How To Set Up A Solo 401k Plan

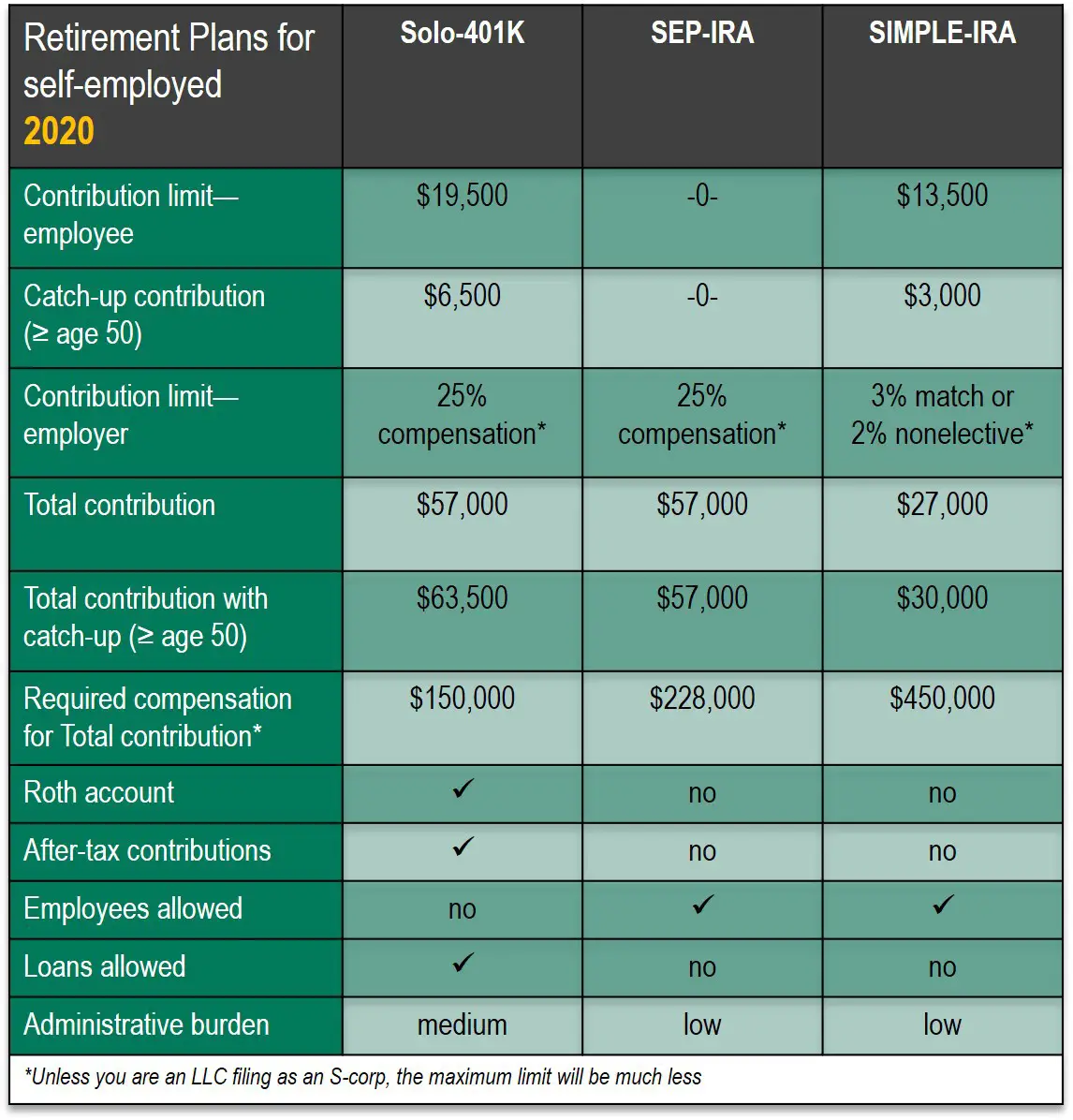

The Solo 401 retirement plan, also called the self-employed 401 or individual 401, is similar to a traditional 401, except that it was designed to benefit business owners with no full-time employees .

