Its Better Than Falling Behind On Your Bills

Sometimes, you just dont have a better option. If a 401 withdrawal is the only way that you can pay your bills without taking on costly credit card debt, do it. Leaving your retirement savings alone isnt worth it if it threatens your current financial security and your ability to save more for retirement in the future.

Only withdraw as much as you need and keep seeking out alternative sources of funding. Look for a new job if youve lost yours, start a side hustle, or consider applying for a personal loan with a reasonable interest rate.

Read Also: How To Check 401k Balance Fidelity

What Is A 401 Plan

Traditional 401 plans are employer-sponsored retirement accounts. They allow you to contribute pre-tax earnings through automatic payroll deductions. Employers can also contribute to your account by matching your contributions or making non-matching donations.

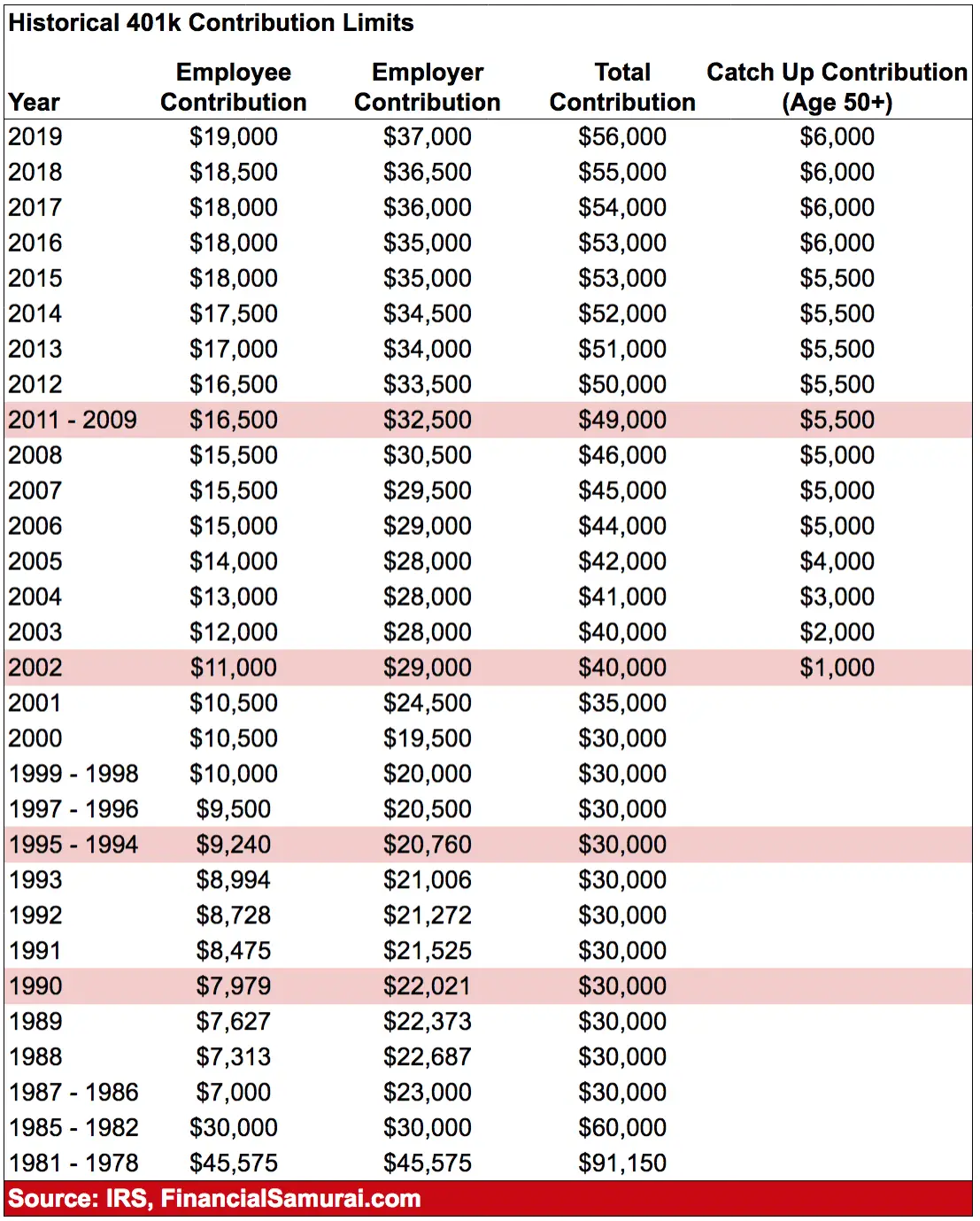

Your 401 account balance grows over time, not only from contributions but thanks to interest yields. However, the Internal Revenue Service restricts how much you can contribute each year and when you can take penalty-free distributions.

