Is Your Balance More Or Less Than The Average

Its imperative that youre financially prepared for retirement. Living on Social Security alone is difficult, so youll want an additional source of income. For most people, that extra money must come from retirement savings.

A 401 is a popular retirement investment account used by millions of U.S. workers, in large part because this account offers generous tax advantages. Because its administered by employers, its convenient to invest in.

If you have access to a workplace 401, saving in it early and aggressively could provide a path to a secure retirement. But how have Americans done with investing in their 401 accounts? Check out the average 401 balance by age and income level to see where you stack up when it comes to your retirement savings.

Tips On Retirement Planning

- We can all use help with our finances, and never more so than when its time to save for retirement. Thats where a financial advisor can offer valuable guidance and insight.

Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Use SmartAssets 401 calculator to get a quick estimate of how much youll have in your 401 by the time you retire.

I Wish I Had Stayed In Touch With My Friends

Often they would not truly realise the full benefits of old friends until their dying weeks and it was not always possible to track them down. Many had become so caught up in their own lives that they had let golden friendships slip by over the years. There were many deep regrets about not giving friendships the time and effort that they deserved. Everyone misses their friends when they are dying.

Recommended Reading: How To Pull Out 401k

Don’t Miss: What Is The Most You Can Put Into A 401k

Start Living On A Budget And Tracking Your Expenses

The fact is that until you know where your money is going each month youre going to have a hard time finding money to set aside for retirement savings.

The reason its so important to discover and track where your money is going each month is so that you can identify wasteful spending and reroute it toward causes that are more important to you.

Many people find when they start tracking expenses that they are spending money in $5, $10 and $20 increments that seems like its not a lot but adds up to hundreds or thousands of dollars each month.

When my family started tracking expenses in 2013, we were able to cut them down by nearly $1,000 a month and we were making well under $100,000 per year at the time.

By trimming grocery expenses, cutting back on entertainment costs and being more mindful of each purchase, we found a lot of waste in our spending. We were able to use what we were wasting for much more important things, such as paying off our debt.

How Much Do I Need To Retire

How much money do you need to comfortably retire? $1 million? $2 million? More?

Financial planners often recommend replacing about 80% of your pre-retirement income to sustain the same lifestyle after you retire. This means that, if you earn $100,000 per year, you’d aim for at least $80,000 of income in retirement.

However, there are several factors to consider, and not all of your income will need to come from savings. With that in mind, here’s a guide to help calculate how much money you will need to retire.

You May Like: Can I Rollover My 401k To A Roth Ira

Using This Retirement Calculator

-

First, enter your current age, income, savings balance and how much you save toward retirement each month. Thats enough to get a snapshot of where you stand.

-

Want to customize your results? Expanding the Optional settings lets you add what you expect to receive from Social Security , adjust your spending level in retirement, change your expected retirement age and more.

-

Hover over or tap on the color bars in your results panel to get further insight into where you stand.

-

You can adjust your inputs to see how various actions, like saving more or planning to retire later, might affect your retirement picture.

