What Is A 401a Profit Sharing Plan

A 401 profit sharing plan is a tax-advantaged account used to save for retirement. Employees and employers contribute to the account based on a set formula determined by the employer. Unlike 401 plans, the employers contributions are discretionary, and they may not contribute to the plan every year.

All contributions from employees are fully vested. The ownership of the employer contributions may vary depending on the vesting schedule they create.

Like 401 plans, 401 profit sharing plans allow employees to select their investments and roll over the account to a new plan if the employee leaves the company. If an employee wants to take a distribution before reaching age 59 ½, they are subject to income taxation and a 10% penalty.

What Is A 401 Plan

A 401 plan is an employer-sponsored retirement account that typically covers government workers and employees from specific education institutions and nonprofits. It is different from an IRA in that the employer sponsors the plan, determines the investment options that the employees can choose from, and sets the vesting schedule .

With a 401 plan, employer contributions are mandatory employee contributions are not.

With IRAs, the individual investor decides how much to contribute and if/when they want to make withdrawals from the account. With a 401 plan, employer contributions are mandatory employee contributions are not. All contributions made to the plan accrue on a tax-deferred basis.

However, withdrawing from either type of plan may incur penalties for withdrawing money before age 59½.

A Vs 401k: Which Is Best For Retirement

A retirement plan is your gateway to a stress-free life after your stopping work. Also, you can leave it as an inheritance to your spouse or children in the event of your death. Regardless of your age right now, it is not too late to start building your retirement plan. Of course, the earlier you start, the better.

If your age today is 35, your annual salary is $100,000, and you are just starting with your 401k plan, you will have a retirement account of $1.46 million when you retire at 65. This is possible if you save 10% of your annual salary and your employer gives a 100% match. If you find out later that you need more money than this during retirement, there are several things you can do to achieve this.

The above example is just one of the retirement options available to you. There are several others out there. In this article, we will cover the 401a plan as well. We will look at the differences between 401a and 401k plans, the pros and cons, contribution limits, tax rules, and others that will guide you in your decisions.

Don’t Miss: What Is The Difference Between 401k And 403b

Employer Contributions And Employer Match

As noted previously, your employer must contribute to your 401 account. How much it contributes depends on the rules it establishes for the 401 plan.

In cases where the 401 plan allows employees to make contributions, some employers match these contributions. The match is typically a percentage of the employees contribution, up to a specified limit. For example, the employer might match 100% of an employees contributions up to 6% of the employees salary.

Recommended Reading: When Leaving A Company What To Do With 401k

Can You Cash Out A 401a

When you leave your employer, you can cash out your account and rollover the balance into another qualified plan without a penalty. If you decide to cash it out and withdraw the money without rolling over, then you will pay a 10% penalty if you do so before age 59 1/2. Rollovers incur no penalty as long as the full account balance is rolled into another qualified plan.

Recommended Reading: What Is A Robs 401k

Can You Borrow Money From A 401 Or 401 To Buy A Home

You may be able to use the funds from a 401 or 401 account to purchase a home. Remember, with 401 plans, the employer ultimately decides if loans are permitted from the 401.

If you borrow money from your 401 or 401 to fund the purchase of a home, you have at least five years to repay what youve taken out.

The maximum amount youre allowed to borrow follows the rules stated above: $50,000 OR The greater between $10,000 or half of whats vested in your account,

Whichever is less.

A Vs 401k: What Is The Difference

Traditionally, most workers used to rely on income from their monthly retirement contributions such as Personal retirement savings and social security plans. Today, most employers are doing away with pension plans and replacing them with workplace retirement savings packages such as the 401a and the 401k.

Both the 401a and the 401k are regarded as sponsored retirement savings plans for the workplace, perhaps they are regarded as tax codes. Using the one or the other will largely depend on the type of employer offering them, and the circumstances surrounding the arrangement with the workers.

401a vs 401k: In this article we reveal the main differences of both retirement savings plans.

You May Like: Can You Have Your Own 401k

The Minimum And Maximum Contributions In 401a Vs 401k

Another difference between both the retirement plan is to the 401a plan an employee can contribute a maximum of $18,500 annually, while in the 401k plan the maximum of $55,000 annual contributions is allowed.

