Contact Your Current Plan Administrator And New Plan Administrator

The easiest 401 rollover option is to get your old plan administrator to transfer your balance directly to your new account. This is called a direct 401 rollover, and it frees you from having to worry about tax consequences or early withdrawal penalties.

Speak with your new plan provider about getting an account number, then provide the information to your current 401 administrator. Theyll take care of the rest.

Be aware that not every plan administrator will perform a direct 401 rollover. In this case, the plan administrator cuts you a check for the balance, and its up to you to send the funds to your new 401 plan provider. You have just 60 days to redeposit the balance in your new plan. Otherwise its treated as an early withdrawal that incurs a penalty and income tax liabilities.

Advantages Of Rolling Over Your 401k Or 403b

The first is you can pick an IRA provider who is known for their commitment to low fees with a lot of investment variety. Certain IRA providers like Vanguard, Blackrock and Schwab are known for their transparency and commitment to low fees. Many charge no administrative fees on IRAs with over $10,000 and offer expense ratios less than 0.2% on a large variety of investments. In addition, while a 401K or 403b will offer a curated list of investing options, an IRA will give you access to a much larger list of funds including stocks, bonds, and money market funds. The going wisdom used to be that the buying power of a large 401K plan would get you better pricing than going it alone. However, in a world where there are NO-fee mutual funds, you dont need your employer to get access to cheap investment options. Plus, if you want to invest in socially-good funds or adopt another custom strategy, you probably wont have access through your employer plan to customize but could have access through an IRA.

Dont Forget To Invest

Once you complete your rollovers and have your money in your new IRA and/or Roth IRA, dont forget to invest it! The investing process is what actually grows your money over time. Exactly what you invest in is your choice, but my two favorite options are included below.

- Target Date Funds

Find out more information about each option in my article I Wanna Roth.

If you have any questions or want to discuss your specific rollover scenario, reach out to me. If the employer plan that you have is different than the accounts I discuss, check out the IRS Rollover Chart to see exactly what you can and cannot do.

Disclaimer: I am not a certified financial advisor and this article is intended for educational purposes only

You May Like: What Age Can I Draw From 401k

Rollover Iras Consider Simplifying Your Retirement Accounts By Combining Into One Ira

If youve worked at several jobs, you may have a few 401k-type plans from previous employers plus your own IRA accounts. Managing all those accounts can be a real challenge. You may want to consider a direct transfer of your account balances under these plans into a single IRA – without paying taxes on the transaction, if done properly. Once in the new IRA, your money has the opportunity to continue to grow federal income tax-deferred.

Benefits And Risks Of A 403 Plan

403 plans offer several benefits and carry some risks. The benefits of contributing to your 403 plan include the following:

- Some employers offer matching contributions

- May be able to claim a credit for the elective deferrals that you contribute to your 403 account

- No income tax on allowed contributions until you start making withdrawals unless the contribution is to a Roth plan

- In emergencies, loans can be taken from the 403 balance that must be paid back or will face tax penalties

Some of the risks of a 403 plan include the following:

- There is an early withdrawal penalty of 10% for withdrawals made before you reach age 59 ½ unless that withdrawal meets an exception, including leaving the employer when you reach age 55, when you have qualified medical expenses, or when you die or become disabled. Read more information

- Similarly, Withdrawals will face a 20% federal income tax withholding if you do not transfer the total held in a 403 plan to another retirement plan or an IRA

- For plans that feature an annuity, If you want to dissolve your annuity investment, you will have to pay a surrender charge of up to 8% of your investment

Also Check: Where Can I Roll Over My 401k

Your 403b Must Be Rolled Over To Another Qualified Account:

Your 403b rollover must be completed to another qualified account in order for you not to face penalties or taxes.

You can usually roll a 403b over to another 403b account, to a 401k account, to a , to a Roth IRA, and even to a SIMPLE IRA. If you decide to handle the rollover yourself, you will probably only receive 80 percent of the funds in your account. This is because 20 percent has to be withheld to cover penalties if the funds are not rolled over. However, since you will need to rollover 100 percent of your account to avoid penalties, you will need to come up with the 20 percent from other sources. If you are unable to make up the 20 percent that is withheld, you might have to take it as income and pay the extra tax penalties associated with an early withdrawal.

