What Is An Early 401k Withdrawal Or Early 401k Distribution

An early withdrawal is a withdrawal that occurs before you are 59½

There may be penalties for withdrawing funds from a 401K early.

- The penalty is 10% of the distribution

- Lets say you have $100K in your 401K and you take an early distribution for $10K

- The penalty is 10% of $10K which is $1K

- If the 401K was a traditional 401K, then $10K will also be added to your income for the year and you will pay taxes on it, based on your taxable rate for ordinary income. If it was a Roth 401K, then $10K will not be added to your income

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Early Withdrawals During A Recession

A recession spells out bad times for all. Gross domestic product falls and industrial production slows down. Most noticeably of all, unemployment rates rise. You may find yourself on the wrong side of that trend with dwindling savings. You do have a nice amount of money that you set aside for a future version of yourself.

It’s a tempting idea that many people follow through on. A study from the IRS conducted in 2013 found that in 2004, prior to the Great Recession, 13.3% of people with some retirement plan experienced a taxable retirement account distribution essentially they did an early withdrawal. That percentage rose to 15.4% in 2010.

An early withdrawal should be a last resort. If you can afford not to withdraw early, do so. However, like many other issues within personal finance, recessions impact income levels differently. The same survey states that lower-income households have a higher propensity for an early withdrawal because they’re more deeply impacted by the economic shock.

Note: Retirement savings in a 401 might decline as a result of a recession-induced bear market, which might also drive people to withdraw. The Great Recession set 401s back by over $2 trillion. Yet, despite the volatile markets over the last few years, the average 401 balance has stayed relatively steady, according to Fidelity.

Don’t Miss: How Much Can You Put In 401k

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

Need Help With A Rollover Contactmyra For A Free Consultation On Your Unique Financial Planning Needs

