How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab or Vanguard. You should be able to log into your 401K account online through the website of the broker your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

More on Charles Schwab vs Ameritrade

Youve Got Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into a new account with your new employer, or roll it into an individual retirement account , but you must first see when you are eligible to participate in the new plan. You can also take some or all of the money out, but there are serious tax consequences to that.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Also Check: How To Roll 401k Into Roth Ira

More From Portfolio Perspective

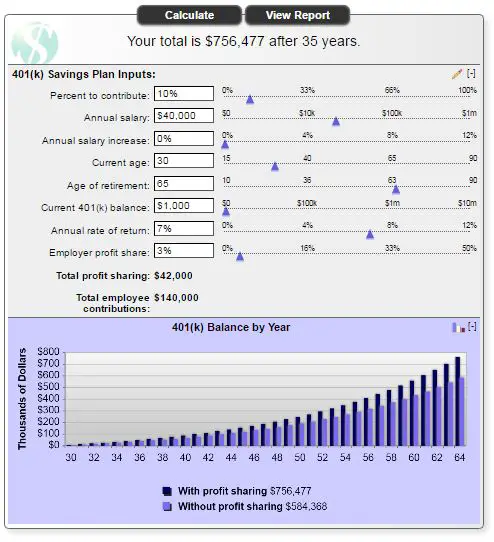

To give your retirement savings an extra boost, Jessica Macdonald, a vice president at Fidelity, recommends opting into an auto-escalation feature, if your employer offers it, which will automatically boost your savings rate by 1% or 2% each year.

And always contribute enough to get the full employer match, she said, that way you wont leave money on the table.

Overall, aim to save 15% of your income in a retirement account, including the employer contribution, Macdonald also advised.

If you are over age 50, you set aside even more withcatch-up contributions. plans and $6,000 for IRAs in 2021 those who qualify can put an extra $6,500 in their 401 or $1,000 in their IRA.)

Finally, avoiding borrowing from these accounts at all costs. Try to stash a little bit of money away in a rainy-day fund so you can dip into that instead, Macdonald said.

Don’t Miss: How To Calculate 401k Match

Manage Your Retirement Account Online

You made a commitment to your employees by offering them a way to help plan for their futures. Let us help you keep that commitment by offering an easy-to-use online retirement plan management website. You can view participant requests, manage transactions, and track participation anytime, anywhere.

See how our website can help you and your employees by watching this video. You can also read on to learn more.

You May Like: How Much Does Fidelity Charge For 401k

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Also Check: How To Find Out If You Have A 401k Account

Check On Your 401 Periodically

As mentioned, it’s essential to check how much is in your 401 throughout the year. Ideally, more than once, however, annual checks are enough.

The reason to monitor your retirement savings is to keep up with your retirement goals. For instance, as you near retirement, you may want to move your money to safer investments like bonds. Or, if one area has over-performed others, you might decide to reallocate your money to limit your exposure to one category.

Typically these drastic swings in your portfolio won’t happen that quickly. But by scheduling an annual check of your 401 balance, you’ll get a good picture of your 401 portfolio.

Tags

How To Check My Account Balance

To check your bank account balance, you must keep in mind the following things.

- Firstly, your mobile number should be registered with the bank.

- The mobile number should be active to receive and send SMS and call.

- Having a smartphone is preferable. The reason is, with an active internet connection, you can use different apps like banking apps or UPI apps.

- You should also have your ATM or debit card activated with your bank account

- Also, internet banking should be activated by your bank.

Keeping these things in place, you can check your bank account balance anywhere and anytime. The various ways to check bank account balance are as follows

Read Also: How To Open Up A 401k

Recommended Reading: Can I Set Up My Own 401k Plan

How Much Support Do They Provide

ADP provides fiduciary support by serving as both the plan administrator and record-keeper. Heres what that means:

A fiduciary is defined as a trustee. Fiduciary support can be defined as involving trust, especially with regard to the relationship between a trustee and a beneficiary. ADP provides this support in compliance with federal law. This ensures that the 401k plan is being managed properly and that beneficiaries are benefiting.

