Manage Your Retirement Account Online

You made a commitment to your employees by offering them a way to help plan for their futures. Let us help you keep that commitment by offering an easy-to-use online retirement plan management website. You can view participant requests, manage transactions, and track participation anytime, anywhere.

See how our website can help you and your employees by watching this video. You can also read on to learn more.

You May Like: How Much Does Fidelity Charge For 401k

Check Your 401 Beneficiary

While youre in your online account dont forget to check that youve named a beneficiary for your 401 account. Typically, a spouse must be the beneficiary unless they sign a waiver. If youre not married its important to name a beneficiary in your account. The Motley Fool shares additional tips on when someone inherits a 401.

You May Like: What Are The Different 401k Plans

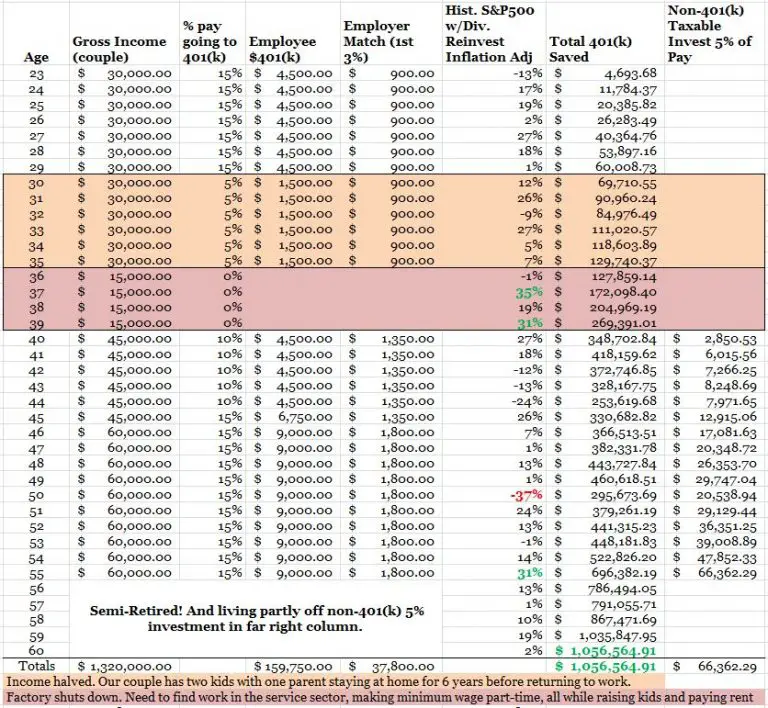

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

Recommended Reading: Can You Start A 401k Without An Employer

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

File Electronically And Choose Direct Deposit

The amount of the 2021 Recovery Rebate Credit will reduce the amount of tax owed for 2021, or, if its more than the tax owed, it will be included as part of the individuals 2021 tax refund. Individuals will receive their 2021 Recovery Rebate Credit included in their refund after the 2021 tax return is processed. The 2021 Recovery Rebate Credit will not be issued separately from the tax refund.

To avoid processing delays, the IRS urges people to file a complete and accurate tax return. Filing electronically allows tax software to figure credits and deductions, including the 2021 Recovery Rebate Credit. The 2021 Recovery Rebate Credit Worksheet on Form 1040 and Form 1040-SR instructions can also help.

The fastest and most secure way for eligible individuals to get their 2021 tax refund that will include their allowable 2021 Recovery Rebate Credit is by filing electronically and choosing direct deposit.

Anyone with income of $73,000 or less, including those who dont have a tax return filing requirement, can file their federal tax return electronically for free through the IRS Free File program. The fastest and most secure way to get a tax refund is to file electronically and have it direct deposited contactless and free into the individuals financial account. Bank accounts, many prepaid debit cards, and several mobile apps can be used for direct deposit when taxpayers provide a routing and account number.

Recommended Reading: How Can I Invest My 401k

You May Like: What Should I Contribute To My 401k

How And Why To Check On Your 401

If youre like many Americans, you may feel some unease when there is volatility in the markets. No matter what happens, try not to cash out your retirement savings, a move that could trigger taxes and reduce your retirement security in the long run. Be patient, and let your money keep growing through the markets ups and inevitable downs. But, do pay attention to the investment choices you make within these plans and their diversification.

Now could be the perfect time to give yourself a retirement plan checkup, perhaps with the help of a CFP® professional or your accountant. Just like your car, your retirement plan needs regular maintenance to make sure it will get you where youre going. A retirement plan tune up can feel like a chore. But you may get a pleasant surprise as you open the statements and check your online balances.

Here are five steps to a retirement plan tune up.

