What Is An Opt

An opt-out plan is an employer-sponsored retirement savings program that automatically enrolls all employees into its 401 or SIMPLE IRA. Companies that use the opt-out provision enroll all eligible employees into a default allocation at a set contribution rate, usually around 3% of gross wages.

Employees can change their contribution percentages or opt-out of the plan altogether. They also may change the investments their money goes into if the company offers choices.

Dont Expect High Returns From Fixed Income

Till 2020, Bank FDs offered 6% to 7.5% returns. In the last 2 years, fixed income options including bank FDs or debt funds have given 4% to 5% returns. Dont expect high returns from fixed income options in future. Countries like Denmark, Japan, Sweden and Switzerland have negative interest rates i.e. Investors need to pay money to keep their money in banks in these countries. While it might take some time for such situation to arise in India, one should expect that FD rates would decline gradually in the coming years.

Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

Also Check: How To Transfer 401k To Another 401 K

What Does Rolling Over A 401 Mean

Rolling over your 401 fundamentally means moving the funds from one place to another, and it customarily happens between different places of employment.

When you leave a job for any reason, you generally have three opportunities. You can either leave your 401 with your current employer, roll over the funds to an IRA, or roll over the funds to a new employers 401 plan.

In any case, you should either be able to execute a direct or an indirect rollover. A direct rollover implies that the assets move directly from your previous 401 plan to the one at your new job. The indirect rollover transpires when you receive the funds as a distribution from your previous employer, but you have to put it into the new account within 60 days or face taxes and penalties.

Leaving your 401 with an old employer is very uncommon and has many drawbacks. If you possess less than $5,000 in savings they could force you out by presenting you a check, in which case you will have to do an indirect rollover to your next employers plan.

You also wont be able to generate contributions and take out loans, and your former employer may even add administration fees. Because of this most plan participants roll over their 401 to their new employer.

Rolling over to a different 401 plan can be done directly or indirectly and is usually the best choice.

Heres When And When Not To Cash Out Your 401 According To Experts

Your retirement fund is for retirement but what if you need the money in your 401 now? After all, you earned it, right?

Not so fast.

Find Out: 7 Things You Should Never Do When Planning for Retirement

The IRS lets you grow a portion of your income before the agency ever takes its cut but only on the condition that youll save it for your golden years and not touch it until youre at least 59½. The consequences of not holding up your end of the bargain are just what youd expect from the IRS severe and expensive.

Also Check: How To Claim 401k Money

The 401 Withdrawal Rules For People Older Than 59

Most 401s offer employer contributions. You can get extra money for your retirement, and you can keep this benefit after you change jobs as long as you meet any vesting requirements. Thats an important advantage that an IRA doesnt have. Stashing pre-tax cash in your 401 also allows it to grow tax-free until you take it out. Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty.

You can choose a traditional or a Roth 401 plan. Traditional 401s offer tax-deferred savings, but youll still have to pay taxes when you take the money out. For example, if you withdraw $15,000 from your 401 plan, youll have an additional $15,000 in taxable income that year. With a Roth 401, your contributions come from post-tax dollars. As long as youve had the account for five years, Roth 401 withdrawals are tax-free.

Withdrawal Taxes After Retirement

The account holder can cash out their savings without a penalty tax after retiring.

However, for a traditional 401 plan, the holder still must pay income tax on the money. The tax rate will depend on the federal tax bracket at the withdrawal time.

After retirement, the pensioner must watch out for the required minimum distribution, which is obligatory after 72 years. If they dont take the RMD, the IRS can penalize them by taking 50% of the amount that they didnt distribute.

Recommended Reading: How To Change 401k Contribution On Fidelity

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred, but the IRS requires that you begin to take withdrawals known as “required minimum distributions” by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while they’re still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

Calculating The Total Penalty

In the example above, assume your employer-sponsored 401 includes a vesting schedule that assigns 10% vesting for each year of service after the first full year. If you worked for just four full years, you are only entitled to 30% of your employer’s contributions.

If your 401 balance is composed of equal parts employee and employer funds, you are only entitled to 30% of the $12,500 your employer contributed, or $3,750. This means if you choose to withdraw the full vested balance of your 401 after four years of service, you are only eligible to withdraw $16,250. The IRS then takes its cut, equal to 10% of $16,250 , reducing the effective net value of your withdrawal to $14,625.

If you remove funds from your 401 before you turn age 59 12 , you will get hit with a penalty tax of 10% on top of the taxes you will owe to the IRS.

