Consider The Pros And Cons

Early withdrawals from your hard-fought savings should be considered carefully. There are many factors to consider with long-term implications. Study the alternatives available and make decisions according to your ultimate goal.

Whether you decide to keep your 401k contributions intact with your old employer, move it to your new employer, roll it over to an IRA, or simply cash it out, the question of taxes and penalties loom.

Related: 5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

There are pros and cons to taking a lump-sum distribution. Four important factors to consider include:

In summary, there are many conflicting issues you must balance. Lifestyle needs, taxes, and penalties today versus future savings tomorrow. It is a difficult decision.

Move Money Between Fidelity And Other Accounts

| One to three business days to transfer money between your bank and Fidelity accounts. | Free |

| Same day transfer to wire available money between Fidelity and your bank using the Federal Reserve Wiring System. | Fees may apply |

| Addresses and instructions to deposit stock certificates to your brokerage account. | Free |

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Recommended Reading: How Much Can I Withdraw From My 401k

Read Also: What Happens To Unclaimed 401k Money

Where Fidelity Go Shines

Low cost: Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999.

Fidelity integration: Customers who already have an IRA or taxable account with Fidelity can easily take advantage of the companys robo offering.

Human portfolio oversight: The day-to-day investment and trading decisions for portfolios are handled by a team of humans from Strategic Advisors, a registered investment advisor and Fidelity company.

You May Like: How To Increase 401k Contribution Fidelity

Before You Accept An Offer

So you’ve found a new opportunity that you’re feeling pumped about, and you have an offer in hand. Hopefully, it even comes with a nice boost in pay.

Before you get too dazzled by that salary figure, however, pause to think about how the move would affect your finances in total. A higher pay number might be misleading if you’d be moving from an employee role to a contractor role, or if you’d be relocating to a more expensive area. And salary may be only one part of each role’s total compensation package, which might also include bonus or stock compensation potential, matching retirement contributions, insurance, or even tuition or childcare assistance.

Fidelity’s job offer evaluator tool can help you better understand how the new job and your current job compare on total compensation . Consider running the numbers carefully before you make a final decision, or even using the results to give yourself added leverage as you’re negotiating.

Also Check: How To Find 401k From An Old Employer

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Roll Your Assets Into A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

Don’t Miss: How To Start A 401k Self Employed

Find The Mortgage Option Thats Right For You

Your 401 account may seem tempting as an untapped source of cash, especially if youre struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort. Consider applying for a low down-payment loan like an FHA or VA loan, or, if you have one, making a withdrawal from your IRA.

Whatever you decide, make sure you consult with a mortgage specialist before committing to an option. Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If youre ready to take that next step toward a mortgage, then get started with our experts today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

If You Are Under 59 1/2

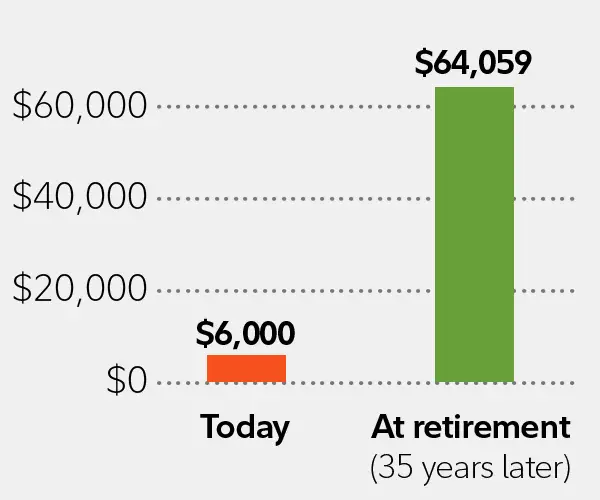

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Know: The Best Roth IRA Accounts

Read Also: How To Switch 401k To Ira

When To Cash Out Your 401k To Pay Off Debt

The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans. Withdrawing the 401k plan early can cost money. The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans.

Is It Worth It To Take A 401k Withdrawal

Sometimes you just dont have a better option. If withdrawing from the 401 plan is the only way to pay your bills without incurring expensive credit card debt, go for it. There is no point in leaving your retirement assets alone if it jeopardizes your current financial security and your ability to save more for your future retirement.

You May Like: How To Use 401k To Pay Off Debt

Initiate Your Rollover With Fidelity

Youre making great progress. Youve confirmed key details about your 401 plan and you have an IRA to transfer your money into. The next step is to initiate your rollover with Fidelity. Fidelity has two methods for requesting a rollover to another institution:

If you are rolling over your Fidelity 401 to an IRA at Fidelity, you can request a rollover online, through your NetBenefits account. For rollovers to another institution, youll have to call or use the form.

Recommended Reading: How Do I Cash Out My Fidelity 401k

When Can You Withdraw Money From Your Ira Without Penalty

If you are over 5912, you can withdraw money from your IRA without penalty however, keep in mind that taxes will still be due. You can take IRA withdrawals without penalty if you are under the age of 5912 and have a balance of more than $72, but you must pay taxes on the withdrawal. You do not have to withdraw money from any accounts before the age of 72. To plan for retirement, keep your withdrawals in mind.

