What Could Be The Cost Of Missed Retirement Savings

A report from the National Institute on Retirement Security found that 95% of millennials arent saving enough for retirement. And a 2017 study from Wells Fargo shows that other generations arent faring much better. So if youve been trying to beat the odds and put aside adequate savings for retirement, taking out a 401 loan can be a triple whammy.

First, some plans dont allow participants to make plan contributions while they have an outstanding loan. If it takes five years for you to repay your loan, that could mean five years without adding to your 401 account. During that time, you may be failing to grow your nest egg and youll miss out on the tax benefits of contributing to a 401.

Next, if your employer offers matching contributions, youll miss out those during any years you arent contributing to the plan. Loan repayments arent considered contributions, so if the employer contribution is dependent upon your participation in the plan, you may be out of luck if you cant make contributions while you repay the loan.

And finally, your account will miss out on investment returns on the money youve borrowed. Although you do earn interest on the loan, in a low-interest-rate environment you could potentially earn a much better rate of return if the money was invested in your 401.

What are the tax benefits of 401s?

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Read Also: What Is The Most I Can Contribute To My 401k

A Bank Or Credit Union Loan

With a decent credit score you may be able to snag a favorable interest rate, Poorman says. But favorable is relative: If the loan is unsecured, that could still mean 8%12%. If possible, secure the loan with some type of asset to lock in a lower rate.

Interest is the price of borrowing money. Learn how interest rates work.

When Can You Withdraw Money From Your Ira Without Penalty

If you are over 5912, you can withdraw money from your IRA without penalty however, keep in mind that taxes will still be due. You can take IRA withdrawals without penalty if you are under the age of 5912 and have a balance of more than $72, but you must pay taxes on the withdrawal. You do not have to withdraw money from any accounts before the age of 72. To plan for retirement, keep your withdrawals in mind.

Recommended Reading: How Do I Borrow Money From My 401k

Read Also: Can A Company Hold Your 401k After You Quit

I Need Emergency Funds

Removing funds from your 401 before you retire because of an immediate and heavy financial need is called a hardship withdrawal. People do this for many reasons, including:

- Unexpected medical expenses or treatments that are not covered by insurance.

- Costs related to the purchase or repair of a home, or eviction prevention.

- Tuition, educational fees and related expenses.

- Burial or funeral expenses.

The IRS is making it easier to access the funds in your 401 by amending the rules around hardship withdrawals. But hardship withdrawals are a drain on your hard-earned retirement savings, and they stunt all the growth youve previously achieved. They can even impact your ability to retire when you want.

