The True Cost Of A 401 Loan

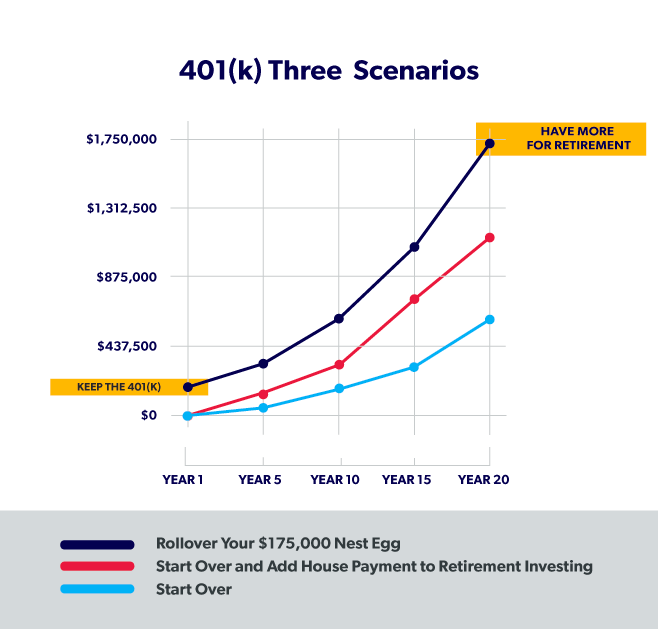

Any money you borrow from your retirement fund misses both market gains and the magic of compound interest.

Just imagine taking out a five-year 401 loan during this current bull market at 30 or 35 years old it could severely impact your future nest egg, says Malik Lee, a certified financial planner at Henssler Financial in Kennesaw, Georgia.

According to Vanguards 401 loan calculator, borrowing $10,000 from a 401 plan over five years means forgoing a $1,989 investment return and ending the five years with a balance that’s $666 lower.

But the cost to your retirement account doesnt end there. If you have 30 years until retirement, that missing $666 could have grown to $5,407, according to NerdWallets compound interest calculator .

Moreover, many people reduce their 401 contributions while making payments on a loan from the plan. In fact, some plans prohibit contributions when a loan is outstanding. This further damages retirement plans.

When Can You Start Using Your 401

You can start using your 401 as soon as you have vested in the account. The vesting schedule varies from plan to plan, but it is typically between one and five years. To determine how long you need to be employed before becoming vested, you can check your employee handbook or contact your employer. If you dont yet have access to your 401 funds, you can look at alternatives, such as taking out a personal loan or using a credit card.

What Is A 401

A 401 plan is a retirement savings plan. The money you contribute to your 401 plan is not taxed until you withdraw it in other words, your savings will be tax-deferred as they grow.

There are two types of 401 plans: Traditional and Roth. With a traditional 401, you will not pay taxes on the money that you contribute until you withdraw it. On the other hand, with a Roth 401, you pay taxes on the money you contribute, but you dont have to pay taxes when you withdraw it in bulk. Another difference between a traditional and Roth 401 is that the former lets you take a loan from your account. With a Roth 401, you cannot touch the savings until youre retired.

Don’t Miss: Can You Set Up Your Own 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Dont Miss: Can You Rollover A Roth 401k To A Traditional Ira

Looking For More Tax Advice

We hope that this post has helped you to be able to make a sound decision about whether or not using a 401k loan to pay off debts to the IRS is the right move for you.

If its not your best option, consider speaking with a tax or financial professional to help you better understand the other options weve discussed here.

No one enjoys dealing with the burden of back taxes, taking money from their retirement funds, and dealing with high-interest rates on loans. However, the inability to repay your taxes on time is just one of the many issues with your tax return that you could face.

Are you in need of actionable tax advice that will save you time, stress, and most of all, money?

We can help.

Reach out to us today for a free tax evaluation, and dont face the IRS on your own.

