Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

The Importance Of Making A Plan

Monitoring how much you withdraw in retirement against a long-term plan is important. You want a secure retirement income. Having a plan and measuring against it will accomplish this goal while answering the question of just how much you can withdraw in retirement.

Create a retirement income plan, and consult with a retirement planner or tax advisor who can calculate the after-tax impact of your proposed retirement account withdrawals.

Can I Take A Withdrawal Before I Terminate Employment

In general, you cant take a withdrawal from your 401 account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit withdrawals while you are still employed. These in-service withdrawals are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service withdrawal rules applicable to our 401 plan, check your plans Summary Plan Description .

Don’t Miss: How Do You Move Your 401k When You Change Jobs

How Much State Tax Do I Pay On 401k Withdrawal

Because payments received from your 401 account are considered income and taxed at the federal level, you must also pay state income taxes on the funds. The only exception occurs in states without an income tax. Your 401 plan may offer you the opportunity to have taxes automatically withheld from a withdrawal.

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Also Check: How Do I Use My 401k To Start A Business

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

You May Like: When Can You Roll Over 401k To Ira

Alternatives To A 401 Early Withdrawal

As we mentioned, a 401 early withdrawal can be used in a financial emergency, but it shouldnt be your first choice. The good news is there are plenty of other options available to you.

There are several alternatives to an early withdrawal from retirement, however, most of them mean going into debt, Woodward said. The only difference is your credit will not be used in determining your eligibility for a 401 loan. Your credit will be used for credit cards , HELOCs, personal loans, and any other type of loan.

Your creditworthiness is a major factor when youre borrowing money. Some of the options below may only be available if you have good credit. In other cases, a poor credit score could make the loan cost-prohibitive.

When You Should Take All Your Money Out Of A 401

If you are a skilled investor or have access to financial advice, a lump sum payment can help you:

- Better control your lifestyle to travel or live a more comfortable, upscale life.

- Have the opportunity to make your own investments to leave a legacy.

- Pay off your existing debts and mortgage or pay for a new home in cash.

- Feel more confident, no matter what the market does, knowing the set value of your savings.

In some cases, your employers 401 plan may require you to take the lump sum of cash for instance, if you have less than $5,000 invested in the plan. However, there are options for what you can do with that money, and there is no rule preventing you from reinvesting.

Don’t Miss: How Is A 401k Divided In A Divorce

Are There Any Reasons Not To Take A Lump Sum 401 Payment

There are a number of reasons NOT to take a lump sum payment. You could wind up with a huge tax bill, fail to make your money stretch as long as it needs to, or spend all of it in one fell swoop.

- Responsibility Once you withdraw that money, you alone become responsible for making these funds last throughout your retirement.

- Diminished Value If the interest rate rises, the overall value of your nest egg will diminish unless its parked in an account that generates higher annual returns.

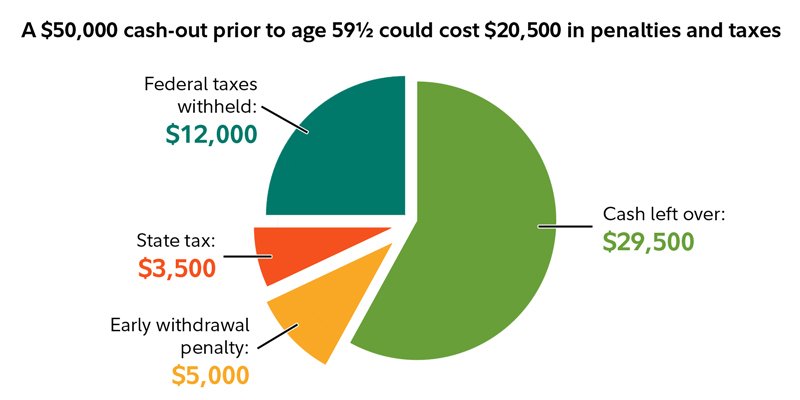

- Tax Liability Also, unless your 401 is a Roth account, you will be expected to pay the full income tax on the amount . If you are under 59.5, you may also owe an additional 10% early withdrawal tax penalty.

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Recommended Reading: How To Find 401k Balance

Risks Of A 401 Early Withdrawal

While the 10% early withdrawal penalty is the clearest pitfall of accessing your account early, there are other issues you may face because of your pre-retirement disbursement. According to Stiger, the greatest of these issues is the hit to your compounding returns:

You lose the opportunity to benefit from tax-deferred or tax-exempt compounding, says Stiger. When you withdraw funds early, you miss out on the power of compounding, which is when your earnings accumulate to generate even more earnings over time.