That is the reason, why the volume of investment in the 401k is much lower than 401a, this also means that a 401a beneficiary may have more disposable funds after retirement than the beneficiary who started the 401k contribution around the same time.

A Final Word On 401a And 403b Retirement Plans

Knowing which plan you qualify for with your employer will help you be able to make the right decision about your contributions. Both plans are very similar in structure, with only a few exceptions separating the two.

Each plan allows you to save for retirement. Each gives you choices in how you can grow your wealth, with specific contribution caps in place that you must consider. Over time, and with the catch-up contributions allowed, you can use this tool to effectively save for the future years to come.

You May Like: Can You Rollover A 401k Before Leaving Your Job

What Is A 401a Retirement Plan

It is a plan sponsored by your employer if you are connected to a government agency or a non-profit association or work in an educational institution. As a sponsor for this plan, your employer outlines the investments you can choose from and defines the vesting timetable when you become the owner of the employer contributions.

How Is A 401 Different From A 401

401 and 401 plans are similar, but have some major differences.

While 401 plans have many similarities with 401 programs, there is one overriding difference. Private employers set up 401 plans, while government organizations use 401 programs. Particularly popular with public school systems, 401 retirement savings plans cover the majority of teachers in the United States. Another difference is the menu of options offered employees for the amount of compensation contributions and types of investment choices. Withdrawal regulations are often similar, if not identical.

Don’t Miss: How Do I Close Out My 401k Account

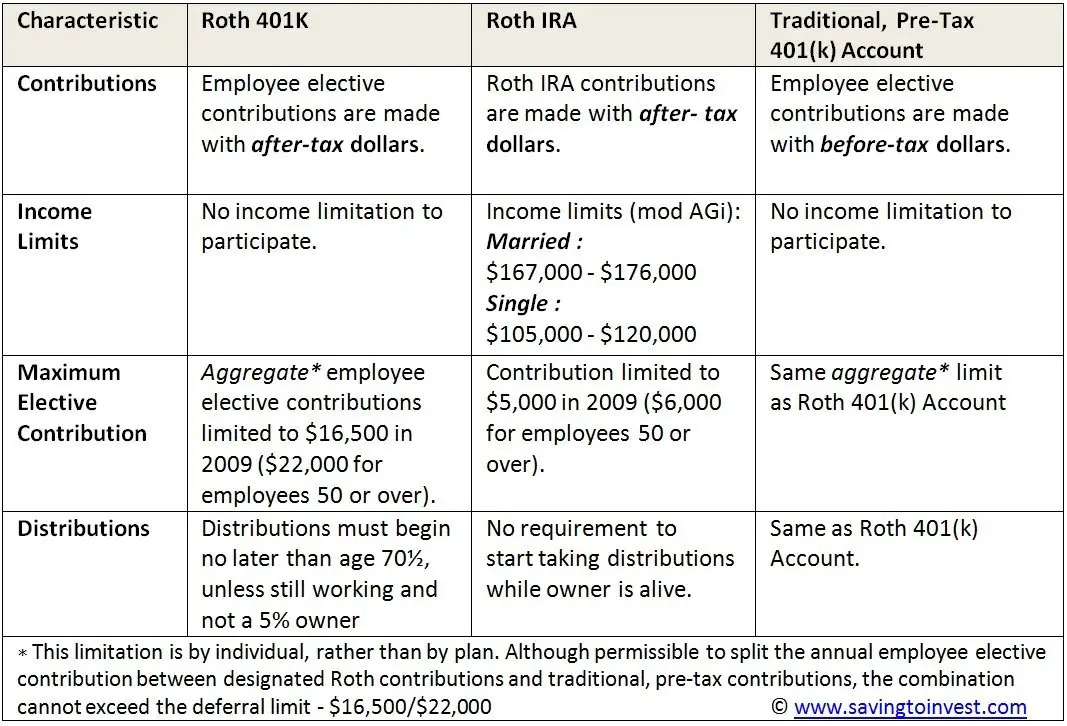

Traditional 401 Vs Roth 401

There are two types of 401 plans: Traditional and Roth 401s.

The traditional 401, named after the relevant section of the IRS code, has been around since 1978.