Ready to secure your financial future? Subscribe Today For Tax Knowledge Tomorrow

Also Check: How Long To Transfer 401k After Leaving A Job

You Miss Out On Compounding Interest

Finally, you miss out compounding returns. Even if you dont default, you miss out on up to five years of potential gains. If you take your loans out during a market downtown, you lock in losses and miss out on the gains from a recovery. When you start contributing again, you might be buying at a higher price, reducing your ability to enjoy future gains. There is no making up for time in the market.

How To Borrow Money From A 401

There are two ways that you can borrow money from a 401 retirement account.

Both of these options will impact your long-term ability to grow your money and save for retirement, so be aware of the downfalls. Taking money out of your 401 reduces the principal balance, which also impacts the amount of interest it can earn.

Depending on when you are planning to retire, this can can have a serious impact on your total savings at retirement. in some situations, though, it can make sense to use that money to pay off other debt.

Also Check: Can I Borrow From My 401k For A House

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason that they deem necessary. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

Increase Your Investment Return

There are certain situations where you can use a 401 loan to increase your overall investment return. Heres a hypothetical example showing how it can work.

Lets say that the following things are true:

- Your 401 money is invested partially in a stock mutual fund and partially in a bond mutual fund.

- The bond mutual fund currently has an SEC Yield of 1.97%, meaning you can expect about a 1.97% return from that fund going forward .

- You can borrow money from your 401 at 4.5%.

Given that scenario, here are the steps you could take to increase your expected investment return while only adding a small amount of risk:

In other words, youre getting essentially the same return on your bond fund in the taxable account, minus the tax cost. But you get a higher return in your 401 because the interest rate is higher than the expected return on the bond fund.

Here are a few things to keep in mind as you consider this approach:

Also Check: How Do You Transfer Your 401k

Alternatives To Borrowing From Your 401

Some 401 plans allow hardship withdrawals for circumstances like preventing eviction from your apartment or making needed repairs to your home. If you take a hardship withdrawal, you will pay federal and possibly state income taxes on the amount you withdraw, as well as a 10% federal tax penalty if you are not yet age 59 1/2.

You might also consider borrowing money from a bank or a relative. And if you owe a lot of money, you could consult with a to find ways to help you get out of debt. As a last resort, you might decide to hire a bankruptcy attorney to wipe out your debt while preserving your 401 and other retirement money.

Moving Towards A Debt

Debt might be a weight on your shoulders that youd gladly get rid of, and at first glance, tapping your 401 might seem like an easy solution. But when youre aware of all the other options available to you, you might be pleasantly surprised to know you can keep saving while paying down debt.

So dont rule anything out before doing your research. By comparing your options, you can determine which actions work best for your situation. A deeper dive into how personal loans differ from 401 loans could help.Read about Personal Loans vs 401 Loans

Don’t Miss: How To Pay Off 401k Loan

Consider Your Entire Financial Picture

Also be sure to research all your other options before making a decision, because borrowing from your 401 should be a last resort. If you’re struggling with credit card debt, for instance, but you have a good credit history, you may be able to transfer your balance to a balance transfer credit card with a 0% APR introductory period. Or you may qualify for a debt consolidation loan to pay down your debts without pulling money from your 401.

One of the most important things to consider, though, is how a 401 loan will impact your retirement savings in the long run. Some 401 plans don’t allow you to make additional contributions until your loan is paid back, so you’re essentially pressing pause on your retirement savings for five years — which can significantly impact your financial goals.

Say, for instance, you’re borrowing $10,000 from your 401 with a 5% annual interest rate and plan to pay it back within five years. Let’s also say you’re not making any additional contributions and that you could have been earning a 7% annual return on your investments had you not taken a loan. Over that five-year period, you’re potentially missing out on returns of around $2,000.

In addition, one of the greatest perks of contributing to a 401 is that you’re contributing pre-tax dollars. However, repayments are not pre-tax, meaning you’re not only missing out on potential gains while you’re repaying your loan, but you’re also shelling out more money in taxes.

Refinance Or Use A 0% Balance Transfer

If you have the opportunity to refinance at a lower rate or take advantage of a 0% balance transfer promotion, that may impact your decision between paying off debt or investing. Either strategy will reduce your interest rate costs, which reduces your monthly debt payments and allows you to increase your savings rate. This improves your financial world today, as well as in the mid-term and long-term future.

