Rollovers: The Complete Guide

A 401 rollover is the process by which you move the funds in your 401 to another retirement account usually either an IRA or another 401. A 401 rollover typically happens when you leave your employer, either to retire or to start a new job. There are certain regulations you need to follow when rolling over your assets, most notably the 60-day rule. And you will also need to choose a new financial institution to house your account when you roll over your money into an IRA. If youre considering a 401, a financial advisor can help you set up a retirement plan for your nest egg. Lets break down everything you need to know about 401 rollovers.

Keep Your 401 With Your Previous Employer

In this instance, you wont change a thing. Just make sure that you actively monitor your investments in the plan for performance and remain aware of any significant changes that occur.

If you really like your current investment options and are paying low fees on the investments, this might be the right choice for you.

Changing Jobs Options For Your 401 Plan

If you have a 401 plan, you are familiar with the benefits afforded by these popular retirement accounts. They are a great way to set aside pre-tax earnings and enjoy tax-deferred investments that have the potential to grow over the years, especially if your employer matches your contributions.

But what will happen to that nest egg if you leave your company to take another job? Maybe little or nothing at all, if you transfer the money to another qualified plan. Or, you might face a big tax bill and a government penalty if you prematurely withdraw funds.

Employees who leave their companies have several options when it comes to their 401 plans, and each option has advantages and disadvantages.

Keep your old 401 where it is and start another one at your new job

This option avoids the possibility of taxes and penalties, and your money will continue to grow tax-deferred. Another potential advantage is this: If your old and new companies offer plans with differentyet complementaryinvestment options that meet your needs, you will be able to enjoy the benefits of both plans.

Before making any decision, ask your former employer if your access to money in the existing 401, such as borrowing against it, will be restricted once you leave the company. It should also be noted that another possible drawback to having two accounts is just thatthere will be two sets of records to track.

Roll over existing 401 assets to an IRA and start another 401 at your new job

You May Like: How To Invest 401k In Stocks

Rollover 401 To New Jobs 401

Another route to take is to transfer a 401 to new job and into the new employer-sponsored 401. Investors can verify with their new employer if this is possible. They can also review fees and the investment options offered to see if this is the best path to take.

Advantages:

- Keeps 401 funds under the 401 umbrella. 401s have higher contribution limits than IRAs, meaning that one can invest more pretax money into a 401 than into an IRA.

- Streamline funds. Instead of having multiple 401 accounts, this option consolidates the old 401 with the new, so thereâs only one account to keep track of.

- Avoid paying early withdrawal taxes. Doing a direct rollover where funds get moved via check from your old 401 to the new 401 can help avoid triggering a tax event.

Disadvantages:

- May have a different fee structure. A new employerâs 401 may charge more in fees. Investors can ask about 401 fees to understand total costs.

- New rules and options. The new employer may have a different set of rules for a 401, such as a years of service requirement for participation, and different investment options available.

- Less flexibility. In general, 401 accounts have less flexibility than IRAs when it comes to distributions.

