How Much Tax Do I Pay On 401k Withdrawal

When you withdraw funds from your 401 account, you will owe income taxes and a potential penalty. Find out how much you will owe.

One of the attractive features of a 401 plan is that it is tax-deferred, meaning that there is no tax charged on contributions, or on interest and gains earned on the retirement savings until you withdraw it. This allows individuals to contribute a bigger portion of their paycheck to their retirement savings up to the 401 contribution limit. However, you will still have to pay taxes when you withdraw money from a 401 plan.

When you make a withdrawal from a 401 account, the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. For example, if you fall in the 12% tax bracket rate, you can expect to pay up to 22% in taxes, including a 10% early withdrawal penalty if you are below 59 ½. However, if you are above 59 ½, you will only pay income taxes on the amount withdrawn. You must file your annual tax return, reporting all the income earned during the year, including the 401 distributions, and taxes you have already paid.

Eligibility For Cashing A 401 Plan

In the event that you are still under the employment of the company that is paying for your 401, you wont be eligible for cashing out your 401 plan. The only exceptions to this would be if the plan, in particular, allows for a 401 loan, an in-service withdrawal, or a hardship withdrawal.

One piece of advice would be to avoid taking out a 401 loan as much as you can. The cash you have in your 401 needs to be given as much time as you can in order to grow. The loan is also required to be paid back with interest, so youll just end up losing money in the long run.

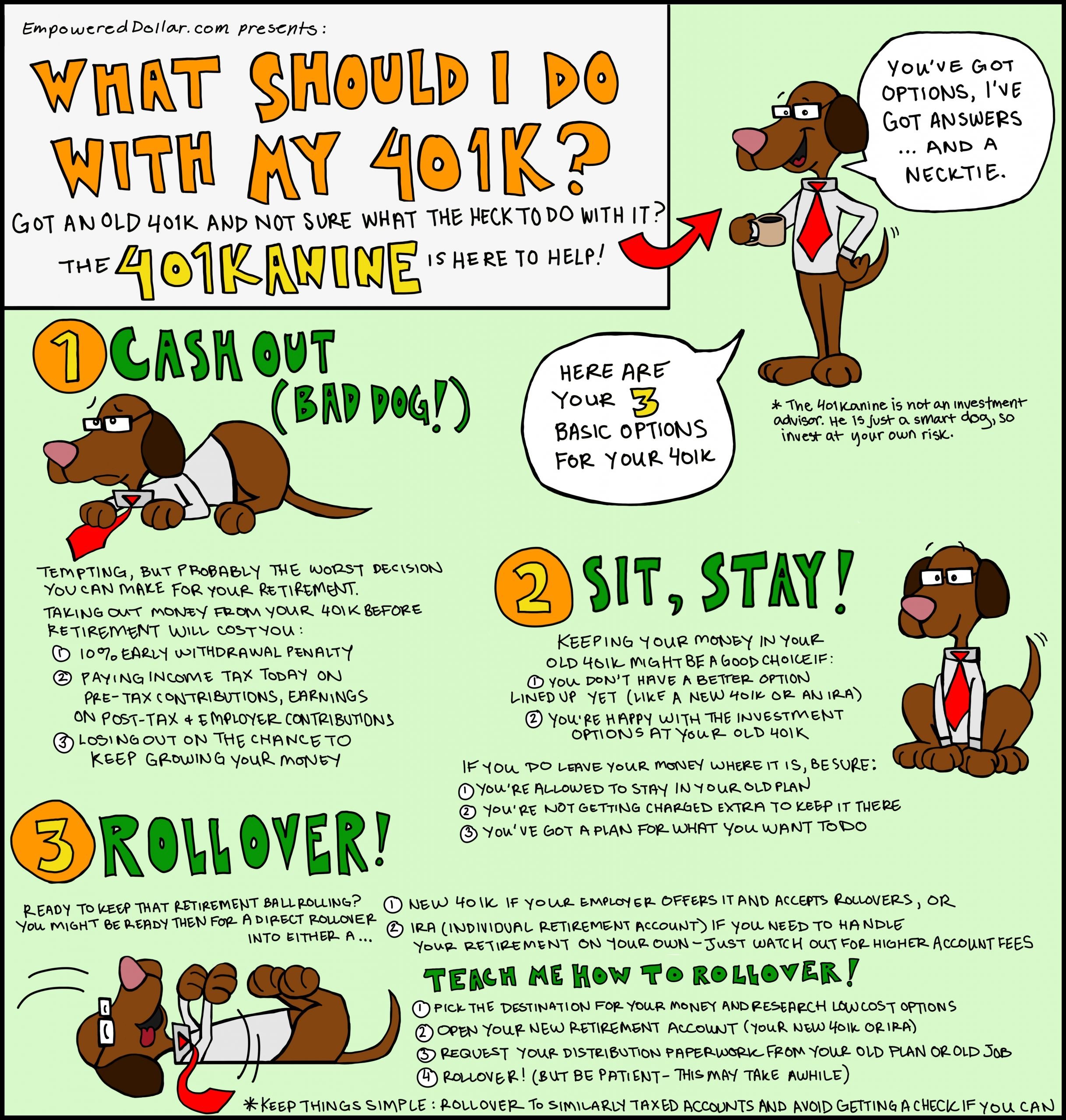

If you are no longer under the employment of the companies that sponsor your 401 plan, then you are indeed eligible to get the money. You can either cash it out, or you may roll it over through an IRA.