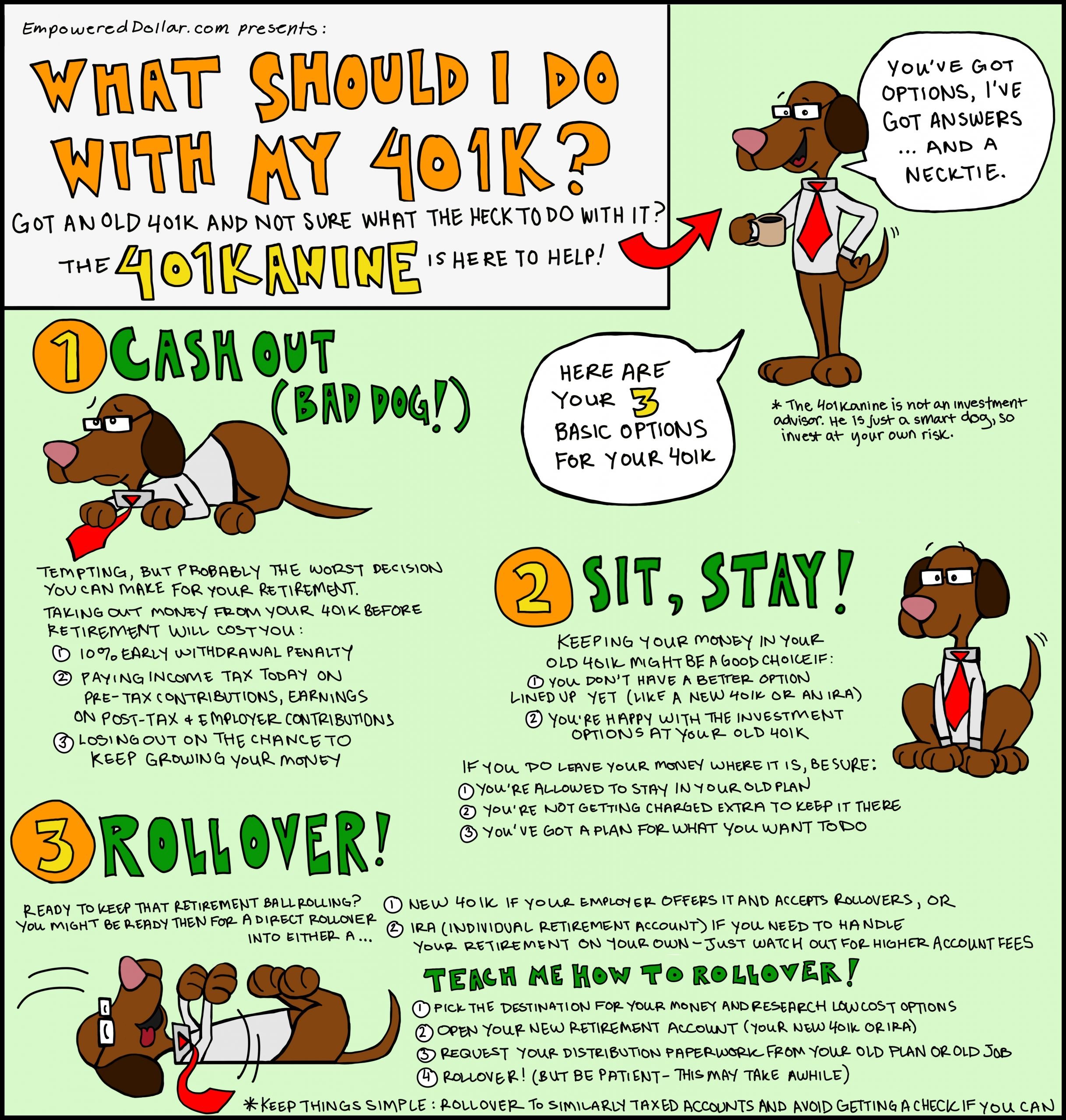

Option B: 401K Loan – Certain 401K administrators offer 401K loans. Generally, if your plan allows it, you can take a loan for up to 50% of the vested 401K account balance to a maximum of $50,000. You must repay the loan within 5 years unless you use the loan to buy your primary residence. There may be other requirements about how frequently you must make payments on the loan . Your loan payments may be taken out of your paychecks. 401K loans are not usually considered taxable income but certain plans may treat them as taxable income. You will have to pay interest on the loan and the interest rate is usually the prime rate. In a 401K loan, you actually pay the interest to yourself. Some people have argued that this is a good investment but Michael Kitces explains in this blog post why that isnt the case.

If you quit your job before paying back the entire loan, you will owe income tax and a 10% penalty on any amount that is not repaid. Thus, if you are planning to leave your job and may have taken out a 401K loan, you may want to consider paying off the loan before leaving or shortly after leaving to avoid the penalty.

Recommended Reading: What Is The Maximum Contribution For A 401k

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Whats The Difference Between A Withdrawal And A 401 Loan

With a 401 loan, you must repay the money back into your account over a period of time. With a standard withdrawal, there are no repayment requirements. You will be charged interest on the loan, although you are technically paying the interest back to yourself. The money goes back into your 401 account, and you usually can spread the payments out up to 5 years. If you are using the money for a down payment on a home, you can even spread them over 15 years. A loan is usually a much better option than a withdrawal because at least you will be replacing the money. However, not all plans offer 401 loans, so that might not be an option for you.

Recommended Reading: How Much Are You Allowed To Contribute To 401k

Withdrawing From A 401

The IRS allows you to start withdrawing from your 401 account at age 59 1/2. But, you dont have to start taking withdrawals at this time if you dont want to.

Since many people work well into their 60s, its possible to delay your withdrawals.

However, traditional 401 accounts require you to take your first required minimum distribution the year you turn 72. Not taking an RMD can result in penalties.

Roth 401 accounts dont have RMDs, meaning you never need to withdraw the money in the account, and you can pass it on to your dependants as an inheritance if you choose.

If you want to withdraw money earlier than age 59 1/2, the early withdrawal penalty is 10%. Youll also have to pay regular income taxes on the withdrawn funds.

For example, if your ordinal tax income bracket is 24%, youll pay 34% in taxes and fees on your early withdrawal. So, if you withdraw $15,000 early from your 401, youll only receive $9,900.

For this reason, most financial advisors and tax consultants dont advise withdrawing early from any retirement fund if you can avoid it. After all, the IRS enacted the penalty to dissuade people from dipping into their retirement savings.

Substantially Equal Period Payments

Substantially Equal Period Payments might be a good option if you need to withdraw money for a long term need. These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 1/2, whichever is shorter. For this reason, this is not a good option if you have a short term need like a sudden unexpected expense. You cannot withdraw funds under this method if you still work for the employer through which you have the 401. To calculate the amount of these payments, the IRS recognizes three acceptable methods.

You May Like: What Happens To My 401k If I Get Fired

Early Withdrawal Calculator Terms & Definitions:

- 401k A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket The division at which tax rates change in the federal income tax system .

- State Income Tax Rate The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution The withdrawal of funds from a 401k.

- Rollover Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties The payment demanded for not adhering to set rules.

- Future Value Before Taxes The value of ones asset at the end of the term before taxes are paid.

- Future Taxes to be Paid The taxes that are required to be paid at the end of the term.

