Maximize Your 401k Returns And Fees

Are you getting the most for your fees? Most people dont know what theyre paying in 401k fees. By some estimates, the average fees for 401k plans are between 1% and 2%, but some outliers can have up to 3.5%. Fees add upeven if your employer is potentially paying the fees, youll have to pay them if you leave the job and keep the 401k.

Essentially, if an investor has $100,000 in a 401 and pays $1,000 or more in fees, the fees could add up to thousands of dollars. Any fees you have to pay can chip away at your retirement savings and reduce your returns.

Its important to ensure youre getting the most for your money in order to maximize your retirement savings. If you are currently working for the company, you could discuss high fees with your HR team. One of the easiest ways to lower your costs is to find more affordable investment options. Typically, the biggest bargains can be index funds, which often charge just 0.3% to 0.5 %

If your employers plan offers an assortment of low-cost index funds or institutional funds, you can invest in these funds to build a diversified portfolio.

If you have a 401 account from a previous employer, you might consider moving your old 401k into a lower fee plan. Its also worth examining what kind of fund youre invested in and if its meeting your financial goals and risk tolerance.

Do You Get Your 401 If You Quit

Be aware of the following rules regarding your old 401 account:

-

If your 401 has a total investment of more than $5,000, your employer may allow you to leave the account with them even after you quit the job.

-

If your account has a balance of less than $1,000, your employer may force you out and pay the amount left in your account with a check.

-

If the total investment amount in your old 401 is between $1,000 and $5,000 and your employer wants to force you out, they must transfer the amount to your IRA.

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Read Also: How Can You Take Money Out Of Your 401k

What Happens To My 401k If I Get Fired Or Laid Off

Getting laid off or fired can be a scary experience. Make sure all of your financial bases are covered, including your 401k.

If youve been let go or laid off, or even if youre worried about it, you might be wondering what to do with your 401k after leaving your job.

The good news is that your 401k money is yours, and you can take it with you when you leave your old employer. Whether that means rolling it over into an IRA or a new employers 401k plan, cashing it out to help cover immediate expenses, or simply leaving it in your old employers 401k while you look into your options, your money isnt going anywhere.

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Don’t Miss: What Is A Hardship Loan From 401k

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will likely trigger a lump-sum distribution.

If you do not need your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

It’s fairly easy to put money into a 401, but getting your money out can be a different story. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal.

But 2022’s high inflation, rising interest rates and rocky stock market all have some investors itching to cash out early. In a November 2022 Wells Fargo & Company study,

If you’re thinking of cashing out a 401 before you reach 59½, proceed with caution. You could pay a steep price.

» Dive deeper:What to do when the stock market is crashing

Read Also: How Do I Draw Money Out Of My 401k

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

You Can Roll It Over To A New Employers Plan

If youre starting a new job, you can roll over your 401k money directly into your new employers retirement plan, in most cases. Thats something to ask about during the onboarding process. You should also ask if your new company will match any of your rollover. If youre lucky, youll get even more money out of your job change.

Read Also: Can I Transfer Roth 401k To Roth Ira

It Can Be Done But Do It Only As A Last Resort

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If your employer allows it, its possible to get money out of a 401 plan before age 59½. Taking that route is not always advisable, though, as early withdrawals deplete retirement savings permanently and, minus a few exceptions, carry a 10% penalty and a substantial income tax bill.

If you have no better alternatives and decide to proceed, youll need to get in touch with your human resources department. Theyll give you some paperwork to fill out and then ask you to provide some documentation. Once thats done, you should eventually receive a check with the requested funds.

Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

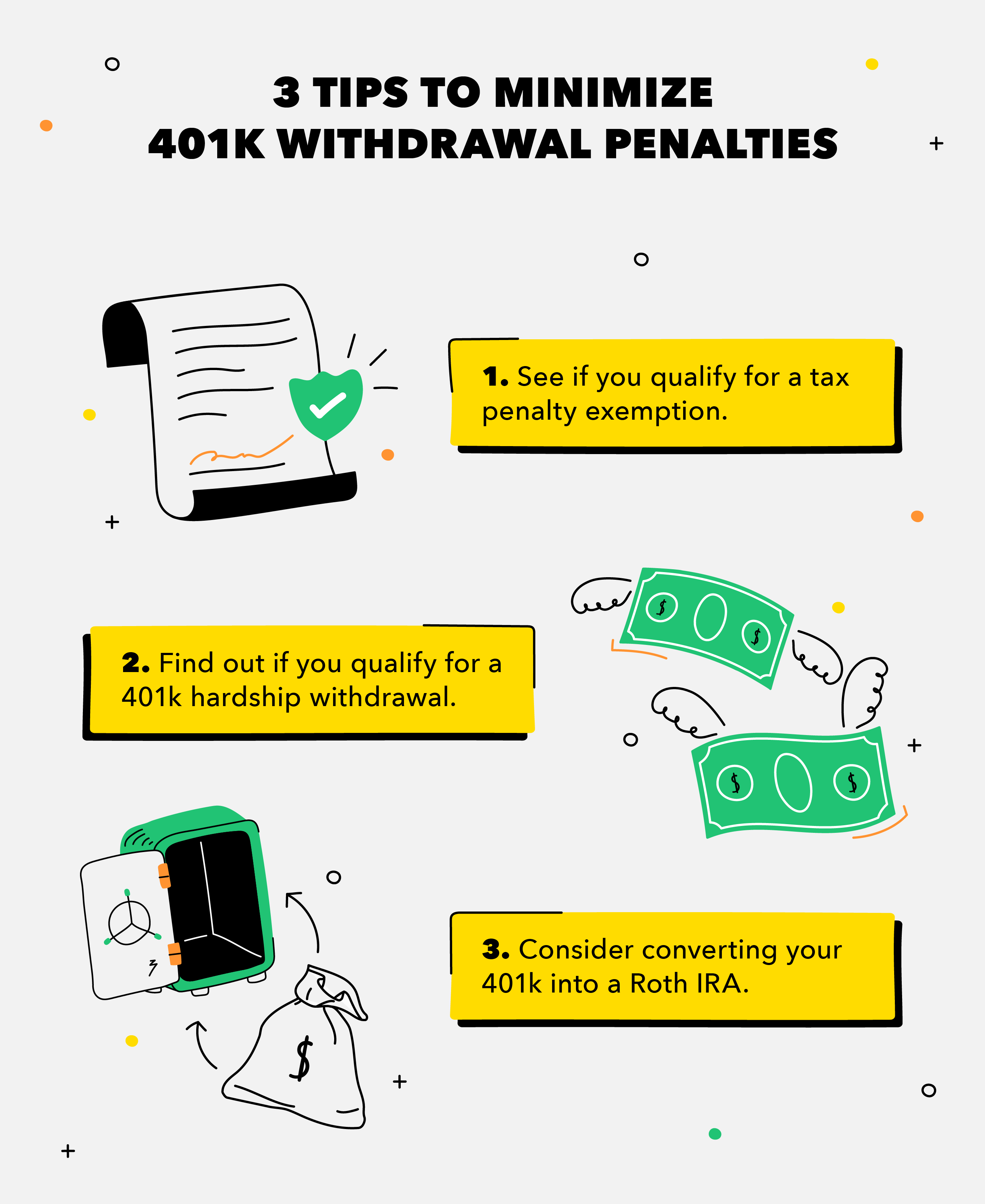

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Read Also: What Is The Most I Can Contribute To My 401k

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

How To Cash Out A 401 After Quitting

You may follow this type of action plan for your 401 when you quit your job:

If your new employer offers a 401 plan, check your eligibility and enroll yourself.

Once enrolled, get the funds and investments in your old account directly transferred to your new account. You can opt for a direct administrator-to-administrator transfer through simple documentation to avoid potential taxes and penalties.

Instead of direct transfer, you can also cash out your old account and deposit the proceeds in your new account within 60 days of cashing out. That way, you dont have to pay income tax on the amount of the withdrawal .

You must start taking 401 distributions after you turn 70 ½ years old and you are not working anymore. However, unlike traditional plans, in a new retirement plan with your current employer, you cannot be forced to take the required minimum distributions even after you reach the age of 70 ½.

If your new employer does not have a 401 plan or you do not like the plan your new employer has, you may roll over your old 401 account to an IRA. The rollover process is like the process of rolling over to a new account. You can either get it done directly through your plan administrator or take out the proceedings and deposit them in your IRA within 60 days.

Also Check: How To Find 401k Money

Withdrawing After Age 595

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Recommended Reading: What Does A 401k Third Party Administrator Do

How Much Will I Lose Cashing Out My 401 Early

Consider this concrete example. Lets say your plan allows early distributions, so you decide to take $10,000 out of your 401. Youre taxed at a federal rate of 22% and a state rate of 8%, so youll end up paying $2,500 in federal tax and withholding, plus $800 to the state. That means that you will be paying a hefty $4,300 from your retirement savings to receive $5,700.

Worse yet, assuming the average 8% year-over-year returns, leaving that $10,000 in the account could make you $68,485 over the next 25 years.

How much will you pay for 401? Get an instant quote.

Or schedule a free consultation with a retirement specialist.

Rollover Money: An Easy Option

If youre still working and you cant get money out of your 401 with any of the techniques above, there might be another approach. If you ever made rollover contributions to your 401 into your existing 401, for example), you might be able to take those funds back out. You wont have access to your entire 401 account balance, but you might get a nice chunk of change outat any time, for any reason. Employers are often unaware of this option, so you may need to ask your employer to do some research with your Plan Administrator.

Again, you may have to pay income taxes and tax penalties, and youre raiding your retirement savings, so only use this option when you have no other choice.

Next Up: Curious About Meeting?

Don’t Miss: Can I Start My Own 401k

Understanding The Rules For 401 Withdrawal After 59 1/2

LAST REVIEWED Apr 15 20219 MIN READ

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½.

Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Read Also: Should I Rollover My 401k Into An Ira