How Much Can An Employer Match 401 Contributions

One of the most common questions asked when it comes to 401 plans is what is the maximum amount an employer can contribute on a 401. The answer is the employer can match up to 6% of the employees contribution. This matching amount would be repeated each year, but is subject to change.

How this works out for a 50% match is the employer contributes 50 cents for every dollar you contribute to your 401 based on a maximum of 6% of your annual gross income. If your earnings are $50,000 annually and your maximum contribution is $3,000 . In this example, your employer matches half that amount, $1,500, so the annual contribution comes out to $4,500.

With a dollar-for-dollar plan, your employer will match your contribution to the plan until you reach the percent limit allowed. For example, a $50,000 salary with a maximum contribution percentage of 5% would allow you to put $2,500 into your 401. Your employer would match that figure with its 100 percent match resulting in a contribution of $2,500 for a grand total of $5,000 for the year invested into your 401 plan.

Before committing to a plan, its important to know how much your employer will be contributing. Discuss this with your employer or someone in your companys human resources department when you first set up the plan, and every year thereafter, as the contribution amount can vary based on how much your earnings change from year to year.

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits.

The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals.

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans.

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer match to your 401k contributions.

How Much Should You Contribute

Ideally, you’d take advantage of the IRS maximum contribution limit to your account year after year. But if that’s not possible financially, start by contributing enough to max out your employer contribution. If you’re not sure what that is, check with your company’s benefits administrator. They can walk you through the matching contribution policy and direct you on how to set up contributions.

“Contribute the maximum your household budget will allow, up to the maximum annual contributions allowed by the IRS,” says Daniel Milan, managing partner at Cornerstone Financial Services. “At the very least, if your company offers a match, you should contribute at least the percentage required to get the maximum match, as that is free money you’re leaving on the table if you don’t.”

Pay attention, though. Your company may change its matching policy from time to time, so make sure to check in annually with your plan administrator. You’ll want to take full advantage of any employer contributions as long as it’s financially possible.

You May Like: What Age Can You Pull From 401k

Simple 401 Limits In 2022

Employers offering a SIMPLE 401 allow employees to save up to $14,500 in 2022, which is up by $1,000 from 2021. Those age 50 and older may contribute another $3,000 for a total of $17,000.

Employers can contribute dollar-for-dollar up to 3% of a workers pay or contribute a flat 2% of compensation regardless of the employees own contributions. Employer 401 contributions are subject to an employee compensation cap of $305,000 for 2022.

Why Are States Mandating These Retirement Plans

Some states have begun mandating retirement plans as a way to address the retirement savings gap in this country. Their response is based on research that shows:

- The average working household has virtually no retirement savings1

- Employees are more likely to save when they have access to a 401 or similar plan by their employer2

- Only four in 10 businesses with less than 100 employees offer retirement benefits3

Also Check: When You Quit Your Job Do You Get Your 401k

Also Check: Is A Solo 401k A Qualified Plan

How Much Should You Match 401 Contributions

Employers 401 match amounts vary widely. However, all contribution limits and withdrawal regulations must comply with the standards of the Employee Retirement Income Security Act. Otherwise, you can set your 401 contribution rates however you please.

There are two especially common methods for determining how much money you should contribute to your employees retirement accounts:

- As a percentage of an employees wages: Some employers will match all employee contributions up to a contribution limit equal to a percentage of an employees wages. For example, if you set a contribution limit of 4% of an employees income and the employee makes $50,000 per year, you will contribute at most $2,000 over the course of the plan year. Note that if your employee contributes less than $2,000 to their retirement account, you have to match only that amount, not the full $2,000.

- As a percentage of an employees contributions: Other employers will match a percentage of contributions instead. For example, if you choose to match 40% of your employees contributions with the same 4% contribution limit as in the prior scenario, then for an employee with a $50,000 annual salary, your employer contribution limit isnt $2,000 over the course of the plan year. Instead, its $800 .

Did you know?:Self-employed 401 plans may not offer employer matching, but they still allow independent contractors and sole proprietors to save for their retirement.

