Implications Of Withdrawing From A Roth Ira Or 401

Contributions to a Roth retirement account are taxed in the year the income is earned, and all withdrawals after you hit age 59 1/2 are made without tax obligations as long as your plan is at least five years old. Similar to traditional retirement plans, cashing out your Roth IRA before that age will cost you a 10% penalty on all earnings within the plan.

For example, if you put $20,000 into your IRA in 2019, then you can withdraw that $20,000 tax- and penalty-free at the end of 2023, but any money that $20,000 has made is not eligible. Using a Roth IRA to start a business may be ideal if you have a large number of contributions that have been in your retirement plan for at least five years.

How You Can Use Retirement Funds To Start A Business

Getty

Entrepreneurship is one of the most important developments of modern economic life. Entrepreneurs help create new companies, which spur economic growth, create jobs, and introduce new technologies, products and services that improve our living standards and quality of life.

Starting a new business or franchise is not easy and is quite risky. Hundreds of thousands of small businesses open and close every year. In addition, about 20% of businesses fail in their first year, and about half of all businesses close after five years.

For many people, the hardest part is not coming up with a business idea or a potential business to buy, but finding the capital needed to start or buy the business. Too often, an entrepreneur doesnt even know that using retirement funds could be an option for investing in a new business.

Funding new business ventures has become a popular TV phenomenon. As the producers of the reality show Shark Tank know, watching would-be entrepreneurs market their business ideas, products or services has become extremely popular with the American public.

The first place entrepreneurs typically start when looking to fund a startup is personal savings. If they do not have sufficient personal savings, then third-party loans, such as Small Business Association loans, are a popular option. However, if acquiring a loan is not viable for you, then seeking third-party investors is often the last resort.

Taxable Distribution

401 Plan Loan

ROBS

Which Is Right For You?

Roundabout Prohibited Transaction Question:

While the solo 401k investment rules allow for promissory note investments, this transaction would result in a roundabout prohibited transaction because the rules do not allow for a transaction that is prohibited to be done indirectly. In other words, while your brother is not a disqualified party from a solo 401k investment perspective, if he were to turn around and loan those borrowed funds or other funds to you, the IRS would view as you essentially processing a promissory note from your own solo 401k which is prohibited. Dont confuse this rule with the solo 401k participant loan rules, though. To learn more about the difference between a promissory note investment and a solo 401k participant loan.

Recommended Reading: Should I Use My 401k To Pay Off Debt

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, though the employee can’t make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employer’s plan is well managed and you are satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

Using Your 401 To Fund Your Business

Mike Pred has led a successful career in Corporate America, with his latest position being the vice president of worldwide operations at Immucor. But when he left the firm last year, he wanted to try something newthat is, something entrepreneurial

So he looked at buying a franchise and saw that PrideStaff was a good fit.

But a big question remained: how to finance it?

The thought of taking on debt was not a good one. It just seemed too risky, even though he saw that many banks like Wells Fargo and BankOfAmerica offered solid programs geared for new business owners .

Yet there had to be another way. So as he talked to the folks at PrideStaff, he learned that many franchisees were using their 401s as source of financing. For Mike, it certainly looked like an interesting option

In fact, there was a nice tax advantage. The process allows me to use pre-tax dollars to fund my business, he said. I see this as an integral part of my exit strategy to the extent that when I sell my business, it will be under the protection of a 401k investment and I can roll capital gains back into my IRA for use when I am retired.

