Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

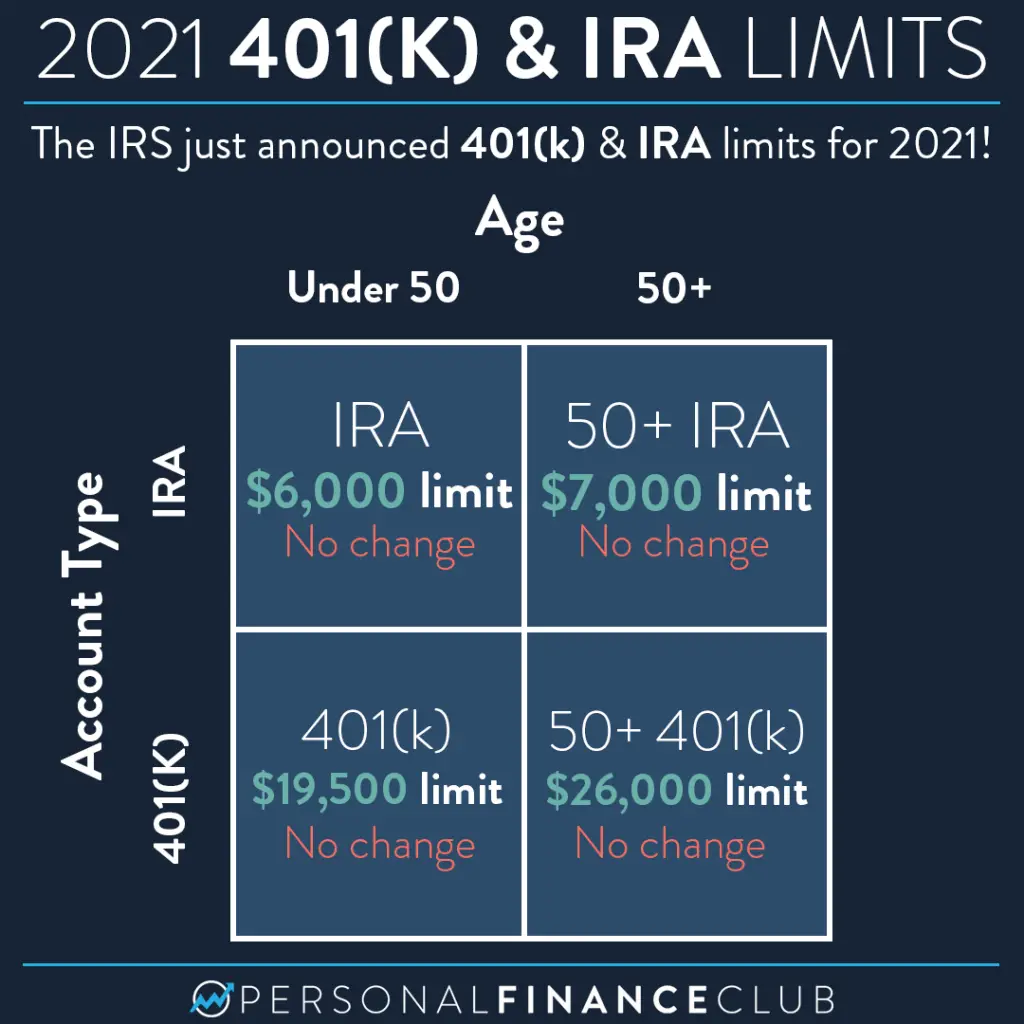

Contribution Limits For 2021

The 401 contribution limit stayed the same for 2021. But workers 50 and older can save an extra amount for retirement.

One of the best and most tax-friendly ways to build a nest egg for retirement is by contributing to an employer-sponsored 401 account. If your employer offers this benefit, jump in as soon as you can, because it’s never too early to start saving for retirement.

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Also Check: What Can You Roll A 401k Into

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $20,500 in 2022 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Claiming The Solo 401k Contribution Deduction:

Roth solo 401k and voluntary after-tax contributions are not tax deductible, but pretax solo 401k contributions are deductible. Claiming the pretax contribution deduction is driven by the type of self-employed business sponsoring the solo 401k plan. See the following chart to determine where to claim pretax solo 401k contributions.

Don’t Miss: How To Use My 401k To Buy Real Estate

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Tax On Excess Ira Contributions

An excess IRA contribution occurs if you:

- Contribute more than the contribution limit.

- Make a regular IRA contribution for 2019, or earlier, to a traditional IRA at age 70½ or older.

- Make an improper rollover contribution to an IRA.

Excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA. The tax can’t be more than 6% of the combined value of all your IRAs as of the end of the tax year.

To avoid the 6% tax on excess contributions, you must withdraw:

- the excess contributions from your IRA by the due date of your individual income tax return and

- any income earned on the excess contribution.

See Publication 590-A for certain conditions that may allow you to avoid including withdrawals of excess contributions in your gross income.

