Can I Contribute To A 401k And An Ira

It is a question that comes up frequently when it comes to retirement planning: Can I contribute to a 401 and an IRA? The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans.

Fortunately for your retirement nest egg, you can contribute to both types of retirement accounts. In fact, both workplace and individual retirement accounts represent important building blocks in your retirement savings. Supplementing your workplace retirement account is a great way to boost your retirement savings and put even more of your money to work in tax-advantaged accounts.

An added bonus: IRAs also often offer more investment options than the typical 401 plan. Just as with your traditional 401, you may contribute pretax dollars to a traditional IRA and then benefit from tax-deferred growth and distributions. As I later cover, be aware that you can only contribute pretax dollars if you stay under certain income thresholds.

Read More: When is the IRA Contribution Deadline?

Talk To Hr About Enrolling In Your 401

If you’re interested in opening a 401, talk with your employer to learn about how your company’s plan works. Some employers automatically enroll employees and withhold a default amount of their paychecks, which you can change yourself at any time. You can also opt to stop contributing to the plan if you’re not interested in doing so right now.

Other companies require participants to declare their desire to participate in the 401. You’ll have to fill out paperwork saying that you’d like to contribute to the plan and how much money you’d like to set aside initially. You can always change this later.

You’ll also need to choose your beneficiary — the person you’d like to inherit your 401 if you die — when you sign up. Usually you choose a primary beneficiary and a secondary, or contingent, beneficiary who will inherit the 401 if the primary beneficiary is deceased or doesn’t want the money.

How To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as are given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by Dec. 31 in the tax year for which you are making contributions.

You can open a solo 401 at most online brokers and traditional brokers or directly through a financial services company. You’ll want to do some research ahead of time to identify the best solo 401 company for you.

You’ll need an employer identification number to get started with the enrollment process. If you don’t have one already, you can apply online directly to the IRS.The rest of the documentation will be provided by the broker or financial services company you choose for the account.

Don’t Miss: How To Start A 401k For My Company

You Can Designate A Wide Range Of Heirs For Your 401

When you sign up for a 401 plan at work, youll be asked to name beneficiaries: the people or other entities to inherit the account if you pass away.

When you first opened a 401, you may have overlooked the importance of naming the right beneficiaries and keeping that information up to date. In this guide, well take you through what you need to know to ensure that your assets are passed on as you would like.

How Much Does It Cost To Open A Solo 401

There is no cost to open a 401 account but watch out for those fees later on. While you’re researching your options, check for account maintenance fees, transaction fees and commissions, mutual fund expense ratios, and sales loads.

A fractionally higher fee can mean a big hit to a retirement portfolio. If you make the right choices you can minimize the fees you pay.

Don’t Miss: How To Get A Hardship Loan From My 401k

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contribution may be made up through the business tax filing due date plus extensions.

Read Also: Can I Rollover 401k To Ira While Still Employed

Is There A Solo Roth 401 K

Roth Solo 401k contributions have been allowed since January 1, 2006. While our plan documents allow Roth contributions, not all Solo 401k providers allow Roth contributions. Unlike deferrals made for regular solo 401k, the amount in arrears to the Roth Solo 401k does not reduce your taxable income for the tax year.

Can I have a Roth IRA and a solo Roth 401k?

True IRS rules allow both Roth Solo 401k and Roth IRA contributions in the same year / same time.

Can I open a Roth 401k without an employer?

If you are self -employed you can actually start a 401 plan for yourself as a solo participant. In this situation, you will be both an employee and an employer, meaning you can actually put more into your own 401 because you are a suitable employer!

You May Like: How To Find My Old 401k

Beneficiary: How It Works And What To Consider When Naming One

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

A 401 beneficiary is the person who will receive the money in your retirement account upon your death. That sounds pretty simple, but there are several things about naming a beneficiary that you should know especially if youre married, divorced or considering naming your children as beneficiaries. We will walk you through the ins and outs of picking a beneficiary, as well as what happens if you dont.

