Why Should I Roll Over An Ira Or 401

401s in particular are unique investment options because they are employer driven. That means when an individual leaves a company, they need to decide what to do with their 401 funds. Theres no longer the option for the investor to contribute to the 401 funds themselves, but they can continue to grow their investment in different account types via rollover.

In some cases, investors are able to transfer their funds into the next 401 available with a new employer, assuming one with those allowable terms is offered. Another viable option for repurposed 401 funds is to roll them over into an IRA. This can often be the best option because the money contained in the account gets to remain tax deferred while investors continue to grow their retirement savings. Whats more, IRAs are among the most flexible options when it comes to choosing the investment choices that are available. IRAs can encompass mutual funds as well as anything from stocks and bonds to real estate .

Of course, there is always the option of withdrawing the 401 funds prematurely, but this exposes investors to a bevy of taxes and penalties, especially if they do not meet certain age requirements or qualified expenses criteria.

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around is now easier than ever. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. However, allocating your retirement funds to new plans becomes tricky upon leaving the company.

The new allocation rules took effect in 2015, but taxpayers chose to apply them to distributions as early as September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula, resulting in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You can now choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Recommended Reading: How To Access My 401k Money

K And Roth Ira Plans How To Invest Money

Investing for the long term and retirement has become particularly difficult in recent years, as pension plans rollback and self funded retirement plans take over. The issue with self funded retirement plans is that your retirement income varies with the market instead of having a fixed income. Over the last 20 years, 9/11, the Great Recession and now the Coronavirus have caused major financial setbacks for individuals. Two types of major retirement accounts that everyone should be investing in are 401k and Roth IRA plans. Having a non-retirement brokerage account in addition is great for short term goals. So is a 401k, Roth IRA, or non-retirement account better for you and why?

You May Like: Can My Wife Take My 401k In A Divorce

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

You May Like: Can You Roll Over 401k To Ira While Still Employed

Your Roth 401 Rollover Options

For the most part, your choices for a Roth 401 follow those of a traditional 401, but the transfers should be to Roth versions of the available accounts. If you opt to roll the funds over to an IRA, you should transfer the funds from the Roth 401 into a Roth IRA. If your new employer has a Roth 401 option and allows for transfers, you should also be able to roll the old Roth 401 into the new Roth 401.

Rolling a Roth 401 over into a Roth IRA is generally optimal, particularly because the investment choices within an IRA are typically wider and better than those of a 401 plan. More frequently than not, individual IRA accounts have more options than a 401. Depending on the custodian, sometimes your options in a 401 are limited to mutual funds or a few different exchange-traded funds , versus being able to invest in a plethora of choices in an IRA.

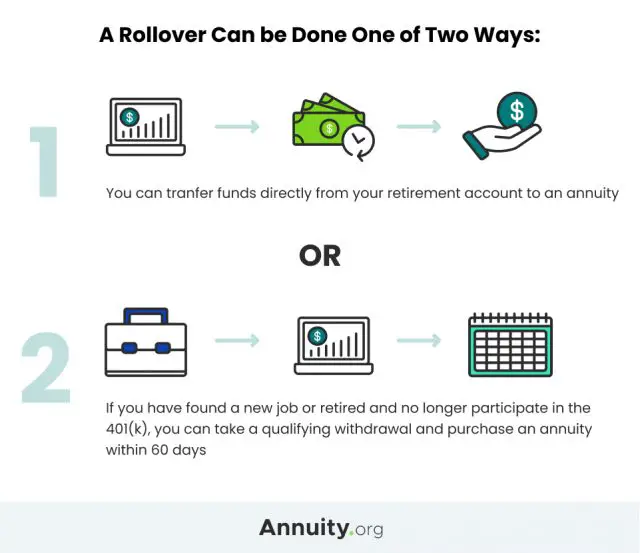

The best way to accomplish a rollover to either a Roth IRA or another Roth 401 is from trustee to trustee. This ensures a seamless transaction that should not be challenged later by the IRS, which may be concerned about whether the transaction was made for the full amount or in a timely manner.

If, however, you decide to have the funds sent to you instead of directly to the new trustee, you can still roll over the entire distribution to a Roth IRA within 60 days of receipt. If you choose this route, however, the paying trustee is generally required to withhold 20% of the account balance for taxes.

