Can Someone Else Put Money On My Walmart Moneycard

The cheapest way for someone else to put money on your Walmart MoneyCard is for them to transfer the money from their bank to your MoneyCard using your routing and account numbers. If they cant do a bank transfer, or if you need money more quickly, they can purchase a MoneyPak at most retailers for $5.95 and deposit cash into your account that way.

You May Like: Can I Rollover My 401k To A Roth Ira

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $20,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.

The average life expectancy for men is around 84 years old, and 86.5 years old for women.

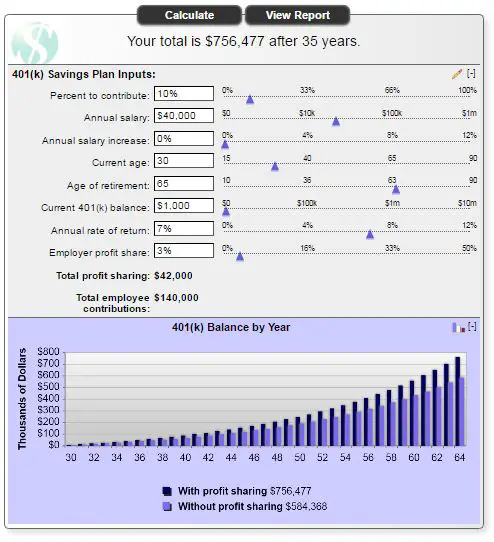

How Much Will A 401 Grow In 20 Years On Average

The amount that a 401 will grow over a 20-year period can depend on how much someone contributes to the plan annually, how much of that contribution their employer matches, and their average rate of return. Someone who saves consistently, increases their contribution rate annually, and chooses investments that perform well will likely see more growth than someone who saves only the bare minimum or hands back a chunk of their returns in 401 fees.

Don’t Miss: Can I Roll My 401k Directly Into A Roth Ira

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Don’t Miss: Should I Rollover My 401k When I Retire

When You Plan To Retire

The age you plan to retire can have a big impact on the amount you need to save, and your milestones along the way. The longer you can postpone retirement, the lower your savings factor can be. Thats because delaying gives your savings a longer time to grow, youll have fewer years in retirement, and your Social Security benefit will be higher.

Consider some hypothetical examples . Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle. Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income. John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Of course, you cant always choose when you retirehealth and job availability may be out of your control. But one thing is clear: Working longer will make it easier to reach your savings goals.

Read Also: Can You Take A Loan From 401k For Home Purchase

Average 401 Balance By Industry

According to Vanguard data, balances also vary widely among industries. One possible explanation for this is that retirement-savings matches, in which an employer matches an employee’s contributions to their savings up to a given percentage, may be more common in some industries than others. Earnings could also affect how workers in a specific industry save.

Here’s how the average balances break down by industry, according to Vanguard’s data.

|

Industry |

You May Like: Can You Roll Over Your 401k To An Ira

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Read Also: How To Pull 401k Early

Recommended Reading: How To Find Old 401k Plans

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Improve Your 401 Balance

Improving your 401 balance depends on how well you can handle your finances and how much you can contribute to it. Doing your research for the best interest options for your 401 plan can help you start building compound interest, which will result in a higher balance.

If you think youre at a good place with your finances and making sure your living expenses and debts are being paid off, it might be worth considering maxing out your 401 contributions. According to Vanguard, only 12 percent of 401participants maxed out their401 contribution limit of $19,500 in 2020, and you could be one of them.

Whether you start small or contribute close to the limit, consistently contributing to your 401 and making sure your plan meets your goals will help you improve your average 401 balance and save more for retirement.

Recommended Reading: How Can I Withdraw Money From 401k

Recommended Reading: How Do I Cash Out My 401k

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If youre able to do all three of these, it can help you get the most out of your investments.

Calculate How Your 401k Balance Compares To Others Your Age

See if youre on track to the retirement you want with this free 401k calculator.

Tip: Get a handle on your money with Personal Capitalsfree financial dashboard. You get a quick overview of your net worth, cash flow, investment allocation, and more. You can also plan for long-term goals like retirement.

Recommended Reading: When Do You Have To Take Money Out Of 401k

How Much Should I Have In My 401k At 30

Again, the average 401 amount is more than twice as high as the median 401 balance. This indicates that high-wage earners and those who are committed to making the most of their 401 plan have a greater capacity for savings.

If youre falling behind, throughout your 30s you should consider bumping up the amount you contribute by a few percentage points when you have the opportunity. When you schedule the increase with any increases or bonuses you obtain, this becomes an incredibly simple task to do. In this method, you wont see any reduction in your discretionary money. In point of fact, if you live within rather than over your means, it will be easier for you to maintain control over your spending habits.