With this plan, any contributions you make to the 401 account will reduce your income taxes for that year and will be taxed when they are withdrawn.

Roth 401s, named after former senator William Roth of Delaware, were introduced in 2006.

Unlike a traditional 401, all contributions are made with after-tax dollars and the funds in the Roth 401 account accrue tax free.

Typically, employees can take advantage of both plans at the same time, which is recommended among financial advisors to maximize retirement savings.

Because of the way the contribution limits work, it is possible to invest different amounts into each account, even year-to-year, so long as the total contribution does not exceed the set limit.

How Does A 401 Plan Work

All 401 plans share basic features, but employers define the specific rules about how their plans work. For example, employers are required to make contributions on their employees behalf, whether as a percentage of employees earnings or a set dollar amount. Employee contributions, on the other hand, can be either mandatory or voluntary.

Don’t Miss: How Much Money Do I Have In My 401k

The Difference Between 401a Vs 401k

401a plans and 401k plans are the two primary types of defined contribution retirement savings plans that are offered by employers.

The basic difference involves the employers who offer the plan. The plan gets their names after Section 401 of the United States Internal Revenue Code, which defines them.

The core differences between the 401a vs 401k plan are first in the types of employers who offer them and then in various key provisions as for contributions and investment options.

Initially, most workers depend on their monthly retirement contributions income like Personal retirement savings and social security plans.

Now most employers have stopped using pension plans and are replacing them with workplace retirement savings packages like the 401a and the 401k.

401a and the 401k both plans are looked at as sponsored retirement savings plans for the workplace, at times they are interpreted as tax codes.

Using either of them will mainly rest on the type of employer offering them, also on the events and situations surrounding the arrangement with the workers.

A Vs 401k Differences

- 401 is offered by public employers and NGOs

- 401 is offered by private employers

- Participating in a 401k is voluntarily

- Participating in a 401a is mandatory

- 401 contributions amounts are dictated by the employee

- 401 contributions amounts are dictated by the employer

- 401k offer a wide range of investment options

- 401a offers a limited range of investment options

- Employee to be at least age 21 to participate in a 401 and 401

- Employees must have at least 1 year of service for 401k plans.

- Employees must have at least 2 years of service for 401a plans.

- $58,000 is the maximum annual contribution for 401 plans.

- $19,500 is the maximum annual contribution for 401 plans.

- 401 plans offer an Age 50 Catch-Up, 401 plans do not.

Also Check: How To Set Up A 401k Without Employer

The Flexibility Of The 401a Retirement Plan

There are several different ways that a 401a retirement plan can be implemented in the workplace. The most common method is to take a percentage of an employees pay and place it into the plan. Aside from agreeing to the percentage taken, no other work needs to be done by the employee. You can decide to change the percentage withdrawn for the retirement plan at a designated point during the year.

A 401a may also be created with an employee required to pay a specific percentage to the plan without exception. This lowers the employees salary for take-home pay, but increases the amount saved in the retirement plan.

Another variation of the 401a is that an employee can be asked to contribute a percentage of pay before taxes, but this is a one-time choice. If you decide not to participate in the 401a plan offered at the time, then you are excluded from future participation. If you do decide to participate, then the contribution percentage you choose is locked in permanently.

A final variation, but one that is rarely offered in the United States, is similar to a Roth retirement savings plan. Instead of using pre-tax dollars to contribute to the 401a, you would use after-tax money. In this plan, you can start, stop, or change the amount you contribute at any time. The advantage of this plan is that your earnings are taxable, but the contributions are not taxed when you withdrawal at retirement.

Borrowing From A 401a Plan

When it comes to 401a plans, your employer may allow you to borrow money or not. When your employer does permit you to take out a loan from your retirement plan, the maximum amount you can take out is one of the two options below, whichever is lower:

- $50,000

- $10,000 or half of your total contribution, whichever is higher

Recommended Reading: How Do I Find An Old 401k

What Investments Should I Make In My Physician Retirement Plan

So, now that you know your contribution level, match and vesting schedule, it is time to invest!

Please note that you have to set up your contribution investments in addition to the allocation for the funds that already exist in your account. You have to change both the contribution and the existing funds if that is your intention. Just changing the contribution investment doesnt change your overall asset allocation.

