Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arenât high fees and that the investments available work for you.

Other Things To Look Out For

When rolling over assets to a 401 or IRA, there are a couple of things to keep in mind. First, no amount is too small. Sharma stresses that even a small 401 account can make a big impact.

A small amount of money today can grow into a sizable sum with the power of long-term investing and compounding, particularly because money in an IRA can grow tax-free. For example, $3,000 in assets today could turn into over $40,000 at retirement if invested appropriately.

Kenny Senour, a certified financial planner for Millennial Wealth Management, cautions to keep an eye on investment options and their fees. He says, Your 401 plan may have access to a low-cost institutional share class with a high investment minimum. In this example, you may end up paying higher costs for an investment through a higher expense ratio for a comparable investment option in an IRA.

This means the same investment could be more expensive in a 401 than in an IRA.

Dmitriy Fomichenko President Sense Financial

The value of your 401k minus loan balance can be rolled over into an IRA if your plan permits doing partial rollovers. Some plans dont and require you to rollover the entire balance. That is if your 401k is with the past employer. If it is with the current employer the chances are you can not . So if you get OK to rollover the balance and continue paying the loan you are OK. Otherwise the outstanding loan balance will be considered a distribution which will result in taxes . You need to contact your plan administrator or custodian and discus this.

Also Check: How To Collect My 401k Money

Also Check: What Percentage Of Paycheck Should Go To 401k

How Does The Nerdwallet 401k Calculator Work

401 Calculator 401 Calculator NerdWallet calculates your 401 balance in retirement, considering your contributions, applicable employer dollar amounts, expected retirement age, and investment growth. New to 401s? Learn the basics from your 401 guide.

Roth ira vs brokerage accountWhat is the difference between an IRA and a brokerage account? The securities account is managed like a savings account with a bank. However, your brokerage money can grow faster because it is invested in financial assets. Consequently, the brokerage account is more focused on growth. An IRA can also be called a minor escrow or escrow account.What do banks offer Roth IRA?Roth Bank IRAs generally

Also Check: What Happens To Your 401k When You Die

What Are The Disadvantages Of Waiting To Roll Over Your 401

If your previous employer had a 401 plan with expensive investment options or otherwise high fees, youll want to look into moving the money to an IRA or your new 401 plan as soon as you reasonably can. The longer you leave the money there, the more the fees are working to eat away your hard-earned investment returns.

Next, leaving the account at your old employer can sometimes lead to it being forgotten. At the same time, a financial life with scattered accounts is much more difficult to manage. Its smart to consolidate to the extent possible and be proactive about optimizing the number of accounts you have.

There usually isnt a lot of upside associated with waiting, so its a good idea to create a plan and consolidate as soon as is practical for you. If you do decide not to roll over your old 401, make sure that its an active choice. So whatever you decide to do, be sure to give it some thought first.

Recommended Reading: Should I Convert My 401k To A Roth 401 K

How Direct Rollovers Work

A rollover occurs when one withdraws cash or other assets from one eligible retirement plan and contributes all or a portion of this to another eligible plan. The account owner may be subject to a penalty if the transaction is not completed within 60 days. The rollover transaction isnt taxable, unless the rollover is to a Roth IRA, but the IRS requires that account owners report this on their federal tax return.

To engineer a direct rollover, an account holder needs to ask his plan administrator to draft a check and send it directly to the new 401 or IRA. In IRA-to-IRA transfers, the trustee from one plan sends the rollover amount to the trustee from the other plan. If an account holder receives a check from his existing IRA or retirement account, they can cash it and deposit the funds into the new IRA. However, they must complete the process within 60 days to avoid income taxes on the withdrawal. If they miss the 60-day deadline, the IRS treats the amount like an early distribution.

Read Also: Should I Use My 401k To Pay Off Debt

What Is A 401 Rollover

A 401 rollover is when you take funds out of your 401 account and move them into another tax-advantaged retirement account. You can roll a 401 over into an individual retirement account or into another 401, most commonly when you get a new job with a new retirement plan. Either way, you should understand the best 401 rollover options for your particular situation.

