Average 401 Balances Dont Reflect All Retirement Savings

Theres another key fact to remember when looking at average 401 balances. They do not reflect total retirement savings, says David Stinnett, principal of Vanguard Strategic Retirement Consulting.

Participants may also have other savings accounts, such as individual retirement accounts , retirement accounts at previous employers or spousal accounts, not to mention additional retirement income sources like real estate, pensions and Social Security. All of these assets combined determine a persons retirement readiness.

What Determines Ira Interest

Traditional IRAs have different interest rates, and the rate of return you earn depends on the investments you choose. The total earnings will be an aggregate of the performance of individual bonds, shares of mutual funds, stocks, ETFs, certificates of deposits, etc.

For example, if you invest your retirement contributions in shares of an index fund comprising stocks from multiple companies, your IRA earnings will reflect the performance of the market. When the stock market returns are high, you will profit from the high stock returns. However, if the stock market experiences a downturn, you will see a dip in your IRA earnings.

Depending on your age and years remaining to retirement, you can hold short-term securities with average earnings or hold high-risk securities with the potential to earn high returns but with a high risk of loss.

How 401 Plans Work

A 401 plan allows employees to stash away part of their paycheck for their retirement. Once an employee enrolls into the 401 plan, they must decide how much to contribute to the 401, and the employer will make payroll deductions and deposit the deferrals to each eligible employeeâs 401. Some employers may also make matching contributions to the employeeâs 401 up to a specific percentage of the salary as an incentive to retain top talents.

Depending on the investment options provided by each employer, the contributions will be allocated to income-earning investments. The most common investments options include stocks, mutual funds, bonds, and exchange-traded funds. Employees earn different returns on their investments depending on their asset allocation and investment options.

You May Like: Who Can Open A 401k

The Average 401 Balance By Age Income Level Gender And Industry

- The average 401 balance is $129,157, according to Vanguard’s 2021 analysis of over 5 million plans.

- But most people don’t have that much saved for retirement.

- The median 401 balance is significantly lower at $33,472, more reflective of how most Americans save for retirement.

A 401 account is an employee-sponsored retirement vehicle that allows you to contribute pre-tax income towards your retirement. A 401 lets you lower the amount of income you’re taxed on and lets your funds grow tax-free.

In 2020, the average 401 account balance was $129,157, an increase from 2019’s $106,478 average, according to Vanguard data.

Each year, Vanguard analyzes account data from 5 million retirement accounts. Across these accounts, the typical account balance varies widely by the method used to calculate it while the average 401 savings balance is well over $100,000, the median account balance is much less at $33,472, according to Vanguard’s latest data.

The amount you save up toward retirement depends on how long you’ve been saving and how much of your annual income you can afford to put away. The Vanguard data broken down by demographics demonstrates as much, showing a wide range of average account balances across various age ranges, income levels, industries, and gender. Here’s a breakdown of those balances.

How Much Interest Can You Earn In A Year From $1 Million

As mentioned previously, there are many ways to earn interest on your money, and a million dollars isnt a bad place to start. Theres the stock market, money market accounts or high-interest savings accounts, mutual funds, bonds, and rental income from real estate, to name a few.

Each option comes with its own average annual return. Your comfort level plus the amount of time you have to invest will play a role in where you choose to put your money. If youre nearing retirement age and looking for a stable retirement income, youll want to be more conservative. On the other hand, if youre not looking to retire anytime soon, you might consider investing more aggressively.

To give you a better idea of the money you could earn through interest, see the various interest rates and returns below.

| APY |

|---|

| $200,000 |

Don’t Miss: Is Tiaa Cref A 401k

What Is Compound Interest

Compound interest is the interest earned on the initial investment and any accumulated interest from the previous period . This means that you earn interest on the interest that you have already earned.

Compound interest is different from simple interest. While simple interest is earned only on the original deposit, compound interest takes into account the initial investment amount and any interest gained since you put 401 money into the investment. Hence, your investment will grow at a faster pace with compound interest than with simple interest.

