Do Roth 401k Contributions Count Towards 401k Limit

You make designated Roth contributions into a separate Roth account from your 401 plan. They count towards the limit.

Do Roth 401 K contribution limits include employer contributions?

Any employer match you receive will not count towards this limit. There is a limit on total contributions to a 401 from both the employee and the employer.

Can I contribute to both a 401k and a Roth 401k?

If your employer offers a 401 plan, there may still be room in your retirement savings for a Roth IRA. Yes, you can contribute to both a 401 and a Roth IRA, but there are certain restrictions to be aware of. This article describes how to determine your eligibility for a Roth IRA.

Is Offering A 401 Employer Match Mandatory

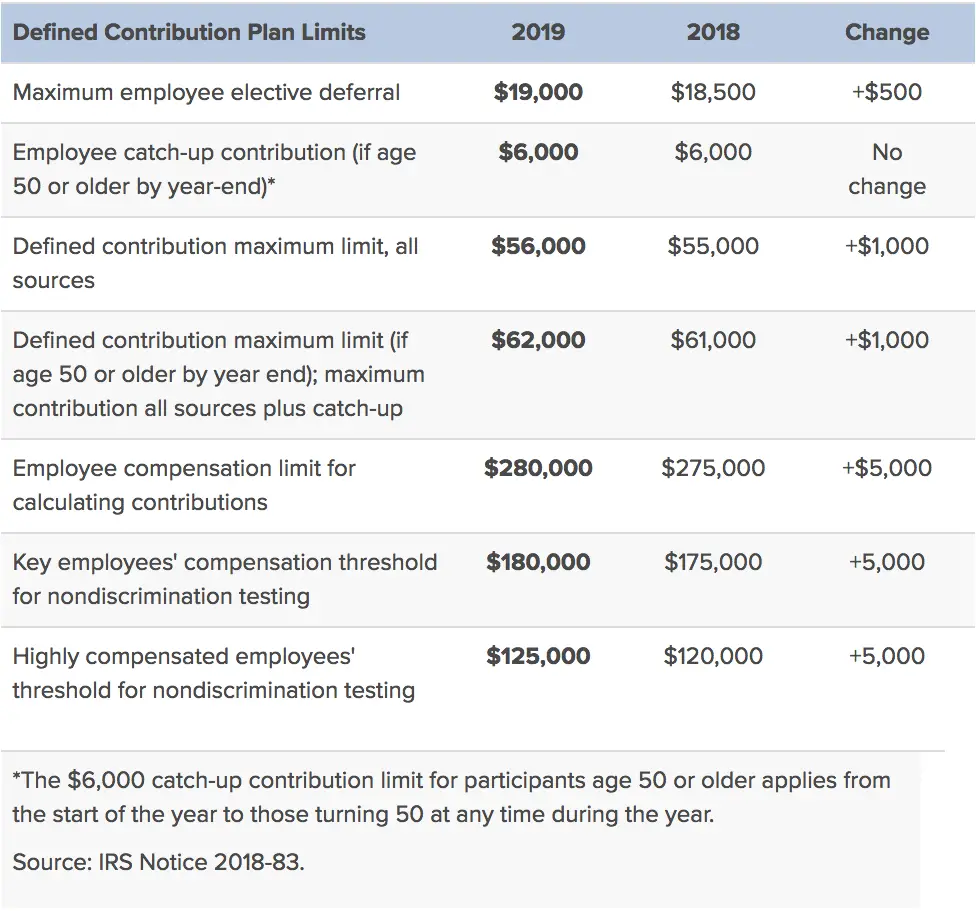

Although offering a 401 employer match for employees retirement plans may benefit your business, there are no laws requiring employer matching. However, if you do offer a 401 employer match contribution program, you are legally required to conduct nondiscrimination testing to ensure your program equally benefits all of your employees. These IRS-created tests, known as the Actual Deferral Percentage and Actual Contribution Percentage tests, ensure that your companys most highly paid employees benefit as much from tax-deferred contributions as your other employees.

Also, even though its not mandatory, the best employee retirement plans typically include matching as part of the retirement fund package. A certified financial advisor can walk employers through the legalities of 401 matching and the different components of 401 programs.

Did you know? Some payroll companies also operate 401 plans. See our review of ADP for one such example.

