Calculate Your Earnings And More

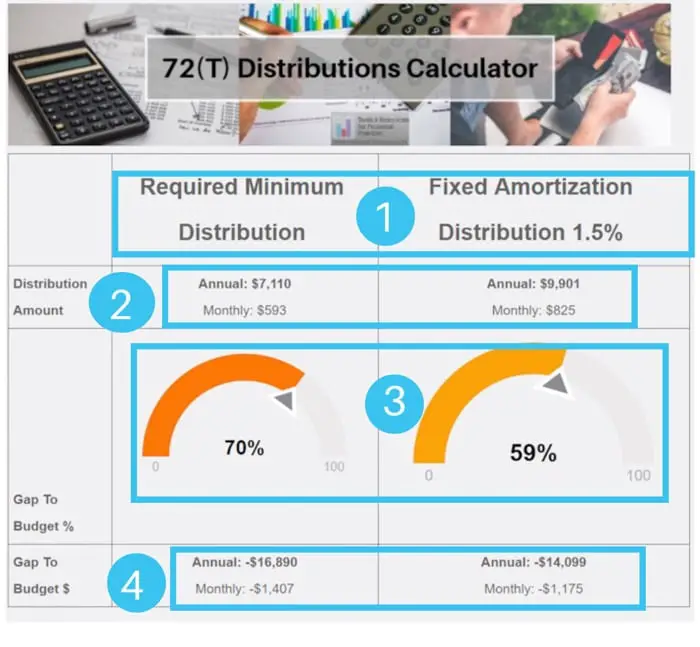

The Internal Revenue Code sections 72 and 72 allow for penalty free early withdrawals from retirement accounts. The IRS limits how much can be withdrawn by assuming any future earnings will be at most 120% of the Federal Mid-Term. This conservative approach can help assure that you will not prematurely deplete your retirement account. However, if you have a higher rate of return your account can actually grow, even with your distributions. On the other hand, if you suffer losses your account balance may end up shrinking faster than you might expect. This calculator is designed to examine the affects of 72/ distributions on your retirement plan balance.

How Early Retirement Plan Withdrawals Work Under Normal Circumstances

When there isnt a global pandemic impacting the livelihoods of the entire nation, withdrawing money early from a retirement plan is a serious decision. Thats because it carries with it some pretty serious consequences: namely, a 10% penalty paid on all of the money you withdraw, in addition to paying normal taxes. This, of course, assumes it is not a Roth plan, where the money has already been taxed.

Even if youre willing to pay the penalty, you have get approval from your plan beforehand. This is typically known as a hardship withdrawal. Some plan sponsors may not be willing to grant them, so make sure you check with your HR department before you plan on making one. Acceptable reasons for a hardship withdrawal include:

- Paying certain medical bills for you or family members

- Avoiding foreclosure on or to buy a primary residence

- Covering educational expenses for you or family members

- Paying for family funeral expenses

- Paying for some home repairs, such as those necessary after a natural disaster

Note that these reasons still carry the 10% penalties, in addition to taxes. There are a few instances where the penalty is waived:

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

Recommended Reading: Is It Better To Have A 401k Or Ira

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. This allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Do You Have To Pay Taxes On An Ira After 70

All of the money in your traditional IRA belongs to you. … You must begin taking minimum withdrawals from your traditional IRA in the year you turn age 70 1/2. The amount you withdraw at that time is taxed as ordinary income, but the funds that remain in your IRA continue to grow tax deferred regardless of your age.

Read Also: How To Transfer 401k To Different Company

Where To Keep Your Emergency Fund

The best place to keep your emergency fund is in a high-yield savings account, which offers easy access and pays a competitive yield. Look for banks and credit unions that insure deposits through the Federal Deposit Insurance Corp. or the National Credit Union Administration .

Online-only banks are good options for an emergency savings account because they typically offer higher yields and charge lower fees than brick-and-mortar banks. Fees can eat into your emergency fund balance, which makes comparing savings rates and account features key.

Also, theres no need to stick with an account just because youve had it a while. Consumers keep their savings accounts for an average of nearly 17 years, according to a recent Bankrate survey, but if the current account charges monthly fees or pays a subpar APY, its worth some inconvenience to find a new account that offers better terms.

Tapping Your 401 Early

If you need money but are trying to avoid high-interest credit cards or loans, an early withdrawal from your 401 plan is a possibility. However, before you consider this option, be forewarned that there are often tax consequences for doing so.

If you understand the impact it will have on your finances and would like to continue with an early withdrawal, there are two ways to go about it cashing out or taking a loan. But how do you know which is right for you? And what are the tax consequences you should be expecting?

Don’t Miss: What Is The Minimum 401k Distribution

Understanding 401 Early Withdrawals

If an account holder takes withdrawals from their 401 before age 59½, they may incur penalties in the form of additional taxes. The additional tax for taking an early withdrawal from a tax-advantaged retirement account is 10% on top of any applicable income taxes.

The 10% early withdrawal tax may be waived if the account owner withdraws 401 funds in order to pay for certain qualified expenses, however.

Do You Have To Pay Taxes On 401k After 60

A withdrawal you make from a 401 after you retire is officially known as a distribution. While you’ve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw.

You May Like: What Will My 401k Be Worth At Retirement

How Much Money Can You Take Out Of Your 401k Without Penalty

Individuals affected by COVID-19 can withdraw up to $100,000 from employee-sponsored retirement accounts like 401s and 403s, as well as personal retirement accounts, such as traditional individual retirement accounts, or a combination of these. The 10% penalty will be waived for distributions made in 2020.

