What Are The Benefits Of A Roth Individual Retirement Account

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Option : Cashing Out Your 401

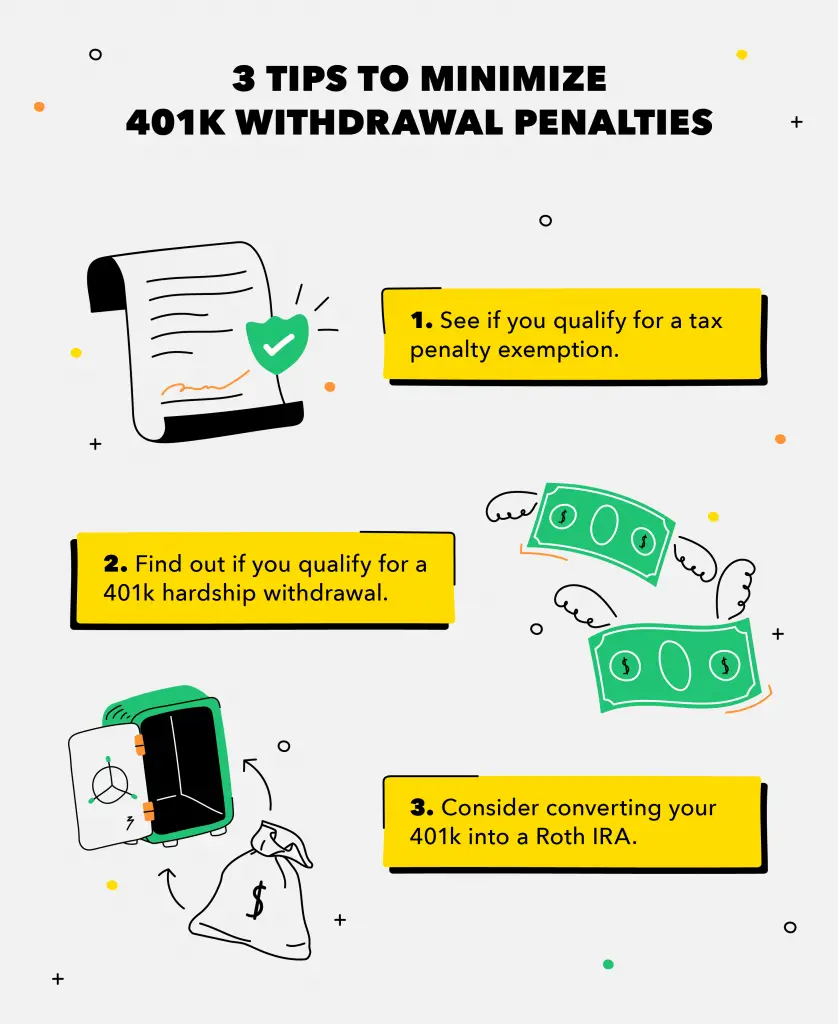

While withdrawing your money is an option, in most circumstances, it means those funds will not be there when you need them in retirement. In addition, cashing out your 401 generally means youll have to pay taxes on the withdrawal, and theres typically an additional 10% tax penalty if youre younger than 59½, unless you left your employer in the calendar year you turned 55 or older.

Net unrealized appreciation: special considerations for employer stockIf you own stock in your former employer and that stock has increased in value from your original investment, you may be able to receive special tax treatment on these securities. This is referred to as net unrealized appreciation . If you roll the employer stock into a traditional or Roth IRA or move it to your new employers plan, the ability to use the NUA strategy is lost. NUA rules are complex. If youre considering NUA, we suggest consulting with a tax professional prior to making any decisions on distributions from your existing plan.

Should I roll over my 401?The decision about whether to roll over your 401 is dependent on your individual situation. A financial advisor will work with you to help identify your goals and determine whats important to you. By understanding your investment personality, he or she will be able to advise if rolling over your 401 is the best option for you.

Dont Miss: How To Transfer 401k To Another Account

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around is now easier than ever. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. However, allocating your retirement funds to new plans becomes tricky upon leaving the company.

The new allocation rules took effect in 2015, but taxpayers chose to apply them to distributions as early as September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula, resulting in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You can now choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Don’t Miss: Can You Rollover Roth 401k To Roth Ira

You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

Covering Your Bases Through Tax Diversification

If you’re not sure where your tax rate, income, and spending will be in retirement, one strategy might be to contribute to both a Roth 401 and a traditional 401. The combination will provide you with both taxable and tax-free withdrawal options. As a retired individual or married couple with both Roth 401 and traditional 401 accounts, you could determine which account to tap based on your tax situation.