1. Remember all your different retirement accounts. Many people have multiple IRAs and 401s from different employers. Make a list. If you have old 401s at previous employers and havent accessed the accounts or collected the paper statements, now would be a great time to reach out either to the employer or the financial institution that held the account to get copies of statements. You might also have to reset passwords to gain access to online accounts.Consider rolling over your old 401s into your current one, or into IRAs. That will make it easier to do your financial checkup each year.

Current Tracking Status Check Using Sms

To improve overall customer happiness, the Indian postal service recently introduced a new SMS service for enquiry into the current status of shipments. The people of India, who do not have access to the internet, will find that it is really helpful, simple, and convenient. The following is a list of the key considerations to keep in mind with SMS tracking:

- All letters are capital only. Because SMS is case sensitive.

- The parcel status is available up to 60 days from the date of booking.

- This service is available on all mobile networks across India.

- Rates will be charged according to the service provider.

Most popular ways are given below:

1. 166 SMS Service

This service was initially launched by India Post Office. In order to get Speed Post tracking status on mobile through SMS, one need to send the following message on 166.

2. 51969 SMS Service

This SMS service is maintained by the Department of India Postal service, Ministry of Communications, Government of India.

Read Also: When Do I Get My 401k After I Quit

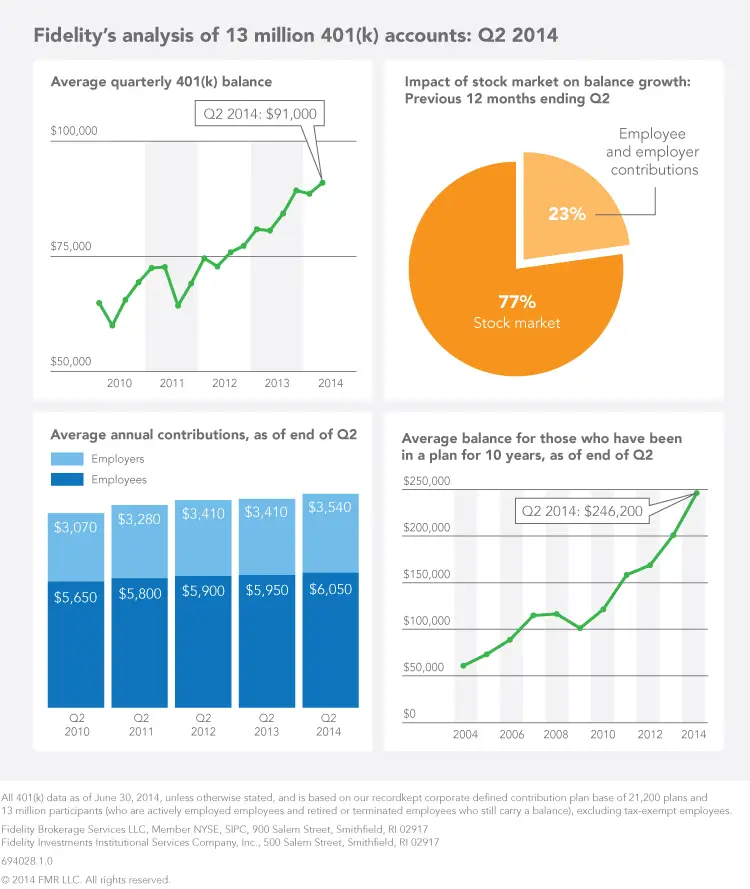

The Average 401 Balance By Age According To Fidelity

Fidelity announced that 401 balances reached records highs. This is due to the surging stock market during that time in addition to a great economy. In fact, in the last decade, assets nearly doubled. This is what you want to see as an investor. Watching compound interest work its magic.

The following are the average and median balances of over 22,000 businesses employee benefit programs under Fidelitys management.

These metrics will show you how lousy Americans are at saving. If your 401k is your primary retirement plan, and you are below these numbers, try to increase your savings by 1% every other month. This will allow you to ramp up your savings over time.

Read Also: How Soon Can I Get My 401k After I Quit

How Do I Track Down An Old 401k

Tracking Down Missing Mystery MoneyStart with Your Old Employer. Contact the 401 Plan Administrator. Check the National Registry of Unclaimed Retirement Benefits. Determine if Your 401 Account was Rolled Over to a Default IRA or Missing Participant IRA Search the Abandoned Plan Database.Jan 22, 2021

Don’t Miss: How To Cash Out On 401k

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab, Robinhood or Vanguard. You should be able to log into your 401K account online through the website of the broker or trading app your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

Follow These Steps With Help If You Need It

At the same time, finding your old accounts may be challenging for several reasons. In the first year of the pandemic, for example, hundreds of thousands of U.S. businesses closed permanently. In addition, says Zigo, you may have moved, or changed your email address, so your previous employer cant find you. Your old 401 plan may have changed sponsors. One of my clients has tried 10 times to reach a previous sponsor. It can be a frustrating process. And the bigger the hurdle, the less likely we are to try, she says. But help is available. A qualified financial planner can guide you through the following steps.

