

If youre in search of your old 401, here are some tips on how you can track it down.

You May Like: How Much Can I Invest In 401k And Roth Ira

How To Track Down That Lost 401 Or Pension

Tweet This

Cant Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401. USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

You May Like: How To Rollover Ira To 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Use Resources To Discover Unclaimed Assets

Once you use these resources to locate your funds, you can use the following resources to get access to your unclaimed assets.

Recommended Reading: Where Can I Start A 401k

You Have Four Main Options For An Old 401 Thats Tied To A Former Employer

At Capitalize we help our users move their legacy 401 account into an IRA. Dont worry if you dont already have one our online rollover process guides you through your different IRA options and helps you pick one thats right for you.

Leave It With Your Former Employer

If you have more than $5,000 invested in your 401, most plans allow you to leave it where it is after you separate from your employer. If you have a substantial amount saved and like your plan portfolio, then leaving your 401 with a previous employer may be a good idea. If you are likely to forget about the account or are not particularly impressed with the plans investment options or fees, consider some of the other options.

If you leave your 401 with your old employer, you will no longer be allowed to make contributions to the plan.

You May Like: How To Claim 401k From Previous Employer

Use A 401 Lookup Database

The Capitalize team has created a database and search tool to help locate a missing 401 account. Simply input your company name below to get started.

Usually, we can locate the account instantly. If we cant, our in-house team will track it down for you and help you move into an account of your choice.

Other databases also enable you to look for unclaimed property, like the Employee Benefits Security Administrations Abandoned Plan Search and the National Registry of Unclaimed Retirement Benefits. One of these databases may be able to reveal the location of your old 401.

First Off Dont Lose Track Of It Youd Be Surprised How Many People Forget About Their Old 401s

Recently, a Capitalize Research study revealed that Americans have left behind over $1 trillion untouched in their old 401s. This implies that millions of employees are struggling to manage their retirement savings as they move from job to job, leading to the accumulation of money in these abandoned accounts.

The 401, a tax-advantaged savings plan, has helped revolutionize the American workforce since its enactment in 1978. However, millions of dollars are left unclaimed as people change jobs, relocate and subsequently forget about their old 401s. When you lose track of a 401 at an old employer, your savings in that account stagnate, leaving an opportunity toward building a secure financial future squandered.

Even if you are contributing to a new plan with your current employer, leaving money behind in an old 401 account and forgetting about it harms your overall financial well-being, prevents you from building a cohesive financial plan and does not allow all your money to work for you and your goals in the best possible way.

Read Also: How Much Will My 401k Be Worth In 20 Years

Read Also: How Does Company 401k Match Work

Lost Your Job Heres What To Do With Your 401

Consider all of the options when transitioning a work-sponsored retirement plan.

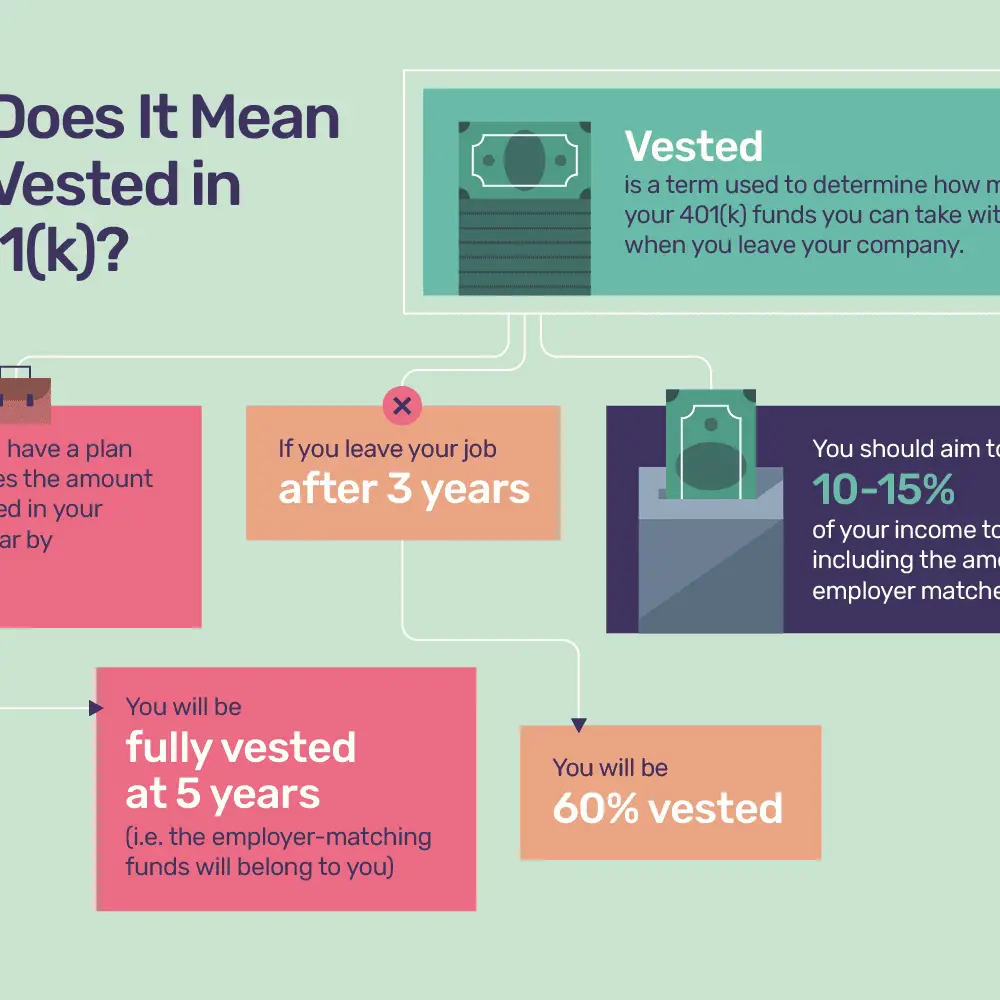

Every week, millions of Americans are filing for unemployment due to the COVID-19 crisis. Whether youve been with a company for six weeks or six years, if you lose your job, there are plenty of options for what to do with your vested retirement funds.

Recommended Reading: How Do You Transfer 401k To New Job