You Get A Tax Break For Contributing To A 401

The core of the 401s appeal is a tax break: The funds for it come from your salary, but before tax is levied. This lowers your taxable income and cuts your tax bill now. The term youll often see used is pre-tax dollars.

Say you make $8,000 a month and put $1,000 aside in your 401. Only $7,000 of your earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

Yes, you will have to pay taxes someday. Thats why a 401 is a type of tax-deferred account, not tax-free. Well get back to that.

Read Also: Is It Better To Rollover Your 401k

Average And Median 401 Balance By Age

These are the average and median balances for specific age groups at the end of 2020, according to Vanguard, which gathered data from 4.7 million defined contribution plan participants across its recordkeeping business.

| Age |

|---|

- Average 401 balance: $6,718

- Median 401 balance: $2,240

The median balance for people just getting started in their careers is $2,240. That means half of 401 plan participants in this age group have less than that amount saved and half have more. Thats a start and offers plenty to build on. The average balance is quite a bit higher, skewed by those who are able to save more in their 401.

How much should you strive to save for retirement? Fidelity, which manages employee benefits programs for more than 22,000 businesses and offers a variety of financial planning services, suggests saving at least 10 times your annual salary by age 67. The firm also advocates following another metric: Save 15 percent of your pretax income from the time you begin your career including any company match. So, if your employer matches 3 percent of your salary, youd need to save 12 percent. If current expenses preclude this possibility, work toward that amount as a goal.

How Is Your 401 Doing

Allocate your assets as you will, you can’t ever be 100% certain of the returns your 401 will generatethat’s why it’s called investing, not saving. But if you want a sense of how your portfolio is performing, you can, and should, make comparisons.

Specifically, you can compare the investments in your account to other mutual funds or ETFs that invest in similar assets , or have similar investment objectives . You can also see how a particular fund is doing compared to an overall index of its asset class, sector, or security type.

For example, if you owned a real estate fund, you might want to see whether it is underperforming or outperforming Dow Jones U.S. Real Estate Index , which tracks over 100 REITs and real estate companies. If you own broad-based equity funds, you can even compare them to the stock market itself.

Don’t be surprised, though, if your actual return lags the index by 1% to 2%. The cause is, in a nutshell, the annual fees charged by both your individual funds and by the 401 plan itself. Unfortunately, this sort of expense is pretty much beyond your control, and to be expected. However, if the index is up and your fund is down, be afraid, be very afraid.

