Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an IRA rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

SEPP withdrawals are not the best idea if your financial need is short term. When starting SEPP payments, you must continue for a minimum of five years or until you reach age 59½, whichever comes later. Otherwise, the 10% early penalty still applies, and you will owe interest on the deferred penalties from prior tax years.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the IRS: fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

Is It Possible For A Plan To Allow In

Indeed. The plan can specify that participants are limited to a maximum number of in-service distributions per year or that there is a minimum amount that can be taken . However, since imposing those sorts of restrictions requires that they be monitored, we dont see them in very many plans.

Another restriction we see a little more frequently is that in-service distributions can only be taken from accounts in which the participant is 100% vested.

If any of these restrictions are to be imposed, they must be written into the plan document and applied consistently across the board to all participants.

Recommended Reading: What To Do With My 401k When I Change Jobs

You May Like: Can I Rollover My 401k To A Roth Ira

What Is A 401k

A 401k allows you to dedicate a percentage of your pre-tax salary to a retirement account.

Employers can also choose to match some or all of the contributions, but this isnât required so itâs not guaranteed.

There are two basic types of 401ks â traditional and Roth â with the main difference being how theyâre taxed.

In a traditional 401k, employee contributions reduce their income taxes for the year they are made, but theyâll pay tax when they withdraw cash.

How To Borrow Against Your 401

You must apply for the 401 loan and meet certain requirements, which can depend on the plan’s administrator. Typically, a 401 borrower has to pay back the loan within five years. Most plans require payments at least quarterly, or every three months.

There are some exceptions again, it depends on the administrator. For instance, if you use the 401 loan to buy a home that will be your main residence, the five-year payback requirement can be waived.

Don’t Miss: How To Locate 401k Account

What Are The Penalty

The Internal Revenue Service permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these exceptions, but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal: for costs directly related to the COVID-19 pandemic.

Youll still owe regular income taxes on the money withdrawn, but you wont get slapped with the 10% early withdrawal penalty.

If You Withdraw Too Much

It will be important to track your withdrawals against your original plan at the time your withdrawal plan is designed, and youll also want to update your plan from year to year. Taking out too much money too soon can obviously cause you problems later.

Well use the example of Susan, whose investments did very well through her first few years of retirement. She insisted on taking out a lot of additional money during those years. She was warned that her plan had been tested against both good and bad investment markets and that she would be jeopardizing her future income by taking out additional profits early.

Rates of return in excess of 12% dont go on forever, so she should have banked those excess returns to enable her to use them in years when the investments didnt fare as well. Susan insisted on taking additional funds out immediately, and the markets went down a few years later. She didnt have those additional profits set aside, and her accounts were severely depleted. She ended up living on a strict budget instead of having some extra fun money.

Dont Miss: Where Can I Find My 401k

You May Like: How To Get My 401k From The Military

Rmd Rules When An Entity Inherits A Traditional Ira

If you have a traditional IRA, you can designate a beneficiary to be an entity instead of an individual. Examples include trusts, charities, and certain organizations. However, this doesnt mean they avoid RMD rules. In this case, the RMD depends on the age of the original account owner upon death.

So lets say the original account owner was still alive by April 1 following the year he or she reached age 72. In this instance, RMDs will be calculated based on the life expectancy factor of the original owner using the IRS Single Life Expectancy table.

Now, consider the account owner died before turning age 72. In this case, the entity must withdraw the entire balance in the account within five years following the year of death.

However, exclusive rules apply to Look-Through Trusts. You should consult a financial advisor and tax professional for specific guidelines on how the IRS treats RMDs in this case.

Read Also: How To Transfer 401k From Fidelity To Vanguard

How Much Can You Withdraw From 401k Tax Free

The legislation allowed people to take distributions of up to $100,000 from their 401 accounts or IRAs without having to pay the normal 10% penalty in 2020, even if they were younger than age 59 1/2. However, the distribution is considered ordinary income for tax purposes and will increase your tax liability.

Don’t Miss: Which Is Better Roth Or Traditional 401k

What Is A 401 And How Does It Work

Before diving into whether you should use your 401 to buy a house, its important to first have a firm grasp on how, exactly, a 401 retirement account works.

Your 401 account is an earmarked savings account created specifically to help you prepare for retirement. As defined by the Internal Revenue Code of the IRS, 401 holders can claim a tax deduction and will see their contributions to the account accrue tax-free interest over time. The trade-off is that access to the account is strictly limited.

