Make Sure Your Payroll Integration Scales With Your Business

If you do get a payroll integration for your 401, youll want to be sure that it works as your business scales up. Most businesses need to upgrade to new payroll systems around the 50 employee mark, as this is when compliance and reporting needs become too complex for simple small business payroll systems to handle. If the provider you choose doesnt integrate with payroll systems suited for larger businesses, you may need to change providers. And trust us, doing this can be a huge hassle.

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

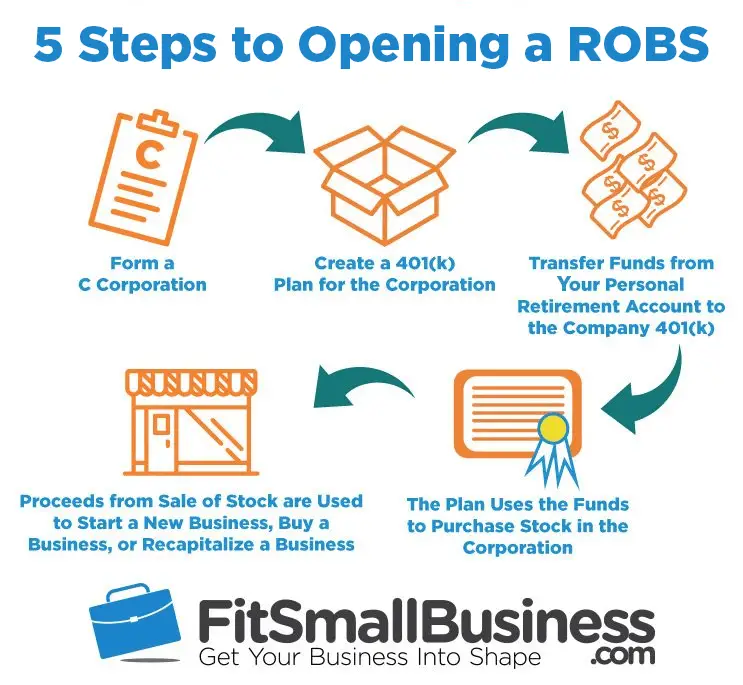

How To Set Up Shop

Before getting your small business up and running, you’ll need to complete the following legal requirements. Consult an attorney and/or accountant for guidance relevant to your specific situation.

Read Also: How To Figure Out Your 401k Contribution

Finalizing Your 401 Selection

Next, with the help of a financial advisor, choose the plan that makes the most sense for your company and your employees. If you have a relatively small company with only a few employees, your plan selection will likely be quite different if you have 90 employees.

The final step will be to inform your employees and to update your benefits package to reflect the change, so you can clearly tell potential employees about the 401 plan, as well. You will likely want to mention the benefit on all of your job listings in the future, too.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Want to read more?

To stay on top of all the news impacting your small business, go here for all of our latest small business news and updates.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Benefits Of Starting A 401

A 401 plan is an employer-sponsored retirement option that lets employees contribute pre-tax dollars to their accounts. As a result, the contribution reduces an employees tax liability and lets them save for retirement. But what about the business benefits of setting up a 401?

Setting up a 401 for small business can help you:

- Attract and retain employees: 68% of private industry workers have access to employer-provided retirement plans. Providing a 401 plan can help you stay competitive as an employer.

- Expand your employer benefits, tax-free: Employer matching and nonelective contributions to retirement plans are not subject to Social Security and Medicare taxes.

- Claim tax deductions: Eligible small businesses who start a new 401 plan and/or add an automatic enrollment feature to any 401 plan can lower their tax liability through 401 tax credits.

- Stay compliant in your state: For some employers, offering a retirement plan isnt a choice. Your state may require that you offer employees a retirement plan, like a 401.

One of the reasons small businesses hesitate on starting a 401 is the time and cost commitment. Recognizing this, Congress passed the SECURE Act in 2019. The act incentivizes small employers to begin offering 401s with expanded tax credits.

Read Also: How To Use Your 401k Money

Choosing A Retirement Plan: Simple 401 Plan

A subset of the 401 plan is the SIMPLE 401 plan. Just like the SIMPLE IRA plan, this is a plan just for you: the small business owner with 100 or fewer employees. However, just as with the SIMPLE IRA plan, there is a two-year grace period if you exceed 100 employees, to allow for growing businesses.

Under a SIMPLE 401 plan, an employee can elect to defer some compensation. But unlike a regular 401 plan, you the employer must make either:

No other contributions can be made. The employees are totally vested in any and all contributions.

If you establish a SIMPLE 401 plan, you:

- Must have 100 or fewer employees.

- Cannot have any other retirement plans.

- Need to annually file a Form 5500.

The IRS has issued Model Amendments for SIMPLE 401 plans. These Model Amendments permit a 401 plan to become a SIMPLE 401 plan .

How Many Employees Do You Need To Have A 401 Plan Can Small Businesses Even Offer A 401

Lets get this out of the way. Yes, any size business can offer a 401 plan. Traditionally, 401 providers charged small and mid-sized businesses exorbitant fees or ignored them altogetherleading millions of smaller businesses out in the cold without an easy way to offer meaningful retirement benefits. Guideline is changing that by offering small businesses an easy, affordable 401.