You May Like: How Much Should I Put In My 401k Calculator

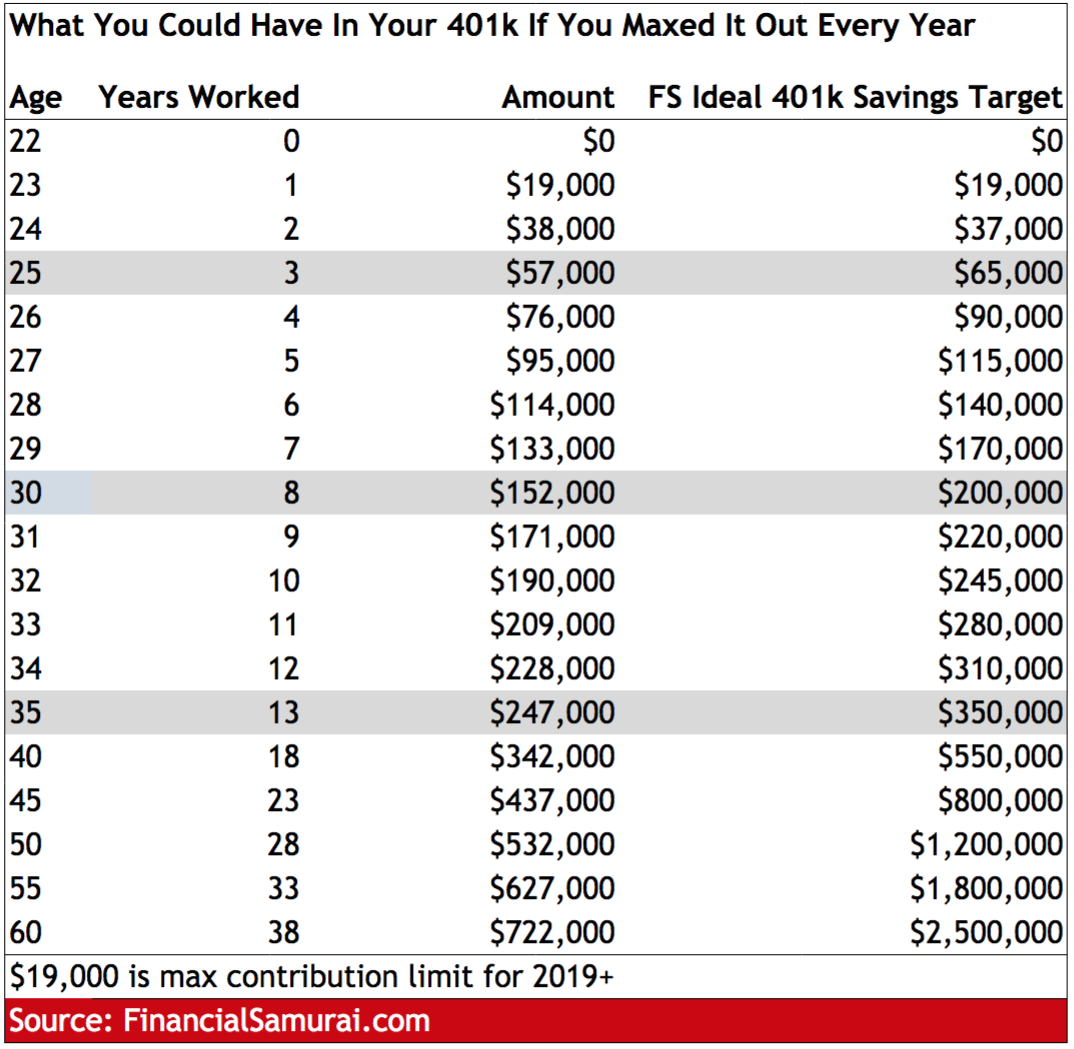

How Much Should You Contribute To Your 401

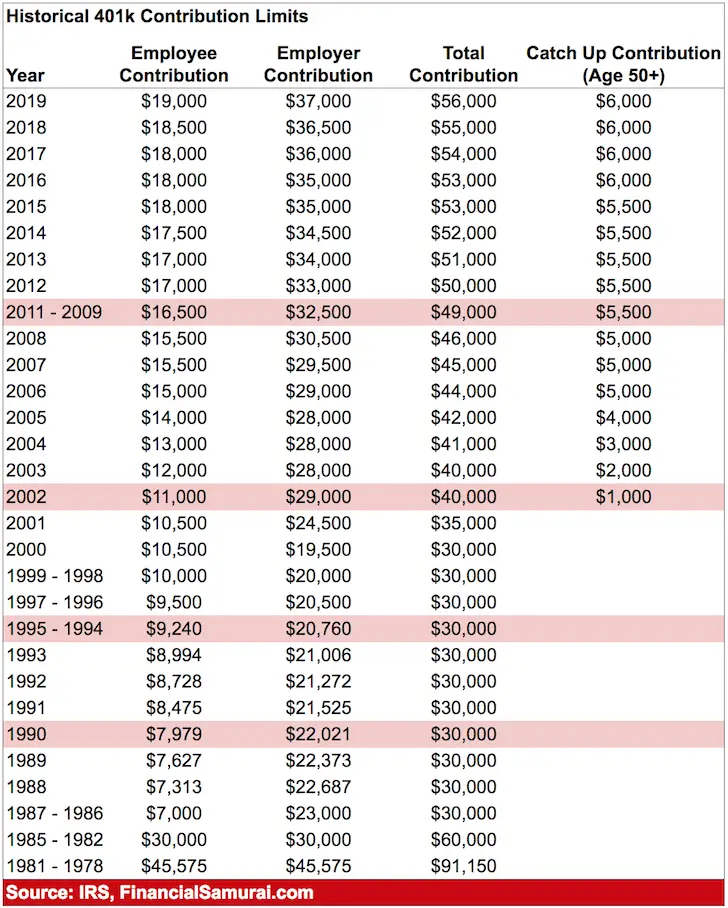

The easy answer is as much as you can. However, the IRS sets 401 plan contribution limits each year. In 2022, you can contribute a maximum of $20,500, or $27,000 if youre at least 50 years old.

401 plan contributions are factored as an annual percentage of your annual income. Many financial planners suggest you should aim for 10% to 15%. But according to the Vanguard study, 58% of plans that auto enroll participants do it with a 4% contribution or higher. It typically makes sense to contribute at least as much as your company 401 employer match, otherwise you are leaving money on the table.

Knowing how much you should contribute depends on your current income, your expected retirement date and how much you think youll need to support the retirement you want.

You can use our 401 calculator to determine how much you should contribute to your plan in order to generate the amount you need to support the retirement you want. In addition, our Social Security calculator can help you visualize how much you can expect in benefits.

But even if you contribute as much as you can into a well diversified portfolio, another factor that can take a major chunk out of even the strongest investment returns is high fees.

Advantages Of An Intertest

The maximum contribution an individual can make to their 401 account in 2021 is $19,500 . Those 50 and older can add an additional $6,500 for both years. If your employer offers even a 1% match on your contribution, that can mean substantial growth in the long-term thanks to compound interest. The gains you see are interest gains on interest and are considered the gold standard of responsible and intelligent investing.

You May Like: When To Withdraw From 401k

Do 401 Dividends Earn Interest

When you invest your 401 money in mutual funds, you will earn dividend income periodically depending on how the investment performs. You may also earn dividends if you hold the employerâs company stock in your 401. The dividend income represents small bonuses paid out from the issuing company’s profits.

Although dividend income does not gain interest on its own, you can earn interest if you chose the reinvest the money into more shares of stock. You can let the reinvested dividend income grow through compounding until when you are ready to withdraw money from 401. However, if you opt to receive the dividend payments, you wonât earn compound interest on the money.