Withdrawals from a 401 should not be made before the account holder turns 59½, or before they turn 55 and have left or lost their job. Early withdrawals incur a 10% early withdrawal penalty on the amount of money being taken out of the account. This amount also immediately becomes subject to income tax, since its no longer in the protected retirement savings account.

While these regulations may seem harsh, they are in place to incentivize account holders to set aside enough money to support a comfortable retirement. That being said, its not illegal to withdraw money from your 401 early, and those funds can certainly be put toward a down payment on a house.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Take Out A Personal Loan

Theres also the option of taking out a personal loan to help deal with a temporary setback. Personal loans arent backed by any assets, which means lenders wont easily be able to take your house or car in the event you dont pay back the loan. But because personal loans are unsecured, they can be more difficult to get and the amount you can borrow will depend on variables such as your credit score and your income level.

If you think a personal loan is your best option, it may be a good idea to apply for one with a bank or credit union where you have an existing account. Youre more likely to get the loan from an institution that knows you and they might even give you some flexibility in the event you miss a payment.

Don’t Miss: How To Sell 401k Stock

How Much Should You Contribute To A 401

When you start a new job and sign up for your companys 401 plan, you will need to decide how much to contribute to the account. This seemingly simple decision will affect how much is withheld from your paychecks, your annual income tax bill and how much money you will have in retirement.

Heres how to determine the amount to save in your 401 plan:

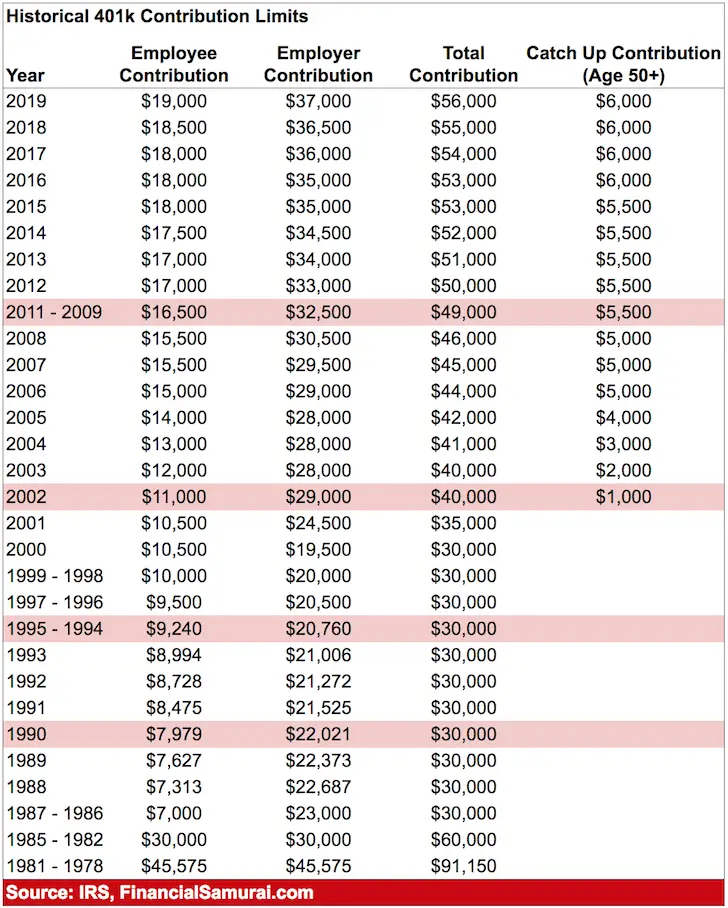

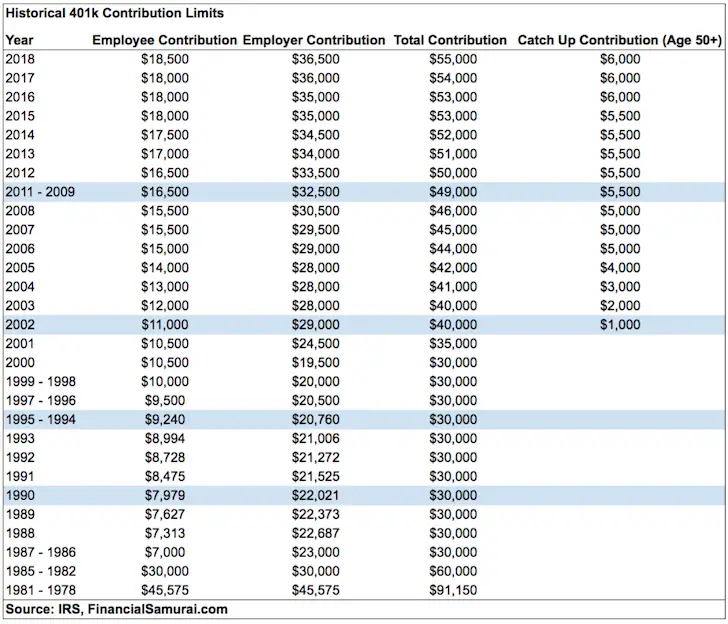

The 401 contribution limit is $20,500 in 2022.