Recommended Reading: How To Roll Your 401k Into A Roth Ira

Is A Partial 401 Rollover Possible

Yes under the right circumstances. The IRS has no problem with you rolling over a portion of your 401 into an IRA account plan). However, your particular 401 plan may not allow partial rollover as not all plans are set up for this and some will only allow you to roll over the entire lump-sum. To find out if a partial rollover is possible, contact your plan administrator.

Most people choose to roll retirement funds out of the 401 when they stop working for the company that sponsors it. One reason for this is to avoid collecting a bunch of different retirement accounts as you move from one job to another.

A similar question is whether you can rollover retirement funds from a current employers 401 plan ?

The IRS allows you to roll money over whether youve separated from the company or not. However, not all employers permit an in-service rollover. Youll have to check with your plan administrator or employer to find out if this is permitted at your company. The main reason for doing this is if you want to take advantage of investment options that are not available inside your current 401.

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

Also Check: What To Do With Your 401k When You Retire

Start Investing With Your New Ira

Ever IRA provider will have its own set of investments that it makes available to you. So hopefully during the account choosing process, you picked a brokerage that offers what you want. Once your account is open and fully funded, you can begin making investments as you see fit. Of course, if you go with a robo-advisor, this work is done for you.

In general, those close to retirement keep their investments on the safer side. This could involve investing in bonds or ETFs, both of which are typically reliable. On the other hand, someone further from retirement can afford to be riskier and more speculative. As a result, younger investors often include more stocks in their portfolio in an effort to achieve higher returns.

Can A Loan Offset Be Rolled Over

You can avoid paying taxes on the 401 loan offset amount by rolling it over to a 401 or other tax-qualified retirement plan. The funds for the rollover must come out-of-pocket so that the rollover amount can extinguish the loan liability. The participant can also use the 401 loan proceeds to pay the rollover. If the funds were already spent, you can take a bank loan to fund the rollover to the new employerâs 401.

Under the Tax Cuts and Jobs Act that became effective in January 2018, you must contribute an amount equivalent to the loan offset amount to the new 401 by the tax deadline. For example, if the loan offset occurred in 2020, you must contribute the amount of the loan offset by April 15, 2021. Before you rollover a loan offset, you must check with the plan administrator to confirm that the unpaid 401 loan will be treated as a loan offset and not a deemed distribution, since the latter cannot be rolled over.

Recommended Reading: How Do I Transfer My 401k To A New Job

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Roll Over 401 Into An Ira

For those who would prefer not to rely on their new companys 401 plan’s investment offerings, rolling over a 401 to an IRA is another option. Again, rollovers can be direct, direct trustee-to-trustee transfers, or indirect, with the distribution paid to the account owner. But either way, once you start the process, it has to happen within 60 days.

The best option might be rolling the money over into the new companys 401 plan. The 401 plan is simpler because the plan is already set up for you. It’s also less expensive, because costs are spread over many plan participants.

Recommended Reading: How To Rollover My Fidelity 401k

Take Advantage Of An Investment Option In The 401

Conversely, there may be an investment option available in your 401 that is not available in your IRA account. You may want to leave a portion of the funds in your 401 to take advantage of that opportunity. Remember, diversifying your portfolio is extremely important when it comes to investing and if you have access to something special inside your 401, its worth keeping some money there to take advantage of the investment opportunity.

Can A 401k Loan Be Rolled Over To Another 401k

When rolling over your 401 money to a new employer, you may consider rolling over a 401 loan to the new 401. Here are rules regarding 401 loan rollovers.

If your 401 plan offers 401 loans, you can borrow against your retirement savings to pay for college, medical expenses, or other immediate needs. Usually, these loans have a repayment period of up to 5 years, but this period could be higher if you are using the 401 loan to buy a home. However, if you have an outstanding 401 loan when you quit your job, you have until the tax due date to pay off the loan.