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

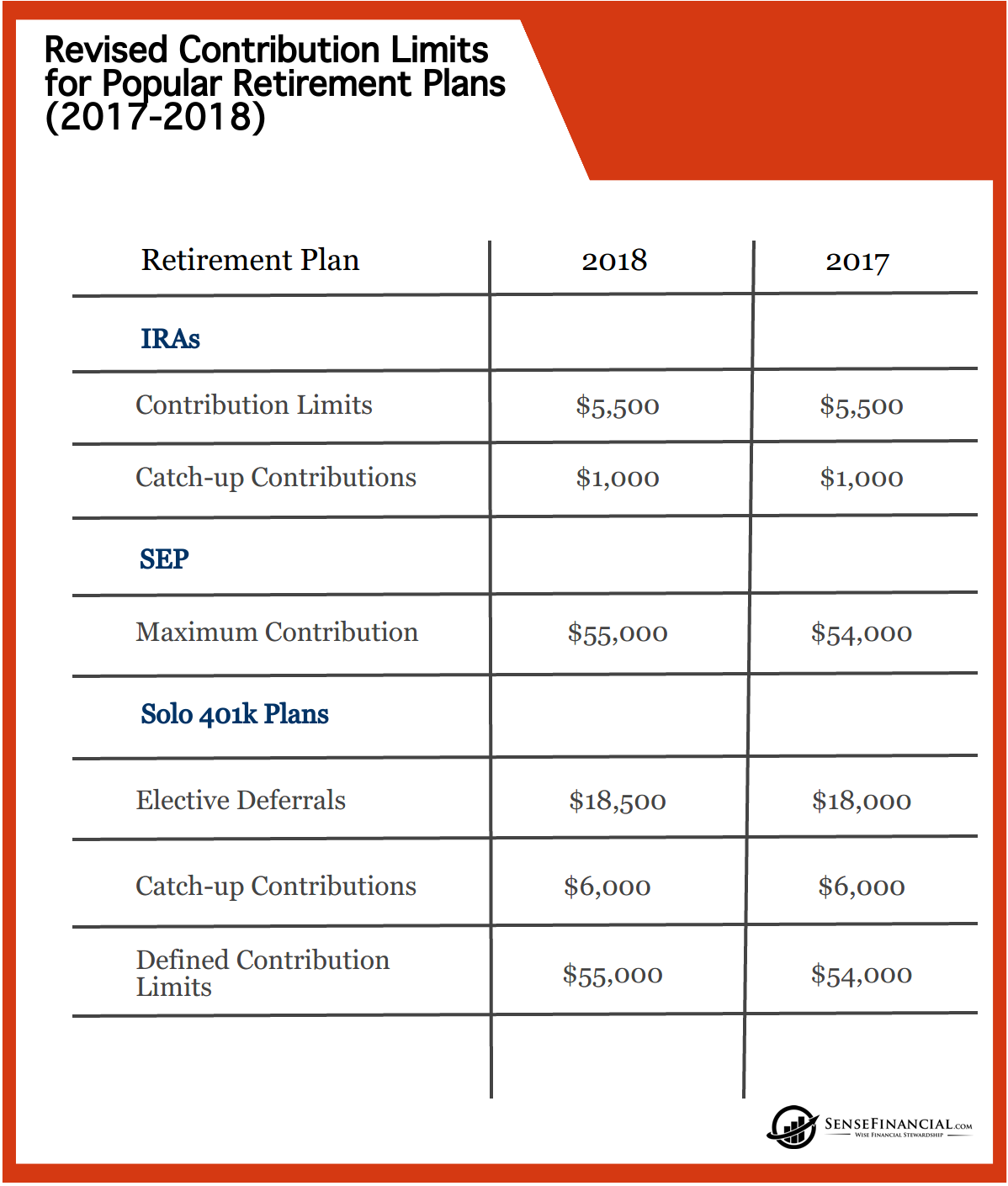

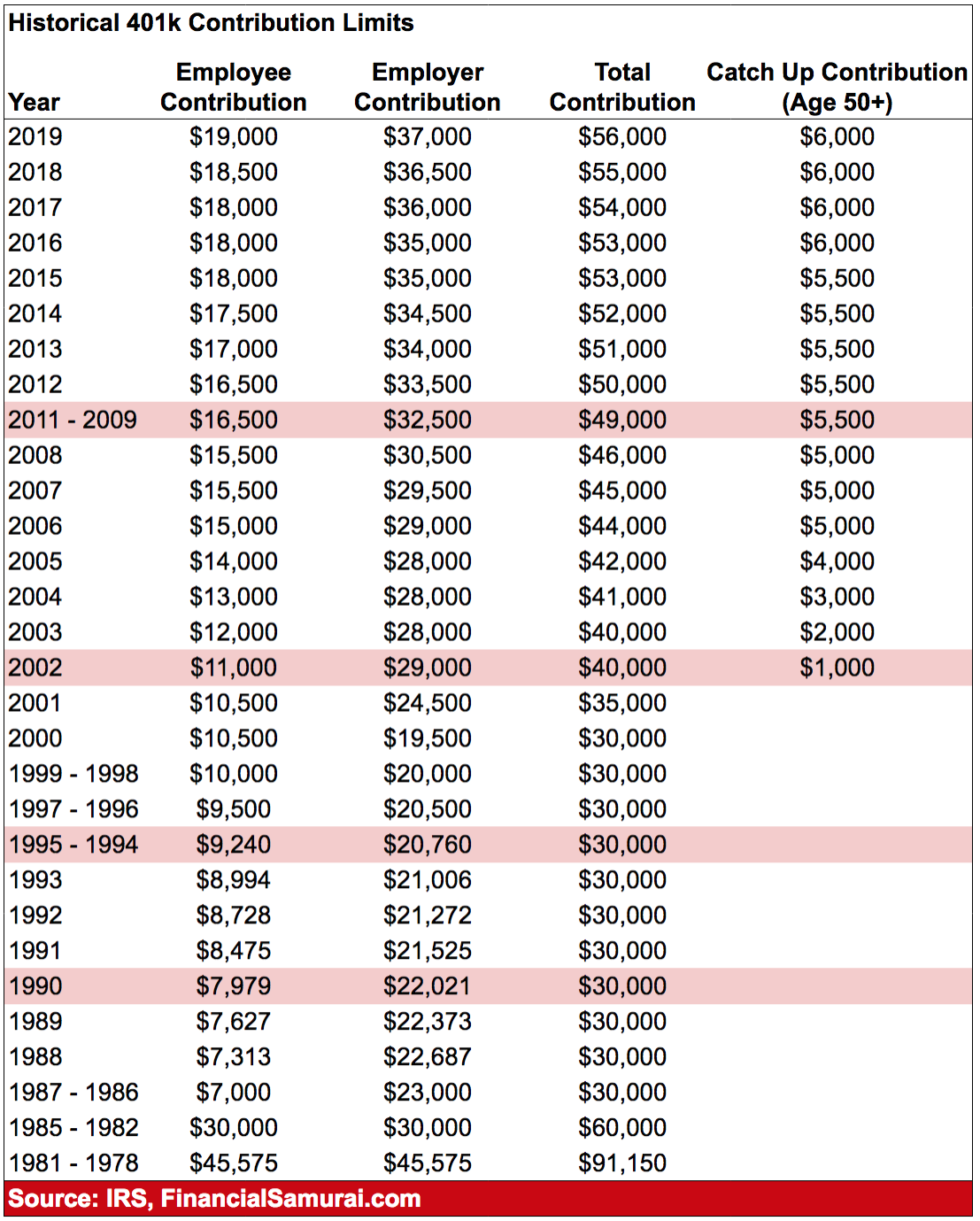

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Also Check: What Happens To Your 401k When You Leave A Company

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Simple 401 Limits In 2022

Employers offering a SIMPLE 401 allow employees to save up to $14,500 in 2022, which is up by $1,000 from 2021. Those age 50 and older may contribute another $3,000 for a total of $17,000.

Employers can contribute dollar-for-dollar up to 3% of a workers pay or contribute a flat 2% of compensation regardless of the employees own contributions. Employer 401 contributions are subject to an employee compensation cap of $305,000 for 2022.

Don’t Miss: How To Protect Your 401k In A Divorce

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Safe Harbor 401 Plans

A safe harbor 401 plan is similar to a traditional 401 plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The safe harbor 401 plan is not subject to the complex annual nondiscrimination tests that apply to traditional 401 plans.