Read Also: When Can I Pull Out My 401k

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Should You Be Maximizing Your 401 And Ira Contributions

With the annual 401 contribution limit rising, you might feel pressure to put more money into retirement savings. However, most people aren’t contributing up to the 401 limit anyways: a recent Vanguard report found that only 14% of people with Vanguard 401 accounts were contributing the maximum amount allowed. The majority of those people were making more than $150,000 annually.

And even having access to a 401 puts you in a better position than many in , 72% of public and private employees had access to some type of employer-sponsored retirement plan like a 401 or pension plan.

So if you’re wondering whether you need to contribute more money to your 401 or IRA now, it really depends on your individual finances. If your employer offers to match a percentage of your contributions, your first priority should be contributing enough to earn the match. By not taking advantage of the match, you’re essentially losing out on free money.

From there, if you have more money to invest, you’ll want to consider possibly opening up a Roth IRA to take advantage of the tax benefits it offers. You can contribute to both a 401 and Roth IRA at the same time, as long as you meet the income requirements of a Roth IRA. With a Roth IRA, contributions are taxed up front, so you don’t have to pay taxes on your investments or investment gains when you take distributions in retirement.

-

Offers informational articles to help users improve their understanding of investment strategies and market trends

Don’t Miss: Can I Withdraw My 401k If I Quit My Job

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

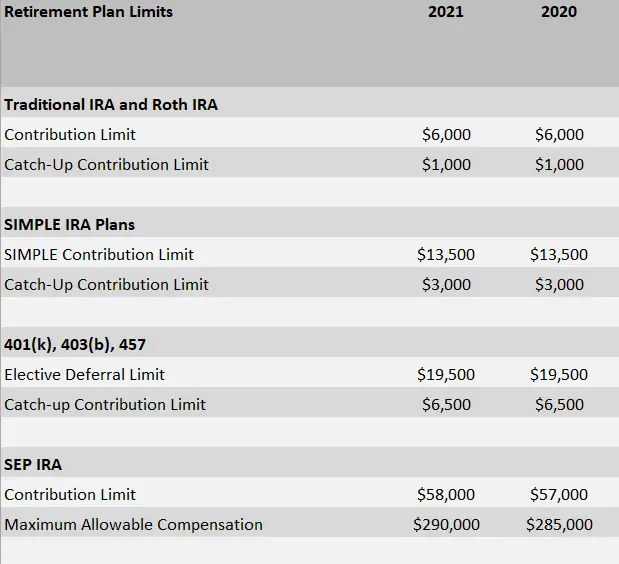

For 2021, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $104,000 but less than $124,000 for a married couple filing a joint return or a qualifying widow,

- More than $65,000 but less than $75,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

1k/403b/457/tsp Elective Deferral Limit

401k/403b/457/TSP contribution limit will go up by $2,000 from $20,500 in 2022 to $22,500 in 2023. This limit usually goes up by $500 at a time but higher inflation is making it go four steps in one year.

If you are age 50 or over by December 31, the catch-up contribution limit will go up by $1,000 from $6,500 in 2022 to $7,500 in 2023.

Employer match or profit-sharing contributions arent included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single employee contribution limit for 401k, 403b, and TSP across all plans.

The 457 plan limit is separate from the 401k/403b/TSP limit. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

Read Also: Can I Rollover From 401k To Roth Ira

What Are The Tax Benefits To The Employer For Offering A 401 Matching Plan

Employers can use the contributions to employee 401 accounts as tax deductions on their federal corporate income tax returns. These contributions may also be exempt from state and payroll taxes. As a result, the employer keeps their employees happy, sees reduced turnover and benefits financially with tax deductions.

What Does The New Compensation Limit For Employer Matching Formulas In 2021 Mean

If your plan allows for a matching contribution, you must follow a set formula and also comply with the maximum limit set by the Internal Revenue Service. This year, your matching formula may apply to up to $290,000 worth of employee income, +$5,000 over 2020.

For example: say your plan matches 50% on salary deferrals, not exceeding 5% of compensation. Employee Bob earns $360,000 this year, but your plan can only apply to up to $290,000 of his compensation.

Even though Bob may defer $19,500, only $14,500 will be matched.Under the terms of the plan, your matching contribution would also be $7,250 .

Read Also: How To Pull Money From 401k Without Penalty

Other Irs Retirement Account Changes For 2022

In addition to contribution increases to 457, 403, and 401 plans, the IRS has additional 2022 updates:

-

Traditional and Roth IRA contribution limits remain the same at $6,000, with traditional and Roth IRA catch-up contribution limits staying at $1,000.

-

Income ranges for determining eligibility to make deductible contributions to traditional IRAs, to contribute to Roth IRAs, and to claim the Saver’s Credit all were raised for 2022.

