Get Cash For Your Own Business

If you want to use your Solo 401k to invest in startups, why not fuel the growth of your own new business? Yes, you can use your retirement account to fund a startup that you launch yourself. However, there are rules to follow.

You cannot invest your retirement funds directly into a business you own. Thats because you are a disqualified person to your Solo 401k plan. Using your retirement funds to invest directly in your business would be a prohibited transaction, and can carry a tax of up to 115%!

The way to compliantly use your retirement funds to invest in your business is through a participant loan. You can take a tax-free loan of up to 50% of your 401k account value, maxing out at $50,000. The loan does not count as new income, as long as you pay it back within 5 years. Any interest earned on the participant loan goes right back into your Solo 401k plan!

Dont Miss: Is There A Fee To Rollover 401k To Ira

More On Social Security And Retirement

- Earning Income After Retiring: Collecting Social Security while working can get complicated. Here are some key things to remember.

- An Uptick in Elder Poverty: Older Americans didnt fare as well through the pandemic. But longer-term trends arent moving in their favor, either.

- Medicare Costs: Low-income Americans on Medicare can get assistance paying their premiums and other expenses. This is how to apply.

- Claiming Social Security: Looking to make the most of this benefit? These online tools can help you figure out your income needs and when to file.

From the second half of 2020 through May 2021, the Census Bureau tracked the highest number of applications to form businesses since the records started being kept in 2004, a recent report from the National Bureau of Economic Research found. Bank loans and venture capital probably did not provide liftoff for most of those businesses. According to 2019 data from the Kauffman Foundation, a nonprofit that works to bolster education and entrepreneurship, nearly 65 percent of entrepreneurs use personal and family savings to fund their start-ups.

Instead of tapping retirement funds, the institute advises crowdfunding to get a business off the ground. If you put your idea out there on Kickstarter and no one is willing to invest even a dollar, you know before you put in a huge amount of time that it might not work, Ms. Isele said. But if the idea proves popular, raising a few thousand dollars on a crowdfunding platform may be doable.

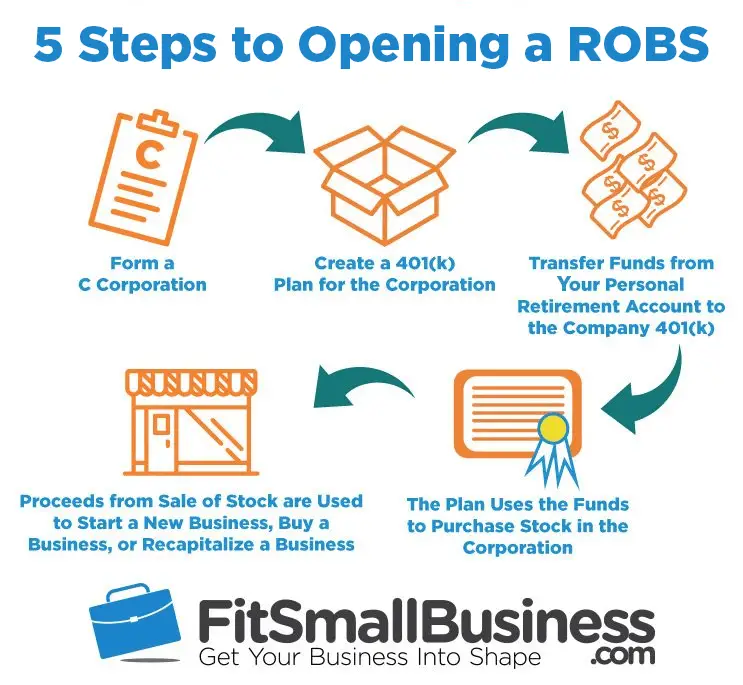

The Steps To Set Up A Robs Plan

Here are the steps for setting up the plan:

1) Establish your new business as a C-Corp.