If you’re looking to explore retirement accounts besides the traditional 401 it may also be worth considering an IRA.

Can The Government Take Your 401k

Lets get one thing out of the way first: unless you have an IRS levy or other legal judgment against you, the US Government has no legal standing to seize the contents of your private retirement account, such as your 401k, IRA, Thrift Savings Plan, your self-employed retirement plan, or any other retirement plan.

Don’t Miss: Can I Borrow From My 401k To Start A Business

How Can I Avoid Paying Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Can You Collect Social Security And A Pension At The Same Time

Can I collect Social Security and a pension? Yes. There is nothing that precludes you from getting both a pension and Social Security benefits. … If your pension is from what Social Security calls covered employment, in which you paid Social Security payroll taxes, it has no effect on your benefits.

Also Check: What Can I Invest My 401k In

New Stimulus Bill Allows Penalty

The $900 billion stimulus bill that Congress passed Monday allows workers to take money from their 401s without being hit with a tax penalty a slight change to a rule passed in the Coronavirus Aid, Relief, and Economic Security Act last March.

Anyone can take up to $100,000 from their account through a loan or withdrawal as long as they live in an area where a major disaster has been declared, according to the bill. The provision excludes areas affected only by the COVID-19 disaster. The CARES Act gave Americans financially hurt from the pandemic an opportunity to withdraw without penalty, but that exception ended in 2020.

But although withdrawing funds from a 401, IRA or any other retirement account is penalty-free for now, financial planners say raiding that account should be a last resort. Withdrawals will ultimately put someone on an exit ramp to eternal financial sadness, said Paul Ruedi, a retirement planner in Illinois.

If you took out $100,000 from your account during the end of March this year, you would have missed the 66.88% gain in the broad stock market, he said. Thats a loss of opportunity of $66,880 that you never get back.

Even before the pandemic many workers have needed to dip into their retirement account to make ends meet, Transamerica CEO Catherine Collinson said. It will take years for those people to recover those losses and some many never recover, she added.

Ways To Withdraw Money From Your 401k Without Penalty

This article was originally published on ETFTrends.com.

When hard times befall you, you may wonder if there is a way withdraw money from your 401k plan. In some cases you can get to the funds for a hardship withdrawal, but if youre under age 59½ you will likely owe the 10% early withdrawal penalty. The term 401k is used throughout this article, but these options apply to all qualified plans, including 403b, 457, etc.. These rules are not for IRA withdrawals see the article at this link for 19 Ways to Withdraw IRA Funds Without Penalty.

Generally its difficult to withdraw money from your 401k, thats part of the value of a 401k plan a sort of forced discipline that requires you to leave your savings alone until retirement or face some significant penalties. Many 401k plans have options available to get your hands on the money , but most have substantial qualifications that are tough to meet.

Your withdrawal of money from the 401k plan will result in taxation of the withdrawal, and if you do not meet one of the exceptions, a penalty as well. See the article Taxes and the 401k Withdrawal for more details about how the taxation works.

The list below is not all-inclusive, and each 401k plan administrator may have different restrictions or may not allow the option at all.

Well start with the obvious methods, all of which generally require the plan participant to leave employment:

1. Normal Begin after age 59½ after leaving employment at any age

Don’t Miss: Who Can Manage My 401k

When Must I Receive My Required Minimum Distribution From My Ira

You must take your first required minimum distribution for the year in which you turn age 72 . However, the first payment can be delayed until April 1 of 2020 if you turn 70½ in 2019. If you reach 70½ in 2020, you have to take your first RMD by April 1 of the year after you reach the age of 72. For all subsequent years, including the year in which you were paid the first RMD by April 1, you must take the RMD by December 31 of the year.