Also Check: How To Transfer 401k From Fidelity To Vanguard

The Problem With 401s

Let’s get one thing out of the way. Some 401 plans are better than others, so while your neighbor’s plan might leave much to be desired, your plan might be fantastic. But generally speaking, there are certain disadvantages you might encounter when you save for retirement in a 401.

First, let’s talk fees. You’ll commonly pay hefty administrative fees with a 401, and those generally aren’t negotiable.

Then there are investment fees to consider. Some 401s offer more choices than others, but if your options are limited, you could get stuck having to load up on mutual funds with high fees, or expense ratios, that eat away at your returns.

Now to be fair, most 401 plans do offer a combination of actively managed mutual funds and low-cost index funds, which are passively managed and therefore a lot less expensive fee-wise. But while index funds may be a cost-effective choice, they don’t give you a lot of say over your investments.

In fact, one major flaw of 401s is that they don’t let you buy individual stocks. To do that, you’ll need to look at opening an IRA.

Why is it important to choose your own stocks? Index funds do a great job of tracking and matching the performance of major indexes like the S& P 500. But if your goal is to beat the broad market, you won’t get there by loading up on index funds. Instead, you’ll need to assemble a mix of stocks that do well enough to outperform the market, which you generally can’t do in an employer-sponsored 401.

Don’t Miss: How To Cash In Your 401k

How A Roth 401 Works

Like Roth IRAs, Roth 401s are funded with after-tax dollars. You dont get any tax benefit for the money you put into the Roth 401, but when you begin to take distributions from the account, that money will be tax-free, as long as you meet certain conditions, such as holding the account for at least five years and being 59½ or older.

Traditional 401s, on the other hand, are funded with pretax dollars, providing you with an upfront tax break. But any distributions from the account will be taxed as ordinary income.

This basic difference can make the Roth 401 a good choice if you expect to be in a higher tax bracket when you retire than when you opened the account. That could be the case, for example, if youre relatively early in your career or if tax rates shoot up substantially in the future.

Dont Miss: Can I Roll My Roth 401k Into A Roth Ira

Can A Grandparent Open A Custodial Roth Ira

Grandparents can open a custodial Roth IRA at financial institutions that offer them. With a custodial Roth IRA, the grandparents maintain control of the account until the child turns either 18 or 21, depending on the state. After the grandchild reaches the specified age, she can use it however she wishes.

Don’t Miss: Should You Withdraw From 401k To Pay Off Debt

Roth 401 Income Limits

Roth 401s are also an ideal avenue for high earners who want to invest in a Roth but may have their contributions to a Roth IRA limited by their income. For example, if you are a single person, you can’t contribute to a Roth IRA in 2021 if your MAGI is over $140,000 , but there are no income limits for contributing to a Roth 401.

Those Who Retire Early Share These Traits

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Don’t Miss: What Happens To 401k When Changing Jobs

Be Smart With Your 401

Opening a 401 is a smart step on the road to a comfortable retirement, but itâs not quite as simple as signing some papers and setting aside a percentage of your paycheck. You have to understand the rules, choose your investments wisely, and continue to maintain your plan for as long as you own it. If you do that, you can feel confident that youâre giving yourself the best shot at a secure retirement.

Can I Contribute To Both A 401 And A Roth 401

Most employers that offer both a Roth 401 and a traditional 401 will let you switch back and forth between them or even split your contributions. Employers may even match Roth 401 contributions. In fact, if your employer offers matching dollars and you contribute to a Roth 401, youll also have a traditional 401 because the matching amount must go into a pretax account.

Using both accounts especially if youre not eligible for a Roth IRA because of income limits can enable tax diversification in retirement. Youll be able to choose whether to pull money from a tax-free or a tax-deferred pot, or a combination of the two, each year. That will let you better manage your taxable income.

|

one year of financial planning |

Also Check: How Long Does A 401k Rollover Take

You May Like: Can You Transfer Your 401k To Another Company

Which Account Is Better

Neither account is necessarily better than the other, but they offer different features and potential benefits, depending on your situation. Generally speaking, 401 investors should contribute at least enough to earn the full match offered by their employers. Beyond that, the quality of investment choices may be a deciding factor. If your 401 investment options are poor or too limited, you may want to consider directing further retirement savings toward an IRA.