Once you rollover the entire distribution, the 20 percent that was withheld will be released directly to you without penalty. The 20 percent withholding is why most people choose to make direct rollovers, which occurs with the 403b plan administrator executes the 403b rollover on your behalf into another qualifying retirement account. This is the easiest way to rollover your account because you do not have to worry about it getting done in the 60 days or about coming up with 20 percent of your balance.

Do You Have To Roll Over 403

When you change jobs, you can decide to roll over your 403 account or leave it with your former employer. If you are comfortable with the 403 plan’s investment options, you can choose to do nothing, and the former employer will continue managing the retirement money until you decide what to do with the money.

However, you must have at least $5,000 in your 403 balance for your employer to continue managing the funds. If your balance is below $5,000, your employer may force a rollover to an IRA of its choice. Once this happens, you would have to contact your 403 plan administrator to locate your 403 fund.

Tags

You May Like: How Does 401k Work If You Quit

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

- Pros

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

- Cons

-

- You may have a limited range of investment choices in the new 401.

- Fees and expenses could be higher than they were for your former employer’s 401 or an IRA.

- Rolling over company stock may have negative tax implications.

Roll Over Your 401 To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, principal at wealth management firm Homrich Berg.

Also Check: How Does A 401k Retirement Plan Work

What Are The Rules For Rolling Over A 403

The plans that youre allowed to roll over your savings into depend on the type of 403 that you have either traditional or Roth. A traditional 403 is pre-tax meaning, the money you contribute to the plan isnt taxed until you start making withdrawals. Contributions to a Roth 403 are taxed at the time you make them but your withdrawals are not subject to income tax.

You can only roll a traditional 403 plan into a traditional IRA or other pre-tax retirement plan. And you can only roll over a Roth 403 into another Roth-style account.

Options For Your 401 Or 403

When you leave your job, you have four options for what to do with your 401 or 403:

Before going into these options, its important to note that a 401, 403, or an IRA is an account.

Within these accounts, you can choose between various investment options with varying fees, risk profiles, and returns .

You can think of an IRA or a 401 like choosing the restaurant where you want to eat.

Once youre there, you have a variety of menu options at different price points, flavor profiles, and nutritional value.

An employer-sponsored plan offers curated investing options. When youre in an employer-sponsored plan, you dont get to choose the restaurant.

If your employer has chosen Chipotle, you can select a Carnitas burrito or a vegetable burrito bowl. But youre out of luck if youre in the mood for tomato bisque.

In contrast, choosing an IRA gives you the choice of what restaurant to go to. And what menu options to select.

You can choose to go to Whole Foods, where you can affordably eat sushi, pizza, or the hot food bar.

But you can also choose a fancy restaurant at a higher price point but with more personal attention.

Returning to the four options for your old 401 or 403, cashing it out is the worst option.

Recommended Reading: How Can I Get My 401k Money Without Paying Taxes

Understanding A Conversion From A 403 To A 401

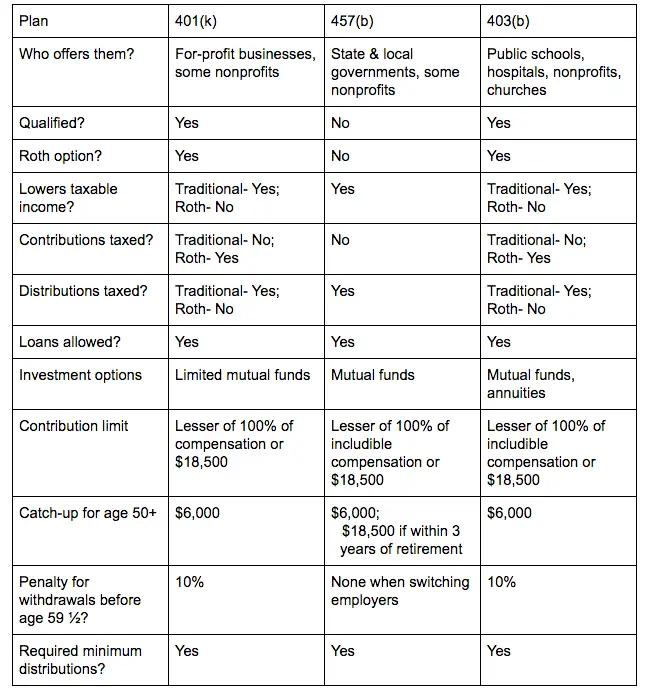

The 403 and 401 retirement plans are similar in their design and features. Both are tax-deferred plans that allow your earnings to grow tax-free, but youre taxed on the distributions or withdrawals in retirement. Both plans require participants to reach age 59½ before withdrawing funds otherwise, theyll face an early withdrawal penalty of 10% of the distribution and face income taxes on the distribution total. However, 403 plans are reserved for government employees such as teachers, while 401s are reserved for the private sector.