Safe harbor 401 plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Code.

Employers sponsoring safe harbor 401 plans must satisfy certain notice requirements. The notice requirements are satisfied if each eligible employee for the plan year is given written notice of the employee’s rights and obligations under the plan and the notice satisfies the content and timing requirements.

In order to satisfy the content requirement, the notice must describe the safe harbor method in use, how eligible employees make elections, any other plans involved, etc. Income Tax Regulations section 1.401-3 , contains information on satisfying the content requirement using electronic media and referencing the plan’s Summary Plan Description.

Both the traditional and safe harbor plans are for employers of any size and can be combined with other retirement plans.

Read Also: Is 401k Protected From Bankruptcy

How Much You And Your Employer Can Contribute For You In 2022

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are some limits on how much you can contribute.

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In November 2021, the IRS made updates for 2022.

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

You May Like: Should You Use 401k To Pay Off Debt

How Much Can I Contribute To My 401 With Employer Matching

Dylan Telerski / 19 Jun 2020 / 401 Resources

In 2022, the total annual contribution maximum, including 401 employer matching, is $61,000or up to 100% of the employees salary if they make less than that. Individuals may contribute up to a maximum of $20,500 to their 401s or $27,000 if theyre 50+ years old. Employer contributions are added ON TOP of this limit to a maximum of $61,000.

Donât Miss: Should I Open A 401k

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $20,500 in 2022 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Read Also: What Happens To 401k When You Leave Company

When Do Employer Matching Contributions Become Vested

As part of a companys retirement savings plan, there may be rules pertaining to whats known as the vesting schedule, that is, rules outlining whether contributions the employer makes are owned by the employee immediately or not until after some waiting period. If there is a vesting schedule and, if the employee leaves before the contributions become fully vested, then some portion of the matched contributions would be returned to the employer.

Like matches, vesting schedules vary by employer. While some plans offer immediate vesting, others have a specified period of time before an employee is vested. Still, others take a graduated approach, with an increasing portion of the employer match becoming owned by the employee over time .

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

You May Like: When Should I Roll Over My 401k

How Can A Small Business Owner Set Up A Solo 401

You can still set up a 401 if you don’t have any employees that’s what who the Solo 401 is for.

There are a few things you’ll need to do to set up a Solo 401. First, you’ll need to choose a custodian for your account. This can be any financial institution that offers Solo 401s, such as a bank, brokerage firm, or credit union. Next, you’ll need to open a Solo 401 account with your chosen custodian. Once your account is open, you’ll need to fund it. You can do this by making contributions from your small business’ earnings. Finally, you’ll need to invest your Solo 401 funds. You can choose from a variety of investment options, depending on your custodian. For example, you may be able to invest in stocks, bonds, mutual funds, and exchange-traded funds.

With a Solo 401, you can enjoy the same retirement savings benefits as with a traditional 401. And because you’re the only participant in the plan, there are no required minimum distributions until after you turn 70½. Setting up a Solo 401 is a great way to save for retirement if you’re self-employed or own a small business with no employees.

Are There Income Limits For 401s

While there’s not a universal income limit on 401 contributions, in some cases the IRS does impose contribution limits on “highly compensated employees” when a company encounters disproportionate contribution levels among its workers. The IRS has a test that helps employers who sponsor 401 plans assess whether employees are participating in their plan at levels proportionate to their compensation.

If the test determines that people across compensation levels aren’t participating in a manner the IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. In these cases, your employer may need to return some of your excess contributions.

The IRS defines a highly compensated employee in one of two ways:

An individual who either owned more than 5% of the interest in a business at any time during the year or the preceding year, no matter how much they were paid.

An individual who received over $135,000 from the business in the preceding year in 2022, and, if the employer ranks employees by compensation, was in the top 20%.

Don’t Miss: What Companies Offer The Best 401k Match

Limits Adjusted Higher For Soaring Inflation

A 401 plan is a great way to increase your retirement savings. Your employer will deduct your pretax contributions from your paycheck, and your savings will be tax-deferred until you take withdrawals during retirement. , which is funded with after-tax dollars and from which withdrawals in retirement are tax-free.) Thanks to some recent adjustments by the Internal Revenue Service, your 401 will get a bit better in 2023.

