How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Cons Of A Total 401 Cash

Youre losing investment potential.

A large loss of accrued gains can impact your retirement plans.

Youre incurring tax and penalties.

The IRS charges a mandatory 20% withholding tax since this is considered income thats thus far been tax-deferred, and an early-withdrawal penalty if youre younger than 55. State and local taxes, depending upon where you live, may also apply.

Rolling Into A New 401

If your new employer also offers a 401 plan, you may be able to roll your existing account into the new one. In order to do so, youll want to contact the plan administrator of your new employers to see if they accept transfers. There may be restrictions for doing so for example, you may have needed to work at your company for a full year before being permitted to do so.

Like rolling into a traditional IRA, you wont owe taxes on this money until it comes time to withdraw from your new 401 plan.

Recommended Reading: When Can I Withdraw From 401k

Who Are Roth Iras Best For

Roth IRAs are best for those whose modified adjusted gross income are below or within the ranges, but the contribution space is reduced as you reach the upper bounds of the ranges. The limits for 2022 are:

- $6,000 for those earning equal or less than $129,000 as single filers with a phase out to zero contributions at $144,000

- $6,000 for taxpayers earning up to $204,000 with a phase out to zero at $214,000

Roth IRAs also make sense if you expect to have significant income into retirement. A common strategy is to withdraw any taxable contributions from other plans to stay within a set tax bracket and then use the Roth IRA as a top up when needed for lifestyle reasons. From a tax perspective, your goal into retirement is to have accounts with a tax burden drawn down to zero by the end of your life and have your financial legacy set up in such a way that it minimizes the estate taxation for your heirs. The Roth IRA is an ideal tool for that role.

Should You Convert To A Roth Ira Now

Once youâve decided a Roth IRA is your best retirement choice, the decision to convert comes down to your current yearâs tax bill. Thatâs because when you move money from a pre-tax retirement account, such as a traditional IRA or 401, to a Roth, you have to pay taxes on that income. It makes sense: If you had put that money into a Roth originally, you would have paid taxes on it for the year when you contributed.

Another issue is that the Build Back Better bill, currently before the Senate, could limit or ban some types of conversions.

-

Roth IRAs deliver huge tax advantages, including tax-free growth and tax-free withdrawals in retirement.

-

You can withdraw contributions from a Roth IRA at any time, for any reason, tax-free.

-

Unlike traditional IRAs and 401, a Roth doesn’t have required minimum distributions.

-

You pay tax on the conversionâand it could be substantial.

-

You may not benefit if your tax rate is lower in the future.

-

You must wait five years to take tax-free withdrawals from the Roth after a rollover, even if youâre already age 59½.

A Roth IRA rollover is most beneficial when:

Read Also: Can I Rollover Current Employer 401k To Ira

How Are Taxes Paid On A Roth Ira Conversion

The federal tax on a Roth IRA conversion will be collected by the IRS with the rest of your income taxes due on the return you file for the year of the conversion. The ordinary income generated by a Roth IRA conversion generally can be offset by losses and deductions reported on the same tax return.

Youll Owe Taxes But It Can Still Make Sense To Rollover

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Saving for retirement is an important consideration, and 401 retirement savings plans, offered by many employers, can make it easy. But what happens if you change jobs? You can always keep your existing account, but you also have the option to transferor rolloveryour account into an individual retirement account .

There are two main types of IRAs from which to choose. Traditional IRAs let you set aside some of your income, before its taxed, just like your typical 401. Youll pay taxes later, during retirement, when you make withdrawals. By contrast, Roth IRA contributions are made from funds that have already been taxed. When you withdraw those funds during retirement, you wont be taxed again.

Depending on the type of 401 you have, rolling over to a Roth IRA may have some tax consequences. Lets take a look.

Recommended Reading: Is A 401k Good To Have

Leave Money In Current Plan

If you have more than the minimum amount in your 401 , you can often keep your money in your previous employers 401. You will no longer be able to contribute to the account and you will lose some of the benefits , but you will still be able to access your account, make investment changes among the various funds that are offered, and get monthly statements. Some 401 plans also provide assistance to help you manage the account at an additional cost. It is important to note that by keeping your money in your old retirement plan, you accept limitations on the number of and types of investments you can utilize and the location of the account. In addition, your past employer has the ability to add or remove investment options and to change the company where your account is held.

Each 401 plan has a document called a Summary Plan Description . The SPD will describe what investment funds are included and what the expense ratios are for those funds. 401 plans also offer a fee disclosure document, which explains the costs of the plan to participants. These documents are important to review as part of your decision.

Leaving your money in a 401 offers two additional benefits:

You May Like: How Can You Take Out Your 401k

Roth 401s As An Alternative

A Roth 401 combines the employer-sponsored nature of the traditional 401 with the tax structure of the Roth IRA. If your employer offers this type of plan, youll contribute after-tax money to your account and you wont owe taxes when you start receiving distributions. If your employer offers a match, though, that money is in a traditional 401 plan. So if you choose to convert it, you will owe taxes on it the year you do so.