The Solo 401k plan isnt a new type of plan, and not all plans are the same. In this article, well explain how to easily set up a Solo 401k plan to make traditional, as well as non-traditional investments.

How To Open A 401k Without An Employer

How do you open a 401 account without an employer plan? Many companies donât offer a 401. But there are many alternatives to save for retirement.

The 401 retirement plan is the most common way in which Americans save for retirement. However, according to a study by the US Census Bureau, only 14% of US employers offer a 401 through their company. That still results in over 70% of Americans contributing to a 401 plan. But if you find yourself working for a company that doesn’t offer a 401 plan, you might not know how to open a 401 without an employer plan.

If your company doesnât offer a 401 plan or you are self-employed, youâll need to join a separate financial institution. There youâll be able to open a 401, IRA, or any other retirement plan you choose.

In addition to these alternatives to 401s, you’ll want to rollover your old 401s to these accounts. Consolidating your 401s will help keep your retirement properly managed and accounted for.

Take Into Consideration The Fees

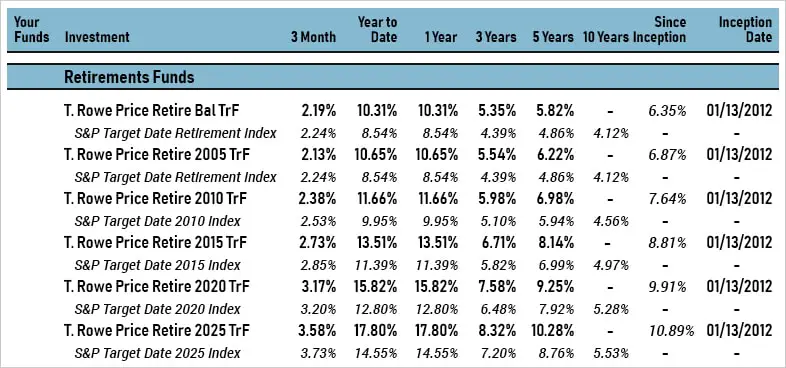

Most 401 plans offer a range of mutual funds that investors can choose from. Mutual funds usually charge investment fees that can eat into returns, so this will need to be taken into consideration when choosing the right funds for you. These fees are detailed in the funds prospectus.

If you go the managed investment route, you will be paying a higher investment fee than someone in a target-date fund or who chooses their own mix of funds for the account, as youll be paying for the advisory services in addition. Each plan has its own service fees which need to be evaluated before making the decision.

Recommended Reading: Is Rolling Over 401k To Ira Taxable

How Much Should I Start A 401 With

There are no minimum balances for your 401, and most if not all of the investment options will have no minimum requirements either. A 401, especially when taking advantage of the employer match, is built slowly over time, so do not worry if you are not able to contribute much when you first start your plan.

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages for the saver. It is named after a section of the U.S. Internal Revenue Code .

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

Also Check: Should You Withdraw From 401k To Pay Off Debt

Work Directly With Trained Tax Professionals With An Ira Financial Group Solo 401k

Working with educated trained tax & ERISA professionals when looking for a Solo 401k plan provider is crucial in ensuring that your plan will be properly setup, as well as remain in full IRS compliance. The Solo 401k is based on the rules found in the Internal Revenue Code, which can be quite complicated to the someone without a tax professional background. Therefore, it is strongly advisable to work with a Solo 401k plan provider like the IRA Financial Group who was founded by a tax attorney who has written seven books on the topic of self-directed retirement plans, including two books on the Solo 401k plan.

Note IRA Financial Group is not a law firm. IRA Financial Group does not provide legal services. Relying on the advice of a document processor or no-tax professional when it comes to establishing and maintaining your retirement plan puts your retirement future at great risk.

Too many times, plan participants have unknowingly violated IRS rules when operating their Solo 401k because a plan provider representative that was not qualified to provide relevant tax advice gave them inaccurate and incomplete tax advice or drafted the plan documents incorrectly. Make sure this does not happen to you work only with qualified 401 Plan tax & ERISA professionals who have been specifically trained on the special tax aspects of the Plan to establish and maintain your Solo 401k Plan.