What should you invest within your 401a? On-line, you get something like this:

Ok, so do you want to look at the 1, 3, 5, or 10-year results when you make your decision what to invest in?

None of the above!

This is, perhaps, the most common mistake people make when investing in their 401a. As they say, past performance does not predict future results! Dont even look at the past performance. Ignore this screen!

You need to decide now if you are going to use a target date fund or determine what your own asset allocation should be in your 401a.

To know what your options are, you need to know what you examine when you are picking funds in your 401a.

Pay Attention to Fees!

Remember, the best correlation to future returns are current expensesfees. You can tab over from average annual total returns to fees and find the Expense Ratio.

Here, you can see a S& P 500 index fund has an expense ratio of 0.015% whereas TRP MID CAP GROWTH is 0.75%. Doing the math, that fund is 50 times more expensive!

Governmental Plans Under Internal Revenue Code Section 401

Under Internal Revenue Code Section 414, a governmental plan is an IRC Section 401 retirement plan established and maintained for the employees of:

- the United States or its agency or instrumentality,

- a state or political subdivision, or its agency or instrumentality, or

- an Indian tribal government or its subdivision, or its agency or instrumentality .

Other types of governmental plans include:

- 403 tax-sheltered annuity plans,

- Certain grandfathered 401 plans adopted by a governmental entity before May 6, 1986.

Also Check: How Often Can I Change My 401k Investments Fidelity

A Retirement Plan: What Is It

Otherwise known as money purchased retirement package, it is mostly offered by educational institutions, government establishments, and non-profit organizations. Not a privately owned company.

This retirement plan is designed and provided as an encouragement by these establishments to keep certain employees faithful to them.

Being an incentive, these kinds of monthly retirement contributions are normally determined by the employer. The employer contributions are usually an addition to the employees contributions on the plan.

What Happens When the Employee Leaves

When an employee leaves a company he or she can effortlessly withdraw contributions, purchase an annuity, or roll them over to a different qualified retirement savings plan.

Compulsory Participation

Participation for workers from an employer providing the 401a pension plan is mandatory. Mandatory participation is also expected from every employer however they can define the amount they can contribute to the plan.

All qualified employees are subject to what the employer decides before getting the retirement plan package. Therefore it is the employer who decides if you are in or not.

401a Plan Can Be Post Taxed or Pre Taxed

One clear feature is the tax advantages the 401a plan comes with as contributions can be done before or after income taxes have been deducted.

What Is The 401k Retirement Plan

The 401k savings retirement plan is mainly offered by the Private sector.

The eligible employees who qualify can decide to contribute voluntarily. when contributing to this retirement plan, normally the employers have options.

If the employee does not have the financial strength to contribute fully then they can match a certain percentage of the employees contributions.

The 401k is pre-taxed before the contributions are made so it is not like the 401a that can be contributed before or after tax.

One of the main advantages of the 401k is that at any point an employee can change the amount he or she contributes which is not available in the 401a. Another advantage is, the contributions to 401 come with some tax advantages.

For example, an employee can put back a portion of his or her wages into the 401k plan just before taxes are applied. This is the reason, the employees can determine the volume of their pre-tax contributions, so they can save money in the long run.

If an employee does not withdraw from their 401k until after retirement, then such withdraws are completely tax-free.

Only the employee makes monthly contributions into the 401k from their paycheck. Even if the employer may offer an alternative plan it is not necessary for the employer to contribute to the 401k.

And in most cases the employer can also decide which investment options are available to the employees, there are up to 30 investment options available.

You May Like: What Age Can You Take Out 401k

Have A 401a Vs 403b Vs 457b What To Do

401a vs 403b vs 457b! Physicians are high income professionals who optimally defer income into retirement plans during peak earning years.

If you have access to a 401a vs 403b vs 457b then you either work for the governmentor a not-for-profit hospital system. Which account should you use and in which order?

Well, that depends on if you are a governmental or non-governmental employee! Im gobsmacked by the poor quality of information on the internet on the topic. So, lets discuss physician retirement accounts: 401a vs 403b vs 457b plans. Also, see below for how to invest in your 401a.