- Future Net Available The amount left after taxes and penalties are deducted.

- Annual Rate of Return The percentage earned every year by having funds in an account.

You Are Penalized By The Irs

If you withdraw money from your 401k before youre 59 ½ , the IRS penalizes you with an extra 10 percent on those funds when you file your tax return. If we use the example above, an additional $1,000 would be taken by the government from your $10,000 leaving you with just $6,000. If youre 55 or older, you could try to get this penalty lifted by the IRS through the Rule of 55, which is designed for people retiring early.

Also, there are exceptions under the CARES Act, which is designed to help people affected by the pandemic. There are provisions under the act that state individuals under the age of 59 ½ can take up to $100,000 in Coronavirus-related early distributions from their retirement plans without facing the 10 percent early withdrawal penalty under certain conditions.

Also Check: How To Get Money From My 401k Plan

Purchasing Your First Home

You can use your 401 money to buy a house. But you will pay a 10% penalty.

You can take money from your IRA without a penalty. You do not have to be a first-time home buyer, but you cannot buy another house if youve owned a home in the last two years. You can take more than one withdrawal for a home, but there is a $10,000 limit over a lifetime.

Cons Of A Total 401 Cash

Youre losing investment potential.

A large loss of accrued gains can impact your retirement plans.

Youre incurring tax and penalties.

The IRS charges a mandatory 20% withholding tax since this is considered income thats thus far been tax-deferred, and an early-withdrawal penalty if youre younger than 55. State and local taxes, depending upon where you live, may also apply.

You May Like: How Much Will My 401k Be Worth When I Retire

Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Options To Get Money Out Of Your 401k

Taking money out of a 401K is called a distribution or withdrawal. Generally, distributions cannot be made until a distributable event happens.

A distributable event is an event that allows distribution of a participants plan benefit and includes the following situations:

- The employee terminates or is terminated from their employment

- Your employer discontinues your plan and offers no new plan

- The employee suffers a significant financial hardship while still employed

- The employee reaches age 59½

You May Like: What Does It Mean To Rollover 401k

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but youll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

How To Withdraw From A 401/ira Early And Not Pay A Penalty

Most people are unaware of the available strategies on how to withdraw from a 401, 457, 403, TSP, IRA and not pay the penalty if you want to retire before age 59 1/2.

If youre looking to retire early and youve put enough money away in your 401, one of the most important questions to answer is:

How am I going to pay for my early bird dinners at 4:30 in the afternoon?

You cant collect social security until age 62 . The imperial federal government wants to protect you from going broke by hitting you with a penalty if you take money out of retirement accounts before age 59 1/2.

But smart people like you arent relying on the government to take care of them. And neither should you rely on the government to do your retirement or early retirement planning.

There are ways to take early withdrawals from your 401 without paying the 10% penalty before age 59 1/2. Ill share with you how to do it.

WARNING WARNING WARNING1) broke2) paying huge penalties

How To Get Started Investing

The international bestseller by CERTIFIED FINANCIAL PLANNER Scott Alan Turner. Choose the right accounts & investments so your money grows for you automatically. No jargon, confusion, or pie in the sky promises. Just a proven plan that works.

Read Also: How To Set Up 401k Plan

Consequences Of A 401 Early Withdrawal

- IRS Penalty. If you took an early withdrawal of $10,000 from your 401 account, the IRS could assess a 10% penalty on the withdrawal if its not covered by any of the exceptions outlined below.

- Withdrawals are taxed. Even if it were covered by an exception, all early withdrawals from your 401 are taxed as ordinary income. The IRS typically withholds 20% of an early withdrawal to cover taxes. So if you withdrew $10,000, you might only receive $7,000 after the 20% IRS tax withholding and a 10% penalty.

- Less money for retirement. Perhaps the biggest consequence of an early 401 withdrawal is missing out on long-term returns in the market. The stock markets average returns have been around 9.6% a year since the end of the Great Depression. If you withdrew $10,000 from your 401 and were about 30 years away from retirement, you could be giving up more than $117,000 in total returns.