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

- Pros

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

- Cons

-

- You may have a limited range of investment choices in the new 401.

- Fees and expenses could be higher than they were for your former employer’s 401 or an IRA.

- Rolling over company stock may have negative tax implications.

Read Also: Can I Take Out Money From 401k To Purchase Home

Does Time Of Year Matter

Converting earlier in the year generally gives you more time to pay taxes. Taxes aren’t due until the tax deadline of the following year, so you may have more than 15 months to pay the taxes on your converted balances.

But there are also some advantages to converting later in the year:

- You can still start the clock on the 5-year rule as of the beginning of the year. This IRS rule requires a waiting period of 5 years before withdrawing converted balances or you may pay a 10% penalty. But the clock starts on January 1 of the year you do the conversionno matter when during the year it actually happened. The 5-year rule is counted separately for each conversion.

- You’ll have more information about your income for the year. Since the amount you convert is considered taxable income, you may want to consider converting only the amount that would bring you to the top of your current tax bracket.

A conversion must be completed by December 31 to be included in that year’s taxable income. Managing the tax impact of a Roth IRA conversion requires careful analysis. A review with a financial or tax advisor is always a good idea.

What About The Roth 401k

If your employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover will be much easier. When youre converting one Roth product to another, there is simply no need for conversion. You would simply roll the Roth 401 directly into the Roth IRA with the help of your plan provider.

Roll Your 401 by Following These Steps

Read Also: How To Start A Personal 401k

Is A Backdoor Roth Ira Worth It

Yes. Roth IRAs don’t have required minimum distributions, which means you can leave your money in the account and let it grow. And the money you do withdraw isn’t taxable, which means you pay on the contributionsnot the distributions themselves. If you leave the money in a traditional IRA, any earnings are subject to taxes. Just make sure you know the rules so you don’t end up paying more than you save.

Calculating The Tax Impact

That said, income reported on a Roth conversion increases income before credits or deductions so a Roth conversion could potentially increase taxable income and trigger various phaseouts.

An increase in taxable income is fairly easy to figure out. Take a look at the for the year in which youre converting. An increase in taxable income will cost you roughly your marginal tax rate times the conversion value.

Analyzing various phaseouts is a bit more complicated. Having more income could result in more Social Security benefits being subject to taxation, or it could trigger a phaseout or elimination of various deductions or tax credits.

The best way to figure out the impact of a Roth conversion in these various circumstances is to run a projection in your tax software to analyze the tax increase resulting from a Roth conversion.

You May Like: Can You Rollover A 401k From One Company To Another

Withdraw From Your 401

All 401 accounts give you the option to withdraw your funds and receive the proceeds as cash. This option is typically best saved as a last resort, since youll have to pay federal, state, and local taxes plus penalties if you havent yet reached retirement age. Youll also potentially give up the benefit of additional tax-advantaged investment returns.

However, if you need access to the funds for non-retirement purposes or financial hardship, withdrawing from your 401 is something you can consider.

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

You May Like: Should You Convert Your 401k To An Ira

Can You Rollover A Roth 401 To A Roth Ira

Dear Carrie,

I’m 56 and have both a traditional and a Roth 401. Right now I contribute the maximum to my Roth each year. I plan to roll the Roth 401 into a Roth IRA before 72 to avoid having to take an RMD. Two questions: Do I need to open a Roth IRA five years prior to the rollover to meet the 5-year rule? And can I contribute to a Roth IRA even though I max out my Roth 401?

A Reader

Dear Reader,

I rarely get questions regarding a Roth 401 rollover, but as this type of retirement plan becomes more widely available, I’m sure more and more people will be looking for similar answers. So thanks for asking.

I think you’re right on target with your basic idea. With a Roth 401unlike a Roth IRAyou must take a required minimum distribution beginning at age 72 if youre retired. So the idea of rolling your Roth 401 money into a Roth IRA before that magic age makes a lot of sense. With your money in a Roth IRA, rather than being required to take a certain amount out of your retirement savings each year, you can choose how much, whenor if everyou want to make withdrawals.

But as you suggest, there are certain things you need to be aware of to make sure you can take full advantage of all the Roth IRA benefits.

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Donât Miss: Can You Contribute To 401k And Roth Ira

Recommended Reading: How To Withdraw From 401k For Home Purchase

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.