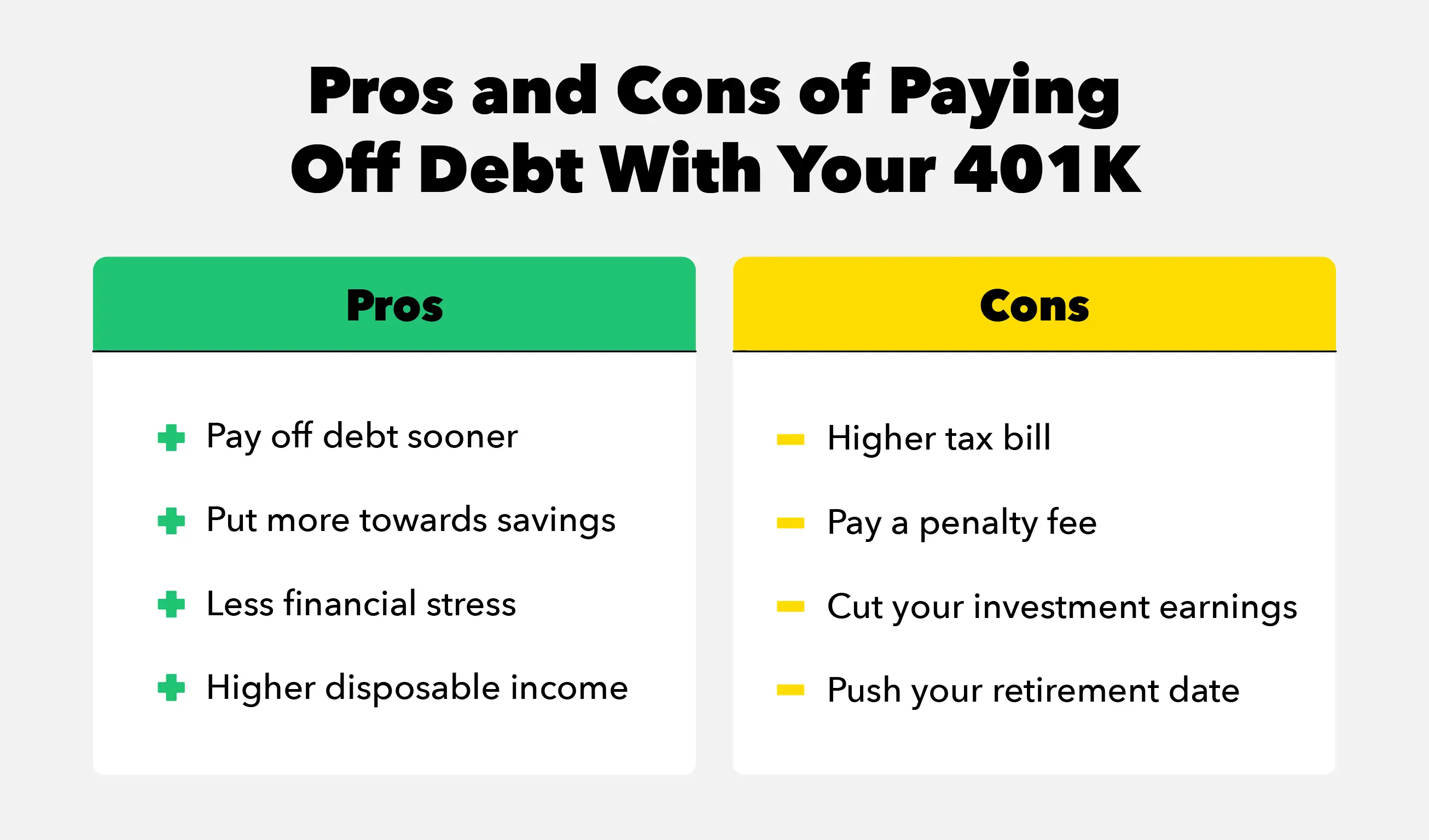

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.

Recommended Reading: Does My 401k Transfer From Job To Job

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Reasons For Cashing Out A 401

There may be a few reasons why you would consider withdrawing from your 401. The simplest answer may be that youre in retirement. Youre already past the minimum age requirement of 59 ½ and need to start supporting yourself with the funds. But your situation may be more complicated. You may have urgent medical expenses, burial costs or other immediate needs that you cant avoid. In such cases, it may be necessary to cash out your 401 despite the financial consequences.

Before moving forward you should be clear on what your reasons are for cashing out your 401 and make sure that the costs of doing so are worth it to meet those reasons. If not, You should probably consider other ways to get access to the cash you need for your specific situation.

Don’t Miss: How Do I Get My 401k

Convert To An Ira To Keep Contributing

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

Read Also: How To Rollover 401k From Vanguard To Fidelity

Is There A Way To Get The Funds Out Of My 401k Early Without Paying A Penalty

Option A: Rollover to an IRA And Withdraw – You can rollover your 401K to an IRA but that will not give you early, penalty-free access to your retirement funds. It simply transfers the funds from your employers retirement account to a personal retirement account that also has early withdrawal restrictions. If you rollover your 401K to an IRA, no taxes are withheld . Rollover transactions are reported on Form 1099-R. You can rollover by having one institution pass the funds to another or you can actually withdraw the funds and move them yourself to a new institution within 60 days. If you choose this latter option, there will be mandatory withholding of 20%, so it is easier to do a direct institution to institution transfer. There may be an option to withdraw the funds early for specific reasons – IRAs are another type of retirement vehicle and have slightly different early withdrawal rules than 401Ks. If you rollover your 401K to an IRA, you may be able to withdraw money early penalty free for the following reasons: first time home purchase, tuition and educational expenses, disability, medical expenses, and health insurance

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Recommended Reading: How Much Do You Need In Your 401k To Retire