2) Establish a new 401 plan for your new business

3) Process direct rollovers from your 401 accounts and IRA accounts into your new 401 plan

4) Use the balance in your 401 account to purchase shares of the corporation

5) Now you have cash in your business checking account to pay expenses

You May Like: Can You Move 401k To Ira

Some Considerations To Using Your 401

Utilizing your 401 isnt without its downsides if plans dont work out as you intended, they could set back your retirement years. Be aware of how much you have in your account and what that amount will look like if your business is unsuccessful. Youll need to budget for the worst-case scenario: losing money on your investment.

You also need to look at the tax advantage growth and whether leaving the money in your plan or taking it out now is more beneficial. Leaving your 401 alone to grow over time may be far more profitable than using it as a short-term loan.

Taking money out of your 401 plan is a considerable risk, despite the immediate benefits it affords. Many financial experts recommend using it only when you have no other option and, even then, only when you know youll see a relatively quick return. Determine whether you want to use your 401 to start your businessor if you even should.

ASPPA

IBBA

© Copyright 2022. Pango Financial®, LLC. Pango®, Pango Financial®, the Pango logo, Forging Your Future, and DreamSpark® are trademarks of Pango Financial®, LLC. All rights reserved. A De Novo Corporation company.

What Are Robs And How Can You Use Them To Fund Your Business

Starting a business requires cash. The problem is that few entrepreneurs have a ready supply handy.

If youre looking to fund your new venture, you have several options. Yes, you can borrow from the bank or find investors, but youll be starting your business in debt. But did you know you may be sitting on a pile of cash, which can allow you to start your business cash-rich and debt-free? If you have money in a qualified retirement plan, you are and can with a process known as ROBS .

What Are ROBS?

With a ROBS plan, you withdraw money from your 401 or other tax-advantaged retirement fund to finance your new business venture. Normally, if you withdraw money from one of these accounts before the age of 59 1/2, youll pay both income taxes and an early withdrawal penalty. In the example below, your $200k retirement plan, once subjected to penalties and taxes, leaves you with $120k to use for your new business.

ROBS is a particular program election that allows you to use these funds without the income tax or withdrawal penalty. That means, the entire $200k is available to use. You can use ROBS to start a new business or to purchase an existing business. The money from your qualified retirement plan is not a loan, so you dont begin your business in debt.

However, you should be aware of both the pros and cons of using a ROBS before you make your choice.

The Pros and Cons of Using ROBS

How ROBS Funding Works

You May Like: How Does Company 401k Match Work

Should I Borrow From My 401 To Start A Business

People often ask us about using their 401s for different purposes, and one of the most common questions is, Should I borrow from my 401 to start a business?

This is an understandable question.

According to the New York Times, From the second half of 2020 through May 2021, the Census Bureau tracked the highest number of applications to form businesses since the records started being kept in 2004.¹

However, the vast majority of these businesses got their funding from personal and family savings.²

If you dont have personal savings or family willing and able to help you start your new business venture, where will you get the funding?

Hence the reason many people ask, Should I borrow from my 401 to start a business?

Moreover, starting a business is a huge financial risk.

Forbes reports, Hundreds of thousands of small businesses open and close every year. In addition, about 20% of businesses fail in their first year, and about half of all businesses close after five years.³

When you ask, Should I borrow from my 401 to start a business? it means you are willing to risk losing financially on your new business and your financial future.

How To Start Making Money Using Your 401k

15 ways to make more money in your 401 Save as early in your working life as you can. Save more. Take advantage of the Roth variations of your 401 and IRA, especially in your early working years when you may not be in a high tax bracket. Whatever else you do, be sure that your contributions to your retirement plan are enough to get the full benefit of your companys matching funds.

