Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Before Taking A Hardship Withdrawal

Many people do not know that 401 money is shielded from creditors and protected from bankruptcy. If you are experiencing financial hardship and think that you may end up filing bankruptcy, do not cash out your 401 plan. Your creditors cannot take your 401 plan money.

It may be better to borrow money rather than take a 401 hardship withdrawal. Too many people cash out of a 401 plan or take a hardship withdrawal to pay medical expenses when their 401 money would be protected. Try working out a payment plan before you touch your 401 money.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2, even if you haven’t retired. The best idea for old 401 accounts is to roll them over when you leave a job. If you are 59 1/2 or older, you will not be hit with penalties if you withdraw from your old accounts. However, you need to check with your human resource department about the rules around withdrawing from your current 401 if you are still in the workplace.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Also Check: How To Transfer 401k To Vanguard Ira

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

How Much State Tax Do I Pay On 401k Withdrawal

Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

You May Like: How To Tell If You Have A 401k

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

You May Like: Does Borrowing From 401k Affect Credit Score

What Qualifies As A Financialhardship

The following reasons qualify as a financialhardship as set forth in the plan document:

- Buying the participants primaryhome

- Post-secondary educational feesfor the next 12 months, including tuition, room and board, and other relatedcharges for the participant or the participants spouse, children ordependents, or the participants primary beneficiary* under the plan

- Unreimbursed medical expenses, forthe participant or the participants spouse, children or dependents, or theparticipants primary beneficiary* under the plan

- Preventing eviction from orforeclosure on the participants primary home

- Burial expenses for theparticipants deceased parent, spouse, children or dependents, or theparticipants primary beneficiary* under the plan

- Expenses to repair damages to theparticipants primary home that would qualify as a casualty deduction underSection 165 of the Internal Revenue Code .

*The primary beneficiary under the plan is theindividual who has an unconditional right to all or a portion of theparticipants account balance upon his or her death.

Because hardship withdrawals can only beapproved by the Plan Administrator, you will need to keep on file theapplicable documentation in the event your plan is audited.

Read Also: How To Invest In A 401k For Dummies

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Read Also: Can You Move Money From Ira To 401k

Need Help With A Rollover Contactmyra For A Free Consultation On Your Unique Financial Planning Needs

Option B: 401K Loan Certain 401K administrators offer 401K loans. Generally, if your plan allows it, you can take a loan for up to 50% of the vested 401K account balance to a maximum of $50,000. You must repay the loan within 5 years unless you use the loan to buy your primary residence. There may be other requirements about how frequently you must make payments on the loan . Your loan payments may be taken out of your paychecks. 401K loans are not usually considered taxable income but certain plans may treat them as taxable income. You will have to pay interest on the loan and the interest rate is usually the prime rate. In a 401K loan, you actually pay the interest to yourself. Some people have argued that this is a good investment but Michael Kitces explains in this blog post why that isnt the case.

If you quit your job before paying back the entire loan, you will owe income tax and a 10% penalty on any amount that is not repaid. Thus, if you are planning to leave your job and may have taken out a 401K loan, you may want to consider paying off the loan before leaving or shortly after leaving to avoid the penalty.

Withdrawing From A 401 After Leaving The Company Without A Penalty

In any of the following situations, you may qualify for early withdrawal without being subjected to any penalty:

-

If you leave a company the same year you turn 55 years old

-

If you suffer from total or permanent disability

-

If you cash out in equal installments spread over an expected period of your remaining lifetime

-

If you need to pay for medical expenses, which are more than 10% of your income

-

If as a military reservist, you have been called to active duty

You May Like: How To Find My 401k Contributions

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you.If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Don’t Miss: Can The Irs Garnish Your 401k

What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

It’s fairly easy to put money into a 401, but getting your money out can be a different story. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But 2022’s high inflation, rising interest rates and rocky stock market might have some investors itching to cash out early. However, if you do decide to make an early 401 withdrawal before that magical age, you could pay a steep price if you dont proceed with caution.

» Dive deeper:What to do when the stock market is crashing

Recommended Reading: How To Find Out If I Have Money In 401k

Ways To Withdraw Money From Your 401k Without Penalty

This article was originally published on ETFTrends.com.