Recommended Reading: What Is A Good Percentage To Put In Your 401k

People May Have Different Reasons For Withdrawing Funds Early From A 401k

- Financial Hardship: People sometimes withdraw funds early due to financial hardship . Example include: medical care, expenses related to the purchase of a home, tuition, and funeral expenses

- Discretionary Spending: People may withdraw funds from a 401K because they prefer to have the money now rather than save it for retirement. In general, we do not recommend this strategy

- Early Retirement: Some people retire earlier than the standard retirement age. In this case, it is understandable why they may want to access funds early since they are no longer working

The 401 Withdrawal Rules For People Between 55 And 59

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

You May Like: How Do I Know I Have A 401k

How To Build Wealth With Compound Interest

First, we need to explain what compound interest is. With compound interest, unlike simple interest, you invest your money, earn money, and then invest that new money you made along with the sum you started out with, and that adds up year after year. Especially with considerable sums in your 401.

This is called compounding. Wealth is something that you create and compounding is a great way to do so. You can make money from both guaranteed and non-guaranteed investments while using compound interest. You can even take care of your retirement money this way.

Every year you can invest your money to make more money next year and save up for your future. These are the secrets of building wealth with compound interest. There are a lot of investment options out there that you can take and compound interest is closely related to retirement topics.

For example, if you invest $1,000 now in a guaranteed investment, years down the line your annual compound could go up to a couple of thousand dollars.

Before you start, you need to have a good foundation. Getting rid of consumer debt is your first step. If you dont pay off your credit card balance, you will be charged interest on your entire owning balance, including the interest added to your account the previous month. This will just make your credit card debt bigger.

After all, avoiding debt is one of the habits of millionaires.