“You can’t really know what future tax rates will look like, so building in the flexibility to use multiple accounts to manage taxes is important and helpful,” says Rob.

For example, you could take RMDs from your traditional account and withdraw what you need beyond that amount from the Roth account, tax-free. That would mean you could withdraw a large chunk of money from a Roth 401 one yearsay, to pay for a dream vacationwithout having to worry about taking a big tax hit.

Besides the added flexibility of being able to manage your marginal income tax bracket, reducing your taxable income in retirement may be advantageous for a number of reasons, including lowering the amount you pay in Medicare premiums, paring down the tax rate on your Social Security benefits, and maximizing the availability of other income-based deductions. Be sure to weigh all your available options to maintain your retirement goals.

1Individuals must have the Roth 401 account established for five years and be over the age of 59½ for tax-free withdrawals.

5The Tax Foundation, 3/22/2017.

Also Check: Can I Withdraw From My 401k Without Penalty

Youll Owe Taxes On The Money Now But Enjoy Tax

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve been diligently saving for retirement through your employer’s 401 plan, you may be able to convert those savings into a Roth 401 and gain some added tax advantages.

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Recommended Reading: When Should You Rollover A 401k

Why Bother With A Backdoor Roth Ira

Both Roth and traditional IRAs let your money grow within the account tax-free however, Roth IRAs have a couple of advantages over traditional IRAs.

First, they dont have required minimum distributions . You can leave your money in your Roth for as long as you want, which means it can keep growing indefinitely. This characteristic may be valuable to you if you expect to have enough retirement income from another source, such as a 401, and you want to use your Roth as a bequest or an inheritance.

The lack of RMDs also simplifies record-keeping and makes tax preparation easier. It will save you time and headaches in retirement when youd rather be enjoying your free time.

Second, Roth distributionswhich include earnings on your contributionsare not taxable. Future tax rates may be higher than current tax rates, so some people would rather pay taxes on their retirement account contributions, as one does with a Roth, than on their distributions, as one does with a traditional IRA or 401. Other people want to hedge their bets by making both pretax and post-tax contributions, so they have a position in both options.

Can I Convert Money From A Traditional 401 To A Roth Ira

Yes, once retired or while still working if your plan permits in-service withdrawals from your 401. Then you can convert your traditional 401 either through a direct rollover to a Roth IRA or by rolling funds over to a traditional IRA, and then converting to a Roth IRA.

Tip: For more detail, see Converting your traditional IRA to a Roth IRA which includes a Roth conversion tool and a checklist.

You May Like: What Is The Max Percentage I Can Contribute To 401k

What’s The Difference Between A Rollover And An Asset Transfer

The main difference between a rollover and an asset transfer is where the money is held before it’s moved to Vanguard. If you’re moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, you’re moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

Roth Ira Conversion Methods

There are several ways to enact a Roth conversion, depending on where you hold your retirement accounts:

- With a 60-day indirect rollover, you receive a distribution in the form of a check paid directly to you from your traditional IRA. You then have 60 days to deposit it into your Roth IRA.

- A simpler way to convert to a Roth IRA is a trustee-to-trustee direct transfer from one financial institution to another. Tell your traditional IRA provider that you’d like to transfer the money directly to your Roth IRA provider.

- If both IRAs are at the same firm, you can ask your financial institution to transfer a specific amount from your traditional IRA to your Roth IRA. This method is called a same-trustee or direct transfer.

Also Check: How To Collect 401k After Quitting

Rolling A 401 Directly Into A Roth Ira

If you qualify, you can do an eligible rollover distribution from your old 401 directly to a Roth IRA. Youll owe taxes on the amount of pretax assets you roll over.

Note also, if you have assets in a Designated Roth Account ) and would like to roll these to an IRA, the assets must be rolled into a Roth IRA.

As with Traditional IRA conversions to Roth IRAs, if you are required to take an RMD in the year you roll over into an IRA, you must take it before rolling over your assets.

Recommended Reading: How To Transfer 401k Without Penalty

Establish A Financial Plan And Stick To It

Everyone knows the rent is due at the beginning of the monthso there’s no reason you shouldn’t be prepared. Paying your bills on time and regularly tracking income and expenses are foundational principles of retirement planning. Another good idea: Build an “emergency” fund that covers about six months’ worth of living expenses. When you receive a bonus, tax refund, or other windfall, consider only spending half and saving the other half in your emergency fund or an individual retirement account .