Recommended Reading: How Do I Borrow Money From My 401k

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

Understanding Early Withdrawal From A 401

The method and process of withdrawing money from your 401 will depend on your employer and the type of withdrawal you choose. Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. Its really a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available. If it is, then you should check the fine print of your plan to determine the type of withdrawals that are allowed or available.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay normal income taxes on the withdrawn funds. For a $10,000 withdrawal, once all taxes and penalties are paid, you will only receive approximately $6,300. There are some non-penalty options to consider, however.

Before deciding upon taking an early withdrawal from your 401, find out if your plan allows you to take a loan against it, as this allows you to eventually replace the funds. You may also want to consider alternative options for securing financing that could hurt you less in the long run, such as a small personal loan.

Recommended Reading: How To Get My Walmart 401k

How Long Does It Take To Withdraw Money From Fidelity

Withdrawals made via check typically take anywhere from five to seven business days, while withdrawals made via electronic funds transfer or Fidelity Electronic Funds Transfer typically take anywhere from one to three business days, and withdrawals made to a Fidelity account that is not a retirement account typically take anywhere from one to two business days to process.

How To Protect Your 401k From A Stock Market Crash

Are you riding your retirement on the success of the stock market? If so, its understandable that youre worried about what a crash could mean for your 401k.

If thats you and youre wondering how to protect your 401kfrom a stock market crash, Ive got good news for you:

You dont have to worry.

The stock market is volatile, but you can minimize that risk with the right investing strategy.

If you invest your money the right way, you can not only protect your retirement but also experience even greater returns so your retirement can be even sweeter. Ill show you how to take advantage of stock market volatility, which includes a stock market crash, so you can profit from the fluctuations instead of watching your portfolio take a plunge.

Are you with me?

Read Also: Do I Need Ein For Solo 401k

How Long Does It Take To Get 401k Withdrawal From Fidelity

It takes about one to two weeks to get a 401k withdrawal from fidelity. The process is simple and easy to follow. You will need to fill out a form and provide some basic information about your account. Once the form is complete, you will submit it to fidelity. They will then review the form and release the funds to you.

Are There Limits Or Fees For Transactions With Betterment

There are no transaction fees with Betterment. That said, there are a few parameters regarding transactions to be aware of:

- The minimum amount you can deposit is $10.

- The maximum amount you can deposit is $300,000 every two business days.

- You can always wire funds into Betterment of any amount, but your bank may charge wire fees.

- You must wait 60 days to withdraw from an IRA Rollover deposit.

- You can only make one allocation change per business day, as we are not a licensed day-trading platform.

You May Like: How To Check How Much You Have In Your 401k

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

Read Also: What Is The Maximum I Can Contribute To My 401k

What Are Minimum Required Distributions

Beginning the calendar year after the year you turn 70 1/2, you are generally required to withdraw a minimum amount of money from your retirement accounts each year. This amount is called a minimum required distribution, or MRD. Note that you can always take more than the MRD amount.

You generally have to take MRDs from the following retirement accounts:

- Traditional IRAs

You May Like: How To Transfer 401k After Leaving Job

An Astounding 90% Of American Workers With 401k Plans Said That Payroll Deduction Helps Them Save

Stats show that workers are satisfied with 401k plans and their features as they make it easier for them to save money for retirement. Whats more, 90% said that it helps them think about the future rather than their needs at the moment. Besides, 82% believe that saving money with every paycheck makes them less anxious about investment performance.

Recommended Reading: How To Recover 401k From Old Job

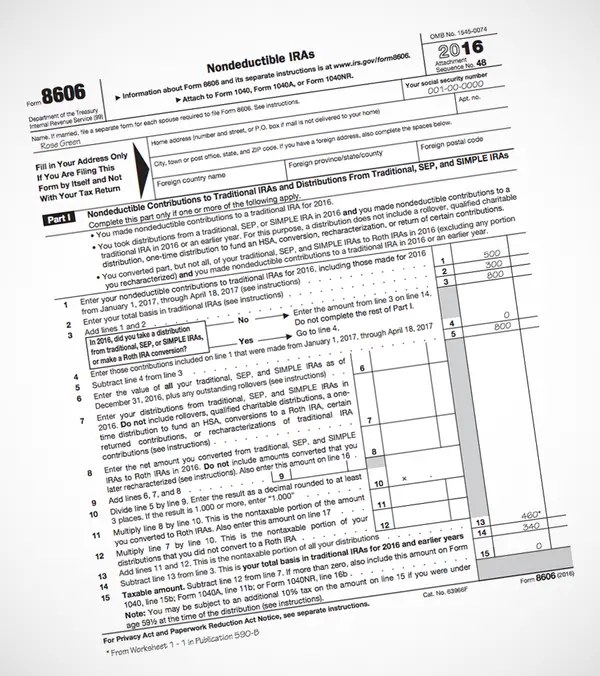

Traditional Rollover Sep And Simple Iras

If you are considering a withdrawal from one of these types of IRAs before age 59½, it will be considered an early distribution by the IRS.

In many cases, you’ll have to pay federal and state taxes. There may also be a 10% penalty unless you are using the money for exceptions such as a first-time home purchase, birth or adoption expense , qualified education expense, death or disability, health insurance , and some medical expenses. A 25% penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA.

If any of these situations apply to you, then you may need to fill out specific IRS forms. Always consult your tax advisor about your specific situation.

Don’t Miss: How To Calculate 401k Retirement Income

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.