As the administrator and record-keeper, ADP provides documents related to the plan and prepares IRS Form 5500 for tax filings. They offer extra options for additional fees, such as fund performance monitoring and investment advice. These advisory services help employees enrolled in the plan to decide where and how to invest their money.

How Much Does It Cost

ADP is rather transparent about its direct fees.It is easy to understand their:

- Base record-keeping fee

- 5500 preparation fee

These fees are all reported clearly in their 404a-5 participant fee disclosure forms, plan statements, and 5500 forms.

However, when it comes to revenue sharing fees, they are not as upfront.

Why does this matter? Because revenue sharing fees can be the same as the direct fees, meaning that the total of your fees for having the plan may be double what you may think.

Revenue sharing payments are based on a percentage of the plans assets. As assets grow, so do the revenue sharing fees. And they can grow quickly. The bigger your plan design grows, and the more assets you have, the more fees youll have to pay.

You May Like: What Is The Minimum Withdrawal From 401k At Age 70.5

Don’t Miss: How To Find Out If You Have Unclaimed 401k Money

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search theDOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Vested Versus Unvested Amounts

When you find your 401 balance, you might notice that some of the account is vested and some of it isnt. Amounts that are vested are yours no matter what if you leave the company, you get to take that money with you, but you would lose any unvested amounts. Youre always 100 percent vested in your contributions. However, your employer may make contributions to your 401 plan on your behalf but might put vesting requirements on the money. According to federal law, contributions must vest at least as fast as either the cliff vesting or graded vesting schedules. With cliff vesting, you must be fully vested at the end of three years of service. With graded vesting, you must be 20 percent vested by the end of your second year of service, and must vest an additional 20 percent each year after that, making you fully vested by the end of your sixth year.

Dont Miss: Can I Use My 401k To Buy Investment Property

Also Check: How To Check 401k Amount

Average 401 Plan Balances By Age

According to Fidelity Investments, the financial services firm that administers more than $11.8 trillion in assets and has 34.7 million workplace participant accounts, the average 401 plan balance decreased to $121,700 in the first quarter of 2022.

However, the savings rate contributions), was about 14%. This percentage almost met Fidelity’s suggested savings rate of 15%.

How does workplace plan saving break down by age? Here’s how Fidelity crunches the numbers.

How To Find The Mistake:

Complete an independent review to determine if you properly classified HCEs and NHCEs, including all employees eligible to make a deferral, even if they chose not to make one. Plan administrators should pay special attention to:

- Prior year compensation

- The rules related to ownership when identifying 5% owners.

- Plan administrators need access to ownership documents to identify 5% owners.

- Take care to identify family members of the owners, as many will have different last names.

Review the rules and definitions in your plan document for:

- Determining HCEs

- Prior or current year testing

If incorrect data is used for the original testing, then you may have to rerun the tests. If the original or corrected test fails, then corrective action is required to keep the plan qualified.

Also Check: How Does 401k Retirement Work

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Insights Delivered To Your Inbox

The Financial Planning 5

Terms and Conditions for the CFP Board Find a CFP® Professional Search

These terms and conditions govern your use of the Find a CFP® Professional Search feature on Certified Financial Planner Board of Standards, Inc.s Lets Make a Plan website . Before using Find a CFP® Professional, you must read and agree to be bound by these terms and conditions and CFP Boards Terms of Use, which also apply to your use of Find a CFP® Professional.

Permitted Uses

Find a CFP® Professional is compiled and published by CFP Board as a reference source about CFP® professionals in the United States. It does not include all CFP® professionals only those who chose to be included. It may be used only by members of the public to locate CFP® professionals and obtain information about them, and individual CFP® professionals or their staff to view their own listings or those of colleagues. CFP Board reserves the right to block your use of this search tool indefinitely should CFP Board determine, in its sole discretion, that you are using it for a different purpose. Except as expressly provided herein, neither Find a CFP® Professional nor any of its data, listings, or other constituent elements may be modified, downloaded, republished, sold, licensed, duplicated, scraped, or otherwise exploited, in whole or in part. CFP Board expressly prohibits use of this information by individuals or business organizations to offer products or services to CFP® professionals.