You May Like: How Do I Start My 401k Plan

How Borrowing Against A 401 Plan Works

IRS rules on 401 loans include:

- Limited to $50,000 or half your vested balance

- Loans limited to five-year terms

- Interest rates are set by the administrator, comparable to five-year business loans

- Interest payments go back into your plan

Employers may also establish rules for how you can borrow against your account. Some employers limit loans to the contributions youve made into the plan while others allow you to borrow against both your contributions and the employers matching contributions.

If your employment ceases while you still owe money on your 401 loan, you are responsible for repaying the loan on an expedited timeline. You will have until the due date of your next federal tax return to repay the remaining balance owed. If the funds have not been fully repaid by the time your federal taxes are due, the remaining amount owed will be treated as taxable income.

Fully Legal And Irs Compliant

In 1974, Congress enacted the Employee Retirement Income Security Act to shift the burden of building retirement assets from the employer to the employee. ERISA, when paired with specific sections of the Internal Revenue Code, makes it legal to tap into your eligible retirement accounts without an early withdrawal fee or a tax penalty.

Don’t Miss: How To Do Your Own 401k

Starting A Business With Your 401 Be Careful

As an aspiring entrepreneur, you may have a good idea, but tread lightly before using retirement savings as capital.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

Renee Edwards has wanted to be her own boss since she first heard the name Warren Buffett.

Ive been following him for a long time, she said of the Berkshire Hathaway chief executive and revered investor. And the thing that always stuck out for me is him saying something like, Youll never live comfortably unless you work for yourself.

In October, Ms. Edwards, 45, made the jump: After 18 years as a clinical researcher at the Roskamp Institute, a pharmaceutical testing company in St. Petersburg, Fla., she quit her job to start Saturday Morning Shoppe, a monthly outdoor market featuring vendors who are women and people of color. Mr. Buffetts prognostications aside, not everyone would have encouraged her to bet on herself. Especially because she made the bet by emptying her 401.

Her financial adviser, Toriano Parker, provided a measure of comfort. Instead of talking me down about using my 401, he said, You should do it, she said. Her age, which afforded her time to replenish her retirement savings, was a factor in his approval. So was her research into Saturday Morning Shoppes potential profitability. Renee had a very solid business plan, Mr. Parker said.

Open Business Owners Retirement Savings Account

1

Find a CPA that administers Business Owners Retirement Savings Account rollover Individual Retirement Accounts. This is a specialized IRA that allows the IRA to buy stock in a personal corporation. The CPA will not only set up the account, but must become the plan administrator.

2

Open a rollover IRA with the CPA designated as the Business Owners Retirement Savings Account.

3

4

Open a corporation in the state you reside in through the secretary of state. File articles of incorporation and pay any registration fees.

5

Instruct the CPA rollover administrator to buy stock in the new corporation. The money goes into the company operating accounts and the corporation sends the stock certificates of ownership to the CPA to hold in the IRA. Use the assets in the general operating account to purchase the new business.

References

Recommended Reading: How To Invest Your 401k Money

Option : Rollover For Business Startup

Rollover for Business Startups is the most likely route you can take to buy a business with your 401. This method allows you, as a future business owner, to tap into your retirement funds in a tax-advantaged way. This process rolls over your existing retirement plan into the new company in exchange for stock that you issue to yourself. By far, the greatest advantage of using a ROBS is being able to invest your retirement savings in a small business entirely tax-free.

Setting up a ROBS is not overly complicated, but it is important to follow the procedure defined by the IRS in order to avoid tax complications or other compliance issues. There are providers who will provide the service for you for a rate of around $4,000.

These services, or any business accountant, can help you set up the required C Corporation paperwork and issuing the Qualified Employer Securities can be somewhat involved. Once it is set up, your retirement plan, now issued by the C Corp, purchases stock in the newly-formed company.

Many people find that they are able to set up a ROBS without paying for an all-inclusive service. In order to roll over your 401 into this structure, you need to follow five key steps.