Average 401 Return: What You Can Expect

Many retirement planners suggest the typical 401 portfolio generates an average annual return of 5% to 8% based on market conditions. But your 401 return depends on different factors like your contributions, investment selection and fees. And sometimes broader trends can overwhelm these factors during the first half of 2022 the S& P 500 dropped more than 20%. This article will explain these points in-depth so you can aim for the best returns from your 401. We can also assist you in finding a financial advisor. This professional can help you create a personalized retirement planning strategy.

Also Check: What Is A 401k Audit

Physical Real Estate Investing

You could also use that million dollars to buy several rental properties of your own and pretty easily live off the income that you receive in rent.

There is obviously more time and effort required when investing in rental properties . Plus, the liquidity isnt there as with REITs, but the potential for higher earnings is strong. Whether you decide to seek out long-term renters or shorter-term clients will also be a big factor in how much you can make to live on.

Example:

Lets say you buy a three-bedroom house for $250,000. You could probably rent that out for, say, $2,000 a month after expenses. Multiply that by 12 months and you get $24,000 a year.

If you have four similar rental properties, you could be taking in $96,000 a year. Thats a respectable income and means your investment of one million dollars earns you more than 9% a year.

You could probably double that money if you chose to use the properties for Airbnb-style rental units, but you would be opening yourself to a lot more work in addition to the extra cash. Using just one of the houses for short-term renting might be a good compromise and a nice boost to your cash flow.

How Do You Calculate A 401 Annual Return

To run the annualized return calculation yourself, take your ending balance for a specified period usually a year and subtract your beginning balance. Thats your total dollars of growth. Then, divide that by the beginning balance to find the percentage your balance grew for the period of time. For example, if your ending balance is $120,000 at year-end and your balance was $100,000 at the beginning of the year, youd subtract $100,000 from $120,000. Then, divide $20,000 by $100,000 to find a 20% return for that time period.