Normally, you canât rollover a 401 loan to another 401 when you leave your job for a new employer. You must pay off the outstanding loan balance, and if you default, the unpaid loan amount could be considered to be a deemed distribution or loan offset and you will owe income taxes and a potential penalty on the unpaid 401 loan. However, if the 401 plan is terminated or the former employerâs company is acquired by another company, you can rollover the 401 loan balance into another employer’s 401.

Don’t Miss: Can I Pull Money From My 401k

Its Easier To Take Advantage Of Roth Conversions

As you get closer to retirement, converting traditional IRA dollars to Roth dollars can be really advantageous as you drop into lower tax brackets. Theyre not for everyone, but they can be a powerful planning tool and you can only do them with an IRA.

Another thing to keep in mind when talking about Roths: RMDs are never required with a Roth IRA. But if you have a Roth 401, you have to start taking them when you turn 70½. So, at the very least if you have a Roth 401, youll want to consider rolling it over to a Roth IRA to avoid the hassle of RMDs.

Can I Roll Over A Portion Of My 401

There a few limited circumstances where a partial 401 rollover makes sense.

There are a few different investment options for retirement that most of you are using, such as traditional IRAs, Roth IRAs, and employer-sponsored 401 retirement plans.

These retirement plans allow you to squirrel away pre-tax money. When you take it out after you retire, the money is taxed at your current tax bracket rate, which will be presumably lower than your tax bracket while working .

Not all your retirement savings have to be in the same place and there are certainly tax benefits to mixing your retirement accounts across a mix of pre-tax and post-tax options.

Lots of people ask what they should do with an old 401 when they change jobs. Some people leave the 401 with the previous employer while others choose to move the old 401 to the new employer.

But what if you only want to rollover a portion of the money? Can you do that? Lets find out.

Read Also: How Much Should I Have In My 401k At 55

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if you’re leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employer’s 401

- Withdrawal from your 401, which would trigger a 10% penalty if you aren’t 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn’t offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration won’t allow you to stay invested for some other reason

- Your new employer’s 401 plan charges high fees, offers limited investments, or has other drawbacks

- You’d prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an “NUA strategy” that could save you a lot of money.)

If these downsides aren’t deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

How To Roll Over A 401 Into A New Retirement Account

Kenadi Silcox15 min read

So youve your old employer-sponsored 401 balance into a new account. Now comes the tricky part: deciding where your savings should go and figuring out how to actually get it from one account provider to another without doing damage to your wallet.

Heres everything you need to know about rolling over a 401, from beginning to end:

Also Check: How To Manage 401k In Retirement

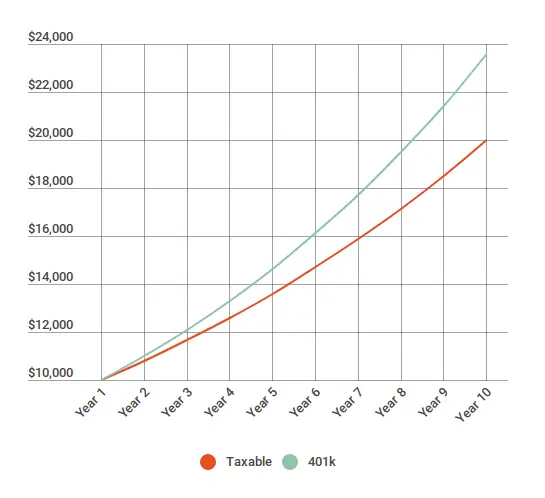

You May Be Able To Invest In Funds With Lower Fees

As a general rule, IRAs tend to be cheaper than 401s. You have more flexibility to find investments with lower fees when you invest with an IRA because its your account that you hold at an institution you choose. Your 401s leave you stuck with what your employer gives you within the plan. Its not out of the question to save 1% per year in underlying fees when you roll over to an IRA.

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

You May Like: Can You Use Your 401k To Start A Business