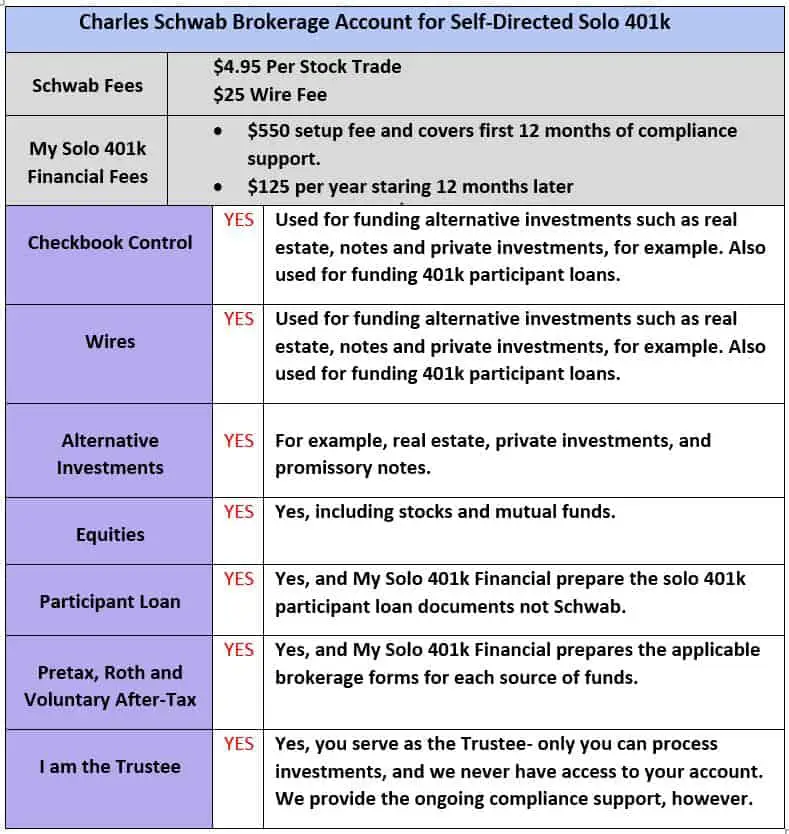

Fund Selection And Fees

Ideally, you want low-cost fund options with no administrative fees. Consider the choices available with different brokerages to minimize the administrative or brokerage fees you may pay.

When it comes to fund selection, the sheer volume of choices can feel overwhelming. Beginner or hands-off investors may benefit from target date funds or robo-advisors that manage retirement funds for you based on your risk profile.

If you prefer to manage investment choices on your own, most advisors recommend beginners start with a simple portfolio of a broad U.S. stock index fund, a broad international stock fund and a U.S. bond fund. For more on how to invest for retirement, check out our guide.

Don’t Miss: How To Find Your Fidelity 401k Account Number

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

What Is The 60

The 60-day rollover rule is applicable to indirect rollovers only and is usually used in the context of taking a short-term loan from your retirement plan. You dont necessarily have to leave a job to attempt an indirect rollover.

Say you withdraw money from your 401. Also imagine that you receive the money directly into your own bank account.

Within 60 days, youll need to deposit the entire amount withdrawn, before taxes, to a new retirement plan to avoid taxation . When you take money out of a retirement plan early, youre subject to a 10% penalty if youre below 59 ½, unless its for a qualified exception.

Due to the nature of indirect rollovers, youre only allowed to complete one per 12-month period. This one-per-12-months rule only applies to indirect rollovers, not to the more traditional direct rollovers as described above.

Note that this does not mean you only have 60 days to roll over your 401 after leaving a job. Many people leave old 401 plans in place for many years before deciding to move them.

The significant takeaway here is that a direct rollover is your best bet for rolling over an old 401, while an indirect rollover is more applicable in the context of taking a short-term loan from your retirement plan one that youre absolutely sure you can pay back!

A quick example:

Say you withdraw $50,000 from your employers 401 plan in an attempt to complete an indirect rollover. 20% of the withdrawal is withheld in the process for federal taxes.

You May Like: When Can You Start Drawing From 401k

Dmitriy Fomichenko President Sense Financial

@dfomichenko06/15/15 This answer was first published on 06/15/15. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

There is only single reason why you would consider moving old 401k into new employer’s 401k plan: that is if you are considering taking a loan out from your new 401k. Otherwise it would be in your best interest to rollover that old 401k into an IRA – you will have much more options and greater control this way.

And How Do Taxes Work With An Ira

That depends. With a Roth IRA, youll pay taxes on the money when you contribute, not when you withdraw. In other words: Youll pay the taxes now, rather than later. Which is a benefit if you anticipate being in a higher tax bracket when you make a withdrawal.

If you go with a traditional IRA, expect taxes to work the same as with your traditional 401. Youll make pre-tax contributions, and youll be taxed when you make any withdrawals.

Read the fine print for your traditional 401 plan if you prefer the Roth IRA option. Some plans only allow a 401 rollover into a traditional IRA. Which means youd have to switch to a Roth IRA after the rollover and pay all the necessary taxes.

Read Also: How Does Rolling Over A 401k Work

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Rollover To A Life Insurance Policy

Technically, you cant roll over your 401 account into an insurance policy however, if you have a life insurance needs, you can withdraw funds from the account and redirect them to pay for a life insurance policy. You can avoid early withdrawal penalties under IRS Rule 72t,2 which allows you to take equal payments from your accounts. However, you must agree to take consistent withdrawals from your account each year for life.

Recommended Reading: How To Get My Walmart 401k

Reasons To Transfer Your 401 To A New Job

There are three main reasons to rollover a 401:

1. To reduce fees. If the fees are too high with your previous employers 401, rolling over a 401 can be advantageous.2. To maximize your money. If you arent happy with the investment options in your old 401 and your new employer accepts rollover 401s, you might be able to save money while investing in a broader range of investment vehicles.3. To streamline your investments. If you leave your 401 where it is, you may not think about it very often. Its important to keep tabs on all of your investments so you can make sure they are on track and appropriate for your time horizon and goals.