Of course, the loss of compounding is a long-term effect that you may not feel until you get closer to retirement. A more immediate risk may be your current tax burden since your distribution will likely be considered part of your taxable income.

If your distribution bumps you into a higher tax bracket, that means you will not only be paying more for the distribution itself, but taxes on your regular income will also be affected. Consulting with your certified public accountant or tax preparer can help you figure out how much to take without pushing you into a higher tax bracket.

The easiest way to avoid these risks is to resist the temptation to take an early 401 withdrawal in the first place. If you absolutely must take an early distribution, make sure you withdraw no more than you absolutely need, and make a plan to replenish your account over time. This can help you minimize the loss of your compound returns over time.

Other Options If You Need Cash

If you are experiencing financial hurdles because of the recent coronavirus outbreak, Ellis recommends exhausting other resources before tapping into your retirement plan balance.

First, consider using any emergency savings you may have. “We recommend our clients keep three to six months’ worth of living expenses in cash for emergencies, which this would definitely fall under,” Ellis says.

If you own a home, you could look into getting a home equity line of credit since housing values have been on the rise and interest rates are low. “You may have the ability to utilize the equity in your home at a low carrying cost,” Ellis says.

If you need cash and don’t have any emergency savings or home equity on hand, consider applying for a personal loan from your bank, which is generally used to consolidate debt or make a big purchase. The average interest rate for a two-year personal loan was about 10.2% in November 2019, according to the latest data from the Federal Reserve.

Keep in mind that the rate depends on both your credit and on the length of the loan, as shorter loans tend to have lower APRs. If you have bad credit, you may be facing an interest rate of up to 36%.

If those options don’t work, you could also tap into a Roth IRA if you have one. With these accounts, you can withdraw any money you’ve invested at any time, without taxes or penalties. But again, remember there’s an opportunity cost to using that money.

You May Like: How To Move 401k From Old Job

Can I Take An Additional Loan From My 401

Most 401 plans allow one loan at a time, and this means you must pay back the first loan fully before you can be allowed to take another loan. However, if your plan allows multiple loans at a time, you can take an additional loan at any time within a rolling 12-month period as long as you have not exceeded the loan limit.

For example, if your 401 vested balance is $120,000, your loan limit is $50,000. If you borrowed $30,000 from your 401, you cannot borrow more than $20,000 as a second loan in a 12-month rolling period even if you paid the first loan early.

Determining Your Retirement Rate Of Withdrawal

How much can you comfortably withdraw without running the risk of using your money up too soon?

The traditional withdrawal approach uses something called the 4% rule. This rule says that you can withdraw about 4% of your principal each year, so you could withdraw about $400 for every $10,000 you’ve invested. But you wouldn’t necessarily be able to spend it all some of that $400 would have to go to taxes.

If this is the only way you’re looking at how much you can spend in retirement, you may want to think again. Calculating a safe withdrawal rate is wise, but it doesn’t consider strategies that can increase your after-tax income. Learn more about non-traditional factors you should consider.

Also Check: How To Find Out Where Your 401k Is

What Is The Rule Of 55

The rule of 55 is an IRS regulation that allows certain people turning 55 or older to make early withdrawals from a 401. You typically must pay a 10% penalty if you make a withdrawal before age 59 1/2. You can make a withdrawal in the year you turn 55 or later if you leave your job for any reason. You can only withdraw funds from the 401 offered by your most recent employer.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: How To Know If You Have 401k Money

Penalties For Withdrawing Money From Your 401 Early

A 401 plan can play a key role in your retirement income, especially if you resist the urge to withdraw from it early . However, you may need a lump sum of cash at some point in your life – such as to cover a medical emergency or the down payment on a house.

While an early 401 withdrawal can help in those situations, it often comes with a hefty cost. Make sure you know the consequences first.

It’s never too early to start planning for retirement. Get started today by creating a free online dashboard to track your progress.

If you’re still considering withdrawing from your 401 early, here’s what you should know about the penalty tax.

Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

Read Also: Can I Start My Own 401k Plan

Contribution Limits Rules And More

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

The Balance / Hilary Allison

Your 401 contribution limits are made up of three factors:

- Salary-deferral contributions are the funds you elect to invest out of your paycheck.

- Catch-up contributions are additional money you may pay into the plan if you are age 50 or older by the end of the calendar year.

- Employer contributions consist of funds your company contributes to the plan also known as the “company match” or “matching contribution,” they may be subject to a vesting schedule.

There are two types of limits. One is a limit on the maximum amount you can contribute as a salary deferral. The other limit is on the amount of total contributions, which includes both your and your employer’s contributions.

Most People Have Two Options:

- A 401 loan

- A withdrawal

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Read Also: How Do I Know If I Have Money In 401k