If youre looking to do a rollover from a Roth 401 to a Roth IRA , the process is quite simple. All youll have to do is follow the same steps as if you were rolling over a traditional 401 to a traditional IRA. The tax structure is staying the same. If youre looking to convert your Roth 401 into a traditional IRA, youre out of luck. Unfortunately, this isnt possible, since you cant un-pay taxes on the money in your Roth 401.

Read Also: Why Cant I Withdraw My 401k

Invest The Money In Your Roth Ira

A common pitfall for people that go through this process is that theyll see the funds arrive in their Roth IRA, and think that the process is complete. It is not.

Youll need to go into the account and actively invest the money, ideally in the context of all of the accounts you have.

When youve completed this step, youre done! You now have a tax-exempt Roth IRA growing in perpetuity all with a zero tax liability .

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover and then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Don’t Miss: When Can You Take Out 401k Without Penalty

What Are The 401k To Roth Ira Rollover Tax Implications

Funds rolled over from a 401k to a Roth IRA are subject to current taxes of the rollover amount at the ordinary income tax rate for the individual. Once the funds are rolled over to a Roth IRA and remain there for five years, earnings are not taxed and withdrawals at retirement are not taxed.

To ensure that distributions from a Roth IRA are tax- and penalty-free, the funds must remain in the account for at least five years. If a rollover is completed on July 1, the five-year count starts from January 1 of that year. If there are multiple rollovers over several years, the five-year countdown begins anew for each set of funds as they are rolled into the Roth IRA.

Key Takeaway: The five-year rule countdown for withdrawing funds from a Roth IRA tax-free starts anew for each set of funds added to the account.

Convert Into A Roth Ira

The pros: Withdrawals are entirely tax-free in retirement, provided youre over age 59½ and have held the account for five years or more. Roth IRAs are also exempt from RMDs.

The cons: Because Roth IRAs are funded with after-tax dollars, youll have to pay taxes on your existing 401 funds at the time of the conversion. A Roth IRA must be open for five years in order to withdraw earnings tax-free, and youll be subject to a 10% penalty if you withdraw any money before youre 59½ without an exemption.

Recommended Reading: Why Cant I Take Money Out Of My 401k

Why Would You Choose A Roth Over A Traditional Ira Or An Annuity

Generally, people choose to convert to a Roth when they believe they are headed into a higher tax bracket in the future. That’s because you won’t pay taxes on distributions from a Roth after retirement.

Another good reason for choosing a Roth is the belief that your income will increase. While current tax law does not restrict Roth conversions based on income, contributions to a Roth IRA are. Let’s say you think you will earn more than the maximum allowable to contribute to a Roth in the future. You may want to invest in a Roth now and open a traditional account later so you can diversify your tax structure.

Finally, you may choose to convert your 401 to a Roth if you wish to hold off on making withdrawals for as long as possible. Federal law requires investors to take withdrawals from traditional IRAs and some other vehicles beginning at age 72Roth IRAs do not contain this stipulation.

Roll It Into A New 401 Plan

The pros: Assuming you like the new plans costs, features, and investment choices, this can be a good option. Your savings have the potential for growth that is tax-deferred, and RMDs may be delayed beyond age 72 if you continue to work at the company sponsoring the plan.

The cons: Youll need to liquidate your current 401 investments and reinvest them in your new 401 plans investment offerings. The money will be subject to your new plans withdrawal rules, so you may not be able to withdraw it until you leave your new employer.

Don’t Miss: Can I Move Money From 401k To Roth Ira

Should I Roll Over Traditional Ira Funds To A Roth

It depends on your tax situation. If you are in a lower tax bracket this year than you plan to be during retirement, a rollover may make sense. For example, if you had been furloughed or laid off due to the coronavirus pandemic, that year might be a good year to consider transferring some of your retirement funds into a Roth IRA. On the other hand, if you expect to be in a lower tax bracket during retirement, it is wise to keep your funds where they are currently.

Rolling Over A 401 To A Roth Ira: Should You Convert To A Roth

What are your 401 rollover options? You may consider rolling over an old 401 to a Roth IRA, which is properly described as a Roth conversion. Converting your old 401 or 403 to a Roth IRA is worth considering. A Roth IRA offers unique benefits unavailable in other types of retirement accounts: no RMDs, tax-deferred growth and tax-free withdrawals. But a 401 to Roth IRA conversion doesnt make sense in every situation. For high-earners, it may not make sense to pay tax on your retirement savings now.