Does My Employers 401 Match Count Toward My Maximum Contribution

To put it simply, the answer is no. An employer matching contribution does not count towards your maximum contribution of $20,500. However, the IRS does limit total contribution to a 401 from both the employer and the employeewhich means total contributions can’t exceed either:

-

100% of an employee’s salary, or

-

The limit for defined contributions .

The limit for defined contribution plans in 2022 under section 415 is $61,000 . Workers older than 50 years are still eligible for a $6,500 catch up contribution and can have a maximum of $64,500 in employer and employee contributions. This applies to both traditional and Roth 401s.

Read Also: How Much Can An Employer Contribute To 401k

Make A Contribution To A Traditional Ira

Virtually anyone at any income level can make a contribution. But the tax deduction for a contribution if youre already covered by an employer plan phases out at $125,000 for married couples, in $76,000 for single filers. But if HCE status limits your 401 contributions, this will be a way to take advantage of tax deferral of investment income.

Contributions arent nearly as generous as they are for 401 plans, at just $6,000 per year , but every little bit helps.

Benefits Of Contributing To Your 401 Plan

401 account contributions provide a double tax advantage for taxpayers. Individuals are able to direct pre-tax funds from their paycheck into their 401, reducing the amount of their income subject to income taxes the following year. In addition, any earnings from 401 account contributions are also tax-exempt.

Individuals will need to pay income taxes on funds taken out of 401 accounts during retirement. However, many find their income is lower during retirement than it was while working, placing them in a lower tax bracket.

Also Check: Can I Transfer My 401k To My Spouse

& 2022 Maximum 401 Contribution Limits

Saving for retirement is something everyone should keep in mind– whether they’re just starting in the workforce or retiring soon. Saving for retirement may be intimidating for those who aren’t familiar with the subject, it is easier with a 401 plan. What if your employer offers a 401 retirement plan? In that case, it’s probably best to start contributing as soon as possible. This article will help explain what a 401 is, contribution limits and types of 401 plans.

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

You May Like: Can You Have A Personal 401k

Increases In Ira Contribution Limits Too

Contributions to traditional IRAs and after-tax Roth IRAs will increase as well to $6,500from $6,000 currently, an 8.3% rise. But the IRA catch-up contribution limit stays the same at $1,000.

Eligibility to deduct an IRA contribution or contribute to an after-tax Roth IRA is based on income and access to a workplace retirement plan. But next year, more people will be able to take advantage.

To put any money in a Roth in 2023 your modified adjusted gross income must be below $153,000 . Thats up from$144,000 currently.

For traditional IRAs, to get to deduct at least some of your contributions your modified AGI must bebelow $83,000 next year, up from$78,000 this year.

If you personally dont have access to a workplace plan but your spouse does, then your modified AGI must be less than $228,000, up from $214,000 currently, to get some deduction for your IRA contributions.

Highly Compensated Employee 401 Workaround Strategies

If youre a highly compensated employee, are there any strategies to reduce the impact? Yes none as good as being able to make a full tax-deductible 401 contribution, but they can minimize the damage.

Saving money in taxable accounts is a solid strategy. There are no limits on how much you can contribute. And even though you dont get a tax break on the contributions or the investment earnings, youll be able to take money out as you need it, without having to worry about paying taxes on it.

Also Check: What Can I Rollover My 401k Into

When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesn’t apply, though, if you are age 55 or older in the year you leave your employer.

Depending on the plan sponsor, you may be allowed to borrow up to 50% of your vested account balance or $50,000, whichever is less, but unless the money is used to buy a primary residence, you will generally need to repay the loan within five years, making payments at least quarterly. If you miss a payment, the remaining balance is treated as a distribution, with taxes and penalties for early withdrawals applying.

Traditional Vs Roth 401k Contribution Limits

Some employers offer both a traditional 401k and a Roth 401k, but whats the difference between each? Lets walk through the differences between both account types so you can decide which type works best for your needs.

- Roth 401k: A Roth 401k refers to an employer-sponsored savings plan that gives you in which you can invest after-tax dollars for retirement. The perk to investing in a Roth 401k: You pay taxes on your money ahead of time, which means that you wont pay any taxes on your contributions after you take withdrawals after you reach age 59 ½ as long as the account has been funded for at least five years. All of your accumulated contributions and earnings come out tax free.

- Traditional 401k: A traditional 401k refers to an employer-sponsored plan that gives you the option to defer paying income tax on the amount you contribute for retirement. For example, lets say you earn $50,000 and max out your retirement plan at $19,500. Assuming you have no other deductions, your taxable earnings will reduce from $50,000 to $30,500. .

Wondering whether you should invest in both? You might want to take a tax-diversified approach because it could allow you to invest in many types of assets and allow you to diversify your savings. You can contribute to both a Roth and a traditional 401k plan as long as your total contribution doesnt go over $19,500 in 2021 and $20,500 in 2022.

Also Check: How To Roll Over 401k To New Job