Prototype Plan Vs Custom Plan

Once you understand what options you want for your solo 401k plan, it’s time to discuss plan documents.

See, your solo 401k really has two parts:

When it comes to the solo 401k plan documents, you can either use a prototype plan, or create your own custom plan.

A prototype plan is typically offered by the brokerage firms that offer free solo 401k plans. They are called prototype plans because they are very generic plans that were created by a lawyer, and anyone can use them. However, because these are generic plans, they might not offer all of the options you’re looking for in a solo 401k.

For example, Fidelity’s solo 401k plan doesn’t offer a Roth solo 401k option. Vanguard’s solo 401k plan doesn’t offer loans from your 401k. As such, you need to carefully consider the options available in a prototype solo 401k. E*Trade offers the most robust prototype solo 401k plan.

On the other hand, you can create a custom solo 401k plan. This is where you pay a company to draft you plan documents that are custom to your needs. The reason you create this is because you want to invest in alternative assets like real estate.

Other options include:

Recommended Reading: What To Do With 401k When You Quit Your Job

Make A Date With Your 401 Plan And Ira Once Or Twice A Year

- Review your asset allocation plan. Your retirement accounts should match your risk tolerance and goals. Brush up on asset classes and whats in your retirement plan to better understand your options.

- Check your progress. Are you saving more? If not, consider changing your deferral, adding money to your IRA, or making a catch-up contribution.

- Update beneficiaries on your accounts and keep your contact information current. If you have retirement accounts with Principal, you can log in to make those changes.

How A Sep Ira Works

The employer alone contributes to a SEP IRAnot employees. So, unlike the solo 401, youd only contribute wearing your employer hat. You can contribute up to 25% of your net earnings , up to a maximum of $58,000 in 2021 .

The plan also offers flexibility to vary contributions, make them in a lump sum at the end of the year, or skip them altogether. There is no annual funding requirement.

Its simplicity and flexibility make the plan most desirable for one-person businesses, but theres a catch if you have people working for you. Although you do not have to contribute to the plan each year, when you do contribute, you need to do so for all of your eligible employeesup to 25% of their compensation, limited to $305,000 in 2022.

While SEP IRAs are simple, they are not necessarily the most effective means of saving for retirement. You can contribute more to a SEP IRA than a solo 401, excluding the profit-sharing, but you must make enough money since its based on the percentage of profits, says Joseph Anderson, CFP, president of Pure Financial Advisors.

You May Like: What Is A Ira Vs 401k

Contributing To Both A Traditional And A Roth 401

If their employer offers both types of 401 plans, an employee can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can be made to a traditional 401 account and a Roth 401. In both instances, contributions and their earnings will be subject to tax upon withdrawal.

Transfer Retirement Funds To Solo 401

When you choose your solo 401 provider and you set up your IRS compliant Solo 401k plan, transfer your retirement funds from your current custodian to a financial institution or credit union that can serve as your custodian. There is no fee, and the transfer is also tax-free.

Make a tax-free direct rollover to your new Solo 401k plan bank account. You can contact the specialists at IRA Financial Group can assist you in completing this step in setting up your Solo 401. We will expedite the process in a tax-free manner.

Learn More:How to Transfer Your Retirement Funds to a Solo 401

Recommended Reading: When Can I Rollover 401k To Ira

Choose How Much To Contribute

When deciding how much of your gross income to divert into your 401, youll want to consider whether your company offers a matching contribution. Financial advisors will typically recommend taking advantage of the company match and using that percentage as a starting point. For example, if your company offers to match up to 5% of your contributions, you would want to contribute at least 5% to qualify for the match.

However, there are limits to how much you can set aside each year. An employee can contribute up to $20,500 to their 401 in 2022. Employees who are at least 50 years old can make an additional $6,500 catchup contribution.

How To Set Up Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Every new job comes with a stack of documents to sign, initial and, months later, try to remember where they were hastily tossed. Race too quickly through this first-day ritual and you could be leaving thousands of dollars of employee perks on the conference room table.

If you missed the pitch for the company retirement plan during employee orientation, dont worry. Unlike some employee benefits, such as opting in for insurance or setting up a flexible spending account, you can enroll in a 401 year-round.