If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 plan over into another plan, then the IRS does not see this as cashing out.

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Also Check: Can I Move My 401k To A Cd

Can I Transfer My 401k To My Bank

Once you have attained 59 ½, you can transfer funds from a 401 to your bank account without paying the 10% penalty. However, you must still pay income on the withdrawn amount. If you have already retired, you can elect to receive monthly or periodic transfers to your bank account to help pay your living costs.

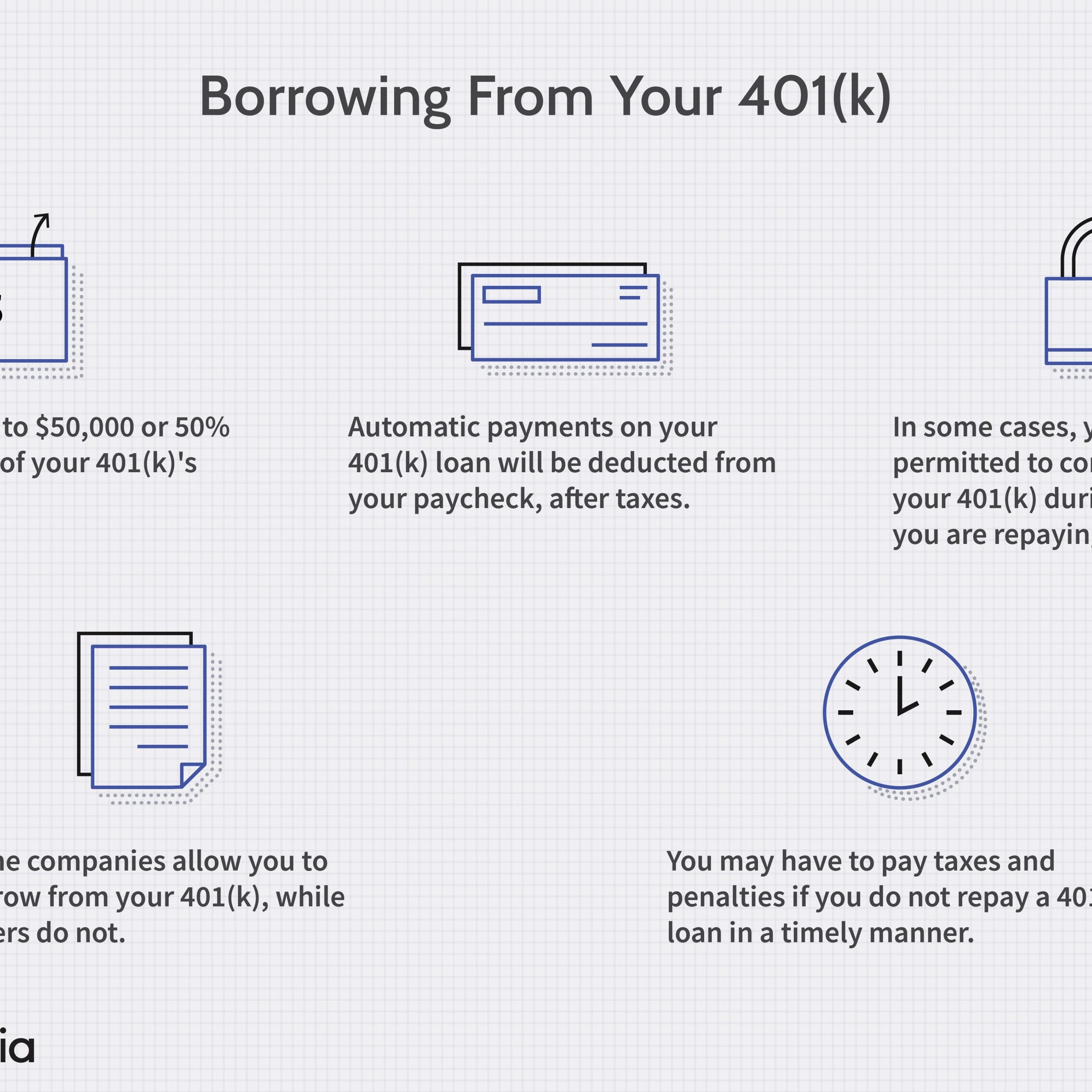

To Borrow Or Not To Borrow

You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. However, a loan may trigger fees, and you may be forced to pay back the entire amount you borrowed if you leave your job, voluntarily or not. You also need to find out how your employer structures these types of loans.