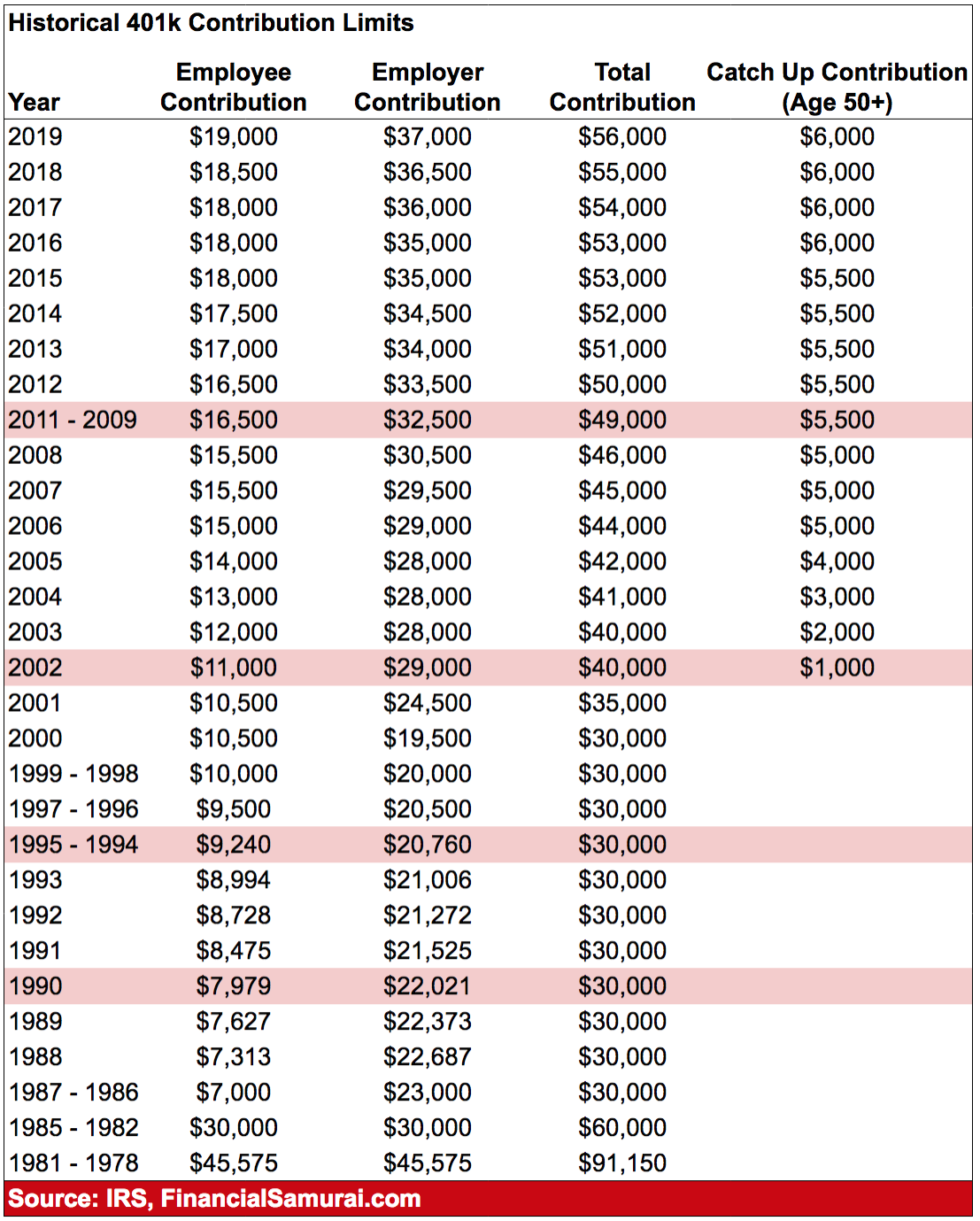

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

Recommended Reading: Can You Transfer Money From 401k To Bank Account

$1 Million Has Long Been The Recommended Goal For Retirement Savings Some Even Suggest That Number Should Be Upgraded To $2 Million For Millennials And Gen Z

If these numbers are starting to give you anxiety, youll be happy to hear that theyre reachable. According to Fidelity, the number of 401 plans with a balance of $1 million or more jumped to a record 168,000 in the second quarter of 2018, up from 119,000 a year earlier. Thats a 41 percent surge!

One of the top ways to make a $1 million 401 a reality is to take full advantage of your employer match. Thats when an employer contributes an amount to your retirement savings plan in addition to what you contribute. The rules for matches vary by company, and often depend on the amount that you contribute yourself.

Lets break down how employer matching works, the key rules to review, and how to maximize contributions to your workplace retirement plan.

Also Check: How To Find Out If Someone Has A 401k

Re: Formula To Calculate A 401k Company Match

Trish wrote:> The company I work for will match employees 401K with the> following: The first 3% the company matches 100%, the 4th> and 5th % the company will match 50%. Does anyone know> a formula that will calculate this, I need to figure this> semi-monthly.I presume you mean that anything above 3% and less than orequal to 5% is matched at 50%. If the salary is A2 and thepercentage contribution is in B2:=A2*MIN + 50%*A2*MAX)or equivalently:=A2* + 50%*MAX))You probably want to put all that inside ROUNDDOWNor ROUNDDOWN to round down to dollars or cents.However, if you mean that anything under 4% is matched100% and anything between 4% and 5% inclusive is matchedat 50%, that is harder. Post again if this is your intent.

