What Is A Good 401k Match

If your employer has a 401 match, you may be wondering how the employerâs match compares to other employerâs 401 match.

A survey by the US Bureau of Labor Statistics reported that only 56% of companies provide a 401 plan for their employees, with about half of these companies providing a 401 match. 41% of the companies with a 401 match up to 6% of the employeeâs salary, while only 10% of the companies match 6% or more of the employeeâs salary. The survey also reported a median 401 match of 3% of the employeeâs salary.

If your employer’s 401 match is above the average and median match, it means you have a good 401 match than half of 401 participants.

Recognize The Tax Advantages

In addition to potentially offering free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Contributions to tax-advantaged retirement accounts, such as a 401, are made with pre-tax dollars. That means the money goes into your retirement account before it gets taxed.* Plus, your contributions, any match your employer provides and any earnings in the account are all tax-deferred. That means you dont owe any income tax until you withdraw from your account, typically after you retire.

With pre-tax contributions, every dollar you save will reduce your current taxable income by an equal amount, which means you will owe less in income taxes for the year. But your take-home pay will go down by less than a dollar.

You May Like: How Do I Stop My 401k

Full 401 Matches In 2022

Full 401 matching means employers put in dollar-for-dollar what employees contribute, up to a set default rate or the IRS maximum. While 3% was the norm at one time, 65% of plans are now using a default rate higher than 3% in order to significantly boost savings for participants over time. In 2022, the most common default rate is now 6% of pay, according to the Plan Council Sponsor of America.

Read Also: How To Transfer My 401k From Previous Employer

Why Should You Offer A 401 Employer Match

Offering a 401 employer match as part of your small business 401 plan has three primary benefits for your company:

- Better recruiting: Not all companies offer a 401 employer match, so doing so can help your business stand out to top job candidates. Providing better benefits correlates with hiring better employees.

- Stronger employee morale and retention: Just as offering 401 contribution matching can draw better recruits to your business, this benefit can also improve morale among existing team members and increase employee retention at your company.

- Employer tax benefits: There are tax savings that businesses can take advantage of by offering 401 employer matching. Tax laws allow employers to claim their matching contributions as tax deductions.

Tip: Retirement savings plans are often considered a key part of a great employee benefits package. Whether they are a taxable fringe benefit depends on whether the plan is tax-deferred.

Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnand Roth 401 withdrawals arent taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

Don’t Miss: How Do I Check My 401k Balance Online

How To Take Full Advantage Of A 401 Match And Build Retirement Savings:

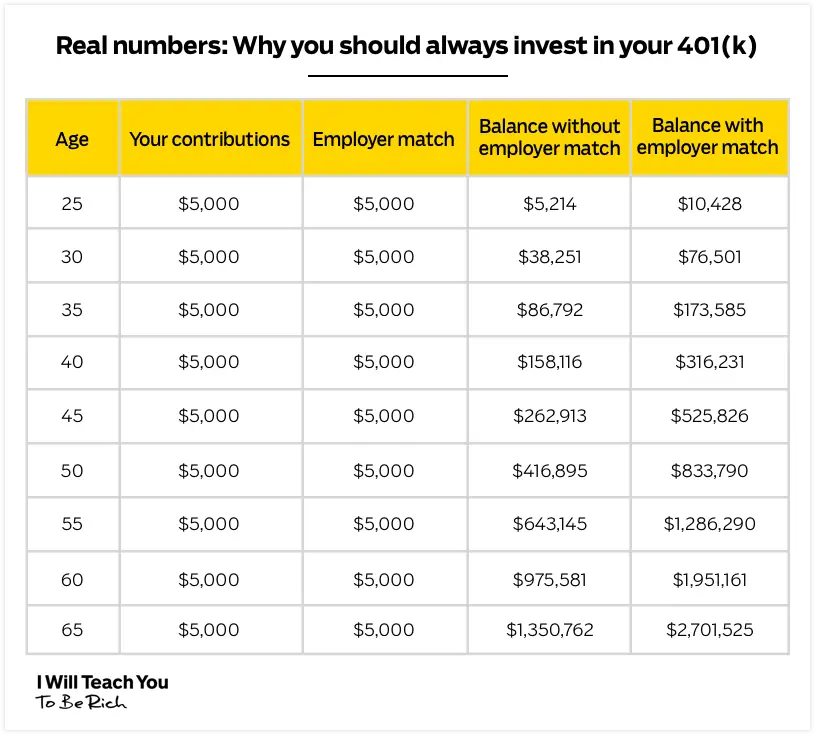

Your minimum goal as a 401 plan participant should be to make sure you dont leave any employer dollars on the table. Find out what the maximum employer match on your plan is, and make sure you contribute enough to qualify for that match.

Beyond that, though, there would most likely still be tax advantages and retirement saving benefits to be had by contributing more than you need to qualify for the full employer match. According to Vanguard, 47% of employees do this, making contributions that go beyond what is necessary to qualify for the full employer match available.