Workers age 50 and older can contribute an additional $6,500 in 2022.

Qualifying for a 401 match is the fastest way to build wealth for retirement.

Many financial advisors recommend saving more than 10% of your income for retirement.

Remember to increase your savings rate over time.

Starting to save at a young age gives your investments more time to compound.

Maxing out your 401 helps reduce your current tax bill.

How Much Can You Contribute to a 401?

You can defer paying income tax on up to $20,500 that you save in a 401 plan in 2022. Workers age 50 and older can make catch-up contributions of up to an additional $6,500 in 2022, for a maximum possible 401 contribution of $27,000. Maxing out your 401 helps you save money on taxes while saving for retirement. A worker in the 24% tax bracket who saves $20,500 in a 401 plan will reduce his tax bill by $4,920. However, income tax will be due on traditional 401 withdrawals in retirement.

Qualify for the 401 Match

Aim to Save More Than 10%

Increase Your Savings Rate Over Time

Factor in Your Age

How to Max Out Your 401

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

You May Like: What Is The 401k Retirement Plan

Home Equity Loan Or Heloc

If you own a home with equity built up, a home equity loan or home equity line of credit can be a low-interest alternative to a personal loan. This type of loan is often referred to as a second mortgage because the loan is secured by your home. In other words, if you default on the loan, your lender may have a right to foreclose on your home.

One of the major benefits of a home equity loan or HELOC over a personal loan is the interest rate. Loans that are secured by homes including mortgages, home equity loans, and HELOCs often have some of the lowest interest rates on the market. As a result, the loan will cost you less money over the long term.

Its important to proceed with caution if youre considering a home equity loan or HELOC. As we mentioned, these loans are secured by your home. If you cant make your monthly payments, you risk having the lender take your home. As a result, you should avoid this option if you think for any reason you may not be able to repay the loan on time.

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requestedmay include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Read Also: Can You Take Money Out Of 401k

What Is The Rule Of 55

The rule of 55 is an IRS regulation that allows certain people turning 55 or older to make early withdrawals from a 401. You typically must pay a 10% penalty if you make a withdrawal before age 59 1/2. You can make a withdrawal in the year you turn 55 or later if you leave your job for any reason. You can only withdraw funds from the 401 offered by your most recent employer.

You May Have To Sell Investments At A Bad Time

Pulling cash out of investment accounts after the market has fallen means youre locking in any losses youve incurred. Even if you reinvest these funds down the road, youll have missed reaping any gains those investments would have seen in the interim.

In 2020, the S& P 500 had its largest first-quarter decline in history, finishing down 20%. Stats like this can lead to panic selling, or, coupled with the loosened withdrawal rules, may tempt you to dip into retirement accounts to prevent further losses.

But remember: You havent lost anything until you sell. So if your cash crunch isnt an emergency, you can avoid losses by riding out the storm, and benefit from the rebound whenever it eventually occurs.

Don’t Miss: How Do I Locate An Old 401k

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

It Can Be Done But Do It Only As A Last Resort

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If your employer allows it, its possible to get money out of a 401 plan before age 59½. Taking that route is not always advisable, though, as early withdrawals deplete retirement savings permanently and, minus a few exceptions, carry a 10% penalty and a substantial income tax bill.

If you have no better alternatives and decide to proceed, youll need to get in touch with your human resources department. Theyll give you some paperwork to fill out and then ask you to provide some documentation. Once thats done, you should eventually receive a check with the requested funds.

Also Check: How To Borrow From Your 401k

What Are The Disadvantages Of Withdrawing Money From Your 401 In Cases Of Hardship

- Taking a hardship withdrawal will reduce the size of your retirement nest egg, and the funds you withdraw will no longer grow tax deferred.

- Hardship withdrawals are generally subject to federal income tax. A 10 percent federal penalty tax may also apply if you’re under age 59½. contributions, only the portion of the withdrawal representing earnings will be subject to tax and penalties.)

- You may not be able to contribute to your 401 plan for six months following a hardship distribution.