Figure Out Your Estimated Annual Percentage Return

This figure depends on the type of investments youre considering. For example, the stock market has a well-established, long-term annual return, while bonds have fixed rates that fluctuate only slightly over time.

The long-term average annual return of the U.S. stock market as a whole is around 10%. The annual growth of the S& P 500 index, in particular, is 11.88% . But well use 10% because its an easier number to work with and we want to be conservative with our estimates.

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Next Steps For Your Money

If your old 401 plan is still with a former employer, one option is to leave the money there. But you may not pay as much attention to the account, which could lead to a portfolio thats not appropriate for your age and risk tolerance.

If youre still working and have a 401 at your new job, another option is to roll over the funds into your existing plan, assuming your employer allows it. Another option is to roll the money into an IRA. Having your savings in one place will make it easier to manage your investments.

Also Check: How To Get Into Your 401k

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Free Report, T. Rowe Price – Get Free Report, Vanguard, Charles Schwab – Get Free Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Read Also: What Percentage Should I Put In My 401k

How To Get Money Out Of Your 401

Your 401 money is meant for retirement. Itâs not easy to take money out while youâre still working, without incurring a steep financial loss. The account is structured that way on purpose you let the money grow for your future use.

There are certain circumstances under which you can take funds out of your 401 without paying any penalty. Youâll still need to pay income taxes on the money, since it most likely went into your account on a pre-tax basis.

You can start taking withdrawals once you reach 59 1/2 years of age. You can also take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday. This is known as the IRS Rule of 55.

Recommended Reading: What Happens When You Rollover A 401k

How To Reclaim Your Retirement Plan With A Previous Employer

Millions of Americans accidentally or unknowingly leave money in retirement plans with previous employers. According to a study by the National Association of Unclaimed Property Administrators, Americans lost track of more than $7.7 billion in retirement savings in 2015.

If you’ve left a retirement plan with a previous employer, not to worry. Here are 6 tips you can follow to reclaim your money.