Don’t Miss: How Do I Pull From My 401k

How Much Can You Contribute To A 401 Plan Each Year And How Does That Impact Your Taxes

For small business owners, 401 plans offer a great way to save for retirement while also getting a tax break. The contribution limit for 401 plans is $19,500 per year . This means that you can put away a significant amount of money each year, and any contributions that you make will be deducted from your taxable income.

This can result in substantial savings come tax time. In addition, the money in your 401 account will grow tax-deferred, which means that you won’t have to pay taxes on any investment gains until you withdraw the money in retirement. For small business owners, a 401 plan can be an extremely powerful tool for building a secure retirement nest egg.

Establish An Organized Recordkeeping Process

Youve drawn up the plan document and cleared it with the IRS. Now, keeping meticulous records documenting the progress of that plan is essential, including information about plan values and employee contributions. In addition, you must regularly update your participants census and employment data to ensure theyre still eligible for their 401 benefits.

Also Check: Can I Move My 401k To Roth Ira

Maintaining Your Businesss 401 Plan

Figuring out how to start a 401 for a small business is just the beginning. Keep in mind that there are some recurring employer responsibilities after starting a 401 for a small business.

Depending on the type of 401 you selected, youll need to conduct nondiscrimination testing, make employer contributions, report plan information, and keep up with fees.

How Do You Choose The Best Funds To Offer To Your Employees

The contributions you make to your 401 are invested in a portfolio made up of mutual funds, stocks, bonds, money market funds, savings accounts, and other investment options, as permitted by the plan.

Beneficial funds allow your employees to choose the types of investments they make. The fund choices are transparent, have a low fee, and follow well-researched investment approaches. Again, speak with a finance professional while you are researching options.

Read Also: How Many Loans Can I Take From My 401k

What Are The Benefits Of A 401k Compared To Other Retirement Options

Compared to simplified employee pension individual retirement accounts and savings incentive match plans for employees , 401k plans have higher annual contribution limits. Thus, employees may be able to save more money in a shorter amount of time with a 401k, making it ideal for those who are older and short of their savings goals. It also allows employees to borrow money from their retirement savings accounts. SEP IRA and SIMPLE IRA plans do not.

Get Clear On Why Youre Offering A Small Business 401

The 401 can be a very powerful benefit for you and your employees. In order to ensure that youre getting the most value you can out of your 401, youll need to be clear on your reasons for starting one. Here are 3 of the most compelling reasons why so many business owners nowadays are setting up a 401k for their small businesses:

Don’t Miss: Can I Rollover 401k To Another 401 K

Choose A Plan For Your Employees

Once you’ve chosen a retirement services provider, it’s time to decide on a plan that fits both your business and your employees’ needs. Options available to employers regardless of size, including businesses with only one employee, include:

1. A traditional 401 plan, which is the most flexible option. Employers can make contributions for all participants, match employees’ deferrals, do both, or neither.

2. The safe harbor 401 plan, which has several variations and requires the company to make a mandatory contribution to the plan participants. The contributions benefit the company, the business owner, and highly compensated employees by giving them greater ability to maximize salary deferrals.

3. An automatic enrollment 401 plan, which allows you to automatically enroll employees and place deductions from their salaries in certain default investments, unless employees elect otherwise. This arrangement encourages workers to participate in the company 401 plan and increase their retirement savings, which also benefits business owners. Automatic enrollment plans may also contain a safe harbor provision.

S To Start A Small Business

Use this guide to help turn your idea into a successful business

Starting a small business is exciting and challenging, and involves careful planning and decisions. It’s important to have a well-developed business proposal that meets an untapped need so that your idea can turn into a successful business. The following steps can help move your business idea forward.

You May Like: Can I Pull From My 401k

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeepingmake the implementation and maintenance of offering a retirement plan more affordable than ever.

Can You Roll Over A 401 Account

If you’re leaving your job, you can roll over the balance of your 401 into an IRA. Or, if you’re switching providers, you can roll over your 401 into a new 401 with your new employer. You can also do a direct transfer from one provider to another.

The best way to roll over your 401 depends on your circumstances. But regardless of how you do it, rolling over your 401 is a great way to keep your retirement savings intact and growing.

Recommended Reading: How Much Do You Have To Withdraw From 401k

How To Set Up A 401k For A Business

The path to a successful retirement savings program starts with plan design. And while its true that employers can set up 401ks on their own, its generally recommended to seek the help of a professional or a financial institution. Theyll provide expert guidance throughout each of the following steps:

Learn How To Pass Nondiscrimination Testing

Each year, the IRS requires plans to undergo nondiscrimination testing. These are tests designed to ensure that your plan isnt favoring business owners or highly-compensated employees . These tests can place big limits on how much your owners or HCEs can contribute, so youll want to take proactive steps and partner with providers who can help you pass your testing. Learn more about this in our guide on nondiscrimination testing!

