Start Lower And Increase Later

If you find that you cant contribute as much as you think you will need because of your living expenses or debts, figure out what you can contribute. Start by making a budget.

Think about increasing your contributions later on, consider doing so when you get a raise, a promotion, or on a set periodic basis. The important thing is to start saving as early as possible. And if circumstances change, you can update your contribution rate at any time.

Talk To An Advisor If Youre Unsure

Mr. SR, Founder of Semi-Retire Plan

Consider what your goals for your future are. I encourage readers to plan the retirement of their dreams, decide how much money the will need to fund that dream, then calculate a savings rate to achieve that portfolio value.

But, depending on your income level now versus what you expect your income to be in retirement, you may want to consider a Roth option like a Roth IRA or a Roth 401. I recommend speaking with a financial advisor for personalized advice. Many companies actually offer free periodic financial advising from their 401 provider, so that could be a good option to start with.

3 quick takeaways

So, what are a few common themes we can extract from our 10 experts?

- First and foremost, establish a budget that takes into account your short and long-term financial commitments. If budgeting isnt your strongest trait, check out our guide to making a budget for smarter spending.

- Next, consider contributing as much as you feasibly can, especially if youre early on in your career. Youll have a general dollar amount of how much you can contribute to your plan after you establish a budget.

- Finally, take into account employer matching if the company you work for provides it. As mentioned numerous times throughout the article, employer matching is essentially free money you can take advantage of.

How Much Can I Put In A Roth Ira 2021

More On Retirement Plans Note: For other retirement plan contribution limits, see the Retirement Topic Contribution Limits. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot be more than: $ 6,000 , or.

Can I put 50000 in a Roth IRA? Your alternative Roth IRA can contribute up to $ 19,500 per year in 2021 and $ 20,500 in 2022 . Some employers even offer a Roth version of a 401 with no income limit.

Recommended Reading: How Do I Roll A 401k Into An Ira

Tips When Choosing How To Invest For Retirement

General guidelines for retirement saving are that individuals should contribute at least enough to a 401 plan to receive the full employer match, if applicable. In some cases, it can make sense to use an IRA in addition to a 401. Investment selection and traditional vs Roth contributions will depend on a range of factors, including age and income.

Tips for choosing how to save and invest for retirement are:

- Take advantage of a match: If an employer offers a match, its almost like free money. If a budget allows, its generally wise to contribute at least enough to receive the full employer match.

- Consider an IRA: If a 401 is not available, investors may consider taking advantage of an IRA for retirement savings. Some investors use an IRA, either to add a Roth option when one isnt available in a 401, to expand the investment options, or to maximize annual contributions, if applicable.

- Maximize contributions when possible: For those retirement savers who are fortunate enough, and when the budget allows, contributing up to the annual allowed amount will maximize retirement savings.

- Invest for risk tolerance and time horizon: When it comes to the investments, the primary determining factors are tolerance for risk and time horizon .

You May Like: Can I Use 401k To Pay Off Debt

Saving In A Roth Ira Without Much Money

Maxing out your annual contributions is difficult if you’re on a tight budget. So Elise suggests creating an automatic contribution of as little as $50 per month. While small, its a start and a good habit to build.

Setting up your Roth IRA and becoming familiar with how to invest is sometimes the biggest challenge, Elise said.

Look at your monthly budget, and make room for a Roth IRA contribution as a fixed cost like rent or a car insurance payment. Again, even if its only a small amount, prioritizing that contribution will pay off as compounding comes into play.

Don’t Miss: How To Retrieve 401k Money

How Much Can I Contribute To My 401k And Ira In 2021

16 For 2021, the combined 401 contribution limits between yourself and employer matching funds are as follows: $58,000 if you are under 50 $64,500 if you are 50 or older and 2022) 100% of your salary if it is less than the dollar limits.

What is the max traditional 401k contribution for 2021?

Employee 401 contributions for plan year 2021 will increase once again to $19,500 with an additional $6,500 catch-up contribution allowed for those turning 50 or older. But maximum contributions from all sources will increase by $1,000.

Can I have both IRA and 401k?

Yes, you can have both accounts and many people do. The traditional Individual Retirement Account and 401 offer the benefit of tax savings for retirement. Depending on your tax situation, you may also be able to get a tax deduction for the amount you contribute to a 401 and IRA each tax year.

What Is The Highest Amount You Can Contribute To 401k

For 2021, your 401 contribution limit is $19,500, or $26,000 if youre 50 or older. In 2022, the 401 contribution limit for individuals is $20,500, or $27,000 if youre 50 or older.

What is the max 401k contribution for 2021?

WASHINGTON â The IRS announced today that the amount individuals can contribute to their 401 plans has increased to $20,500 in 2022, up from $19,500 for 2021 and 2020.

