What Happens If I Leave My Employer And I Have An Outstanding Loan From My Plan Account

Keep in mind that most plans require that loans be repaid when you leave. If you roll over your remaining account balance to a new employers plan, you may also be able to roll over the outstanding balance of your loan to your new employers plan. Check with your new employer to find out if the loan will be accepted by the new plan. You cannot roll over your loan to an IRA.

If you cant move the loan to your new plan, and if you dont repay the loan within the time allotted, the outstanding balance will be treated as a withdrawal, subject to federal and applicable state and local taxes. If youre under age 59½, you may also have to pay a 10% early withdrawal penalty unless you qualify for an exception.

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Roth 401 To Roth Ira Rollover

The process of rolling over a Roth 401 to a Roth IRA is relatively simple. In fact, itâs the same process as rolling over a traditional 401 to a traditional IRA.

If you donât already have a Roth IRA, youâll need to open one with any institution that offers a Roth IRA. Then, youâll need to contact your Roth 401 planâs administrator or your human resource department and tell them youâd like to roll over your Roth 401 to your Roth IRA. Youâll need to provide them with your Roth IRA account information, and theyâll facilitate the transfer for you.

You May Like: Can I Invest My 401k In A Business

Can I Convert 401k To Roth 401k

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types. As mentioned, you’ll owe income tax on the amount you convert.

The Penalty If You Deposit To The Wrong Account

You have 60 days to deposit the funds into the appropriate account when you receive a rollover check. Your rollover won’t count as a rollover if you miss the 60-day deadline. It will become taxable.

Exceptions to the 60-day rollover time frame are hard to come by unless your financial services company makes a gross error. It’s important to have a clear plan for where your rollover funds are going and to make sure your financial advisor or plan administrator knows exactly where to put the money.

Recommended Reading: Can I Withdraw From My 401k Without Penalty

Taxes On Roth Ira Conversions

One of the biggest reasons investors gravitate toward Roth IRAs is the tax benefit. The money is put into the account after tax, so when its time to retire, youll be able to take the money out tax-free. That makes the Roth IRA a natural contender for rolling over 401s since it allows you to enjoy tax-free distributions during your golden years.

However, its important to understand the rollover 401 to Roth IRA tax consequences. You didnt pay taxes when you put money into your 401, with the understanding that youd pay when you took it out. A Roth IRA is funded with money youve already paid taxes on, which is why you dont pay taxes when you take it out. This means that the IRS has to get its money now, when youre putting the money into the Roth IRA account.

You May Like: How To Borrow From 401k To Buy A House

Roth Iras Have Income Limits

While anyone can contribute to a regular IRA when it comes to Roth IRAs, the IRS does discriminate and it does so based on annual income. The rationale behind this particular piece of regulation was that it would prevent high earners from somehow abusing the tax-advantaged nature of a Roth IRA as an investment vehicle.

The way that these income limits work is through a process of gradual phasing out. Once a certain threshold is reached, individuals, can contribute less money to a Roth IRA on an annual basis than those who earn less.

As income grows, the limit grows ever tighter until, at one level of income, investing in Roth IRAs becomes impossible.

The points at which these income caps kick in and come into play arenât set in stone they are adjusted each year with an eye toward inflation. For example, in 2021, the phaseout range for single filers began at $125,000 in MAGI, and the point of total exclusion was set at $140,000.

In the same years, married couples who filed jointly saw phaseouts begin at $198,000, with the point of total exclusion being $208,000.

There are two crucial pieces of good news, though the first is that converting a 401 into a Roth IRA sidesteps the issue of income limits completely.

Recommended Reading: Can I Roll My Old 401k Into A Roth Ira

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

⢠You donât meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

⢠Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you canât meet, or they might not provide the services you want.

Don’t Miss: What Is The 401k Retirement Plan

Alternatives To Roth Ira Rollovers

If you want to move your old 401 account, there are other options that are available to you besides a Roth IRA.

If you have a new 401 plan offered to you at your new employer, you could roll the old 401 plan into your new plan. Similar to opening a Roth IRA, there are a few easy steps to take to move your old 401 into a new employers plan.

You could also roll over your 401 into a Traditional IRA. You wont pay taxes when you convert the money to a Traditional IRA, as you will be taxed when you withdraw the money in retirement. You may want to do this, as Traditional IRAs typically offer more investment choices than workplace 401s.

If you own your own business, then you could open a self-employed 401 plan and convert an old workplace 401 to this account. A self-employed 401 plan offers many of the same benefits as a traditional 401, except that, as a business owner, you could make contributions both as an employee and employer. This helps minimize your business income and maximize your retirement contributions.

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

Read Also: When Do You Have To Start Withdrawing From 401k

How Do Roth 401 Withdrawals Work

As mentioned previously, the main benefit of saving for retirement through a Roth 401 is that withdrawals are made tax-free. Because taxes were paid on the amount that was contributed, the tax obligation has already been met.

However, according to the IRS, withdrawals can still be subject to taxes and penalties if they do not qualify.

To make a “qualified” withdrawal from a Roth 401, the account must have been contributed to for at least the previous five years and the account holder must be at least 59½. Also, withdrawals can be taken if the account holder becomes disabled or after the death of an account owner, in which case the funds would go to the beneficiaries of the account.

Withdrawals from a Roth 401 will be exempt from any taxes penalties if the account has been contributed for the past five years, and:

- The account owner becomes permanently disabled

- After the death of the account owner

- Or after the account owner is 59½.

You Want To Relax Early

Proponents of the FIRE movement invest aggressively so they can become work-optional in their 50s or even earlier.