The risky part of this strategy is resisting the temptation to continue spending on the old card that you’re paying off. However, if you’re disciplined, it can allow for a much cheaper servicing of debt. It also allows for earlier and more substantial investment into retirement and non-retirement accounts.

Recommended Reading: Who Can Contribute To A 401k

Is Borrowing From 401k To Pay Off Debt A Good Idea

If you have credit card debt, but you have some retirement savings, theres a good chance that youve thought about borrowing from a 401 to pay off debt. While borrowing from your retirement account is certainly an option, like any other financial decision, it does come with its own pros and cons. With that in mind, weve taken the liberty of exploring this option in-depth for you below. Keep reading to learn more.

Using Your 401 To Pay Down Debt

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Lets say you have debt from high-interest credit cards, a student loan, and a car loan. But you also have a stash of cash just sitting in your 401 plan. You might think that taking money out of your 401 is a smart way to pay down that debt or even pay it off completely.

But is using your 401 to pay off debt really a good idea? Well go over the rules around withdrawing money from your 401, the costs associated with loans, and how a loan can ultimately affect your retirement. Finally, well offer some alternatives to 401 loans to pay off debt.

You May Like: How To Open Individual 401k Account

What You Should Do Instead To Pay Off Your Credit Card Debt

In hindsight, Nitzsche says he would have handled his credit card debt differently, such as reaching out to the specific issuers to inquire about a financial hardship plan or participating in a debt management plan through a credit counselor.

He also recommends using balance transfer credit cards, which allow qualifying cardholders to move their credit card balances from one card to the next.

If you have credit card debt, this could be a good option as long as you have a plan to pay off the transferred balance within the card’s introductory no-interest period , otherwise you accrue more interest on top of that debt.

The Citi Simplicity® Card offers 0% intro APR for 21 months for balance transfers from date of first transfer . There is an introductory balance transfer fee of 3% or $5, whichever is greater for transfers completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer . To qualify for these longer interest-free periods, you will most likely need to have good or excellent credit, but there are options available for fair credit as well.

The Aspire Platinum Mastercard® is one where applicants with fair or good credit may qualify, but the balance transfer period is shorter at only six months. After the intro period, there’s a relatively low variable APR of 9.65% to 18.00%.