You May Like: Should I Move Money From 401k To Roth Ira

You May Like: How Much Should I Put In 401k

Is Backdoor Roth Still Allowed In 2021

In 2021, single taxpayers cant save in one if their income exceeds $140,000. High-income individuals can skirt the income limits via a backdoor contribution. Investors who save in a traditional, pre-tax IRA can convert that money to Roth they pay tax on the conversion, but shield earnings from future tax.

Read Also: Can I Transfer Part Of My 401k To An Ira

What Is 401 Employer Matching

401 employer matching is the process by which an employer contributes to an employees retirement account based on the employees contributions. Employers tend to set their 401 contribution limits based on the employees annual salary. In other words, an employers contribution rate may be at most a certain percentage of the employees salary. For example, an employer may be willing to match 50% of an employees contribution, up to 6% of their annual salary. So, if the employee contributed 6% to their 401 plan, the employer would contribute an additional 3% to the employees retirement savings.

Rarely, some employers instead set a contribution limit of a predetermined dollar amount thats unrelated to the employees annual salary. In either case, these contributions are typically made per pay period and reflected on the employees paycheck.

Key takeaway: 401 employer matching is when an employer also contributes to an employees retirement account based on the amount the employee contributes.

You May Like: What Percent Of Paycheck Should Go To 401k

The Maximum You Can Put Into A 401 In 2022

-

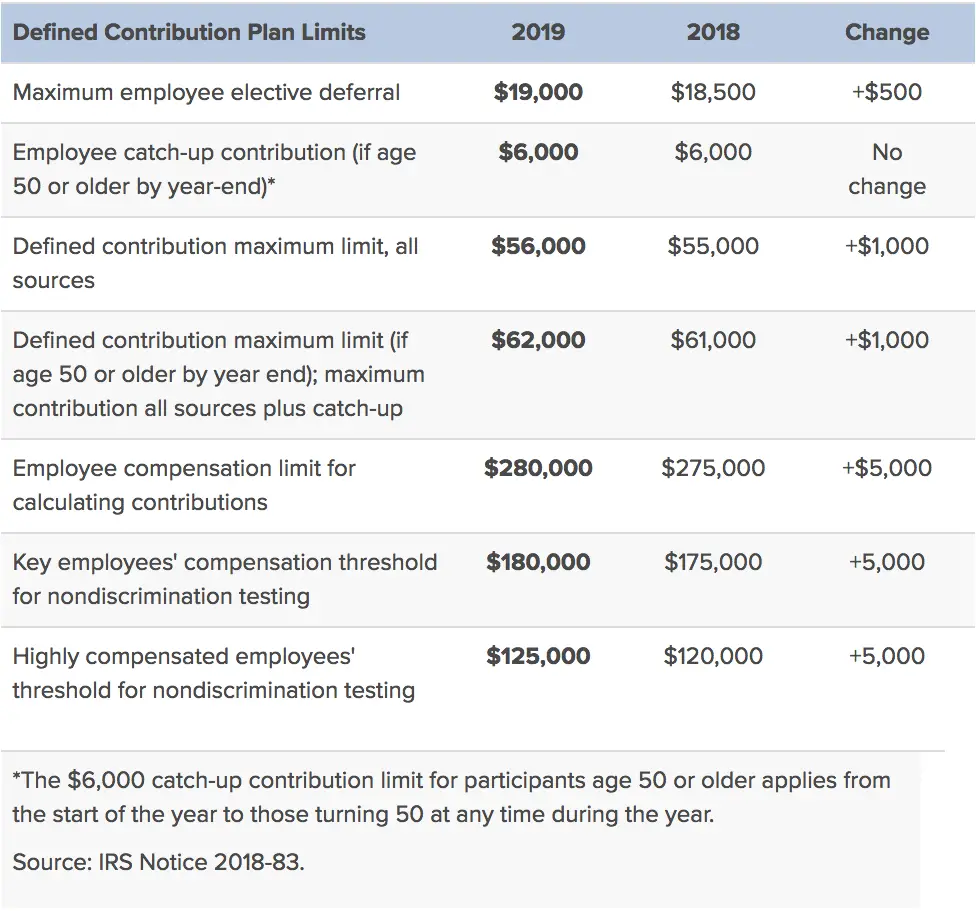

If youre under age 50, your maximum 401 contribution is $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $27,000 in 2022, because you’re allowed $6,500 in catch-up contributions.