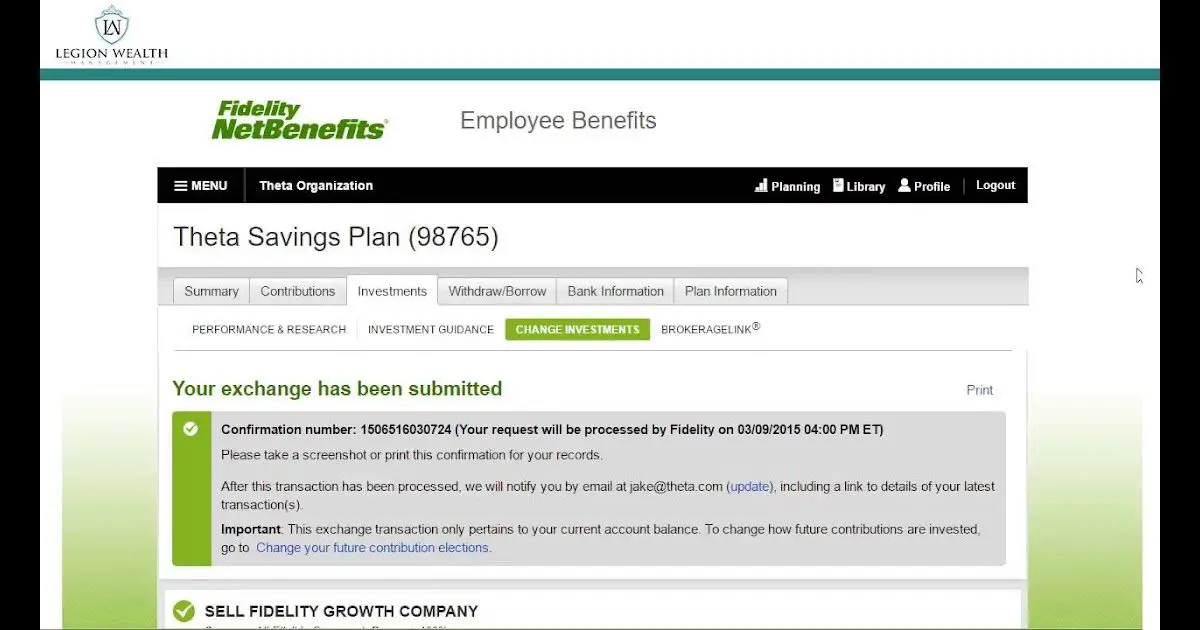

Read Also: How To Rollover 401k To Ira Fidelity

Is A 401k Right For Your Business

When it comes to retirement plans, there are a lot of options. You can choose from a number of different plans if you want to offer retirement benefits to your employees. Here are some of the most popular options:

Traditional 401: The traditional 401 is a retirement plan that offers flexibility. It is available to businesses of any size and allows employers to contribute to employees plans, match contributions, or do neither. There is annual testing that is required for these plans, to ensure that the benefits are equitably offered to all employees.

Safe Harbor 401: Under a safe harbor 401 plan, businesses will have less flexibility but wont be subject to the annual testing requirements that they would be with a traditional 401 plan. A notable feature of the safe harbor plan is you are required to make employer contributions and they vest immediately when they are made.

One-participant 401 Plan: Also known as a 401 plan, a one-participant 401 plan is available to business owners with no employees, aside from their spouse. It comes with the same contribution limits and similar filing requirements as a traditional 401 plan. However, if the plan has less than $250,000 in assets, youre likely exempt from the annual filing requirements.

Related Articles

- Accepting Online Payments Will Help You Scale Faster, Smarter

- Trying to Grow Revenue? Start Investing in Employees

- Strategies for Securing a Small Business Loan in the U.S.

What Is A 401 Plan And What Are The Benefits For Small Business Owners

A 401 plan is a small business retirement plan that allows employees to contribute a portion of their paycheck to a tax-deferred account. The employer may also choose to make matching profit-sharing contributions on behalf of the employees.

401 plans have a number of benefits for small business owners, including the ability to attract and retain quality employees and reduce turnover costs. In addition, 401 plans can provide a small business owner with a source of retirement income and may be eligible for special tax breaks.

Read Also: How Do I Start My 401k Plan

Make Your 401k Policy

Put it in writing. Announce the introduction of the 401k policy to your staff. Outline who can contribute, when they can enroll, and how much the employer contributions will be. Answer the common questions about the tax implications and when the contributions will become vested . Youll also be asked about fees and when they can withdraw their money, so have those answers in there.

Other Questions Related to How to Start a 401k for My Small Business:

Building The Fund Lineup

When we say fund lineup, were referring to the menu of investment options that are available to plan participants. Getting this right is arguably the most important part of building a successful 401 plan.

Having risky, poorly-performing, or unnecessarily expensive mutual funds can significantly limit the amount your employees have in their accounts come retirement. It may even expose you to costly lawsuits.

If you feel any uncertainty around how to build an optimal 401 fund lineup thatll protect you from costly lawsuits, consider hiring an advisor. Not only do the good ones take this off your plate, but theyll even assume legal responsibility for it as well!

Don’t Miss: What Happens To My 401k When I Change Jobs