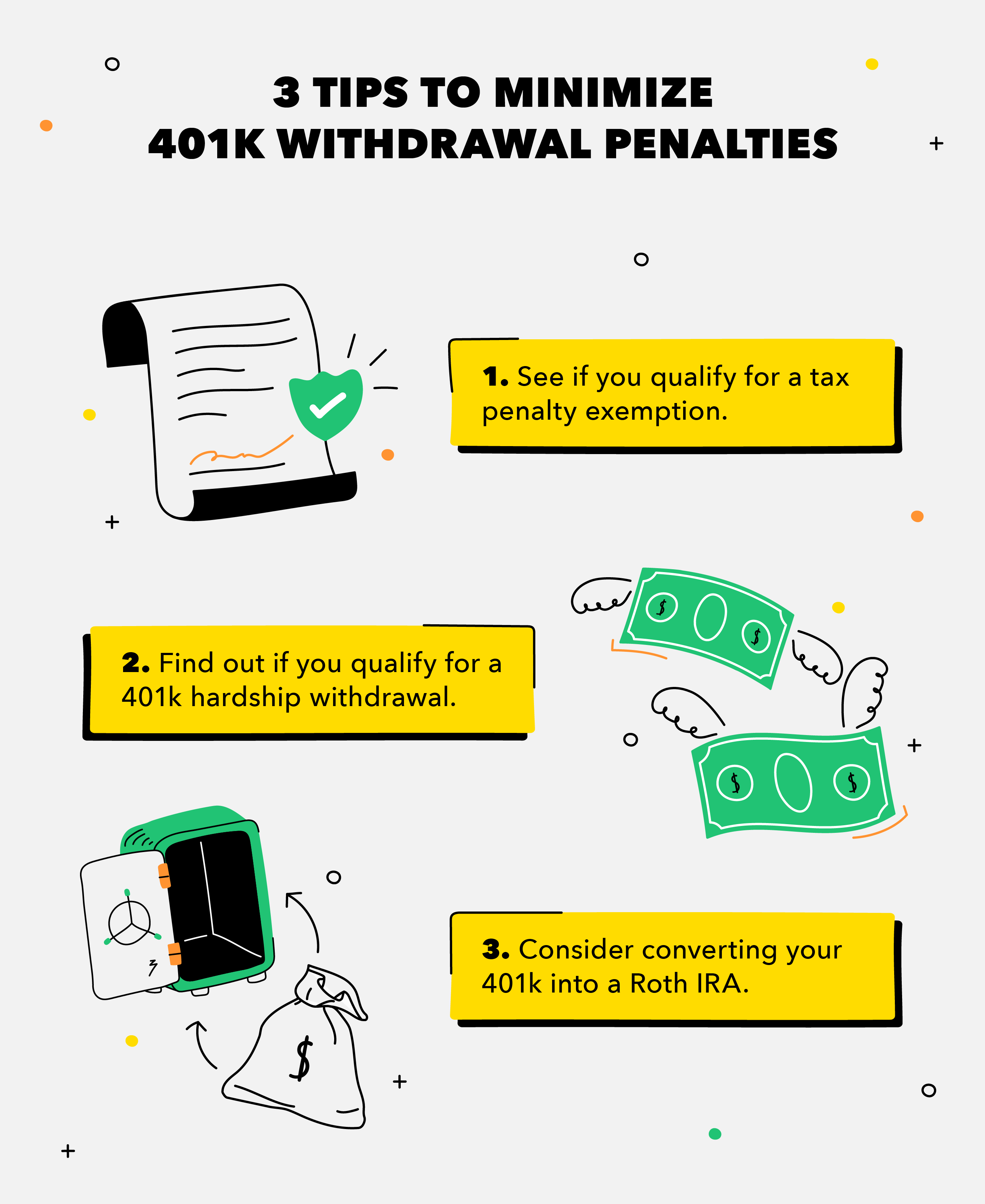

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

Don’t Miss: How To Switch 401k To Roth Ira

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

How To Cash Out Your 401k Without Quitting Your Job

Saving and generating capital for retirement in the USA is mainly done through a 401 plan. They were initiated in 1978 and have since been an indispensable facet of saving for the future and posterity for many Americans.

The 401 plan is essentially a tax-deferred retirement account, meaning that the assets you put in it wont get taxed until you cash them out.

More than 62 million US workers are covered by these plans, and they accumulatively hold over $2.8 trillion in assets.

Having a 401 plan is a fundamental part of accumulating capital for your retirement plan. And that is why there are plenty of requirements set by the IRS to try to hinder you from cashing out the finances from the account, but there are still various ways to access it.

Most plan participants start their 401 plans with the concept of not tapping into the funds until theyre aged enough for retirement, but frequently things can happen that could make you question whether you should cash out the funds from your 401 now. But should you do it?

Were going to support you in learning more about cashing out your 401 and help you understand the advantages and disadvantages of doing it. Youll learn:

Hopefully, this article will help you gain more knowledge about 401 plans, saving money for retirement, starting imperative financial discourse, and making the most satisfactory imaginable resolution for you and your loved ones.

Read Also: What Is The Best Way To Roll Over 401k

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Should You Take A 401 Loan Or 401 Withdrawal

Some plans allow loans from 401 plans as an option to get access to the fund for virtually any purpose. Maybe you want to travel, pay your childs college tuition, put a down-payment on a new house, or cover the cost of a divorce. There are many personal reasons to consider a loan.

Generally, you can take up to 50% of the balance to a maximum of $50,000. The good news is that there is no age restriction, and there are no taxes due when you take out a loan. However, the loan must be repaid over a five-year period, with interest owed back to your account.

There is risk involved in taking out a loan. Some plans allow you to roll over a 401 when changing employers. However, in other cases, you may have to pay your outstanding loan balance in full within 60 days of leaving an employer otherwise, it will be considered a 401 withdrawal, taxed as ordinary income and subject to the 10% withdrawal penalty.

Compared to a loan, an early 401 withdrawal:

- Must have an option that allows for in-service withdrawals, which may be restricted by age or hardship.

- Will be taxed as ordinary income .

- Can be subject to a 10% penalty if youre under 59.5 .

- Will not require repayment loan).

Also Check: What Is A Good Percentage To Contribute To 401k

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

What Is An Early Withdrawal From A 401

An early withdrawal from a 401 happens when you take distributions from your account before the age of 59 ½.

The accounts are designed to provide you with an additional source of income during retirement, hence, the age requirement on distributions. If you decide to make an early withdrawal from your 401, the IRS will charge you a penalty.

Also Check: What Is A Simple 401k

Calculating The Basic Penalty

Assume you have a 401 plan worth $25,000 through your current employer. If you suddenly need that money for an unforeseen expense, there is no legal reason you cannot simply liquidate the whole account. However, you are required to pay an additional $2,500 at tax time for the privilege of early access. This effectively reduces your withdrawal to $22,500.

There are certain exemptions that you can use to take a penalty-free withdrawal however, you will still owe taxes on that money. These are for immediate and heavy financial needs that constitute a hardship withdrawal. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary. These include:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence (such as losses from fires, earthquakes, or floods

You likely will not qualify for a hardship withdrawal if you hold other assets that could be drawn from, such as a bank account, brokerage account, or insurance policy, in order to meet your pressing needs.