You May Like: Can You Have Your Own 401k

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

Recommended Reading: How To Invest In A 401k Plan

Make A Budget And See Where You Can Start Saving More Money

Its important to know where your money is going to find ways to save. Budgeting helps you maximize income and find ways to reduce or manage your spending. Bankrates Home Budget Calculator can help you to set a budget.

A budgeting app is another useful tool that can help you calculate income and expenses to provide a dashboard view of your financial situation. You can also personal finance tool to categorize spending, identify ways to reduce expenses and improve your financial health.

Alternatives To Withdrawing From 401

How can you access cash without withdrawing or borrowing from your 401? If you’re a homeowner with equity, you can consider a cash-out refinance, home equity loan or home equity line of credit . All three of these options typically come with competitive interest rates because the financing is secured by your home.

Permanent life insurance policies with cash value components are another option. In this case, your death benefit serves as collateral for the loan. Once the loan balance is paid off, your death benefit is restored in full.

Read Also: How Do I Set Up A 401k Plan

Alternatives To The Rule Of 55

The rule of 55 is not the only way to take penalty-free distributions from a retirement plan. Theres another way to take money out of 401, 403, and even IRA retirement accounts if you leave a job before the age of 59 1/2. Its known as the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution.

A SEPP plan has a twist. You start by estimating your life expectancy. Then use that to calculate five similar size payments from a retirement plan for five years in a row before the age of 59 1/2. Whats different is that these distributions can occur at any agetheyre not bound by the same age threshold as the Rule of 55.

Circumstances Where Both Iras And 401s Permit Penalty

- If a military reservist is called to active duty. Both IRA and 401 account owners can take certain qualified distributions from their retirement accounts if they are a military reservist who is called to active duty for 180 days or more.

- To cover qualified medical expenses. If unreimbursed medical expenses total more than 10% of the account ownerâs adjusted gross income for that year, early distributions are allowed from both a 401 or IRA without penalty.

- Disability. Early withdrawals can be taken without penalty in the case of a total and permanent disability of the participant/account owner. This applies to both IRAs and 401 plans.

- Adoption or birth of a child. Under the SECURE Act, up to $5,000 in qualified distributions can be taken from an IRA if the account owner adopts or gives birth to a child. â

- Inherited accounts. If an IRA or 401 account owner dies and passes the plan to a beneficiary, that beneficiary can withdraw funds from the account without penalty. As of 2020, inherited IRA distributions must be taken entirely by the end of the tenth year following the original account ownerâs death.

Recommended Reading: Does Maximum 401k Include Employer Match

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

What Is The Rule Of 55

Your 401 account is likely one of the most valuable assets you have, so its essential to know when and how you can access it. These accounts are intended to fund your retirement, and as such you can access them penalty-free when you reach age 59½. In most cases, taking money out of your 401 before then will cost you a pretty penny: Early withdrawals come with a 10% penalty.

There are a few exceptions, however, and one of them could help you if you want or need to retire early. The Rule of 55 is an IRS provision that allows you to withdraw funds from your 401 or 403 without a penalty at age 55 or older. Read on to find out how it works.

Recommended Reading: How Do I Transfer 401k To New Employer

You May Like: How To Set Up A Solo 401k Account

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

Rolling Over Funds In A Roth 401

You can avoid taxation on your earnings if your withdrawal is for a rollover. If the funds are simply moving into another retirement plan or a spouse’s plan via direct rollover, no additional taxes are incurred.

If the rollover is not direct , the funds must be deposited in another Roth 401 or Roth IRA account within 60 days to avoid taxation.

When you do an indirect rollover, the portion of the distribution attributable to contributions cannot be transferred to another Roth 401 but it can be transferred into a Roth IRA. The earnings portion of the distribution can be deposited into either type of account.

Also Check: How To Find Out Whats In My 401k

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

You May Like: Can I Borrow From My 401k To Refinance My House

Early Withdrawals During A Recession

A recession spells out bad times for all. Gross domestic product falls and industrial production slows down. Most noticeably of all, unemployment rates rise. You may find yourself on the wrong side of that trend with dwindling savings. You do have a nice amount of money that you set aside for a future version of yourself.

It’s a tempting idea that many people follow through on. A study from the IRS conducted in 2013 found that in 2004, prior to the Great Recession, 13.3% of people with some retirement plan experienced a taxable retirement account distribution essentially they did an early withdrawal. That percentage rose to 15.4% in 2010.

An early withdrawal should be a last resort. If you can afford not to withdraw early, do so. However, like many other issues within personal finance, recessions impact income levels differently. The same survey states that lower-income households have a higher propensity for an early withdrawal because they’re more deeply impacted by the economic shock.

Note: Retirement savings in a 401 might decline as a result of a recession-induced bear market, which might also drive people to withdraw. The Great Recession set 401s back by over $2 trillion. Yet, despite the volatile markets over the last few years, the average 401 balance has stayed relatively steady, according to Fidelity.

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal but only from a current 401 account held by your employer. You can’t take loans out on older 401 accounts. However, you can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company, but these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Read Also: Should I Move My Old 401k To An Ira

Planning Out The Timing Of Your Withdrawals

The timing of your early withdrawals is important, says Dave Lowell, certified financial planner and founder of Up Your Money Game.

If you were employed for most of the year and had a relatively high income, then it makes sense to not withdraw money under the rule of 55 in that calendar year, since it will add to your total income for the year and possibly result in you moving to a higher marginal tax bracket, Lowell says.

The better strategy in that scenario may be to use other savings or take withdrawals from after-tax investments until the next calendar rolls around. This may result in your taxable income being much lower.