In most cases, you can contribute up to $19,500 to a 401 plan for 2020 . Chances are this is well above what you need to contribute to maximize your employer match, but your goal should be to come as close to this limit as possible. Doing so will enhance your tax savings and build your retirement nest egg more quickly and your employer match should help as well.

Finally, remember that your 401 plan is not your only option for retirement savings.

If you reach the IRS maximum for 401 contributions, there are still other ways from health savings accounts to after-tax savings that you can build a bigger nest egg.

Glossary:

Best For Payroll Services: Paychex

If you own a small firm and are looking into 401 plans but also need a payroll service, Paychex has what you need. It has an all-in-one service for small employers with a fine reputation. Paychexs lower-cost options are a nice break from some of the more expensive 401 providers.

Paychex also has HR services and benefits administration that you can use for your business. Business loans and other services also make up part of its services.

It is mainly an HR/payroll services company. However, it has teamed up with other 401 providers for you and takes care of your plan administration. If you choose to use its tax services, youll find it charges some extra fees for dealing with tax forms and tax services.

For one fee, Paychex makes for a less costly option for small companies that need more than one service.

Paychex has more than 100 offices around the country. Its customer support lines are open 24/7, making it easy to contact someone when you need help. Small employers are billed based on the number of workers and the number of pay periods each year.

Also Check: What Age Can You Take Out 401k

Don’t Miss: Can Anyone Get A 401k

Match Of The Top 41 Employers

Find out how 401 match works and the 401 match of top employers such as Amazon, Google, Microsoft, CVS, and others.

A 401 plan provides a convenient way to build a nest egg for retirement. An attractive feature of 401 plans is the companyâs 401 match, which helps employees grow their savings with some free money from the employer. If your employer offers a 401 match, you should find out if you are eligible to receive the match and start collecting the benefit.

401 match of top employers averages 6% of the employeeâs eligible pay. A 2020 study by Vanguard reported that 71% of companies matched $50 cents for every $1 an employee contributed up to 6% of the eligible compensation. Only 21% of these companies match employee contributions dollar for dollar.

Does Employer Match Count Toward Your 401k Limit

The amount the employer contributes to your account does not count toward your personal limit for contributions set by the IRS. There is a combined limit for the employee and the employer, however, that is higher than your personal one.

There are much better sites dedicated to understanding 401K programs. Im just trying to give some basics as you read up on companies with the best 401K match plans.

Recommended Reading: Can You Get Your 401k If You Quit Your Job

Fidelity National Financial Group

- 401 match: Up to 7% of contributions per pay period

- Total participants: 30,000

- Net plan assets: $1.84 billion

Part of the Fidelity National Financial Groups business involves advising some of the largest retirement plans in the country. So its no surprise that it offers a generous plan to its own employees. Fidelity matches employee contributions dollar for dollar up to 7% per pay period.

In addition, the firm built its investment menu with more than 200 proprietary mutual funds and options from other firms. BrightScope ranked the firm among the top 15% when it comes to total plan costs and praised the firm for having among the lowest fees in its study.

Staying Competitive For Top Talent

The pursuit of hiring great employees often comes down to what you can offer by way of compensation and benefits. Particularly when vying for quality talent with industry competitors, a 401 plan and even better, offering a company match can help your business stand out if candidates are weighing job offers.

Don’t Miss: How To Find Unclaimed 401k Money

Alternatives To An Employer 401 Match

Deferred annuities can offer premium bonuses on contributions that mimic an employers 401 match with no annual limits.

For example, an annuity may offer up to an 11% bonus on all contributions for the first seven years of the annuity. The 11 percent premium bonus mimics the employers match, and the employee has no annual contribution limits.

Unlike a 401, employees can open a deferred annuity without an employer.

Payroll Matching Vs Lump

When matching contributions, employers can choose to match 401 contributions every payday or make one lump-sum match per year.

Payroll matching is the most common matching formula that employers use. In this case, the employer matches the employeeâs contributions in each pay period, or with each paycheck. If you contribute to the 401 plan during the payroll period, the employer will make matching contributions to your 401 for that period. However, if you make contributions outside the payroll period, you wonât get the 401 match.

Lump-sum matching occurs when the employer matches contributions once a year as a lump-sum instead of every pay period. In this case, employees get matching contributions as long as they contributed to their 401 during the year, regardless of the number of times they contributed. Some large employers with tight budgets have shifted from per period matching to lump-sum matching as a cost-saving measure.

Lump-sum matching gained popularity when AOLâs CEO announced that the company was switching from payroll matching to a single lump-sum matching. However, AOLâs announcement received backlash from the public, forcing it to rescind its decision. By holding off the matching contributions until the end of the year, lump-sum matching denies employees the benefits of dollar-cost averaging and compounding interest.