If thats your plan, youll want at least a portion of your investments to be in an account thats more accessible than a 401, which you cannot tap without penalty before the age of 59 ½. A strategy known as a Roth conversion ladder involves converting 401 funds into a Roth IRA over a period of years.

Its a bit complex, says Hernandez. Theres a small number of people that it could make sense for. Its important to understand the tax impact.

Don’t Miss: How Much Should I Withdraw From My 401k During Retirement

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover and then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Don’t Miss: How To Close A Fidelity 401k Account

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Does A 401 To Roth Ira Conversion Work

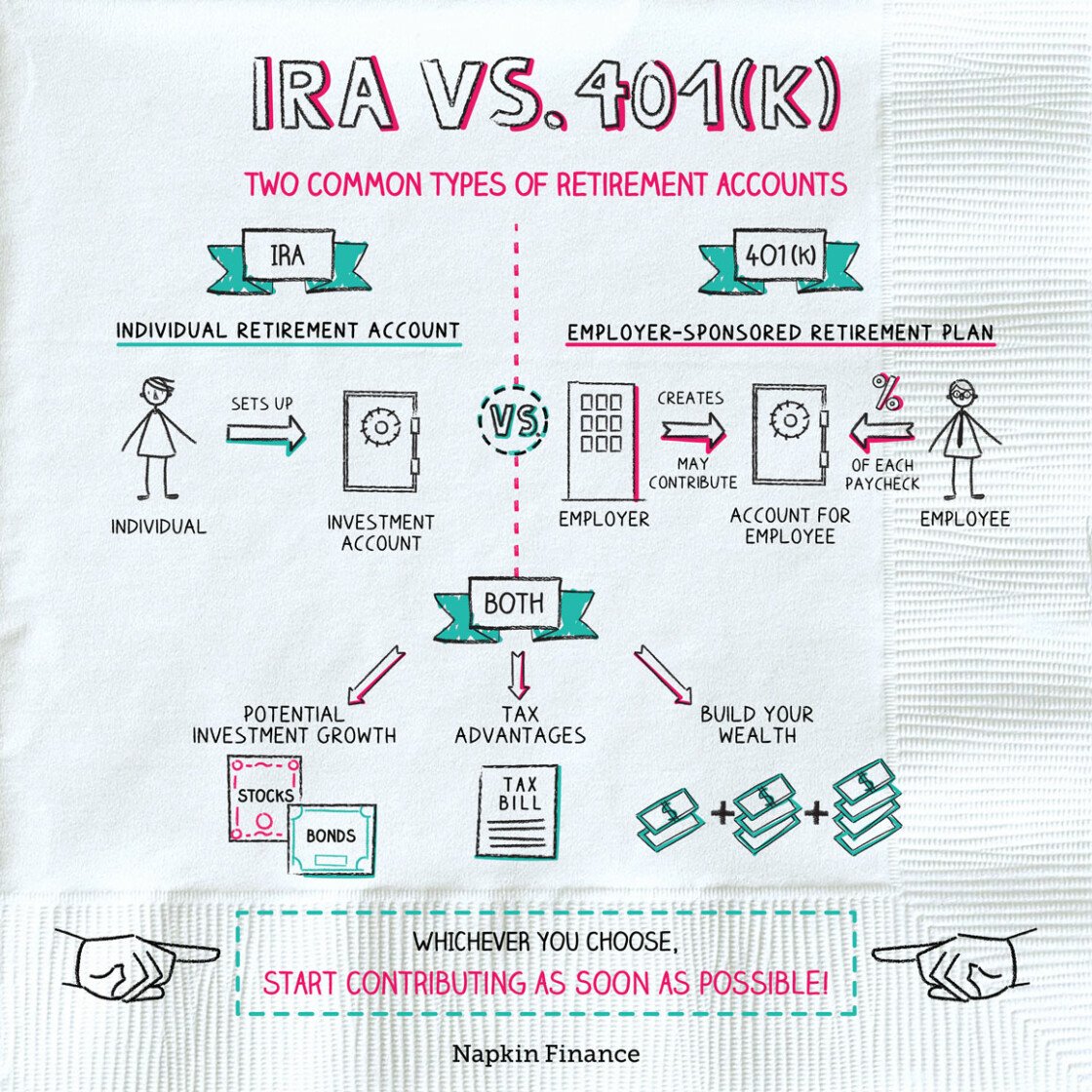

Converting a 401 into a Roth IRA gives you greater ownership and direction over your money. A 401 is a tax-advantaged retirement account that is managed by an employer, while a Roth IRA is a tax-advantaged retirement account that is managed by you.

In practice, this means youll open a Roth IRA account at an online brokerage firm and then roll any money in your 401 into your new account.

Beware: this will likely be a taxable event. Most, but not all, 401 accounts are tax-deferred. This means that youve never paid any taxes on the money within. Roth IRAs, on the other hand, are post-tax, meaning that they must contain only money that has already been taxed. If you have a tax-deferred 401, also known as a traditional 401, you will owe ordinary income taxes on the amount of money you convert into a Roth IRA.

Don’t Miss: What To Do With 401k When You Leave A Company

Why Roll Over Your 401 To A Roth Ira

If you keep a former workplace 401 plan you will have to pay taxes on your contributions and earnings in retirement. Converting to a Roth IRA may help you save money on income taxes if you expect your income to rise in the future or you have a particular year in which your income is low. When you complete a Roth IRA conversion, your pre-tax dollars from a workplace 401 plan are taxed at the time of the conversion, so if you are in a lower income tax bracket you will owe less in taxes. Then, in the Roth IRA, your contributions and earnings will grow tax-free.