Your income may also dictate which types of accounts you can contribute to in any given year, as explained earlier. A tax advisor can help you sort out what youre eligible for and which types of accounts might be preferable.

You May Like: Should I Roll My 401k Into An Annuity

A Couple Of Things To Remember

You own the money you contribute to your 401 so if you change employers, you can roll it over into your new employers 401 or another qualifying retirement plan account.

Keep in mind that your 401 plan operates on the assumption that you are saving for retirement so once youve put dollars in, there are penalties if you decide to take them out before you reach retirement age.

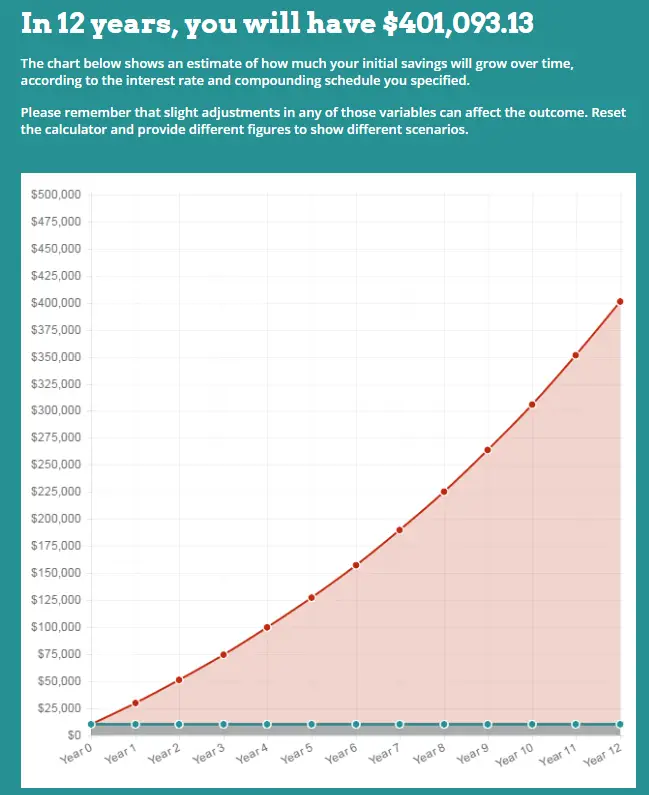

To withdraw the money means you also miss out on the advantage of time and its effect on compound interest.

Saving early and increasing your contributions as you go can help set yourself up for a secure retirement.

Also Check: How To Take Money Out Of My 401k

Larry Mcclanahan Financial Advisor

@LarryMcClanahan01/14/16 This answer was first published on 01/14/16. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