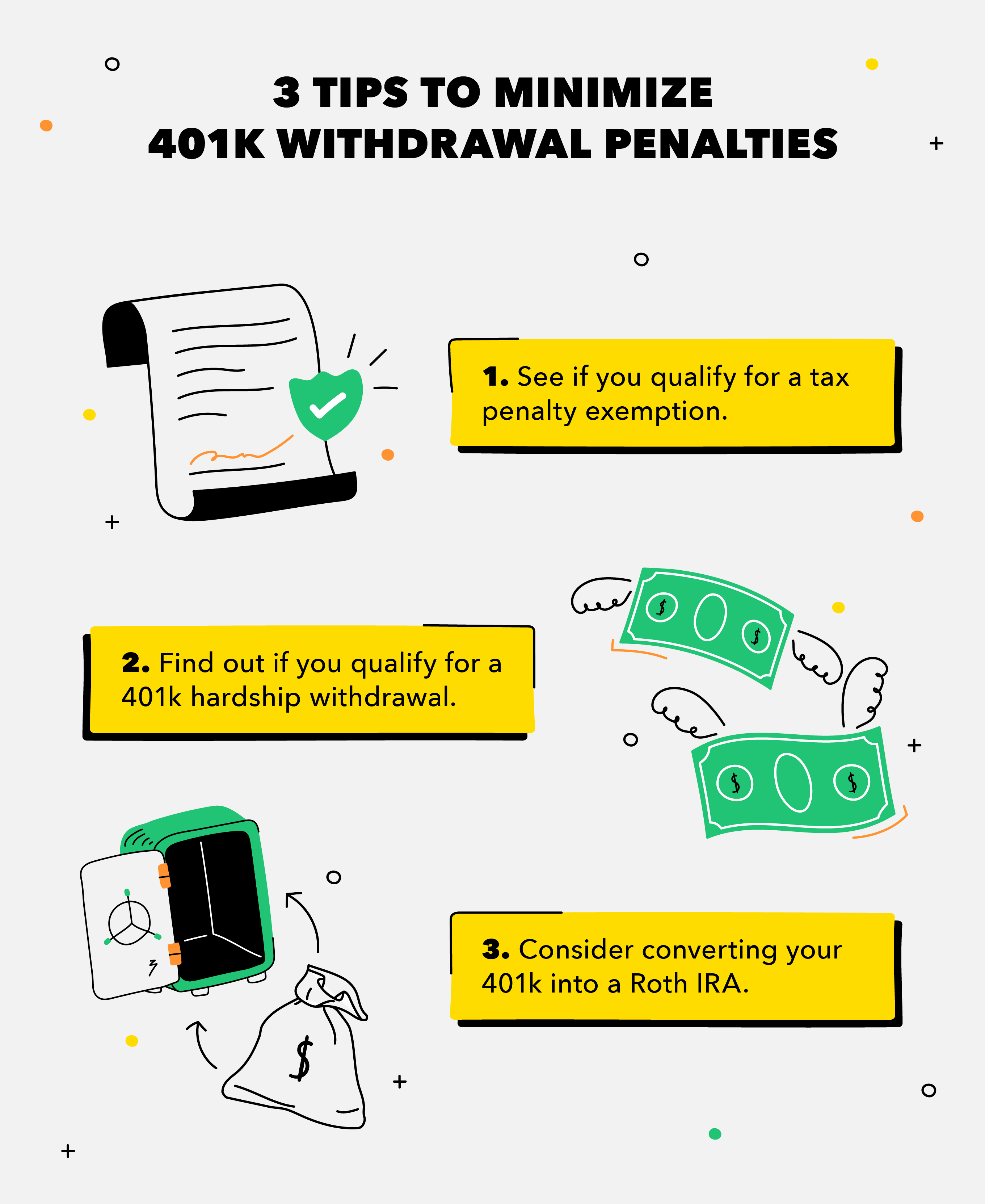

Exceptions To The 401 Early Withdrawal Tax Penalty

In most cases, you’ll just have to take that 10% penalty if you decide to withdraw from a 401. But the IRS will waive that 10% penalty in extenuating circumstances:

- You become or are permanently disabled: If you are or become disabled for life, you won’t owe the penalty.

- You are dividing assets in a divorce: Withdrawals made to satisfy a court order to divvy up the 401 with a former spouse or dependent are penalty-exempt.

- You are a qualified military reservist: You can take penalty-free withdrawals during your service period if you’re called to active duty for at least 180 days.

- You leave your job at age 55: Also known as the rule of 55, this provision allows anyone who retires, quits, or is fired at age 55 to withdraw without penalty.

- You enroll in “substantially equal periodic payments”: With , you withdraw a specific amount from your 401 every year for five years or until you turn 59 ½, whichever comes later. One catch: This account can’t be the one you have at your current job it has to be one you’ve kept from a previous employer. Also, if you quit the SEPP plan early, you’ll owe all the penalties, plus interest.

In addition to these events and situations, there are two other main ways to cash out early without a tax penalty: hardship withdrawals and loans.

Also Check: What Percentage Should I Put In My 401k