About The Authortrue Tamplin Bsc Cepf

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance , author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on , or check out his speaker profile on the CFA Institute website.

What Is A Roth 401k Vs Traditional 401k

With a Roth 401 you pay taxes on the money before you deposit it to the account, not when you take disbursements. Funds in traditional 401s are deposited pre-tax and will be taxed when you start withdrawing money.

Both have benefits depending on the account holders age, tax exposure and future outlook. These account types can be used simultaneously to limit tax exposure and balance risk and long- and short-term benefits.

To see how much you need to invest to prepare for your retirement, use KeyBanks savings calculator.

Use The Funds To Operate Your Business

Once the QES transaction is complete, your retirement funds can be used by the corporation to begin operating and paying for business expenses! The retirement plan now owns the corporation, and the corporation is cash-rich from selling QES stock.

While the ROBS structure can be complex, the end result is your ability to buy or start a business without going into debt or collateralizing your home. For a more in-depth explanation of the ROBS structure, check out our Complete Guide to 401 Business Financing.

Don’t Miss: How Do You Collect Your 401k

Reviewing Approving And Documenting Loan Requests And Setting Up Repayment Withholdings In Payroll

The administrator makes sure 401 loans are reviewed and documented prior to approval, and that the loan repayments are set up within payroll to avoid default. Repayment withholdings will need to be terminated appropriately to avoid overpayment and payroll reversal refunds. Failure to initiate a timely repayment in payroll or an employee actually defaulting can result in the employer having to make a full loan repayment on the employees behalf. For this reason, many employers dont allow 401 loans.

Your 401 Is A Big Part Of Your Retirement Savings But You Dont Know The Last Time You Logged In

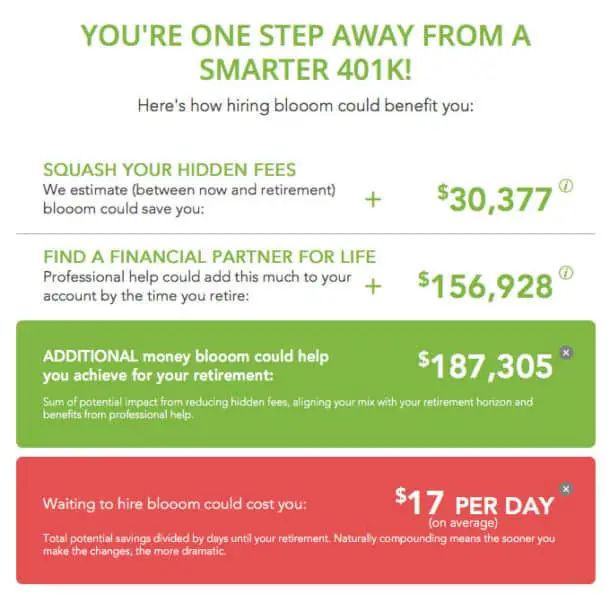

Effectively managing your investments and making the right financial decisions takes time, skill, and effort. Its not something you only need to do once. Your investment options change, the account needs to be rebalanced periodically, and as your 401 grows, you may benefit from a personalized investment mix rather than the age-based allocation in a target-date fund.

Regardless of whether you lack the time, desire, or investment acumen, the result is the same. Thankfully, itâs a solvable problem, and likely worth it have an advisor manage your retirement plan. Time is money, and theres a cost to delaying good financial decisions or extending poor ones, like keeping too much cash or putting off doing an estate plan.

Recommended Reading: How To Get 401k For Employees

How Long Will You Live In Retirement

Based on current estimates, a 65 year old man can expect to live approximately 18 years in retirement, and a 65 year old woman can expect to live about 20 years, but many people live longer. Planning to live well into your 90s can help you avoid outliving your income.

The worksheet takes into account some factors that impact your retirement savings. First, investing – because it involves risk. Second, inflation – because todays dollars will usually buy less each year as the cost of living rises. Your target savings rate includes any contributions your employer makes to a retirement savings plan for you, such as an employer matching contribution. If, for example, you are in a 401 plan in which you contribute 4 percent of your salary and your employer also contributes 4 percent, your saving rate would be 8 percent of your salary.

If you are not currently saving this amount, dont be discouraged. The important thing is to start saving even a small amount and increase that amount when you can. Come back and update this worksheet from time to time to reflect changes and track your progress.

Here are a few tips on how to save smart for retirement:

To track other resources you may have in retirement, start by getting your Social Security statement and an estimate of your retirement benefits on the Social Security Administrations website, www.socialsecurity.gov/mystatement.

Get started today for a secure financial future!

Pooled Employer Plan: The 401 Plan Designed For All Business Sizes

The Paychex Pooled Employer Plan makes it easier for businesses of any size to offer one of the most popular retirement plans for employees. While you reap the benefits of offering a retirement plan, we oversee plan setup, implementation, monitoring, enrollment, and other duties for 401 administration. Learn why a PEP could be a retirement game-changer for your small business.

Also Check: Can I Rollover 401k To Ira Anytime

Can I Withdraw That Money

Access to funds in your retirement account depends on your situation.

After You Leave Your Job

Once you quit, retire, or get fired, you should have access to your vested balance. You can withdraw those funds and reinvest in a retirement accountor cash out, although there may be tax consequences and other reasons to avoid doing so.

While Still Employed

While youre still employed, you typically have limited access to money in a retirement planeven your fully vested balance. Rules may require that you meet specific criteria and that your plan allows you to access your money. There are several potential ways to withdraw money before you leave your employer:

Other Situations

You might become fully vested in all of your balances if your employer terminates or shuts down the retirement plan, enabling you to transfer the funds elsewhere. Likewise, death or disability can trigger 100% vesting. Check with your employers plan administrator to learn about all of the plans rules.