Don’t Miss: How To Withdraw 401k From Old Job

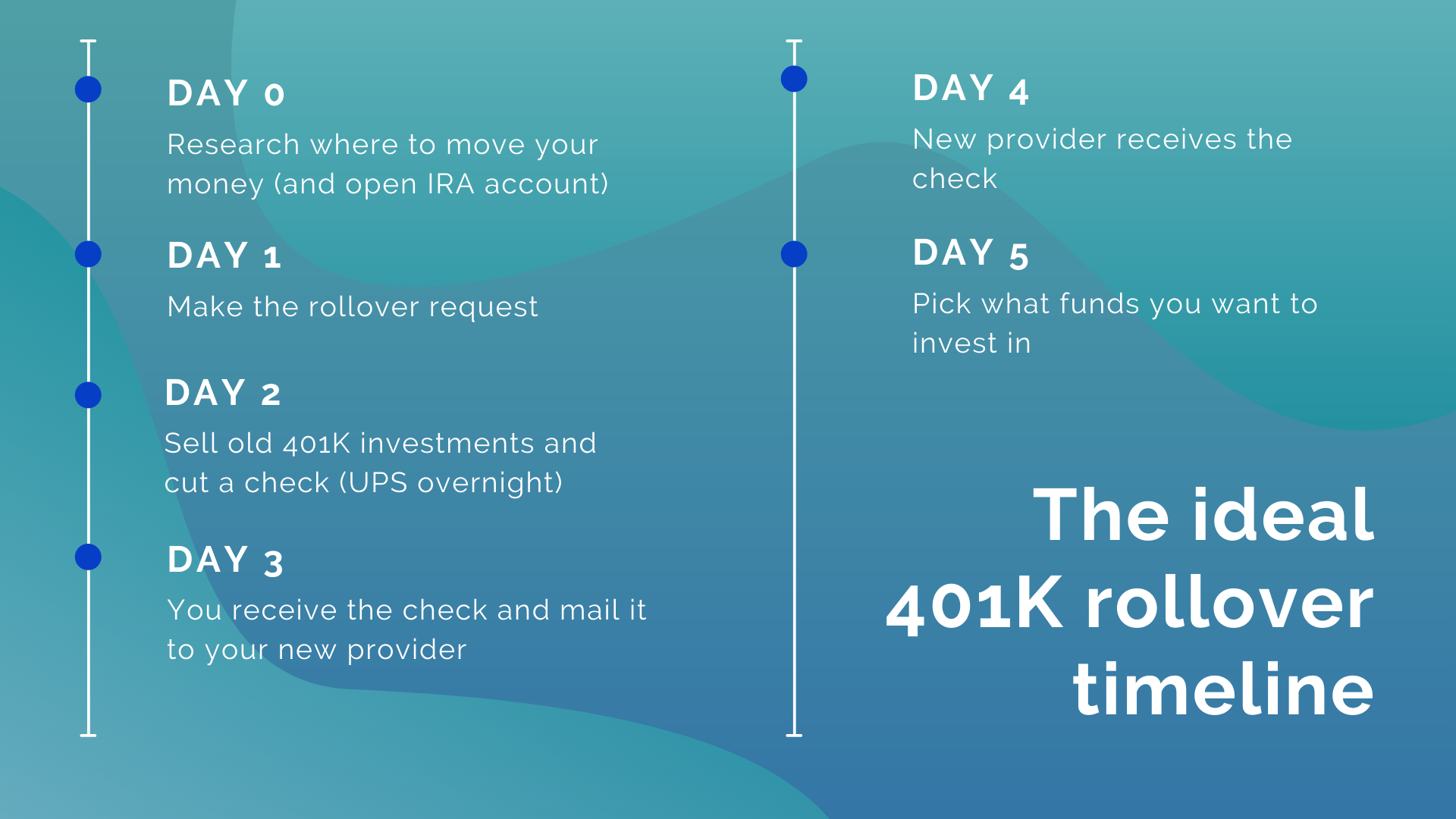

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

How A Roth Ira Conversion Can Leverage Currently Low Tax Rates

One of the potentially overlooked silver linings of the past years economic challenges is a favorable income tax environment created by the 2017 Tax Cuts and Jobs Act. If youre considering a Roth IRA conversion1 from your 401, youll be paying some of the lowest tax rates in history on those converted assets and doing it all at one time. However, if you went with a traditional IRA rollover, you may pay higher taxes in retirement on your RMDs.

If youve lost your job, or your income level drops, you can convert your 401 assets at your new, lower, tax bracket. Say, for example, you convert your 401 assets to a Roth IRA, you may be paying taxes at a reduced rate right off the bat, explains Markwell. And if taxes rise between now and your retirement target date, at which time youd otherwise take distributions, you will have further benefited tax-wise from that earlier conversion.

Keep in mind that establishing an IRA with efficient growth goals may call for more active management on your part, depending on your retirement goals. A financial professional can help tailor your investments to your individual strategy and also help you revisit and refine that plan as needed.

Don’t Miss: How To Invest My 401k In Stocks

How Does A Roth Ira Grow

A Roth IRA grows like every other investment accountthrough the magic of compounding. Your contributions in a Roth IRA are invested to earn interest and that interest helps to increase your overall portfolio balance, thereby helping earn more interest. The more time your money has in the market, the better the opportunity for greater returns over time. The money in a Roth IRA can continue to grow even after you stop making contributions as the ongoing returns continue to add to the balance and get reinvested. The financial institutions reviewed for this article all provide resources and guidance on diversifying a portfolio to ensure the right balance of risk and reward to intelligently grow your retirement savings in a Roth IRA.