Finish Any Last Transfer Steps

Chances are that by this stage youre done, and your 401 provider has initiated the process of rolling over your 401 into your new Vanguard IRA. If so, congrats on getting to the finish line!

But there can sometimes be a small extra step at this stage. Thats because some 401 providers will only distribute your 401 funds to you, not to another institution. If thats the case then theyll send a check with your money to your mailing address. Its then up to you to deposit the check to your Vanguard account. Vanguard offers a few methods for depositing a check:

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Is It Better To Take A Lump Sum Pension Or Monthly Payments

If you take a lump sum available to about a quarter of private-industry employees covered by a pension you run the risk of running out of money during retirement. But if you choose monthly payments and you die unexpectedly early, you and your heirs will have received far less than the lump-sum alternative.

Don’t Miss: How To Invest 401k In Stocks

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Do I Know If I Have A 401k

Choose Your 401 Rollover Destination

Consider whether a traditional IRA or Roth IRA makes the most sense for your 401 rollover.

401 Rollover to Traditional IRA: If you want to maintain the same tax treatment, this can be a good choice, Henderson says. You avoid extra hassle, and you just see the same RMD and tax treatment as you would with your current 401.

401 Rollover to Roth IRA: For those with high incomes, the 401 rollover to a Roth IRA can serve as a backdoor into a Roth tax treatment. But dont forget about the taxes, Henderson says. In addition, remember the five-year rule when it comes to Roth accounts: Even at 59 ½, you cannot take tax-free withdrawals of earnings unless your first contribution to a Roth account was at least five years before. Those close to retirement, therefore, may not benefit from this type of conversion. Talk to a tax professional if youre rolling into an account with different treatment, says Henderson.

Also Check: Is A 401k A Defined Benefit Plan

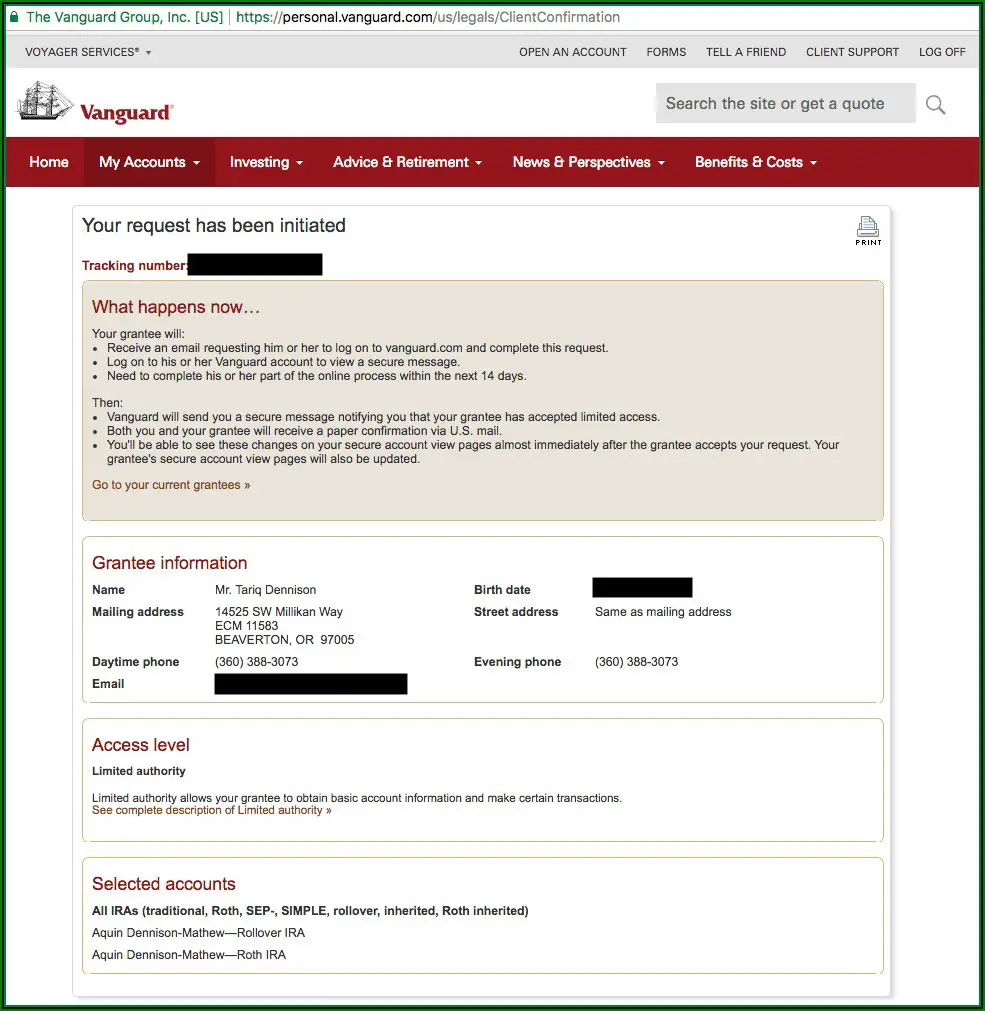

Start Your Transfer Online

Youâll get useful tips along the way, but you can call us if you have a question.