A Wide Array Of Unbiased Investment Choices

Making the best possible investment decisions for your plan is critical to its success. Whether your advisor is providing investment advisory services or you are considering hiring a third party for this support, ADP offers two distinct options for selecting investments:

- Our open-fund architecture provides access to over 13,000 nonproprietary investment options from 300+ investment managers. You and your advisor can compare and evaluate funds to find the right candidates for consideration.

- Our screened investment tiers put simplicity at the forefront by offering fund tiers that have been evaluated and are organized based on ADPs underwriting criteria.2

In both options, as an independent record keeper, ADP is able to provide investment options without any bias or agenda.

A separate, indirect subsidiary of ADP, Inc., ADP Strategic Plan Services, LLC provides fiduciary investment management services. including the analysis, selection, monitoring, and if necessary, replacement of investment options on behalf of employer-sponsored retirement plans.

You May Like: How To Transfer 401k Without Penalty

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

Move Your Retirement Savings Directly Into Your Current Or New Qrp If The Qrp Allows

If you are at a new company, moving your retirement savings to this employers QRP may be an option. This option may be appropriate if youd like to keep your retirement savings in one account, and if youre satisfied with investment choices offered by this plan. This alternative shares many of the same features and considerations of leaving your money with your former employer.

Features

- Option not available to everyone .

- Waiting period for enrolling in new employers plan may apply.

- New employers plan will determine:

- When and how you access your retirement savings.

- Which investment options are available to you.

Note: If you choose this option, make sure your new employer will accept a transfer from your old plan, and then contact the new plan provider to get the process started. Also, remember to periodically review your investments, and carefully track associated paperwork and documents. There may be no RMDs from your QRP where you are currently employed, as long as the plan allows and you are not a 5% or more owner of that company.

You May Like: Can You Use Your 401k To Pay Off Student Loans

How Does 401 Business Financing Work

401 business financing allows you to tap into your retirement account and use that money to start or buy a business or franchise. To access your money without triggering an early withdrawal fee or tax penalty, a ROBS structure must first be put in place. The structure has multiple moving parts, each of which must meet specific requirements to stay compliant with the IRS.

How Much Should You Contribute

Walmarts 401 plan allows employees to start contributing with as little as 1% of their salary and can contribute up to 50%. With such a wide range to choose from, how do you decide what the right contribution is?

First, try to contribute at least enough to take advantage of Walmarts 6% employer match. After all, its literally free money. If you contribute $3,000 to your 401 plan, Walmart will fully match that amount, as long as it doesnt exceed 6% of your income. Think of it as a guaranteed 100% return on your investment.

Even though Walmart doesnt match contributions above 6% of your pay, you may still want to contribute more. With your employer match, youre essentially contributing 12% of your income to your 401 plan each year. But depending on your situation, that may not be enough for a comfortable retirement.

The Personal Capital Retirement Planner can help you figure out how much you should be saving for retirement based on your current retirement savings and your desired income during retirement.

Remember, you can contribute up to $19,500 to your 401 plan each year. And if youve maxed out your 401 contributions, you can also contribute up to $6,000 to an individual retirement account . Depending on your income, you may be able to contribute to only a traditional IRA or either a traditional or Roth IRA.

Read Also: Is It Better To Rollover 401k To Ira

Contributing To Your 401 Plan

As part of enrolling in a 401, you must decide how much you are going to contribute to the plan each year. There are some limits on the upper end, and your employer may require a minimum contribution if you want to join the plan.

But you may find that the critical question is what percentage of your earnings you are willing to commit to retirement savings. Many experts in the retirement field believe a ballpark amount is somewhere around 10 percent of your earnings. But it can be more or less, depending on your personal circumstances. If your company offers a match, you should contribute at least enough to get the full benefit of the match, otherwise you are leaving money on the table. And keep in mind that even if you are automatically enrolled at a certain level , this is often a minimum amount to save for a secure retirement. Consider increasing this amount, perhaps significantly, to give yourself a better shot at accumulating a robust retirement nest egg.

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Also Check: How Can I Get My Money From My 401k

Federal Insurance For Private Pensions

If your company runs into financial problems, you’re likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire. These are single-employer plans. Multi-employer plans have different coverage.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

Recommended Reading: How Much Money Should I Put In My 401k

You May Like: How Do You Use Your 401k After Retirement

Elective Deferrals Must Be Limited

In general, plans must limit 401 elective deferrals to the amount in effect under IRC section 402 for that particular year. The elective deferral limit is $20,500 in 2022 The limit is subject to cost-of-living adjustments. However, a 401 plan might also allow participants age 50 and older to make catch-up contributions in addition to the amounts contributed up to the regular 402 dollar limitation, provided those contributions satisfy the requirements of IRC section 414. These limits apply to the aggregate of all retirement plans in which the employee participates.

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Recommended Reading: How To Enroll In 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

What Is Employer Matching

Some employers match their employees contributions up to a certain percentage. This is free, tax-deferred money from your employer, and youll get it by contributing the minimum your employer requires.

Heres an example of the difference an employer contribution can make to your 401:

If you earn $50,000 a year and contribute 6% into your 401, you will have added $3,000 in your first year. If your employer matches your contribution dollar for dollar, you would have $6,000. Lets say your employer contributes 50 cents for every dollar you do. You would still be ending the year with $4,500 more in your 401. In short, make sure you contribute at least enough to secure your employers contribution.

Read Also: Is It A Good Idea To Borrow From Your 401k

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Recommended Reading: How To Max Out 401k Calculator

Read Also: How Can I Take A Loan From My 401k