Can I Use My 401 To Start A Business

FranFund : Nov 1, 2019 10:00:00 AM

For ambitious entrepreneurs debating their best funding options for their business, this question is often posed: Can I use my 401 as an investment fund?

If youve asked yourself this question, you are not alone, and depending on your circumstances, it could be an option worth strong consideration. Using your retirement funds could be a great way to help you start your business debt-free.

But How?

And yes, ROBS business funding is legal. The ROBS process is governed by the Internal Revenue Service and the Department of Labor and has been in place since the Employee Retirement Income Security Act of 1974 .

Is it Right for Me?

ROBS is a great way to use 401 business funding if you have more than $50,000 in qualifying retirement savings and plan to work full-time in the business. Since you are not applying for a loan, credit scores and current financial situations are not factors. A ROBS arrangement can be started with any qualified retirement vehicle, with very few exceptions. The IRS does, however, have strict guidelines regarding the execution of the plan. If you are considering using the ROBS plan to get your business started, you should make sure you work with an experienced and reputable funding company to administer your plan.

Getting Started

Contact us today to learn how you can use your 401 to start your business!

You May Like: How Do You Roll Over Your 401k

How Do I Create A 401 Plan

Creating a 401 plan for a companyeven a small oneis a complex process. The following is a basic overview of the steps for getting approval and starting the plan:

- Write a plan with the help of a plan adviser and send it to the IRS for a determination letter .

- Find a trustee to help you decide how to invest contributions and manage individual employee accounts.

- Begin making employer contributions, if offered, and allowing employee contributions through your payroll system.

Editor’s Note: Looking For Employee Retirement Plans For Your Company If You Would Like Information To Help You Choose The One That’s Right For You Use The Questionnaire Below To Have Our Partner Buyerzone Provide You With Information For Free:

Again, the steps are minimal to get going, but you’ll need a tax attorney or CPA to handle the formation of the corporation and the new retirement plan. Importantly, the people handling these matters should be well versed in the Employee Retirement Income Security Act, or ERISA, which contains many of the laws regulating employee benefit plans.

“Because it’s retirement plan money that’s being used for this, you have ERISA and internal revenue code penalties that apply unless all the Is are dotted and the Ts are crossed,” warns O’Donnell.

There are companies dedicated to guiding you through the process, such as BeneTrends of North Wales, Pennsylvania, and Guidant Financial Group in Bellevue, Washington. Guidant, for its part, charges a flat of $4,995 for setting up the plan. With that you also get two hours of time with an outside tax attorney. Additionally, Guidant charges a base fee of $800 annually to administer the retirement plan. If you have additional participants in the plan above the first two, there is a charge of $45 per participant.

How to Finance a Start-Up with Your 401: The Risks

The most obvious risk in financing your business with your retirement funds is, if for some reason your business fails, not only have you lost that business, but possibly a significant portion of your retirement nest egg.

So betting the whole farm on that Krispy Kreme franchise may not be the best way to go.

Dig Deeper: Is This a Smart Way to Get Funding?

Recommended Reading: Can I Transfer My 401k To My Child

How Much Can You Borrow

If a plan permits a 401 loan, the IRS lets you borrow 50% of your vested total account balance. This amount is capped completely at $50,000. If you have $40,000 in your account, for example, you can borrow a maximum of $20,000. But if you have $1 million in your account, you still cant borrow more than $50,000.

Why Do Business Owners Use Robs Plans

The benefits are fairly obvious. First off, by using your own retirement assets to fund your new business, you dont have to ask friends and family for money. Secondly, if you were to embark on the traditional lending route from a bank for your start-up, most would require you to pledge personal assets, such as your house, as collateral for the loan. Doing this puts an added pressure on the new entrepreneur because if the business fails you not only lose the business, but potentially your house as well. By using the ROBS plan, you are only risking your own assets, you have quick and easy access to those funds, and if the business fails, worst case scenario, you just have to work longer than you expected.

Read Also: Can You Roll Over A 401k