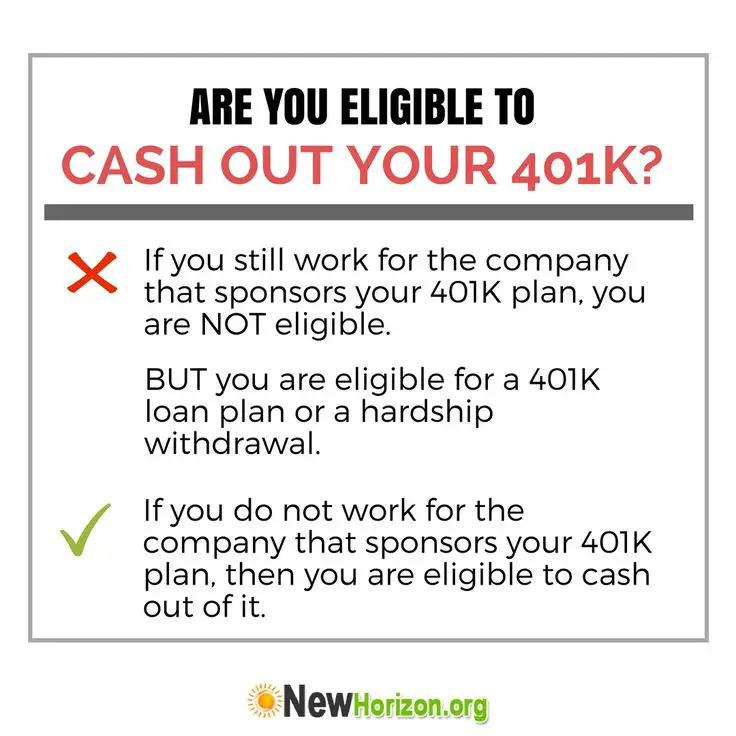

How To Cash Out A 401 After Quitting

You may follow this type of action plan for your 401 when you quit your job:

If your new employer offers a 401 plan, check your eligibility and enroll yourself.

Once enrolled, get the funds and investments in your old account directly transferred to your new account. You can opt for a direct administrator-to-administrator transfer through simple documentation to avoid potential taxes and penalties.

Instead of direct transfer, you can also cash out your old account and deposit the proceeds in your new account within 60 days of cashing out. That way, you dont have to pay income tax on the amount of the withdrawal .

You must start taking 401 distributions after you turn 70 ½ years old and you are not working anymore. However, unlike traditional plans, in a new retirement plan with your current employer, you cannot be forced to take the required minimum distributions even after you reach the age of 70 ½.

If your new employer does not have a 401 plan or you do not like the plan your new employer has, you may roll over your old 401 account to an IRA. The rollover process is like the process of rolling over to a new account. You can either get it done directly through your plan administrator or take out the proceedings and deposit them in your IRA within 60 days.

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

Read Also: How To Take Out A Loan Against 401k

What Is An Early 401k Withdrawal Or Early 401k Distribution

An early withdrawal is a withdrawal that occurs before you are 59½

There may be penalties for withdrawing funds from a 401K early.

- The penalty is 10% of the distribution

- Lets say you have $100K in your 401K and you take an early distribution for $10K

- The penalty is 10% of $10K which is $1K

- If the 401K was a traditional 401K, then $10K will also be added to your income for the year and you will pay taxes on it, based on your taxable rate for ordinary income. If it was a Roth 401K, then $10K will not be added to your income

Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

You May Like: Can I Rollover Current Employer 401k To Ira

Early Withdrawals At Age 55

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Heres What To Do When Your 401 Is Losing Money

Generally, the best move to make when you see your 401 balance go down is to do nothing at all.

This advice generally echoes investment experts guidance when any of your investments are affected by market downturns. Investing is a long-term game you take the short-term dips in exchange for the potential long-term growth, which, history has shown us, is what happens. Though past performance does not predict future performance, historically, any short-term losses have typically been outweighed by larger long-term gains.

In the long run, stock prices are the worlds way of appraising the value of the underlying companies, Winsett explains. In the short term, prices can be chaotically random but over time, prices are firmly rooted in the real value of real companies whose products and services we use regularly, if not daily.

Making an impulsive move like panic selling your 401 investments or withdrawing early from your 401 would have serious consequences. If you sell only to later jump back in the market, you may time it incorrectly and miss out on an upswing, or big recovery gains. Staying invested means as the market recovers, so, too, does your account balance. Dipping into your 401 funds before reaching the age of 59½, meanwhile, entails a 10% early withdrawal penalty on top of it being taxed.

Donât Miss: How To Roll Over 401k To Ira Vanguard

You May Like: Can I Have A 401k And An Ira