Youâll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so weâll ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youâre already a Vanguard client, confirm the information that weâve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

Where Are All These Fees Coming From

All $260,000 in fees came from one source: expense ratios. Expense ratios are the cost for the administration of the investment fund. Investment funds are those options you select when you first setup your account, such as the Retirement 2050 fund. Each investment fund has an expense ratio thats charged annually as a percentage of the total amount in the fund. They are calculated with a simple equation:

Total investment amount * expense ratio = Annual fee

Lets say for instance I had $10,000 in my 401k and the expense ratio is .45%. That means each year I pay a $45 fee to the broker. That doesnt seem so bad, does it? But lets remember that a retirement account like a 401k is intended to grow over time. And because you cannot withdraw until age 59.5, its an account that most people have for decades. For all of these reasons, that seemingly small annual fee is likely to become a very large amount.

Lets take that same $10,000 401k and account for 10% average stock market growth over 30 years.

| Year |

| $15,863.09 |

| $174,494.02 |

Incredibly, that $10,000 401k is estimated to be worth $174,494 after 30 years assuming a stock market average 10% return rate. This is due to the power of compound interest, and it is the reason why everyone emphasizes saving for retirement asap. The sooner you start saving, the more time you have for your savings to multiply in value.

Don’t Miss: How Do I Draw From My 401k

View Important Information About Our Online Equity Trades And Satisfaction Guarantee

- View important information about our online equity trades and Satisfaction Guarantee

-

1. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

2. If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. , Charles Schwab Bank, SSB , or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern. No other charges or expenses, and no market losses will be refunded. Refund requests must be received within 90 days of the date the fee was charged. Schwab reserves the right to change or terminate the guarantee at any time. Go to schwab.com/satisfaction to learn whats included and how it works.

What About M1 Finance

Im a big fan of the online broker M1 Finance. Like Robinhood, M1 Finance charges no fees to buy and sell stocks and ETFs. Investing on M1 Finance is not the same as most online brokers, but I like the intuitiveness of building a dividend portfolio with pies.

Ive created an M1 pie of 10 dividend stocks that I contribute to every month. Its a convenient way to dollar cost average into high-quality dividend growth stocks over time.

Dividends are easily reinvested back into the portfolio, much like DRIPs, but more flexible. I always liked dollar cost averaging with DRIP investing, but now theres a better way to accomplish the same thing. Thats my primary reason for keeping this account active. Someday, I may transfer those assets to Fidelity as well.

I recommend M1 Finance for investors looking to build a long-term dividend growth or index ETF portfolio. RBD is an affiliate partner with M1 Finance and recommends several investing platforms.

You can open individual accounts or IRAs, making it a good choice for many investors. The no-fee model, I do believe, is the future, today.

However, Ive chosen not to use my M1 Finance account for my tax-advantaged investing. Fidelity is a long-established company in the space, and I have built a 20-year relationship with them, and Ive never had a reason to leave. Plus, my employer-sponsored accounts are there, and I expect to remain for a while.

On top of that, the M1 Finance platform does not support mutual funds.

Also Check: How Much Is 401k Taxed

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

Also Check: Is It A Good Idea To Borrow From Your 401k

Open Your Vanguard Account

Already have an IRA open at Vanguard? Great skip this step

In order to move the money out of your 401 account, youll need to have an account opened for that money to move into. If youve decided to move your funds to Vanguard, you have two main options:

Weve written a full guide on the five key differences between 401s and IRAs if youre trying to understand all of the differences.

Ultimately, most people who roll over an old 401 do so into an IRA for a few key reasons:

Think of your IRA as helping you do two key tasks:

The good news? Opening an IRA at Vanguard can be done online and should take you less than 10 minutes, if you dont already have one.

Also Check: What Is A Safe Harbor 401k Plan

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Recommended Reading: Who Has The Best 401k Match

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

Read Also: How Do I Get A 401k Loan

Roll Over Traditional Money Into The Tsp

A rollover is when you receive eligible money directly from your traditional IRA or plan and then you later put it into your TSP account. You cannot roll over Roth money into the TSP and you must complete your rollover within 60 days from the date you receive your funds. Use Form TSP-60, Request for a Transfer Into the TSP, to roll over eligible traditional money.

Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

Also Check: Can You Use Money From 401k To Buy A House

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

Recommended Reading: Should I Contribute To Roth Or Traditional 401k