First and foremost, Ouellette says, make sure youre comparing it to the right benchmarks.

That means you shouldnt compare, say, an S& P 500 index fund with a bond fund. This will let you know if your returns are performing compared to the index its meant to track. If there isnt one, people often compare to the S& P 500, because its an easy proxy for the overall market.

If you made any contributions, youll want to subtract those from your calculations. And if you made several deposits or had any withdrawals, the math can get more complicated. Its also harder to review your returns for multi-year periods, although the method above should give you a reasonably close estimate.

That said, most online brokerages have an option to view your annualized returns and will even calculate your return over a custom period of time, so you dont have to break out the pen and calculator.

Read Also: How Can I Look At My 401k

Pros And Cons Of 401 Plans

401 plans have a myriad of benefits and potential disadvantages within the retirement savings realm. As you prepare for retirement, understanding pros and cons of available plans can help with your financial decision-making.

Pros of 401 Plans

- Federal protection under ERISA:

- The Employee Retirement Income Security Act of 1974 is a federal law that protects retirement plan money through standards set for employers. According to the U.S. Department of Labor, The law also establishes detailed funding rules that require plan sponsors to provide adequate funding for your plan.

- Employer matching:

- Employers can match your contribution to the plan, essentially adding free money. For example, if you contribute 6 percent of your income, they may match the full 6 percent. Some employers may contribute up to a certain percentage, or they may not offer matching at all. Employers may also delay the matching until the employee is vested in the company, remaining with the organization for a determined amount of time.

- High contribution limits:

- The 401 plan contribution limit for 2021 is $20,500 with an additional $6,500 for employees aged 50 and over. The higher your contributions, the lower your federal income tax for the tax year.

Although their benefits almost always outweigh any drawbacks, 401 plans may pose some challenges for some investors.

Cons of 401 Plans

How Much Interest Does $4 Million Earn Per Year

Putting away $4 million for retirement is a great accomplishment, and such an amount has the potential to provide significant interest. Predicting how much interest your nest egg earns will help you decide if its enough to support your lifestyle. But the interest earned will vary depending on the type of investments you choose. Here are a few common investments to give you an idea of the amount of interest you can earn on $4 million. For more specific questions related to your own financial goals, consider speaking to a financial advisor.

Recommended Reading: How Much Can I Rollover From 401k To Ira

Determine Your Financial Goals And Risk Tolerance

When it comes to investing in the stock market, investors have thousands of choices. Before you invest in any stocks, bonds, mutual funds, or ETFs, you must decide whether the investment strategy and risks are a good fit for you.

You should also consider more generally whether the unique type of security is a good fit for you. The first step to successful investing is to figure out your current financial goals and risk tolerance either on your own or with the help of an investment professional.

All investments carry some level of risk. An investor can lose some or all of the money they invest the principal because securities fluctuate in value constantly. Dividend payments may also go up or down as market conditions change. Stocks, mutual funds, ETFs, and other investments have different risks and rewards. Generally, the higher the potential return, the higher the risk of loss.

How Confident Do You Want To Be That Your Money Will Last

Think of a confidence level as the percentage of times in which the hypothetical portfolio did not run out of money, based on a variety of assumptions and projections regarding potential future market performance. For example, a 90% confidence level means that, after projecting 1,000 scenarios using varying returns for stocks and bonds, 900 of the hypothetical portfolios were left with money at the end of the designated time periodanywhere from one cent to an amount more than the portfolio started with.

We think aiming for a 75% to 90% confidence level is appropriate for most people, and sets a more comfortable spending limit, if you’re able to remain flexible and adjust if needed. Targeting a 90% confidence level means you will be spending less in retirement, with the trade-off that you are less likely to run out of money. If you regularly revisit your plan and are flexible if conditions change, 75% provides a reasonable confidence level between overspending and underspending.

You May Like: How To Retrieve 401k From Old Job