A different deadline may apply to RMDs from pre-1987 contributions to a 403 plan .

Taxes On Roth 401 Plans

Some employers offer another type of 401 plan called a Roth 401. These savings plans take the opposite approach when it comes to taxation: Theyre funded by post-tax income. This means your contributions wont lower your AGI ahead of tax-filing season.

The biggest benefit of a Roth 401 is that because youre paying taxes on your contributions now, you can withdraw the money tax-free later. A few other important notes:

-

You can begin withdrawing money from your Roth 401 without penalty once youve held the account for at least five years and youre at least 59½.

-

You can withdraw money from a Roth 401 early if youve held the account for at least five years and need the money due to disability or death.

-

Roth 401s also require taking RMDs.

Don’t Miss: How To Roll Old 401k Into New 401k

Can An Account Owner Just Take A Rmd From One Account Instead Of Separately From Each Account

An IRA owner must calculate the RMD separately for each IRA that he or she owns, but can withdraw the total amount from one or more of the IRAs. Similarly, a 403 contract owner must calculate the RMD separately for each 403 contract that he or she owns, but can take the total amount from one or more of the 403 contracts.

However, RMDs required from other types of retirement plans, such as 401 and 457 plans have to be taken separately from each of those plan accounts.

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

Don’t Miss: How To Open Individual 401k Account

How Is Tax Calculated On 401k Withdrawal

Your 401 withdrawal will be taxed as income. There is no separate 401 withdrawal tax. As with any taxable income, the rate you pay depends on the amount of total taxable income you receive that year. At the very least, you pay the federal income tax on the amount you repay each year.

How much tax do you pay when you withdraw from 401k?

If you withdraw money from your 401 account before age 59 1/2, you must pay a 10% early withdrawal penalty, in addition to income tax, on the distribution. For someone in the 24% tax bracket, a $ 5,000 early 401 withdrawal costs $ 1,700 in taxes and penalties.

How can I avoid paying taxes on my 401k withdrawal?

Heres how to minimize 401 in IRA retirement tax in retirement:

- Avoid early withdrawal punishment.

- Avoid two distributions in the same year.

- Start retreat before you have to.

- Donate your IRA distribution to charity.

What If You Need To Withdraw Money From Your 401 Before Age 59

There are some situations where you may need to withdraw money from your 401 before you reach retirement age. For example, you may need to withdraw money to pay for a childs education or cover the medical emergency cost.

In these cases, you can still withdraw money from your 401 without paying the penalty. However, you will have to pay taxes on the amount you withdraw. So, if you are in a high tax bracket, you will owe a significant amount of money in taxes.

Another workaround is a 72t distribution. This is a way to take periodic withdrawals from your 401 without paying the penalty. However, you will need to follow specific rules and regulations to qualify for this distribution.

Recommended Reading: What Happens To Unclaimed 401k Money

Alternatives To Withdrawing From 401

How can you access cash without withdrawing or borrowing from your 401? If you’re a homeowner with equity, you can consider a cash-out refinance, home equity loan or home equity line of credit . All three of these options typically come with competitive interest rates because the financing is secured by your home.

Permanent life insurance policies with cash value components are another option. In this case, your death benefit serves as collateral for the loan. Once the loan balance is paid off, your death benefit is restored in full.

To avoid the penalties from an early withdrawal, consider how much money you’re really looking for. You may be able to make up some extra cash by refinancing your student loans, particularly if you paid high interest rates when you took out the loan.

Withdrawals After Age 59

Tax-advantaged retirement accounts, such as 401s, exist to ensure that you have enough income when you get old, finish working, and no longer receive a regular salary. From time to time, you may be eager to tap into your funds before you retire. However, if you succumb to those temptations, you will likely have to pay a hefty priceincluding early withdrawal penalties and taxes such as federal income tax, a 10% penalty on the amount that you withdraw, and relevant state income tax.

Most Americans retire in their mid-60s. Theres a little more flexibility offered with retirement savings plans, though, including the company-sponsored 401. The Internal Revenue Service allows you to begin taking distributions from your 401 without a 10% early withdrawal penalty as soon as you are 59½ years old.