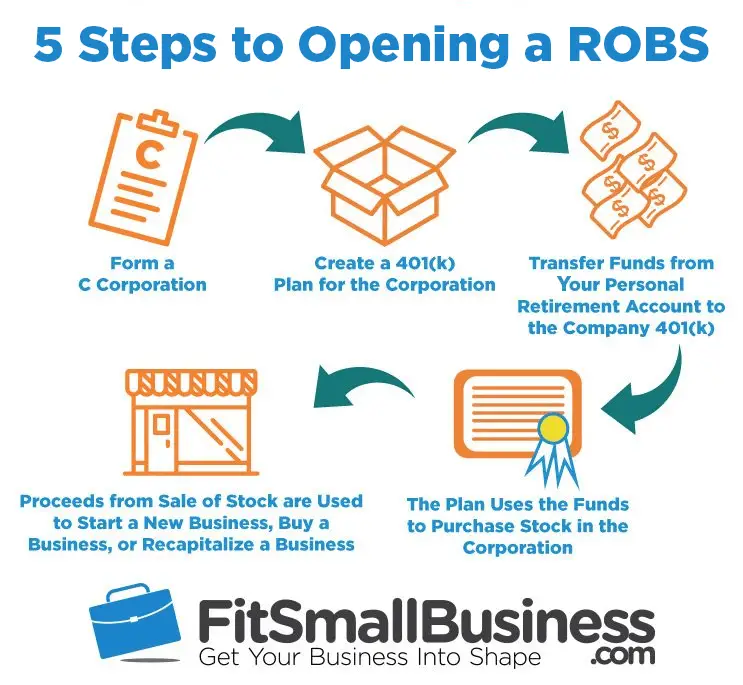

To pull this off, he sought the help of Catch Fire Funding, a firm that specializes in using 401s for financing businesses. And yes, the process was smooth and took a few weeks. The main steps included:

1. Create a C-Corporation

2. Create a 401 plan that is tied to the C-Corporation.

3. Rollover the retirement funds into the new 401 plan

Read Also: How To Find 401k Funds

Using Retirement Funds With Startup Loans

While the current average 401 balance has never been higher, according to Fidelity, it is only $123,900. This amount may not be enough to start or buy the business you want, and you may need additional financing. Small Business Administration loans are a popular source of financing for businesses however, many business owners also utilize personal funds to help get the financing they need.

You can utilize your retirement funds as part of your financing needs. Most lenders will require 20% of the loan package as a down payment. However, if you have sufficient funds available without significantly impacting your retirement account, you can lower your total debt and monthly payments by adding additional money down.

Provide Competent Qualified Financial Advisors

Its very beneficial for your employees to have someone to consult when they have questions about how to invest in their account and how much they should contribute. An advisor takes the burden of providing financial advice to your employees off of you. Be sure to properly vet your applicants for the financial advisor position, because poor financial advice can have serious financial and legal consequences.

Recommended Reading: Can You Contribute To 401k And Roth Ira

How Do I Start A 401

If you work for a company that offers a 401 plan, contact the human resources or payroll specialist responsible for employee benefits. You’ll likely be asked to create a brokerage account through the brokerage firm your employee has selected to manage your funds. During the setup process, you’ll get to choose how much you want to invest as well as which types of investments you want your 401 funds invested in.

Investment Real Estate Swap Question:

Good question. However, such transaction would run afoul with the prohibited transaction rules. While it is true that siblings are not disqualified parties on the surface, what would make such transaction prohibited is that the siblings would be using their respective solo 401k plans to swap their personal investment properties.

You May Like: How To Cash Out My 401k

Fully Legal And Irs Compliant

In 1974, Congress enacted the Employee Retirement Income Security Act to shift the burden of building retirement assets from the employer to the employee. ERISA, when paired with specific sections of the Internal Revenue Code, makes it legal to tap into your eligible retirement accounts without an early withdrawal fee or a tax penalty.

What Is A 401 Plan

A 401 plan is a retirement savings plan offered by many American employers that has tax advantages for the saver. It is named after a section of the U.S. Internal Revenue Code .

The employee who signs up for a 401 agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds.

Also Check: How Much Does A 401k Grow Per Year

Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

The 411 On 401 Upsides

Retirement plans are a great way for employers to attract and retain top talent. Employers should also consider the tax benefits of offering a 401 plan, particularly the advantages of matching employee contributions. To ensure compliance, businesses must evaluate the hours of full- and part-time employees when determining who is eligible for company-sponsored retirement plans. But by following the tips above, youll reap the rewards of offering this valuable retirement benefit to your employees.

Kimberlee Leonard contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

You May Like: Is There A Fee To Rollover 401k To Ira

Understand What A 401 Is

While you sign up for your 401 through the company you work for, it is typically managed by a separate financial firm, such as Vanguard, Fidelity, Principal, Schwab, etc. This is the company you will receive important information and disclosures from about your account and investments.

If you leave your employer, in most cases your account will remain at the financial firm that originally managed it, unless you roll it over to a new company .