For 2022, your total 401 contributions from yourself and your employer cannot exceed $61,000 or 100% of your compensation, whichever is less.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000, and contribute 5% of your salary , and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

Do I Qualify For 401 Employer Match

Your eligibility for employer 401 matching depends entirely on your employer. Not all employers offer a match program. According to statistics from the Bureau of Labor Statistics in 2015 around 51% of companies with a 401 offer some sort of match.

Its important not to assume your employer has automatically enrolled you for contribution matches. Be sure to ask when your matches will take effect. If youre unsure whether your employer offers a match program at all, dont be afraid to ask your boss or human resources representative about the company policy. Be sure to ask about the guaranteed match amount and what the match limits are.

Some firms may also have a vesting period for their contributions. This means that while the company may match 5% of your contributions, those contributions arent permanently yours until youve been at the company for a predetermined amount of time. If you leave before that time is up, you lose that money from your account.

Vesting schedules vary. Some companies have no vesting period, meaning all matching contributions are yours right away. Others have a vesting cliff at which point all of your matching contributions become permanently yours. Others have a schedule where a certain amount of your vested matches say 20% become permanently yours each year.

Don’t Miss: Why Do Employers Match 401k

What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

Matching Helps You Reach Your Retirement Goals

There are several benefits to 401 matching.

First, the amount of money taken from your paycheck is pre-tax. So is the amount your employer will match. This means that you dont pay taxes on this money. Of course, this is true whether or not your employer matches your contributions.

Youll pay taxes when you take the money out when you retire. But during retirement, you may be in a lower tax bracket. This means you wont pay as much in taxes on your retirement income as you would during your prime working years.

Another benefit is that both your employers contributions and your own belong to you. Even if an employer makes a contribution, you can take this money with you when you change jobs.

Of course, you can only take what belongs to you based on the companys vesting schedule.

Most importantly, 401 matching can make retirement planning less stressful and help you reach your retirement savings goals.

At birth, life expectancy in the US is 78.7 years. But at age 65, the amount of time left youre expected to live is 19.5 years.

This means that you need to account for almost 20 years of savings if you want to retire by age 65.

And while social security does provide some money for retirees, the average monthly amount for retired workers is $1,388.08. You also need to account for medical expenses and healthcare costs.

On average, the estimated amount youll need to cover medical expenses during retirement is $295,000.

Also Check: Should I Use 401k To Pay Off Debt

The Short And Simple Answer Is No But

If you participate in a 401 plan through your employer, congratulations. You’ve made a very important step toward securing your financial future. But keep in mind that you must adhere to the maximum contribution limits set by the Internal Revenue Service . Some employers also contribute to their employees’ plans. If yours does, you may be left wondering whether those contributions affect how much you can sock away yourself.

The short and simple answer is no. Matching contributions made by employers do not count toward your maximum contribution limit. But the IRS does place a limit on the total contribution to a 401 from both the employer and the employee. Keep reading to find out more about contribution limits and what they mean to you.

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

One of the advantages of these plans is the power of payroll deduction, said Young. You pay yourself first, automatically, every paycheck, making retirement savings easy.

Use Vanguards plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employers match.

Read Also: Can You Open 401k Your Own

Don’t Miss: Can You Take Money From 401k Without Penalty

Wells Fargo 401k Match

New employers are eligible to get Wells Fargoâs match after completing one year of service.

Once they’ve met this requirement, Wells Fargo will match their 401 contributions dollar-for-dollar up to 6% of their eligible compensation every quarter. Also, employees may benefit from a discretionary profit-sharing contribution to their retirement account depending on the company’s financial performance.

Wells Fargo employees get 100% vesting on the matched contributions regardless of their years of service.

Are There Rules For 401 Matches

Employees can make pre-tax contributions to a 401 plan up to the $20,500 maximum for 2022 . Employer contributions may lead to a total contribution in excess of $20,500* that is, theyre outside the annual contribution limit applied to employees.

An employer is typically the one to set rules around their maximum contributions. Its largely driven by the matching formula and rules that the employer lays out.

One more caveat to know here: If the employee is also the employer, e.g., if they are self-employed, then an employee can contribute up to $57,000 for 2020 *, or 100% of their compensation, whichever is less.

*$20,500 if theyre under age 50 $27,000 is the annual contribution limit for employees if the employee is age 50 or older. $57,000 is the total if youre under age 50. If youre age 50 or older, the $6,500 catch-up contribution can be added on top.

Read Also: How Much Can I Borrow From My 401k Fidelity