If you havent enrolled already, consider eating lunch at your desk today and taking care of this 401 business.

You May Like: How To Get Money From Fidelity 401k

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Important: This page touches on complicated topics related to tax and employment law. The information on this page might not be accurate, up-to-date, or relevant to your situation. Do not make important decisions based on what you read here. Instead, speak with an expert who has a detailed knowledge of your situation and any applicable regulations.

Next Up: Curious About Meeting?

Maintaining 401k Plans For A Business

Most 401k plans are subject to the requirements of the IRC and the Employee Retirement Income Security Act , which provide minimum standards that protect individuals in retirement plans. Administering and maintaining plans that comply with these regulations ranges in difficulty from the moderate to the complex.

You May Like: What Is The Difference Between Annuity And 401k

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

Getting An Early Start Can Have A Significant Impact On The Growth Of Your Savings Down The Road But Its Also Important To Remember That Its Never Too Late To Start Saving

1 “Social Security Fact Sheet,” Social Security Administration, June 2019. 2 Estimates for Health Care Costs in Retirement Continue to Rise, PLANSPONSOR, April 2019. 3 Ordinary income taxes are due at withdrawal. Withdrawals before the age of 59½ may be subject to an early distribution penalty of 10%.

The content of this document is for general information only and is believed to be accurate and reliable as of the posting date, but may be subject to change. It is not intended to provide investment, tax, or legal advice . Please consult your own independent advisor as to any investment, tax, or legal statements made herein.

You May Like: How Much You Should Have In 401k By Age

How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2022, salary deferrals are $20,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

Avoid Early Withdraw Penalties

If you withdraw money from your 401k before reaching 59½ you could be taxed twice. You will be charged a penalty tax of 10% on the amount you withdraw early and you will have to include this early withdrawal on your income tax return too! There are certain circumstances where you are allowed to withdraw funds early from your 401k without penalty.

Also Check: What Are The Advantages Of A 401k

Take Your First Step Confidently

Starting down the path to saving for your retirement may be easier than you think: Begin by enrolling in your 401, 403, or other available workplace savings plan. That’s it. You don’t have to be a financial guru. It won’t take long at all to set up.

Taking that first step to enroll is important for a number of reasons. The earlier you start saving, the more time your money has to grow. That’s called compounding, and it can really help you reach your retirement savings goals. See the illustration on the right.

You’ll also gain a sense of achievement and maybe even some momentum to take the next step, whether it’s getting back on track after an event in your life has slowed your savings, or creating a plan for living out your dreams in retirement.

No matter where you are in life, know that you can take steps toward retirement confidently with the knowledge and tools you’ll find from Fidelity.

Provide Fee Disclosure Information

Your self-employed 401 should not be subject to Title 1 of ERISA because it does not cover employees beyond the owners of the business sponsoring the plan . However, you if operate a money purchase or profit sharing plan with common law employees you should be aware of the to keep up to date on fee disclosure regulations for plan sponsors and plan participants.

Recommended Reading: Can You Do A Partial 401k Rollover

Importance Of Selecting The Right Solo 401 Provider

There are several companies on the internet that advertise themselves to be a Solo 401k plan provider and expert. However, in most cases, the specialists who draft your Solo 401k Plan documents, as well as advising you, are not educated or trained tax attorneys or even tax professionals.

Many times, a salesperson or representative of a Solo 401k plan provider will offer you tax or ERISA guidance with respect to a 401 Plan feature or an investment, while lacking the adequate knowledge or expertise to do so. They may even tell you that you dont need a trained tax attorney or specialized 401 plan tax professional to help you establish the plan. As a result, we have had to, on many occasions, help individuals who worked with a number of these companies who found themselves in some IRS trouble because they have made improper plan contributions or invested in a prohibited transaction as a result of being mislead by a Solo 401k plan provider representative that was not qualified to provide proper tax advice regarding the unique features of the Plan.

Working directly with a 401 Plan tax professional that has been specifically trained on the special tax aspects of the Solo 401k Plan to establish and maintain your Solo 401k is the only way you can guarantee your plan will remain in full IRS compliance and that you will not be engaging in any plan activities not approved by the plan or the IRS.