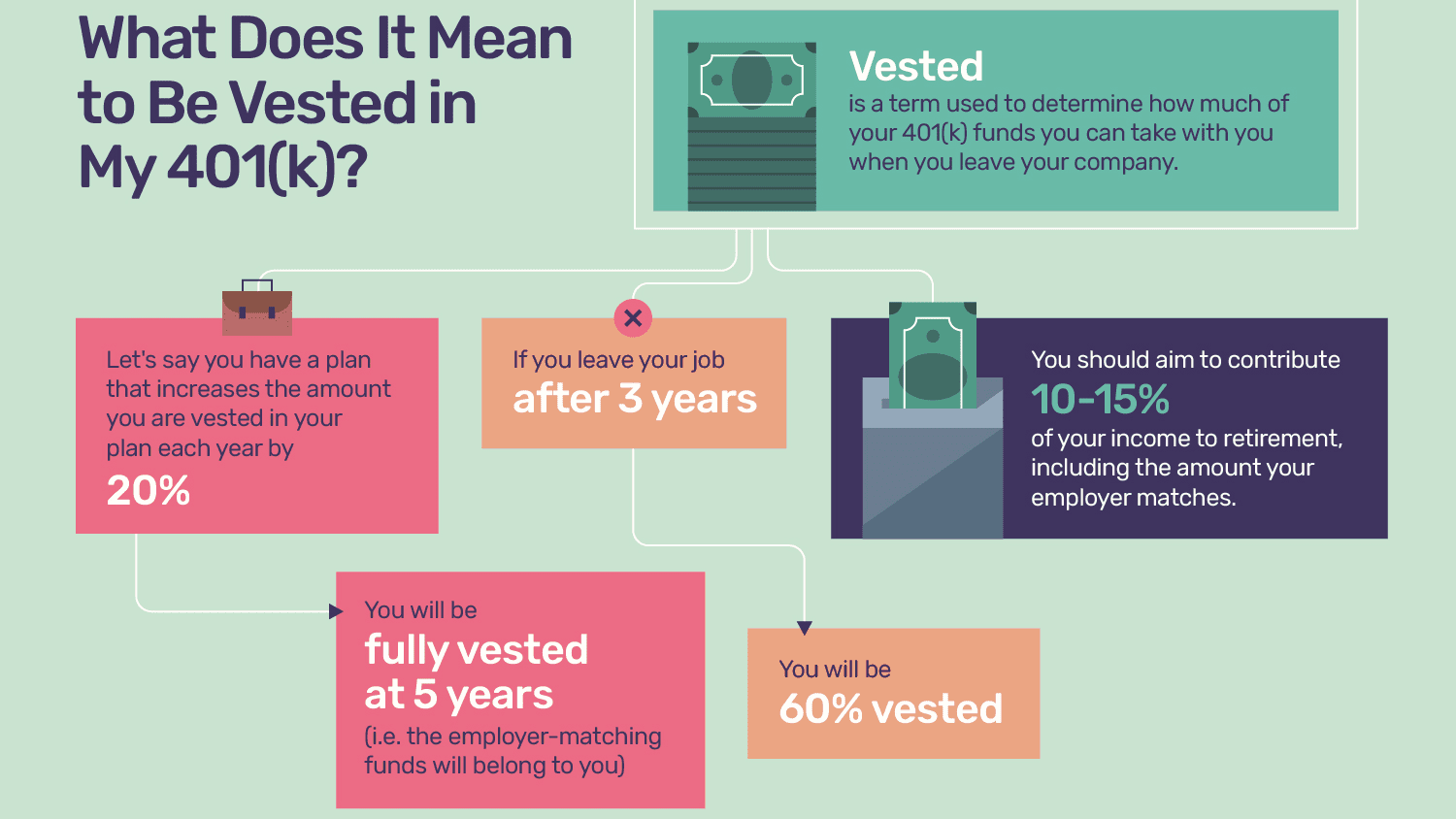

You can begin withdrawing money penalty-free at 59 ½ in most cases. If you withdraw money before that age, you will be hit with a 10% early withdrawal penalty and pay income taxes on the distributions. You can also take a 401 loan, which needs to be repaid, including interest. Learn more about that here.

Not every employer offers employees a 401. If that’s the case, you can open an IRA, which also offers tax advantages for those investing for retirement, on your own through a brokerage firm.