You May Like: How Can I Find Old 401k Accounts

What Should Be Considered A Good 401k Match

Good is subjective, so that will be in the eye of the beholder of the 401K plan. But, I think I can provide some guidelines.

- Matching up to 3% of your salary seems to be the baseline to be considered a good, competitive 401K match

- Of the companies on this list that state their maximum match as a percentage of salary, the average is 6.1%

How Much Do Companies Typically Match On 401 In 2020

Dylan Telerski / 4 Aug 2020 / Business

Getting insight into how much companies are matching on 401s in 2020 will help you know how well your employer stacks up and whether youre in the right ballpark with your contributions.

Long gone are the days where a full pension or government stipend will guarantee you a secure future. These sources of income typically comprise less than half of what you would need to live comfortably in retirement. A 401 investment account is one of the best strategies to bridge the gap and save enough money for your post-retirement years.

In addition to the contribution deducted from your paycheck, about 51% of employers offering a 401 agree to match a certain amount of employee contributions. This generous bonus is literally FREE MONEY that employers add to your retirement savings that will gain interest and compound over time to help you reach your goals faster. There is, however, one caveat to the employer match in most cases , how much you receive depends on how much you put in.

Recommended Reading: How Much Can I Invest In My 401k

Your 2022 Guide To Employer Match And 401 Contribution Limits

Offering a matching 401 plan to your team is a great way to attract high-quality employees to your company. An employer-matched 401 can also help reduce employee churn as individuals recognize the financial significance of this benefit.

Many companies now opt for a 401 employer match program, rather than the traditional pension plan. Employer-matched 401 contributions allow for tax deductions for the employer. For this reason, there are 401 matching limits for how much employers can contribute to their employees 401 savings plans.

Learn more about what a 401 plan is, how employer matching works and the max 401 contribution company match limits over the past few years, including 2022 limits.

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Read Also: How Does A Company Set Up A 401k

Companies With The Best 401k Match Plans

Financial advisors call it free money. Im not sure Id go quite that far, but its a helpful way to think about the amount your employer will contribute to your 401K plan.

Heres an example.

If you make $100,000 and choose to contribute 3% of your salary to your company-sponsored 401K plan, youll personally put in $3,000. If your employer matches up to 3% , they will also put in $3,000. In that sense, its free money so long as you contribute yourself.

Depending on your personal goals, an employers retirement program could be a big part of your decision to work for a company. If thats the case, my friend, this is the best list to start your job search.

We compiled 100+ well-known companies with the best 401K match plans. We set the minimum at 3%, but some of the companies with highest 401K matches go up to 100%.

Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

Read Also: How Do You Max Out Your 401k

This Energy Titan Offers A Titanic Match

Oil and natural gas giant ConocoPhillips provides a match of 6% for all employees who contribute at least 1% to their 401 plans, plus an additional discretionary match of between 0% and 6% depending on factors like the companys performance. The company targets 3% for the discretionary match, putting the targeted match at 9% of an employees salary. Given the cyclical nature of the energy business, the flexibility in the discretionary match helps the company be generous when times are good and cut back when times are tough without affecting employees take-home pay.

A 787 Dreamliner Airplane. Image source: Boeing.

What Is The Best Possible 401 Employer Match

Employers rarely match 100% of employee contributions. Even if they do, there is a limit mandated by the IRS. For 2020, employees can contribute up to $19,500 to their 401 accounts. Employers can contribute up to $37,500 to reach a combined employee/employer total of $57,000. Employees over 50 can add $6,500 in catch-up contributions as well. So that would represent the best possible match an extra $37,500 put toward your retirement.

Recommended Reading: Can You Roll 401k Into 403b

Should I Take My Company Match

It depends. Most advice out there tells you that you should always take the company matchno matter what. But is that really the best advice? Nopeunless you have absolutely zero consumer debt to your name.

Debt is the biggest factor standing in the way of you and the retirement of your dreams. If you have any debt , its not going to disappear until you make it disappear. So instead of focusing solely on your future, you need to take a chainsaw to those chains holding you back . . . student loans, medical bills, personal loans, you name it.

So, if youve got some debt in your back pocket, we recommend holding off on all investingincluding your companys 401until you reach Baby Step 4. What are the Baby Steps? Glad you asked.

The 7 Baby Steps are Dave Ramseys proven and practical way for you to get out of debt, save for emergencies, build wealth, and change your life. Heres a look at the first four:

- Baby Step 1: Save $1,000 for your starter emergency fund.

- Baby Step 2: Pay off all debt using the debt snowball.

- Baby Step 3: Save 36 months of expenses in a fully funded emergency fund.

- Baby Step 4: Invest 15% of your household income in retirement.

We get it: Its hard to stomach wasting that free company match. That feeling right there is whats going to keep you working hard until youre completely debt-free. Why? Because who wants to waste time when theres free money on the line?

About the author

Ramsey Solutions