Also, credit card debt at potentially high interest rates may derail your budget, so aim to pay off your card balances every month. Additionally, there are many choices when it comes to credit cards, with a wide range of interest rates, fees, perks, rewards, and credit limits, so it’s important to do your research and understand what you’re signing up for.

You May Like: How Does Retirement Work With 401k

Should You Consider A Roth 401

Many companies now offer employer-sponsored Roth 401 retirement accounts alongside traditional 401 plans, giving employees another way to save for retirement. What’s the difference between the two accounts? And should you consider opening a Roth 401?

Here, we’ll take a look at how Roth 401 plans stack up against their traditional counterparts and what to consider before contributing to one.

You Think Your Tax Rate Is Going To Go Up

If you believe your current tax rate is lower than it might be in the future, you may want to convert your investments into a Roth IRA, pay your fair share of taxes now, and then let that money grow tax-free until you need it.

Converting a pre-tax 401 into a post-tax Roth IRA will trigger a tax bill, but a financial professional might recommend it anyway. Its a way to hedge against the risk of taxes going up in the future, says Hernandez. In a general sense, if youre still in the early stages of your earning career, it makes sense to go ahead and pay the taxes upfront and do the Roth contributions.

Of course, no one knows for sure what their tax rate will look like in the future. Thats why many experts recommend diversifying your long-term investments into different buckets: some in a tax-deferred account like a 401, and others in a post-tax account like a Roth IRA. If all your money is one bucket, a conversion could make sense.

Recommended Reading: How To Track Down Old 401k Accounts

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Can I Do A Roth Conversion If I Am Retired

Yes, you can do a roth conversion at any time. Just keep in mind a roth conversion always comes with a tax bill. When you move the funds from your 401k or IRA, you will also be missing out on tax-free growth.

If you retire at 59 ½ then it might not make sense to do a roth conversion ladder as your funds for a 401k/IRA will then be accessible penalty-free.

Recommended Reading: What Happens To 401k When You Change Jobs

When Should You Consider Converting My 401 Into An Ira

You should consider converting your 401 into an IRA in the following cases:

- You believe that you would end up being in a higher tax bracket, or if tax rates are likely to be higher during your retirement.

- Your current 401 plan is not performing well due to having high-cost investments and underperforming funds.

- You have several 401 accounts and it has become problematic to manage them all due to frequent changes in jobs.

- You need to rebalance your 401 since it has gotten burdened with weak stocks having a low fixed income and needs to counterbalance with bond funds.

- You require greater flexibility in terms of withdrawals.

Alternatively, you should not opt for a 401 conversion into an IRA, if:

- You are looking at early retirement, thereby, would need early withdrawals.

- Your earnings would exceed the income cap placed on a Roth IRA.

- You do not want to expose yourself to any kind of legal battle or lawsuit in the future.

Recommended Reading: How To Do A Direct 401k Rollover

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.

Read Also: Can I Use My 401k To Invest In Real Estate

Roth Vs Traditional : How To Pick

Choosing one option over the other comes down to when you want to pay taxes on your retirement contributions now or in the future.

There isnt a one-size-fits-all solution. The best choice for you depends on many factors, such as your age and your expected income bracket in the future.

The latter is important because the amount youll pay in taxes is based on your ordinary income tax bracket in retirement.

Which Is Best For You

This decision mainly comes down to how you want to put money into the account and how you want to take money out.

Lets start with today putting money in. If youd prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401.

Youre also giving yourself access to a more valuable pot of money in retirement: $100,000 in a Roth 401 is $100,000, while $100,000 in a traditional 401 is $100,000 less the taxes youll owe on each distribution.

In exchange, each Roth 401 contribution will reduce your paycheck by more than a traditional 401 contribution, since it’s made after taxes rather than before. If your primary goal is to reduce your taxable income now or to put off taxes until retirement because you think your tax rate will go down, you will do that with a traditional 401.

Just know that:

-

Youre kicking those taxes down the road, to a time when your income and tax rates are both relatively unknown and might be higher if you advance in your career and start earning more

-

If you want the after-tax value of your traditional 401 to equal what you could accumulate in a Roth 401, you need to invest the tax savings from each years traditional 401 contribution. For more on this, see our study on the Roth IRA advantage, which also applies here.

Don’t Miss: How To Hide 401k In Divorce