Can I Use My 401 Funds

This may come as a shock to some 401 plan participants, but a plan participant is not permitted to rollover current employer 401 funds to an IRA or another 401 plan unless there is a plan triggering event. The plan triggering rules essentially restrict a plan participant from rolling over 401 plan funds to another retirement plan or take a distribution, except for certain hardship exceptions, until they reach the age of 5912, their job is terminated, or the plan is terminated. Hence, unless a plan participant can satisfy one of the plan triggering rules or specific exception, such as a hardship, he or she will likely not be able to do a rollover of defined contribution plans to a self-directed IRA.

Read More:ROBS Solution for Entrepreneurs

Recommended Reading: How Can I Borrow Money From My 401k

Use A 401 Business Loan To Finance A Business

If youre looking into using a 401 to start a businessâor finance an existing oneâyou might consider getting a 401 business loan, especially if you need less than $50,000 in financing and plan to stay employed for the time being. What is a 401 loan?

If your 401 or other eligible retirement plan allows loans, then the IRS permits you to borrow up to half of your vested balance, or $50,000âwhichever is less. This amount you borrow, therefore, is your 401 loan, which can be used for any eligible purpose, including business purposes. With this loan, you will be charged interest, however, since youre borrowing from your retirement plan, youre actually paying the principal and interest back to yourself.

The key with this type of 401 business financing, though, is that you have to remain employed and enrolled in your employer-sponsored retirement plan while the loan is outstanding. If you lose your job or decide to leave, youll have to pay back the full loan within two months. This being said, for most entrepreneurs, a 401 loan isnt practical unless theyre considering starting a business as a side gig for a while. In fact, most people use 401 loans not for business, but for personal expenses, such as medical bills or home renovation costs.

What Benefits Do Employers Get From Offering A 401 Plan

401 plans are funds that allow employees to contribute a portion of their wages to save for retirement.

Any business can set up a 401, a salary deferral plan to which employees can contribute part of their salary and have it not count as income on their W-2, said Christian Brim, CEO of financial firm Core Group. And oftentimes, businesses with fewer employees benefit most from them.

Here are some of the advantages for employers:

Also Check: How Much You Should Contribute To 401k

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

How Does It Work

It used to be that the self-employed were severely limited in how much they could contribute to their future retirements. Thanks to favorable tax laws, though, the Solo 401 rules changed that by giving you two ways to contribute as an employee and employer.

Employee contribution

You can contribute a pretax and/or Roth salary deferral as an employee of your business of $20,500 in 2022 or 100% of compensation, whichever is less. Employees aged 50 and older may contribute an additional $6,500 as a catch-up contribution.

Employer contribution

You can also contribute as an employer, and the limit is significant 25% of your eligible compensation up to $61,000 for 2022. For sole proprietors or single member LLC’s, employers can contribute about 20% of eligible compensation, depending on the type of business, up to a maximum contribution of $61,000 for 2022.

Also Check: Can You Rollover Your 401k Into A Roth Ira

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if you aren’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Also Check: How Much You Should Have In 401k By Age

How Much Can I Contribute To A 401 Plan

401 plan accounts have higher contribution limits than individual retirement accounts . In 2021, you can set aside up to $19,500 across your 401 plan accounts.

To boost your contributions even further, you might consider catch-up contributions. If you are 50 or older, you can contribute an extra $6,500 to your 401 account. This increased limit can help increase your savings as you near the retirement finish line. But you dont actually have to be behind in your savings to take advantage of catch-up contributions.

Note Transaction With Spouses Solo 401k Question:

Unfortunately, it would still be prohibited for your solo 401K to lend funds to your spouses solo 401K. Unfortunately, there is no way around this rule. The IRS still views your wifes solo 401k as a disqualified party because the solo 401k is for her benefit. Also, the rules do not allow for a solo 401k to obtain a loan for investing in tax liens or notes. However, the solo 4o1k plan can obtain a non-recourse loan when investing in real estate.

You May Like: How Much Employer Contribute To 401k

When Can I Withdraw From My 401 Plan

You can start to withdraw your savings penalty-free when you reach age 59 ½. Taking out your savings before that time could cost you an extra 10% on top of what youd normally pay in state and federal taxes.

When its time to start using your savings, be sure to consider the tax implications. In addition, once you turn 72, you typically have to withdraw a minimum amount annually to comply with distribution requirements

401 plans can be very useful tools in saving for retirement, particularly if you take advantage of features that your plan may offer to help maximize your savings. And the sooner you start saving in your 401 plan, the longer any investment earnings have to produce earnings of their own.