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Also Check: How To Transfer My 401k To My Bank Account

What Your Retirement Savings Should Look Like By Age 50

Financial experts sometimes suggest planning for your retirement income to be about 80% of your pre-retirement income. So, for example, someone who earned $100,000 per year going into retirement would plan on having about $80,000 per year while retired. The reason for this discrepancy is that most households tend to have fewer needs and responsibilities while in retirement, and therefore fewer expenses. The only major exception to this rule is when it comes to healthcare. You should expect those costs to rise in your later years.

To make your savings last, financial experts recommend that you plan on withdrawing about 4% per year from your retirement fund. This will depend on three main factors:

- How much money you have in your retirement fund

- The average rate of return that your retirement fund generates

- Your anticipated Social Security income

So, for example, say you plan on needing $80,000 per year in retirement.

First, you should look up how much money you can expect each month from Social Security. This income will depend on how much you made during your working life, as well as when you choose to retire. If you are an average Social Security recipient it will come to approximately $1,650 a month, or $19,800 a year. So you should plan on withdrawing an additional $60,200 per year to make up the difference.

Develop Other Sources Of Income

Think about other ways you can secure sources of income in retirement outside of collecting Social Security and withdrawing from your 401k. This will not only prevent you from having all your retirement eggs in one basket, but it is also something to consider if your 401k balance is lower than youd like. Where can you invest and how can you optimize your portfolio for greater returns? Consider other ways you can supplement your retirement income, and speak to your financial advisor about what solutions could work for you.

Also Check: How To Move 401k To Vanguard

Read Also: Where Do I Go To Borrow From My 401k

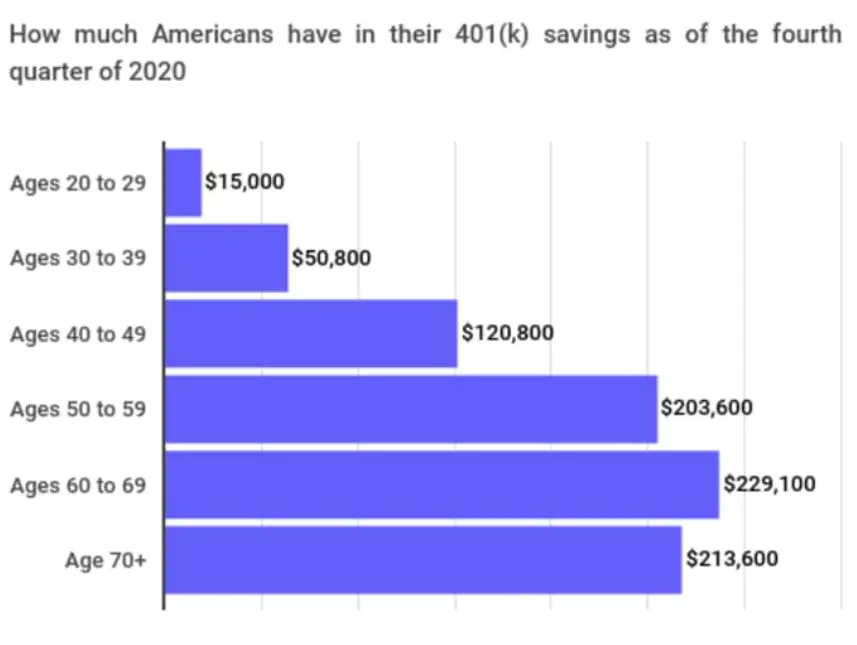

Average And Median 401 Balance By Age

Looking at the average savings by age can give you some idea of whether youre on track. Just keep in mind that your progress and savings should match up with your specific goals.

| Age | |

|---|---|

| $279,997 | $87,725 |

Using a chart like this can make it easier to see where you are on the savings spectrum. So if youre wondering how much should I have saved by 40?, for example, you can see at a glance that the average 40-something has close to $100,000 in retirement savings.

Remember that average numbers reflect outlier highs and lows, while the median represents where people in the middle of the pack land. Between them, median can be a more accurate or reliable number to measure yourself against.

Recommended: Is My 401 Enough for Retirement?

Average 401 Balance By Age

Retirement savings grow with compound interest, which means account balances increase with time. Like other types of retirement accounts, money saved in a 401 grows like a snowball, with interest earning interest on itself. The older you are, the more time youve had to build up your savings.

Note: In 2022, employees can contribute up to $20,500 in their 401. Employees over 50 can contribute an additional catch-up contribution of $6,500.

With compounding interest, the earlier money is put into an account, the more opportunity it has to grow, and the greater the possible returns. In retirement accounts like 401s, building retirement savings early means a greater opportunity for growth.

Heres the average amount people have saved for retirement by age group, according to Vanguards data.

|

$107,147 |

$29,095 |

While a large disparity in savings exists, women often need greater retirement savings than men to retire comfortably. Women tend to live longer and could therefore need more long-term care than men, which could require greater spending in retirement.

Also Check: What Is Max I Can Put In 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

You May Like: What Is 401k In Usa

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

You May Like: How Much Can You Put Into A Solo 401k