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Read Also: How To Move 401k To Cash

What Age Can You Withdraw From 401k

Different rules apply when determining what age to withdraw funds from 401. Find out the various ages when you can take out money from a 401.

401s have different rules on when a participant can access their retirement savings without paying an early withdrawal penalty. Younger participants have fewer opportunities to take out money from their 401s compared to their older colleagues who are already retired or approaching retirement age. The money in a 401 is intended to fund retirement, and the government enforces different rules to discourage withdrawals before attaining retirement age.

The IRS requires that a 401 participant must be at least 59 ½ to begin taking money out of a 401 penalty-free. If you want to start taking distributions before age 59 ½, you will pay income tax and a 10% early withdrawal penalty tax on the amount you take out of your 401. An exemption to this requirement is when an employee quits or is fired by the employer at age 55. This exception is known as the rule of 55, and it allows employees who leave the employer at 55 to withdraw their retirement savings without paying a penalty.

Alternatives To Rule Of 55 Withdrawals

The rule of 55, which doesnt apply to traditional or Roth IRAs, isnt the only way to get money from your retirement plan early. For example, you wont have to pay the penalty if you take distributions from a 401 early for these reasons:

- You become totally and permanently disabled.

- You pass away and your beneficiary or estate is withdrawing money from the plan.

- Youre taking distributions to pay deductible medical expenses that exceed 7.5% of your adjusted gross income.

- Distributions are the result of an IRS levy.

- Youre receiving qualified reservist distributions.

You can also avoid the 10% early withdrawal penalty if early distributions are made as part of a series of substantially equal periodic payments, known as a SEPP plan. You have to be separated from service to qualify for this exception if youre taking money from an employers plan, but youre not subject to the 55 or older requirement. The payment amounts youd receive come from your life expectancy.

Read Also: Is Roth Better Than 401k

What Happens If A Person Does Not Take A Rmd By The Required Deadline

If an account owner fails to withdraw a RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount not withdrawn is taxed at 50%. The account owner should file Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored AccountsPDF, with his or her federal tax return for the year in which the full amount of the RMD was not taken.

And Roth 401 Withdrawals

You will pay taxes on your traditional 401 funds as you withdraw them. You can withdraw without penalty at age 59½. But prior to that, you will pay a 10% early withdrawal penalty plus taxes on the dollars you take out, although some exceptions apply.

Funds withdrawn from a Roth 401 are tax-free so long as certain criteria are met: You must have held the account for at least five years and must be age 59½ to begin making tax-free withdrawals .

You must begin withdrawing the Required Minimum Distributions of your 401 funds by April 1 of the year after you turn 72. 401 RMDs are calculated according to a formula set by the IRS. Consult your 401 plan sponsor to determine your RMD when you decide to begin making withdrawals.

Recommended Reading: What Is The Difference Between An Annuity And A 401k

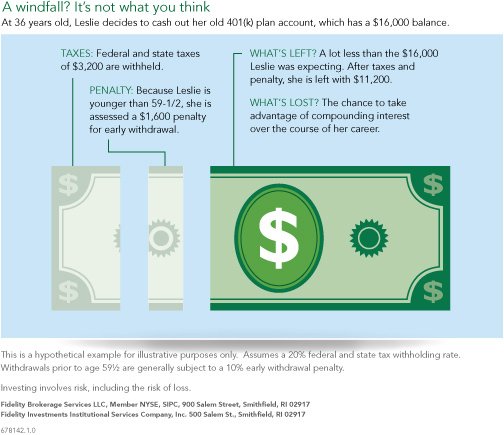

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Cashing Out A : Are You Eligible

A 401 is a retirement plan that is sponsored through an employer. When you contribute to a 401, the money is taken from your paycheck and invested in mutual funds and other securities. Most traditional 401 plans are tax-deferred, meaning you don’t have to pay taxes on the funds until you make a withdrawal.

Anyone can cash out their 401, but doing so early may cost you. Since a 401 is a retirement fund, there are rules that encourage you to wait until retirement to withdraw funds. The earliest you can usually withdraw from your 401 without paying a penalty is at age 59 ½. The requirements vary a bit, however, based on your current employment status.

Recommended Reading: How To Create 401k Account