Savers are able to contribute as much as $20,500 to a 401 plan in 2022, an increase of $1,000 from 2021. Those 50 and older will be able to add another $6,500 the same catch-up contribution amount as 2021 for a maximum contribution of $27,000.

In 2023, the contribution limits are even more generous, because those limits are adjusted for inflation each year. Savers will be able to sock away $22,500 a year in 2023 those 50 and above can contribute an additional $7,500, for a total annual contribution of $30,000.

These limits apply to other retirement plans, such as 403 plans for employees of public schools and nonprofit organizations, as well as the federal governments Thrift Savings Plan.

There is an upper limit to the combined amount you and your employer can contribute to defined contribution retirement plans. For those age 49 and under, the limit is $61,000 in 2022 that rises to $66,000 in 2023. For those 50 and older, the limit is $67,500 in 2022 that rises to $73,500 in 2023. You cant contribute more than your earned income in any year.

Employee Contribution Limits For 2020 And 2021

If your employer offers a 401 plan, you can join the retirement plan, and start saving for your retirement. However, you can only contribute to the 401 up to a certain limit. In 2020 and 2021, you can contribute to the 401 account up to $19,500 per year, and this limit includes the salary deferral and any contributions made to a Roth 401. If you have multiple 401s, the cumulative contributions to the 401s should not exceed the IRS limit. However, if you have an IRA, the IRA contributions do not count towards the 401 limit. If you are above age 50, the IRS allows you to contribute an extra $6,500 to speed up your retirement savings. This increases your total 401 contribution to $26,000.

Also Check: Can I Roll My 401k Into An Index Fund

How To Get Started:

To establish a Solo 401k, set up an application with your Self-Directed 401k provider. You must have an Employee Identification Number . As you contribute more and more to your plan, you may need to fill out additional paperwork. Be aware of any fees a plan custodian may charge so you know what your true cost is, and then begin building your retirement savings for yourself.

You May Like: Should I Have An Ira And A 401k

Do Employer Contributions Affect The 401 Contribution Limit

If both an employee and an employer contribute to a 401 plan, this boosts the employeeâs saving efforts. But does that free money from an employer count toward oneâs annual contribution limit?

In short, the answer is no. An employerâs 401 plan contributions donât count toward the employeeâs contribution limit. So, even if an employee younger than 50 puts $20,500 into their 401 one year, their employer can still contribute funds.

Still, there is a total contribution limit to note.

All plan contributionsâmeaning the total of elective deferrals , employer match funds, employer non-elective contributions, and allocations of forfeituresâcannot surpass the IRSâs overall limit on contributions. For tax year 2022, this limit is the lesser of:

- $61,000 or $67,500 for those over 50

- 100% of an individualâs annual compensation

This limit is designed for employees who have more than one retirement savings account that is managed by the same employer, or a related employer.

High-earning employees may face another hurdle when it comes to salary deferrals: contribution cut-offs. While most plans will allow high-earners to continue making contributions until they reach their annual contribution limit, some will cut off contributions early if their income hits a certain threshold.

Also Check: How Much Invest In 401k

Why Always Investing To Get The Full Match Is So Smart

Okay, you probably have a lot of different money goals , and retirement might feel a long way off. But consider this: The stock market has historically earned an average return of 10% a year. The key word here is average. In any given year, it might be more, it might be less. Theres risk involved. At Ellevest, we assess your risk and recommend an investment portfolio aimed to get you to your goal in 70% of market scenarios or better but still. Risk.

On the other hand, with an employer match of 50%, youre earning a 50% return on everything you put in . Fifty percent. Thats kind of amazing. And then, because that itself gets invested in the market, your 50% gets the chance to earn even more returns compounded. In case youre counting, thats returns on returns on returns.

And heres the situation: Grabbing that match is even more important for women, because the data shows that were behind as it is women retire with two-thirds as much money as men . So this is one opportunity you usually want to jump on.

What Is Considered A Good 401 Matching Contribution

Many employers and employees consider a good 401 match to be an employer contribution of 50 cents for each dollar an employee contributes for up to 6% of the employees pay, which is why this is the most common 401 matching contribution. This is typically considered a generous matching contribution since the average matching contribution is 4.3% of an employees salary.

Read Also: What Age Can I Draw From My 401k