1. Take stock of your accounts

First, make a list that includes every employer where you contributed to a 401, suggests Charles Sachs, a CFP at Kaufman Rossin Wealth LLC in Miami, Florida. Next, call each one to see if they still have an account in your name, and update your contact information, if needed. Reaching out to them is the only way to find out where you stand, Sachs says. Its common for our clients to discover one or two old plans where they still have funds.

2. If a company has closed, check these websites

You can search for your money, which may be considered unclaimed property, at databases such as unclaimed.org and missingmoney.com. Both have links to state treasurers, comptrollers or other officials who update their lists of unclaimed assets regularly.

3. Rollover the money directly to avoid expensive withholding

Read Also: Can I Transfer My Old 401k To Roth Ira

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Also Check: How Does Taking A Loan From Your 401k Work

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Develop Other Sources Of Income

Think about other ways you can secure sources of income in retirement outside of collecting Social Security and withdrawing from your 401k. This will not only prevent you from having all your retirement eggs in one basket, but it is also something to consider if your 401k balance is lower than youd like. Where can you invest and how can you optimize your portfolio for greater returns? Consider other ways you can supplement your retirement income, and speak to your financial advisor about what solutions could work for you.

You May Like: How Do I Start A 401k For My Business

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

How Can I Access My 401k Early

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year.

Also Check: How Much Does A 401k Cost A Small Business

Also Check: How To Grow 401k Fast

Other Forgotten Funds And Where To Find Them

Retirement funds arent the only assets that may be lost or forgotten. Others include insurance accounts or annuities unpaid wages pensions from former employers FHA-insurance refunds tax refunds savings bonds accounts from bank or credit union failures. In addition, heirs may easily overlook one or more accounts, if the estate plan failed to list all of them.

The National Association of Unclaimed Property Administrators reports that about 1 in 10 Americans have unclaimed property, and more than $3 billion is returned to owners each year.

Brokerage firms and other financial institutions must report unclaimed or abandoned accounts once they have made a diligent effort to locate the owner. Should they be unsuccessful, they must report it to the state agency that handles such matters. The agency then claims it through a process known as escheatment so that the owners can find it.

Websites you can use to find lost funds include your states unclaimed property site NAUPAs missingmoney.com the U.S. Department of Labor database for back wages or the Pension Benefit Guaranty Corp to claim your pension funds. To find accounts at failed banks, try the Federal Deposit Insurance Corp. For credit unions, go to the National Credit Union Administration.

A final note: Claiming your assets is free. Beware of anyone who wants to charge you for doing so.

Also of Interest

Personal Capital Average 401k Balance By Age

| AGE | |

|---|---|

| $458,563 | $132,101 |

*Note: Averages are rounded up to the nearest dollar. Numbers are based on aggregated and anonymous data from the Personal Capital Dashboard. Accounts included are the following: 401k, former employer, Roth 401k. Excludes test and invalid accounts. Excludes any account value greater than $100,000,000 or less than -$100,000,000. Excludes spouse accounts. Snapshotted balance as of 9/7/2022.

Don’t Miss: Can I Rollover My 401k To A Mutual Fund

Speed Post Tracking Formats

You will need to input the exact tracking number format in order to discover the current status of your package’s consignment. The reference number will change depending on the mail provider you use. The following is a list of the several types of tracking formats used by India Post:

| Service Type | |

|---|---|

| XX654789123XX | 13 |

If you are having trouble tracking the current location of your shipment, please get in touch with the customer support department of the Government of India’s Department of Postal Service.

Checking Your 401k Balance

Now you are currently working with an employer, having been withdrawing money from your retirement plan under the financial hardships category, yet you want to know how much money left in your plan. To check your 401K balance, is one way of knowing how much you indeed have in your plan. However, with the dramatic change of the current economy who knows how much you do have in your retirement plan.

First, let us define what is 401K before deciding to check your check 401K balance. 401K is a retirement plan which is sponsored by your employer, the employee can also set aside a portion of his or her salary and be contributed to the retirement plan. However, the federal government has limited the contribution, it had laid down the maximum amount one should contribute. Upon retirement, the employee can get his money and the amount will now depend the growth of the plan. Therefore, the employee should be keen enough to choose which investments his or her plan should invest into. When the employee, starts taking the money then, such withdrawals are now taxed. If money is being withdrawn before reaching the age of 59 and a-half, then there is such a thing for early withdrawal penalty.

- Mon Fri: 10 am 8 pm

You May Like: What Is The Benefit Of A Roth Ira Vs 401k