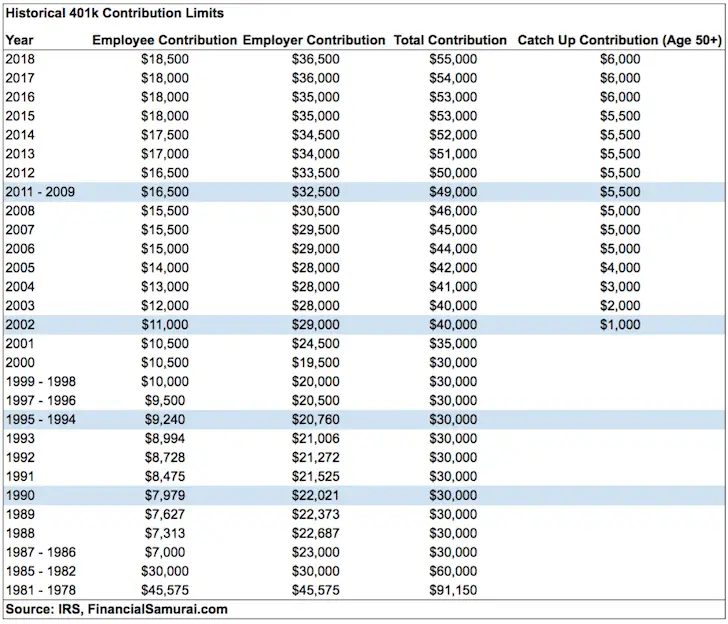

If you’re a self-employed business owner with no employees in your business, you can open a one-participant 401 plan. These plans are offered by many custodians and go by various name such as: Owner-K, Solo 401, Uni-K, and so on.If you’re eligible to move forward, be aware that total “salary deferral” contributions you make as “employee” will still be limited in 2016 to $18,000 of earnings for both plans combined . Only the employer contributions will be treated separately for the two plans.Further, if your current employer offers a matching contribution, don’t pass that up. It’s “free” money. Keep contributing at least what’s necessary to leverage that maximum match.I hope that helps. All the best!

Ad Disclosure:

What Is An Ira

IRAs are a great way to get started on your investing journey. An IRA is a retirement savings account that is not tied to employment. It stands for individual retirement account. You can open an IRA at most banks and brokerage accounts.

There are four main types of IRAs, and the two that you might come across most often are Roth and traditional. Depending on your investment goal, one might be better for you than the other. But theyre both great.

With a Roth IRA, you contribute income that youve already been taxed on. Whatever you contribute, you can take out whenever you wish with no penalties. At 59 ½, you can take out all your money and pay zero in taxes.

A traditional IRA works a bit differently. You put in pre-tax dollars, meaning anything you contribute is shielded from ordinary income taxes. Then, when you withdraw the money at age 59 ½, you pay taxes on it, plus the earnings.

Both IRA types have an annual contribution limit of $6,000. Experts generally recommend Roth IRAs for beginning investors, but you cant go wrong with either.

Don’t Miss: How To Cash Out My 401k

An Individual Retirement Account

Unlike 401s, IRAs arent tied to your employer. Anyone who has earned income can set themselves up with an IRA and start investing for retirement. Which is great news, because they come with some sweet tax benefits.

There are two main kinds of IRA traditional and Roth and you can use either or both . With a traditional IRA, you put tax-deductible money in today and then pay the taxes when you withdraw it in retirement. With a Roth, its the opposite. You put money in after paying taxes today, it can grow tax-free, and then you get to withdraw it tax-free, too.

The most you can put into an IRA is $6,000 a year . Thats the limit across both Roth and traditional accounts .

So thats a great place to start, even though you might not be maxing it out just yet. You can work your way up over time. But as you get closer to the age you want to retire, even investing the max on an IRA may not be enough to fund your entire retirement. Which brings us to

Roth And Traditional Iras

Often the first thing advisors recommend to those who don’t have an employer-sponsored 401 is opening a Roth individual retirement account, where you’d set up your own contributions with after-tax dollars.

“I love the Roth IRA for young investors,” said Tess Zigo, a certified financial planner at Emerge Wealth Strategies in Lisle, Illinois, adding that this is because young people are usually in a lower tax bracket early in their careers than they will be later.

Saving money in a Roth IRA means the funds will grow tax-free, meaning you don’t have to pay anything to withdraw the money in retirement. People using a Roth IRA can also put away a nice chunk of money each year. In 2021, the total you can save in a Roth IRA is $6,000, or $7,000 if you’re 50 or older.

More from Invest in You:10 work-from-home jobs that pay six figures

Of course, there are some limits. In 2021, your modified adjusted gross income must be less than $140,000 for single filers and $208,000 for those married filing jointly in order to qualify.

If you have taxable compensation, you could also save for retirement in a traditional IRA, which allows you to defer taxes, similar to a 401. This makes sense if you are in a higher tax bracket now than you will be later. In 2021, the contribution limit for a traditional IRA is $6,000 or $7,000 if you’re 50 or older.

Recommended Reading: Is There A Limit On Employer 401k Match