What is the most you can contribute to a 401k annually?

The contribution limit for employees participating in 401, 403, most 457 plans and the Federal Savings Plan has been increased from $19,000 to $19,500. The compensation contribution limit for employees age 50 and older participating in these plans has been increased from $6,000 to $6,500.

Don’t Miss: What’s The Difference Between An Ira And A 401k Account

What Is The Downside Of A Roth Ira

A major disadvantage of Roth IRA contributions is made with money after tax, which means there is no tax deduction in the contribution year. Another disadvantage is that payments may not be made until at least five years have passed since the first contribution.

Why bother with a Roth IRA? Contributing to a Roth IRA is more tax efficient than simply investing in a taxable brokerage account. This may interest you : 3 Ways to Make the Most of Your IRA. Roth IRA money is tax-free and all contributions and earnings can be deducted tax-free once you have kept your Roth IRA open for more than five years.

Which Account Is Right For You

Traditional 401

- Taxes: You make pre-tax contributions and pay tax on withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are added directly to your 401 account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72

- Heirs are subject to RMDs and taxed on distributions

Roth 401

- Taxes: You make after-tax contributions and don’t pay tax on qualified withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are deposited into a separate tax-deferred account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- You must take RMDs starting at age 72 however, you could roll over funds to a Roth IRA to avoid RMDs

- Heirs are subject to RMDs but not taxed on distributions

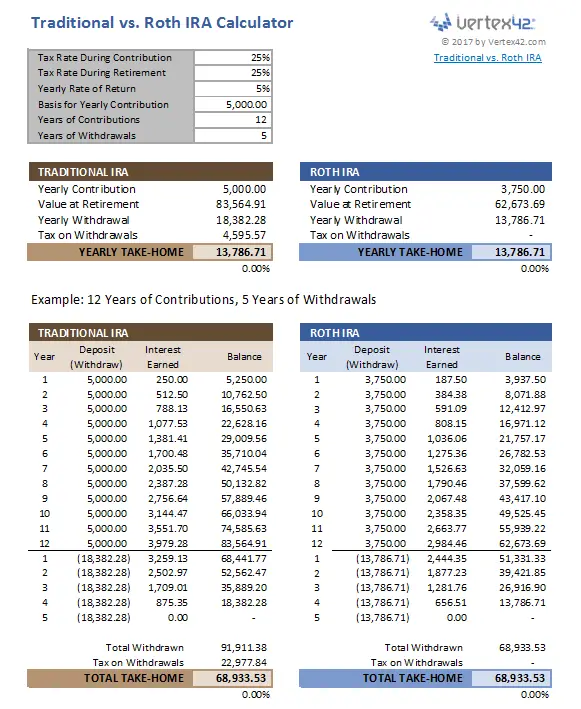

Now that you have a better understanding of a Roth 401, you might be wondering how it differs from a Roth IRA. Contributions to either account type are made with after-tax dollars, and you won’t pay taxes on qualified distributions. The differences between the two types of Roth accounts come down to contribution limits, income limits, and RMDs.

Recommended Reading: Can You Move A 401k Into A Roth Ira

Enter The Roth 401k/403b

Almost 80% of these qualified plans now offer a Roth option for employee contributions. The main difference between Roth 401k contributions and Traditional 401k contributions is when you owe federal income tax on the money. When making Traditional contributions, you get an upfront tax benefit because your taxable income is reduced by the amount you contribute. For example, if youre in the 32% marginal tax bracket and you contribute the maximum $19,500 contribution for 2020, you would reduce your 2020 income tax bill by $6,240 which is significant savings to be sure. It isnt until you begin withdrawing your money that your withdrawals are taxed to you as regular income at whatever your marginal tax rate is for that year.

When you contribute to a Roth 401k/403b the money is taxed in reverse. Youll owe federal income tax on the amount you contribute for the year the contribution was made. However, assuming some basic conditions are met, youll wont owe any taxes on that money when its withdrawn. If youre in the 32% marginal tax bracket and you contribute $19,500 to your Roth account in 2020, youd owe $6,240 in federal income tax however, the IRS will never be able to tax that money, or the decades of compounded growth that it generates over the years, again! This benefit cannot be overstated!

Choosing Between Plans: The Traditional 401 Vs Roth 401

The money you contribute to a traditional 401 is tax-deferred. That means the amount comes out of your annual income before payroll taxes are taken from it. You pay the taxes on your contribution and whatever gains you made on the investment when you withdraw the money from the plan, so if you had very high investment gains, those will be subject to taxes at distribution.

If you withdraw the money before age 59½ or age 55, depending on your circumstances, you will not only be hit with the tax bill but an additional 10% early withdrawal penalty.