|

no account fees to open a Fidelity retail IRA |

||

Account minimum |

||

|

when you invest in a new Merrill Edge® Self-Directed account. |

Promotioncareer counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

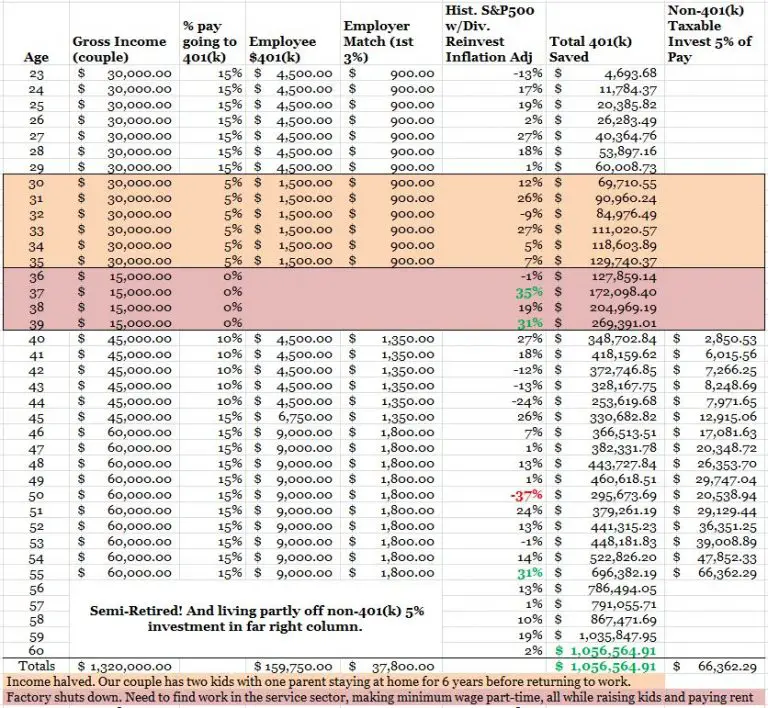

Personal Capital Average 401k Balance By Age

| AGE | |

|---|---|

| $458,563 | $132,101 |

*Note: Averages are rounded up to the nearest dollar. Numbers are based on aggregated and anonymous data from the Personal Capital Dashboard. Accounts included are the following: 401k, former employer, Roth 401k. Excludes test and invalid accounts. Excludes any account value greater than $100,000,000 or less than -$100,000,000. Excludes spouse accounts. Snapshotted balance as of 9/7/2022.

Recommended Reading: How To Get Money From Your 401k

How Much Do I Need To Retire At Age 60

This husband and wife both turned 39 in 2020, and theyre saving fairly aggressively, especially for people in their age bracket. But although their contributions are moderately high, they only commit 10 percent to stocks. They could take more risks if they still have 20 years until retirement at age 60.

Here is where they stand:

- Amount added to savings each month: $2,000

- Percentage of savings in stocks: 10%

- Other debt: $45,000

While their savings arent terribly high, they contribute a healthy portion every month. So in 20 years, it will have grown substantially. Their retirement savings is projected to last until they reach the age of 81, which is past their life expectancy.

They are projected to have between $720K and $1.1M by the time they reach their early retirement age, and their projected need is between $460K and $2.4M. But they also lack a lifetime annuity or Medicare Supplemental Insurance, which could lower those figures to $310 to $960K.

Even without additional insurance, this couples savings should last through retirement. They have long-term-care insurance, which covers the risk of unexpected health care costs. If they increased their savings distribution to 25 percent stocks, they should have a well-funded retirement.

- Maximum amount needed to retire by age 60: $460K and $2.4M

You dont need a partner to live well and retire early.

How Much Should I Have In My 401 By Age 60

For 55- to 64-year-olds with a 401, the average retirement savings is a little more than $408,000, according to the Federal Reserve.

One factor to consider here is how long you plan to be out of the workforce. If you plan to retire early, youâll have to factor in additional health care costs as you wonât be eligible for Medicare until age 65. Meanwhile, the minimum age to begin collecting Social Security is 62, but the longer you can wait, the higher your payment will be. Youâll also need to factor in expenses and the lifestyle you want to live in retirement.

Read Also: How To Close 401k After Leaving Job

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

How To Calculate Retirement Savings

In addition to using the above methods to determine what you should have saved and by what age, online calculators can be a useful tool to help you reach your retirement savings goals. For example, they can help you understand how changing savings and withdrawal rates can impact your retirement nest egg. Though there are many online retirement savings calculators to choose from, some are much better than others. The T. Rowe Price Retirement Income Calculator and MaxiFi ESPlanner are two worth trying.

Also Check: How To Pull Money From Your 401k

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Also Check: What Should I Do With 401k

Your 401 Savings And Your Desired Retirement Lifestyle

How you want to live out your golden years is another huge factor in what your 401 savings will need to look like. Thats because retirement has evolved over time to become a more active time of life. Its now viewed as a new beginning in our lives rather than a beginning of our end. That shift in mindset has driven the need for additional sources of retirement income.

The Employee Benefit Research Institute study on the Expenditure Patterns of Older Americans shows that as we age our expenses decline. Using age 65 as a benchmark, the study found that household expenses drop by 19% by age of 75 and 34% by age 85. The study also found that people over the age of 50 spend 40-45% of their budget on their home and home-related items. The bottom line is that by the time we retire our expenses are down between 20% and 40%. This is why expert opinions differ on how much of our pre-retirement income we need. Guidelines generally vary from 60% to 80%.

If you have a household income of $100,000 when you retire and you use the 80% income benchmark as your goal, you will need $80,000 a year to maintain your lifestyle. Assuming your 401 savings grow at 8%, you should expect to have up to $80,000 a year in interest income so you can avoid having to touch your principal as much as possible.

Also Check: How Much Will My 401k Pay Me Per Month

Tips To Save For Retirement

That most Americans dont have nearly enough savings to sustain them through retirement is sad but true. How do you avoid that fate? Here are some steps that you can take, whether you’re early in your career or closer to your retirement.

Of course, start saving and investing as early as you possibly can. The longer you have, the better, especially where the power of compounding interest is concerned. Retirement may seem a long way off but when it comes to saving for it, the days can dwindle away quickly and any delay costs more in the long run.