You May Like: What Is The Phone Number For 401k

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

What Is The 401k Savings Potential By Age

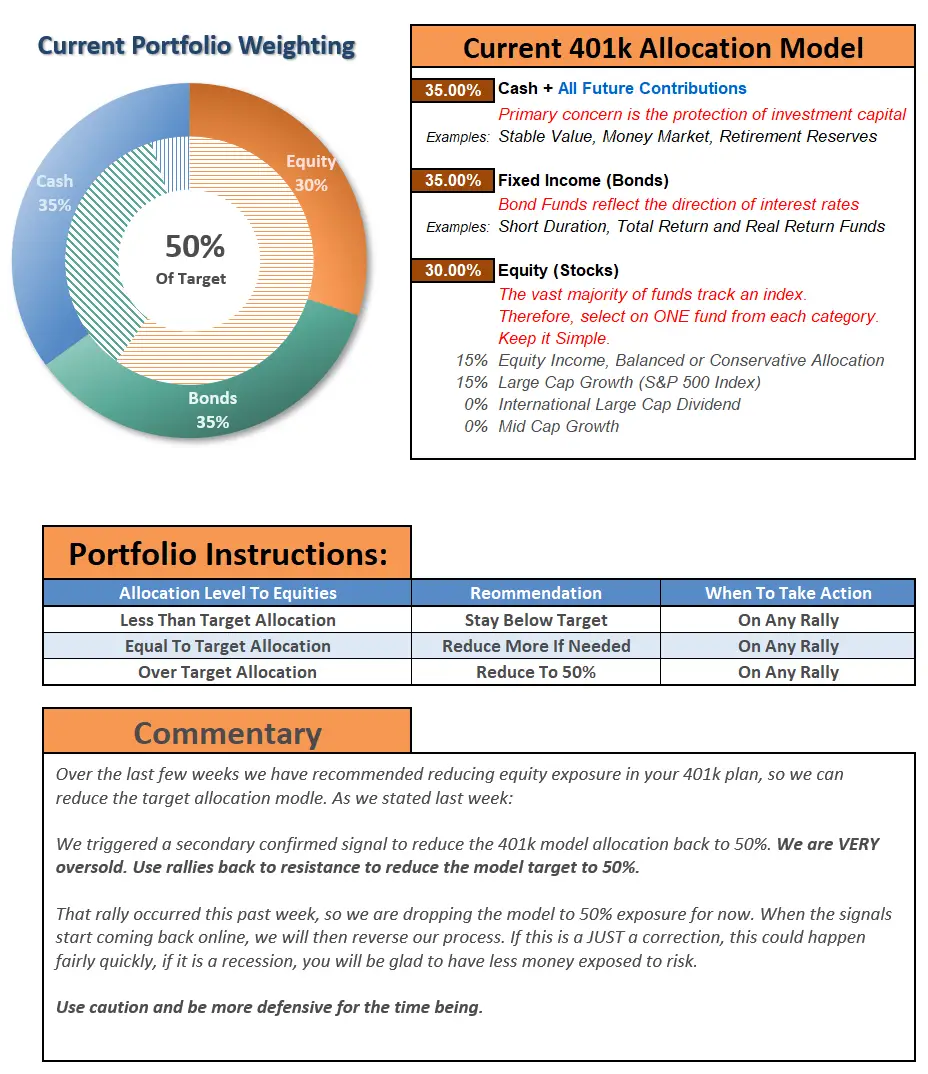

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

Also Check: Can I Have 2 401k Plans

Is There A Company Match And If So What Are The Rules

Many employers offer incentives for employees to contribute to their 401 plans by matching contributions up to a certain point. For instance, some companies may match every dollar you contribute with 50 cents of their own, up to a certain percentage of your salary. Thats a nice benefit you dont want to miss out on. But individual plans vary widely, and there may be restrictions on qualifying for the company match or vesting schedules for the match. Ask your plan administrator for the rules that apply to your companys plan.

Recommended Reading: How Much Can I Put In A Solo 401k

Divide 72 By Your Average Expected Annual Return

Just drop the % symbol and go from there. As an example, if youre assuming a 10% annual growth rate, the Rule of 72 formula will give you 7.2 as an output:

72 / 10 = 7.2

Heres why this formula is so useful. The answer you get is how manyyears it should take for your money to double.

In this case, it would take you 7.2 years to double your money. If instead your average expected annual return was a more modest 7% , dividing 72 by 7 would result in 10.3, meaning it would take slightly over a decade for your money to double under those conditions.

Once you have the number of years it takes to double your portfolio, it will much easier to ballpark how long it will take for you to meet the financial goals youve set for your portfolio under various scenarios.

Lets say your initial investment is $100,000meaning thats how much money you are able to invest right nowand your goal is to grow your portfolio to $1 million.

Assuming long-term market returns stay more or less the same, the Rule of 72 tells us that you should be able to double your money every 7.2 years. So, after 7.2 years have passed, youll have $200,000 after 14.4 years, $400,000 after 21.6 years, $800,000 and after 28.8 years, $1.6 million. So it should take you between 2325 years to reach your goal of $1 million.

Fun fact: You might be wondering, Why 72? The answer has to do with some pretty gnarly algebra we wont be covering in this article. But anyone interested can learn more here.

Read Also: How Much Can We Contribute To 401k

Leave It With Your Former Employer

Some employers will let you leave your old 401 with them. However, doing so might limit what you can do with the money. For instance, you won’t be able to add money to the account, and you might not be able to take out a loan against the 401.

Also, you might be able to withdraw only the entire balance, rather than just some of the money. The good news here, though, is that you can make withdrawals without a financial penalty if you left the employer when you were at least 55 years old.

Retirement Planning: Stay On Track At Any Age

Everyone looks at retirement differently. Some people want to retire early, while others can’t imagine leaving their careers, no matter their age. Since we can never know our futureor how we’ll feel in the futureit’s best to be prepared. As you save for retirement, regularly assess the age you plan to retire and the lifestyle you hope to maintain.

Also Check: Is It Good To Convert 401k To Roth Ira

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2022. So if you contribute the annual limit of $20,500 plus your catch-up contribution of $6,500, thats a total of $27,000 tax-advantaged dollars you could be saving towards your retirement.

Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiserâs responsibility to ensure all posts and/or questions are answered.

Also Check: What Is The Max I Can Put In My 401k

Search Your State’s Unclaimed Property

Still no luck finding your old 401? Visit the website of the National Association of Unclaimed Property Administrators. There, you can search by state. Once you click on your state on the site’s interactive map, you’ll be directed to the state agency that handles unclaimed property.

And if you’ve lived in several states, you can conduct a multistate search for an old 401 at MissingMoney.com, which is endorsed by the National Association of Unclaimed Property Administrators.

Once you find your old 401, you can start the process of filing a claim for the account.

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Recommended Reading: How Do I Know If I Have A 401k Account

How To Track Down Forgotten 401 Money

Although the idea of forgotten money may sound strange to some people, the truth is that there is a lot of misplaced 401 money floating around America. According to Capitalize, as of 2021, there were over 24 million forgotten 401 accounts, with assets totaling $1.35 trillion. In many cases, lost 401 money is the result of changing jobs, with retirement plan paperwork getting lost in the shuffle. Smaller 401 balances are more likely to be forgotten than large ones, but even sizable accounts can sometimes be overlooked, especially when workers have the misguided notion that they arent entitled to them if they leave a company. If you feel like you may have misplaced some 401 money over the course of your working career or if youre now curious to check here are the places you should look to find it.

Read: Best Cities To Retire on a Budget of $1,500 a Month

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Also Check: What To Do With 401k When You Leave Your Job

Read Also: How To Start A 401k For My Company

Develop Other Sources Of Income

Think about other ways you can secure sources of income in retirement outside of collecting Social Security and withdrawing from your 401k. This will not only prevent you from having all your retirement eggs in one basket, but it is also something to consider if your 401k balance is lower than youd like. Where can you invest and how can you optimize your portfolio for greater returns? Consider other ways you can supplement your retirement income, and speak to your financial advisor about what solutions could work for you.

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Read Also: Can I Transfer My 401k To Another Company