Recommended Reading: How To Open Up A 401k

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

Also Check: How To Find My 401k Money

How To Withdraw Money From A 401k After Retirement

Finance Writer

During your working years, youve probably set aside funds in retirement accounts such as IRAs, 401s, or other workplace savings plans. Your challenge during retirement is to convert those accounts into an income stream that can continue to provide adequately throughout your retirement years.

If youâre approaching the age that you want to hang your hat from working, you may be wondering how to withdraw money from your 401 after retirement. It isnât always exactly straightforward, which is why weâve broken down some of the basics of using your 401. Hereâs what you need to know.

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Recommended Reading: How Do I Manage My 401k

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choicesleave your money in the plan until you reach the age of required minimum distributions , convert the account into an individual retirement account , or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

Read Also: How To Sign Up For 401k On Adp

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

Take Caution If You Are Not 55 Yet

Do not retire earlier than age 55, thinking you can access your 401 funds penalty-free once you turn 55. For example, if you retire at 54, believing in one year you can access funds penalty-free, youll have missed the mark. To avoid the penalty from 55 59 ½, you needed to leave your employer no earlier than the year you attained the age of 55. When you leave your employer before age 55, the earliest you can access funds penalty-free will be age 59 ½.

If you roll your previous 401 into a new employers 401 or to an IRA, you void the early access rule! Once its rolled over, you cannot withdraw money until youre 59½ without penalties unless you qualify for an exception or use an odd tax code provision called 72 payments.

Recommended Reading: How Much Do You Have To Take Out Of 401k

Taxes If You Withdraw Money Early

You can make an early 401 withdrawal to pay college fees, emergency medical bills, or when you are a victim of a disaster. In this case, you should expect to pay income taxes on the amount withdrawn, since the distribution is considered an income to you. However, if the withdrawal qualifies as a hardship withdrawal, you may get an exception for the 10% penalty tax.

If you have a Roth 401 account, you wonât be required to pay any income taxes as long as youâve held the account for at least five years. A Roth 401 is funded with after-tax dollars, and you only pay taxes on contributions. The Roth 401 contributions are not tax-deductible, and you wonât pay taxes on withdrawals in retirement. However, if you make a withdrawal before reaching 59 ½, you will pay income taxes on any interests and gains on your retirement savings, and a 10% early withdrawal tax, unless you need the money due to disability or death.

Taking An Early Withdrawal From 401k Can Be A Costly Option

In a perfect scenario with your 401k savings, you wont need to take a distribution until you are ready to leave employment behind for the next chapter of your life, which is retirement. Ideally, this will be at least age 59.5 . Not to be confused with the ages you can generally claim Social Security or Medicare. Those arent arbitrary numbers that we decided to make up. Those are the ages outlined by the IRS at which you can begin withdrawing money from retirement plans without paying the 10 percent additional penalty in most cases. I say most cases because there are exceptions to the rule when it comes to withdrawing retirement money without the costly 10 percent penalty, and the rules can differ depending on whether an employee is currently employed or not. The caveat with any of these exceptions is that it could derail financial plans and projections for the future. It is true that accessing your retirement funds may not be prudent. There is the 10 percent penalty, paying income taxes on the amount taken out above the income you are receiving from your employment, potentially selling holdings when the market is down, no longer contributing to the 401k plan, and missing some potential gain because of a balance decrease. However, it may also be true that you may not have another choice. Lets address the choices you have if you decide to withdraw from retirement assets.

Don’t Miss: How Can I Invest My 401k

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment education, and integration with leading payroll providers.

Don’t Miss: How To Find Out If I Have Old 401k

Tapping Your 401 Early

If you need money but are trying to avoid high-interest credit cards or loans, an early withdrawal from your 401 plan is a possibility. However, before you consider this option, be forewarned that there are often tax consequences for doing so.

If you understand the impact it will have on your finances and would like to continue with an early withdrawal, there are two ways to go about it cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?

How To Make An Early Withdrawal From Your 401k Account

A 401 is an employer-sponsored retirement savings plan with the goal of saving enough that you can make withdrawals in retirement to suit your lifestyle. This money can grow tax-deferred, including employer contributions, while keeping the long-term goal of retirement in mind. Life happens to everyone, and our goals occasionally shift. You may have asked yourself if removing money from a 401k is an option before retirement. The answer to that question is yes. However, if follow-up questions sound something like can I take money out of my 401k and, if yes, what is the most efficient way to do so, then keep reading.

Also Check: How Much Do You Get Taxed On 401k

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

Read Also: Should I Have An Ira And A 401k

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

What Is The Primary Benefit Of A 401k

Your tax burden might be decreased while you save for retirement with a 401k plan. Gains are not only tax-free, but contributions are automatically deducted from your salary so there are no hassles.

Additionally, a lot of firms will match a portion of their employees 401k contributions, thereby increasing their retirement savings at no cost to the individual.

Read Also: How To Access My 401k Money