Plan Balances By Generation

The good news is that Americans have been making an effort to save more. According to Fidelity Investments, the financial services firm that administers more than $9.8 trillion in assets, the average 401 plan balance reached $112,300 in the fourth quarter of 2019. Thats a 17% increase from $95,600 in Q4 2018.

How does that break down by age? Heres how Fidelity crunches the numbers.

Dont Miss: Whats The Max You Can Put In A 401k

Read Also: What Can You Roll A 401k Into

How Much Should A Person Save For Retirement Each Month

Retirement You should consider saving 10 15% of your income for retirement.

How much money should I save for retirement every month?

You should consider saving 10 15% of your income for retirement.

How much does the average person save for retirement?

According to a study by the Transamerica Retirement Research Institute, the average retirement age in the United States is: Americans in their 20s: $ 16,000. 30-year-old Americans: $ 45,000. 40-year-old Americans: $ 63,000.

Beyond The 4% Rule: How Much Can You Spend In Retirement

Youve worked hard to save for retirement, and now youre ready to turn your savings into a paycheck. But how much can you afford to withdraw from savings and spend? If you spend too much, you risk being left with a shortfall later in retirement. But if you spend too little, you may not enjoy the retirement you envisioned.

One frequently used rule of thumb for retirement spending is known as the 4% rule. Its relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation. By following this formula, you should have a very high probability of not outliving your money during a 30-year retirement, according to the rule.

For example, lets say your portfolio at retirement totals lets say your portfolio at retirement totals $1 million. You would withdraw $40,000 in your first year of retirement. If the cost of living rises 2% that year, you would give yourself a 2% raise the following year, withdrawing $40,800, and so on for the next 30 years.

Also Check: Should I Do Roth Or Traditional 401k

What If You Have No Money Saved For Retirement

If you have zero dollars saved for retirement, you certainly are not going to retire at age 30 and you will need to double or triple up the standard savings formula.

For the target age of 65, Hoskin recommends taking your current age and subtracting the number 15. The resulting number is the percentage of your salary you should be saving each year if you plan to retire at age 65. For earlier retirement, you will need to double or triple that percentage.

For example, the esteemed writer of this article is 34 years old. If she had zero dollars saved for retirement, she would need to begin putting 19% of her salary toward retirement savings every year. If she wanted to retire at 50, she would need to at least double that.

Remember: The older you are without any money in retirement, the greater the salary percentage that must be allocated to retirement funds. If you start saving later and find you need extra time to keep saving, consider delaying retirement past age 55.

EDITORS NOTE: This story has been updated to clarify the calculations needed for early retirement.

More From GOBankingRates

Early Retirement Is A Possibility For Frugal Savers And Extreme Planners

Scott Spann is an investing and retirement expert for The Balance. He is a certified financial planner with over two decades experience. Scott currently is senior director of financial education at BrightPlan. Scott is also a published author and an adjunct professor at Maryville University, where he teaches personal finance.

Dave Nagel / Getty Images

Extreme savers who expect to achieve financial independence by age 40 challenge the norm when it comes to retirement planning and timing.

According to the 2020 EBRI/Greenwald Retirement Confidence Survey, only 14% of retirees quit working when they were under the age of 55, compared with 19% at age 55 to 59 11% at 60 or 61 26% at 62 to 64 13% at 65 11% at 66 to 69 and 6% who either retired at 70 or older or said they would never retire.

You May Like: How Can I Roll Over My 401k

It’s Not About Money It’s About Income

One important point when it comes to determining your retirement“number” is that it isn’t about deciding on a certain amount of savings. For example, the most common retirement goal among Americans is a $1 million nest egg. But this is faulty logic.

The most important factor in determining how much you need to retire is whether you’ll have enough money to create the income you need to support your desired quality of life after you retire.

Will a $1 million savings balance allow you to create enough income forever? Maybe, but maybe not. That’s what we’re going to determine in this article.

Average Current Retirement Savings Balance

Unfortunately, many people are woefully under-prepared for retirement from a financial standpoint.

Here are some statistics on the median current retirement savings balances of Americans based on their age.

| Families Between |

|---|

| 70+ | 12.3% |

Workers save more for retirement as they get older and pay off other debts like student loans and a home mortgage.

At a minimum, many experts recommend saving at least 10% of your income for retirement. Dave Ramseys Baby Steps recommend saving at least 15% into retirement accounts after getting out of debt and building an emergency fund.

You can use a retirement calculator like NewRetirement to review your personal progress and project how long your nest egg will last. This tool is free but paid plans are available too.

Read our NewRetirement review to learn more about this interactive retirement planner.

Recommended Reading: How To Start My Own 401k