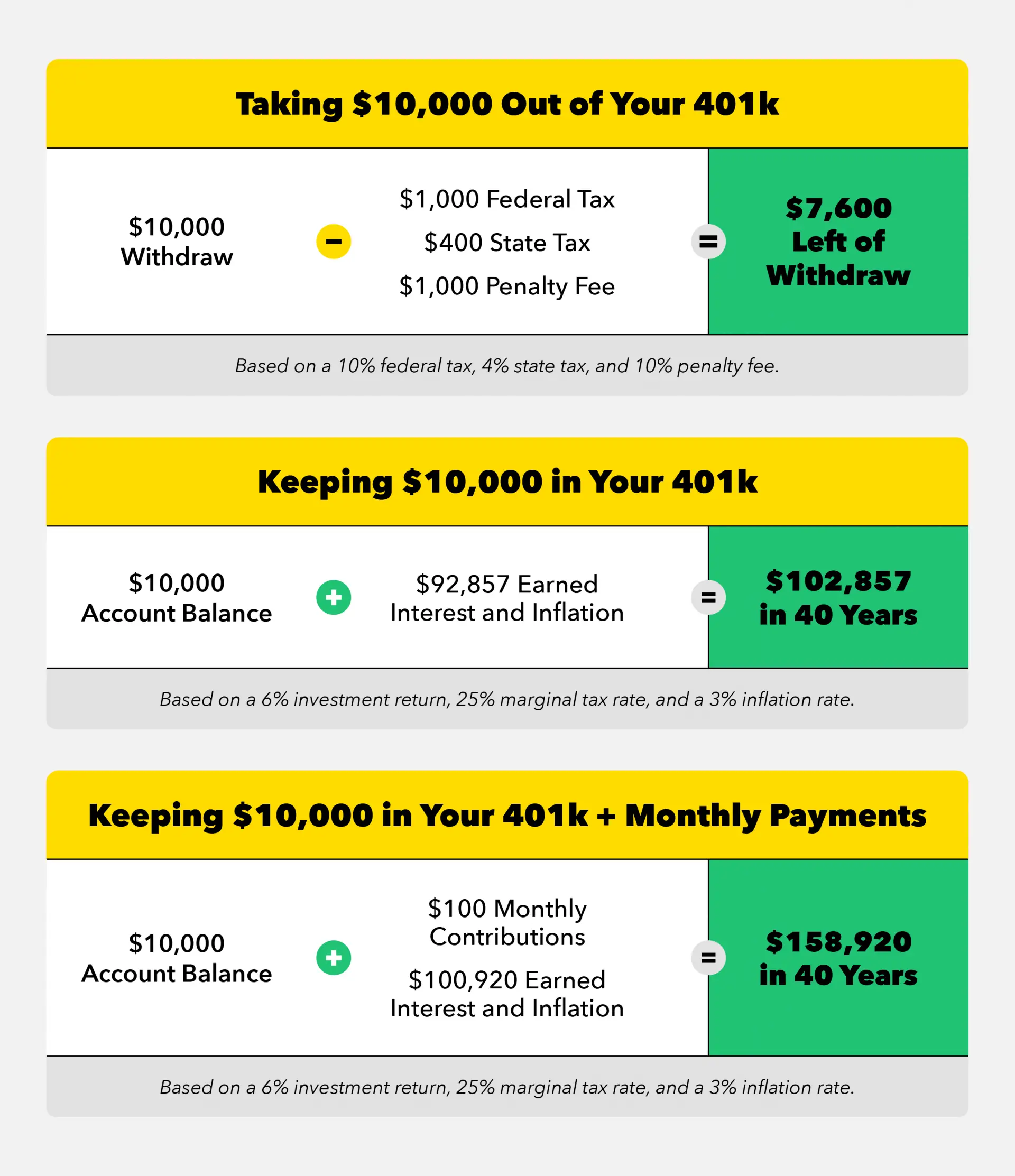

Youll Pay Penalties And Taxes For Using Retirement Savings To Pay Off Debt

Every retirement accounta traditional IRA, Roth IRA, and 401has age distribution limits. That means some combination of penalties and taxes may hit you for early withdrawals.

| Account type | Early withdrawal costs |

|---|---|

| IRA | Youll get dinged with a 10% penalty on the full amount you withdraw, plus taxes at your current income tax bracket. |

| Roth IRA | Its important to distinguish between contributions and earnings for a Roth IRA. You can withdraw the former at any time and any age, tax- and penalty-free . If you withdraw earnings at any time, you must pay taxes on them. If you make a withdrawal before the account is five years old, youll pay a 10% penalty and taxes. |

| 401 | Youll pay a 10% penalty on the withdrawal plus taxes at your current rate. |

Lets say that you have $20,000 in credit card debt. What are the true costs if you withdraw from a 401 to pay it off?

The takeaway? Youll need to withdraw even more than you think to cover your debt and all the penalties and taxes.

Learn about better options for an emergency cash than an early 401 withdrawal.

You May Like: What Is The Current Interest Rate For A 401k Loan

Is Taking A 401k Loan A Good Idea

Taking a loan out of your 401k account is a much better option than withdrawing funds from your 401k. A 401k loan is managed through your employer and the retirement provider.

If you take a loan on your 401k, you are required to pay the loan back within a specific amount of time a predetermined interest rate, usually around 7%. By doing this, you are still in debt, but you are repaying the debt at a rate of 7% interest .

In addition to the repayment rate, you do not suffer a 10% penalty by taking a loan out on your retirement as you would pulling it directly out.

These loans are usually repaid out of your employment checks and do not allow you the choice to modify or neglect payment. By using this method, you are forcing yourself to live off less, and hopefully, you will change your spending habits in the meantime. This still requires a great deal of focus from going back into .