Read Also: How Do I Manage My 401k

How Often Should I Check My 401 Balance

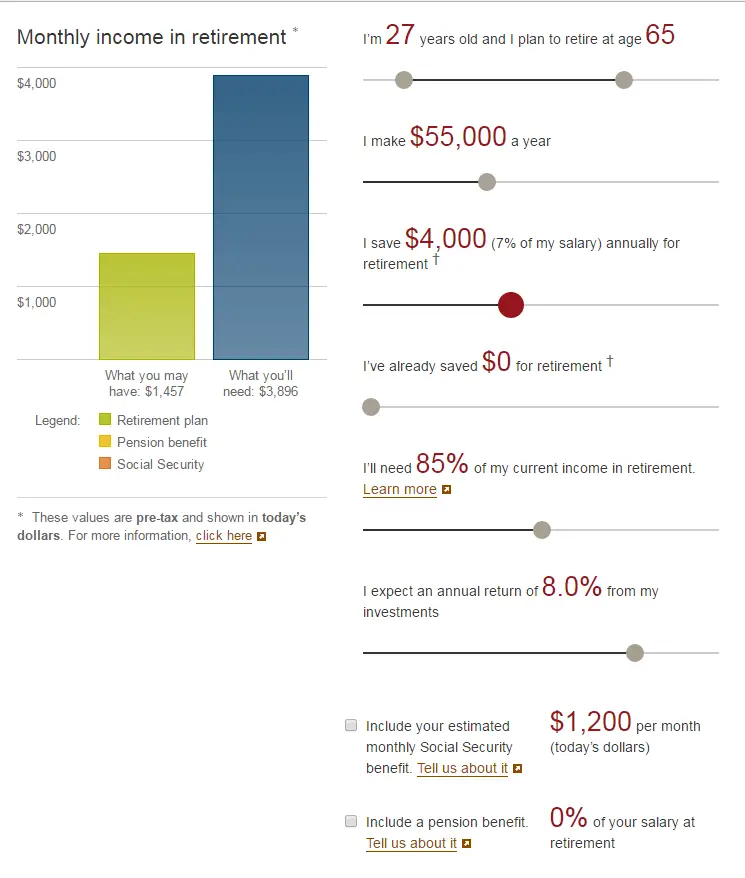

According to Leanna Devinney, vice president and branch leader at Fidelity, thats an age-old question. Never checking my 401 at all is probably a bad idea, but there’s also danger in checking it too often.

To a degree, I need to monitor my 401 and my individual retirement account , for that matter in order to stay informed. Peeking at my balance can help me determine whether Im on track for retirement, whether fees are eating up too much of my money, whether Im complying with IRS rules about contribution limits, et cetera.

Its critical that we participate in and contribute to our own retirement plans, adds Heather Winston, director of financial planning and advice at Principal. When you’re checking that balance, it gives you the opportunity to get a quick, point-in-time sense of how you’re progressing toward that goal and how your investments are faring.

To that end, Winston recommends checking my 401 balance a minimum of twice a year. Every six months or so, I can go in, review my investments and rebalance my portfolio.

But it doesnt need to be a daily thing.

The markets are constantly shifting due to world events, so my balance is always going to be fluctuating. Volatility is normal, especially when my asset allocation is aggressive .

Its ignorance is bliss in action. I’m 30 years from retirement at minimum, and most upsets will smooth out over time anyway.

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

Also Check: How To Take Out 401k After Leaving Job

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America , T. Rowe Price , Vanguard, Charles Schwab , Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

How To Understand The Details On A 401 Statement

Now that you know how to read and understand the account summary, or cover page, of your 401 statement, its time to dive into the details.

Specifically, the activity, transactions, fees, and investment options inside your 401 statement. This information is usually found on all the additional pages of your statement.

The details inside your 401 statement can be broken down into 6 sections:

The final pages of your statement are typically the customary 401 Statement Disclosures, which may be several pages in length.

Also Check: Is A Rollover From A 401k To An Ira Taxable

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

You May Like: Can You Cash Out A 401k After Quitting