What To Do With An Old 401

Its natural to be excited or nervous when changing jobs. Youre probably as thrilled as you are wary. And if youre retiring, its the same way. So while saying goodbye to your old job, dont forget to move the funds from the 401 or 403.

Because your 401 may be a significant portion of your retirement funds, its crucial to consider the benefits and drawbacks of each rollover option before making a selection.

Don’t Miss: Can You Roll Over Your 401k To A Roth Ira

Who Is The Owner Of The Empower Retirement Fund Reviews

Empower Retirement is a retirement plan registration company based in Denver, Colorado. It is part of GreatWest Life & Annuity Insurance Company and is an indirect wholly owned subsidiary of GreatWest Lifeco. Empower is chaired by President Edmund F. Murphy III, who reports to Robert L. Reynolds, CEO and President of GreatWest Financial.

Reasons To Roll Your Money Into An Ira

When you have a lot of retirement accounts in a lot of different places, its hard to a) wrap your mind around where you actually stand and b) make sure that everything you own is properly diversified. If you have all your retirement accounts in an IRA, on the other hand, balancing your investments and forecasting whether youre on track to hit your goals, like we do for you at Ellevest is a lot easier.

Another big reason why many people choose to roll an old 401 into an IRA is to have more choice. When you can decide for yourself which company youll open your IRA with , you often have greater control over things like how much you pay in fees and the types of businesses your money is supporting. With a 401, youre stuck with whatever investment provider and investment options your employer picks for you .

Also, if youre trying to make certain special purchases, the government lets you take money out of an IRA before retirement without facing the 10% early withdrawal penalty. These include things like college costs and your first home. Not so with a 401.

Recommended Reading: How To Roll Old 401k Into New 401k

Tax Consequences Of A 401 Rollover

If you handle it correctly, there are basically no tax consequences that come with a 401 rollover. More specifically, if you complete a direct rollover, your assets seamlessly move from one account to the other without any intervention from the IRS. The rollover doesnt show up on your tax return, nor does the IRS levy any taxes.

Conversely, the 60-day rollover faces a few tax implications. The reason for this is despite the fact that the money will pass through your control only momentarily, the IRS views it as a potential distribution. And because the IRS offers major tax benefits with retirement accounts, its extremely wary of when someone makes a withdrawal, especially a large one.

To cover itself, the IRS orders employers who you take a distribution from to withhold 20%. That can be a massive amount, especially if you have a large 401 balance. Its unfortunately up to you as the account holder to make up that difference before the 60-day period ends, otherwise youll lose the tax-deferred status for that money. Beyond that, if youre making the distribution before age 59.5, the IRS will hit you with a 10% early withdrawal penalty.

In todays day and age, theres virtually no reason a 401 plan provider wouldnt have the technical capabilities to transfer your rollover funds for you. But if the 60-day rollover is unavoidable, simply ask to have the check sent to you in the name of your new accounts custodian.

Read Also: What Can You Roll A 401k Into

What To Do With Your Old 401 When You Quit And Why It Matters

Getty Images/JGI/Jamie Grill

One common question when leaving a job is what to do with the old retirement plan. Whether you leave involuntarily, quit to start a new job, or see yourself switching jobs several times in the next few years, you need a plan for your former employer’s retirement savings plan. That’s your 401, 457 or 403.

One wrong move can cost a big chunk of your savings, so you need to be ready to take the right steps.

Recommended Reading: What To Do With Your 401k When You Change Jobs

Convert Into A Roth Ira

The pros: Withdrawals are entirely tax-free in retirement, provided you’re over age 59½ and have held the account for five years or more. Roth IRAs are also exempt from RMDs.

The cons: Because Roth IRAs are funded with after-tax dollars, you’ll have to pay taxes on your existing 401 funds at the time of the conversion. A Roth IRA must be open for five years in order to withdraw earnings tax-free, and you’ll be subject to a 10% penalty if you withdraw any money before you’re 59½ without an exemption.

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Also Check: How Much Money Can You Take Out Of Your 401k

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

Con: Limited Creditor Protection

The Federal Employment Retirement Income Security Act precludes third parties from accessing assets in your 401 to satisfy their claims if they win a lawsuit against you. IRAs, on the other hand, do not have the same amount of protection as 401 plans. To settle their claims, a creditor may have access to your IRA funds up to a specified level. Some IRAs provide creditor protection up to a certain amount, although these limits vary by state.

Don’t Miss: Should I Change My 401k To A Roth

S To Roll Over Your 401

Before you can roll over your 401, youll need to open an account to roll it into. Consider your options, like your new employers 401 or an IRA.