Can A 403 Plan Merge With A 401 Plan

The ERISA consultants at the Learning Center Resource Desk, which is available through Columbia Threadneedle Investments, regularly receive calls from financial advisors on a broad array of technical topics related to IRAs and qualified retirement plans. A recent call with an advisor in New York is representative of a common inquiry regarding plans for tax-exempt entities. The advisor asked:

I have a tax-exempt client that currently offers a 401 plan. The group is taking over another IRC Sec. 501 tax-exempt entity that has a 403 plan. Can the acquiring entity merge the 403 plan into the 401 plan?

No, generally the IRS does not allow mergers or transfers of assets between 403 and 401 plans . The IRS has stated in private letter rulings that if a 403 plan is merged with a plan that is qualified under IRC Sec. 401, the assets of the 403 plan will be taxable to the employees.

One option would be to terminate the 403 plan, which would allow its participants to receive distributions Plan publication for more information).

The participants in the terminated 403 plan who receive eligible rollover distributions from the 403 plan would have the option to roll the amounts to the 401, provided the 401 plan permits rollover contributions

Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Columbia Threadneedle.

Don’t Miss: When Can You Take Out 401k Without Penalty

Taxes Due From Your 403b Rollover

So what sort of tax consequences do you trigger with a 403b rollover to a Roth IRA?

Youll have to pay income taxes on any amount you roll over, unless of course, you made non-deductible contributions, such as with a Roth 403b .

But assuming you have a typical 403b plan, youre going to owe income taxes on the full amount of the rollover distribution, with the applicable tax rate being the same as what you would pay on your regular income.

For tax purposes, you simply add the full amount of the rollover distribution to your adjustable gross income .

But dont worry about your rollover pushing you into a higher tax bracket. The tax rate you pay is based on your pre-rollover AGI, not your post-rollover AGI.

For instance, lets say you have a 403b with $225,000, an annual salary of $37,000, and youre in a 20% tax bracket.

Even though you file a tax return with $262,000 in adjustable gross income, you remain in the 20% tax bracket. So your total tax liability is $52,400.

Dont Miss: How To Max Out 401k Calculator

Make Sure That Youre Eligible

The general rule of thumb is that you established your 401 as a full-time employee from a previous employer, or you are more than 59.5 years old. Other eligibility requirements can vary, depending on the type of retirement plan you have, such as a Roth IRA, 403, 457 and Thrift Savings Plan .

Please note, the rules dictating eligibility to move a 401 to an IRA arent always crystal clear and can vary from person to person. If you are confused or unsure of your own eligibility, please contact BitIRA today for a complimentary consultation.

We have a team of IRA Specialists, who are well-versed in the rules of 401-to-Bitcoin IRA rollovers. If you make a bitcoin investment for your SDIRA, they can assist you with the entire transfer process to make it quick and easy. However, please note that there is no obligation for you to take any action after your consultation.

Here are the three steps to take to convert your 401 savings into bitcoin:

Recommended Reading: Can I Pull From My 401k

The Pros And Cons Of Funding A 403 Rollover Account With Paper Gold

Paper gold is just thata declaration of gold value on paper or papers that state you hold shares in a gold mine or a company that owns a gold mine. You can find companies like this on the Gold Miners Index . ETFs are another form of paper gold whose value rises and falls depending on how risky the financial climate is.

Owning part of a mining facility can be very profitable but you are also prey to circumstances beyond your control. You are at the mercy of regulations and taxes imposed on these companies by the federal government. If you buy stock in a mine that is located in a foreign country you could profit more due to the lack of regulation. However, if your mine is in a volatile, unstable country you run the risk of it being confiscated by a temporary government, rendering your investment worthless.

Owning stock in a mine also means that your profits depend on the costs or production and the quality of management in charge of the facility. Poor management can mean that you are left holding worthless paper if the mine shuts down. You are also out of luck if the nation experiences a currency collapse since the value of your gold is only on paper, not in your physical possession.

Dont Miss: How To Rollover Ira To 401k