There are also rules about what your employer can do with your money Once your company sends the money to the investment firm after the plan administrator processes your contributions and executes the trades, your employer is out of the equation. Just know that, as with any investment, you can lose money in your 401 if the markets tank.

In both traditional and Roth 401 plans, once you sign up, your employer offers several different investments, usually through an asset manager like Fidelity or Vanguard. Those investments have varying levels of risk, so you must choose which one is most appropriate for your age and goals. You may also have the option of investing your contribution however you choose through a brokerage window in your account that allows you to buy stocks or ETFs if you’re not thrilled with the selection of funds your plan offers.

Also Check: How Do 401k Investments Work

How Much Money Is Too Much For A Roth

Contributions to Roth IRAs are limited and can be phased out, depending on how much income you earn and your tax-filing status. This may interest you : Taxes in Retirement and Roth IRA Conversions: What to Know. For those who propose taxes as a single, contributions cannot be made to Roth if your income exceeds $ 139,000 in 2020 and more than $ 140,000 in 2021.

What income is too high for Roth?

In 2021, if you make more than $ 140,000 filing alone or $ 208,000 filing together as a married couple, you are prevented from contributing to a Roth IRA.

Do I make too much money for a Roth IRA?

So you have too much money to qualify for a Roth individual retirement account. If your adjusted gross income exceeds $ 131,000 or $ 193,000 , you cannot contribute to a Roth IRA directly. To get around this, you finance a traditional IRA, and then convert the money into a Roth.

How much should you put into a Roth IRA?

The IRS, in 2021, closes the maximum amount that you can contribute to a traditional IRA or Roth IRA $ 6,000. Seen the other way, its $ 500 a month you can donate throughout the year. If you are age 50 or older, the IRS allows you to contribute up to $ 7,000 annually .

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Don’t Miss: How To See How Much 401k You Have

Do I Make Too Much Money For A Roth Ira

So you have too much money to qualify for a Roth individual retirement account. If your adjusted gross income exceeds $ 131,000 or $ 193,000 , you cannot contribute to a Roth IRA directly. To get around this, you finance a traditional IRA, and then convert the money into a Roth.

How much income is too much for Roth IRA?

To contribute to the Roth IRA in 2022, single tax filers must have a modified adjusted gross income of $ 144,000 or less, up from $ 140,000 in 2021. If married and filing jointly, your combined MAGI must be under $ 214,000 . in 2021).

Does Roth IRA make sense for high income?

A Roth IRA can be a good option for those hoping in a higher tax bracket once the withdrawal begins. However, unlike traditional IRAs, there is a limit to contributing to Roth IRAs based on income. For married couples, the phase-out is $ 198,000- $ 208,000.

Do I make too much money to open a Roth IRA?

You can contribute to a traditional IRA no matter how much money you earn. But you dont have the right to open or contribute to a Roth IRA if you make too much money. There are still ways around the Roth IRA contribution limit.

Max Out Your 401 During A Recession

Although your 401 alone will unlikely be sufficient to meet all your retirement expenses, if you max out your 401 every year, you will likely far surpass the median and average household retirement savings held by those between the ages of 56 61 today.

In fact, it is likely you will retire a 401 millionaire by the time you are able to withdraw from your 401 penalty-free at age 59.5. Check out the chart below that shows mow many years it will take for you to become a 401 millionaire based on historical returns and portfolio allocations.

In fact, I expect everyone to become 401 millionaires by the age of 60 if they keep maxing out their 401 every year for 30+ years. The power of compounding over time cannot be denied.

Recommended Reading: Can You Rollover A Roth 401k Into A Roth Ira

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

You May Like: What Happens To My Roth 401k When I Quit

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

Recommended Reading: How To Check Old 401k Accounts

Are Roth 401k Contributions Right For You

The question you need to ask before deciding whether you should make Roth or Traditional contributions is this: Is it more important to minimize how much I pay in taxes this year OR minimize how much I pay in taxes over my lifetime? As a CERTIFIED FINANCIAL PLANNER professional and overall finance nerd, Ill emphatically tell you that you should focus on minimizing your lifetime taxes. The easiest way to do that is to ask yourself which you think is going to be higher: your marginal federal income tax rate this year, or your marginal federal income tax rate when you withdraw your money in retirement? Most people can figure out the rate theyre going to pay this year pretty easily. Unfortunately, its not as easy to know what rate youll be paying in the future. That depends on a number of factors like your income in retirement, the sources of your income, the value of your Traditional IRAs & 401k/403b accounts, and perhaps most importantly, the tax rates and respective brackets that exist in those years.

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Recommended Reading: Can You Transfer Money From 401k To Ira