When hard times befall you, you may wonder if there is a way withdraw money from your 401k plan. In some cases you can get to the funds for a hardship withdrawal, but if youre under age 59½ you will likely owe the 10% early withdrawal penalty. The term 401k is used throughout this article, but these options apply to all qualified plans, including 403b, 457, etc.. These rules are not for IRA withdrawals see the article at this link for 19 Ways to Withdraw IRA Funds Without Penalty.

Generally its difficult to withdraw money from your 401k, thats part of the value of a 401k plan a sort of forced discipline that requires you to leave your savings alone until retirement or face some significant penalties. Many 401k plans have options available to get your hands on the money , but most have substantial qualifications that are tough to meet.

Your withdrawal of money from the 401k plan will result in taxation of the withdrawal, and if you do not meet one of the exceptions, a penalty as well. See the article Taxes and the 401k Withdrawal for more details about how the taxation works.

The list below is not all-inclusive, and each 401k plan administrator may have different restrictions or may not allow the option at all.

Well start with the obvious methods, all of which generally require the plan participant to leave employment:

1. Normal Begin after age 59½ after leaving employment at any age

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

You May Like: Who Are The Top 401k Providers

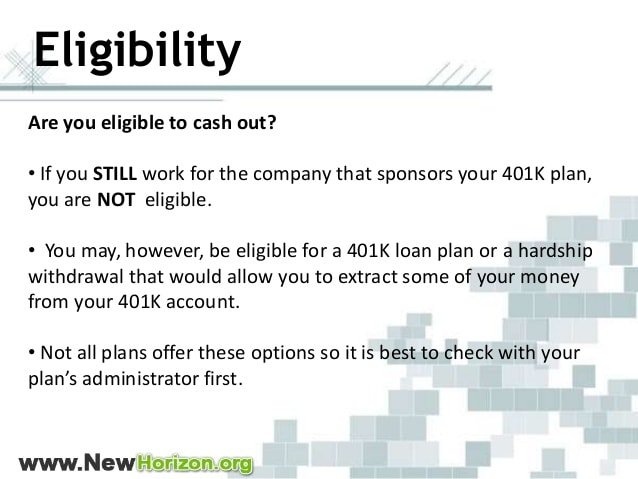

Eligibility For Cashing A 401 Plan

In the event that you are still under the employment of the company that is paying for your 401, you wont be eligible for cashing out your 401 plan. The only exceptions to this would be if the plan, in particular, allows for a 401 loan, an in-service withdrawal, or a hardship withdrawal.

One piece of advice would be to avoid taking out a 401 loan as much as you can. The cash you have in your 401 needs to be given as much time as you can in order to grow. The loan is also required to be paid back with interest, so youll just end up losing money in the long run.

If you are no longer under the employment of the companies that sponsor your 401 plan, then you are indeed eligible to get the money. You can either cash it out, or you may roll it over through an IRA.

If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 plan over into another plan, then the IRS does not see this as cashing out.

Risks Of A 401 Early Withdrawal

While the 10% early withdrawal penalty is the clearest pitfall of accessing your account early, there are other issues you may face because of your pre-retirement disbursement. According to Stiger, the greatest of these issues is the hit to your compounding returns:

You lose the opportunity to benefit from tax-deferred or tax-exempt compounding, says Stiger. When you withdraw funds early, you miss out on the power of compounding, which is when your earnings accumulate to generate even more earnings over time.

Of course, the loss of compounding is a long-term effect that you may not feel until you get closer to retirement. A more immediate risk may be your current tax burden since your distribution will likely be considered part of your taxable income.

If your distribution bumps you into a higher tax bracket, that means you will not only be paying more for the distribution itself, but taxes on your regular income will also be affected. Consulting with your certified public accountant or tax preparer can help you figure out how much to take without pushing you into a higher tax bracket.

The easiest way to avoid these risks is to resist the temptation to take an early 401 withdrawal in the first place. If you absolutely must take an early distribution, make sure you withdraw no more than you absolutely need, and make a plan to replenish your account over time. This can help you minimize the loss of your compound returns over time.

Read Also: How To Open A 401k Self Employed