Expecting Higher Than Average Returns From An Investment Opportunity

If you’re about to make an investment you expect will produce huge returns, then it’ll be in your best interest to convert to a Roth.Wouldn’t you rather pay tax on the smaller investment amounts now? Those larger returns will go back into your Roth IRA or 401k, where they will grow to an unlimited amount and come out tax free.I realize this is hard to predict. After all, if it was easy we’d all be rich. However, a situation like this is bound to happen when you’re investing in real estate, startups, pre-IPOs, and other investments.

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign-up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investment is to get started.

You May Like: How Do Employer Contributions To 401k Work

What Does A Good Combination Retirement Strategy Look Like

The earlier you can start saving for retirement, the better, but when you start, saving a lot of money in both a 401 and a Roth IRA might not be feasible.

Start by maxing out a Roth IRA while you are in your 20s, and if there is a company 401 as well, contribute just up to the amount you need to get your employers match, Whitney says.

As your income rises, saving on income taxes might become more important to many households. At that point, contributing more aggressively to a 401 account should become more attractive.

Planning your strategy this way allows you to end up with both types of accounts in retirement that have been growing for years.

You Expect To Earn More Money In The Future

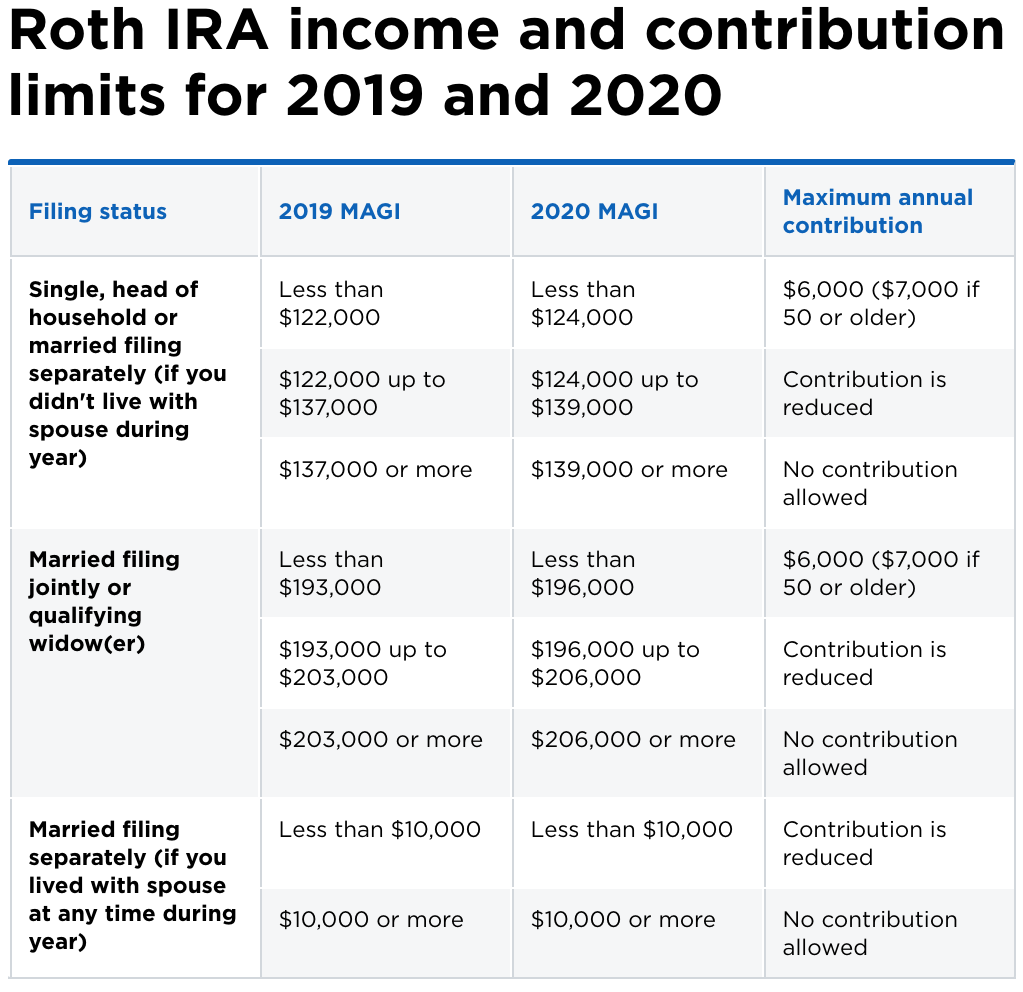

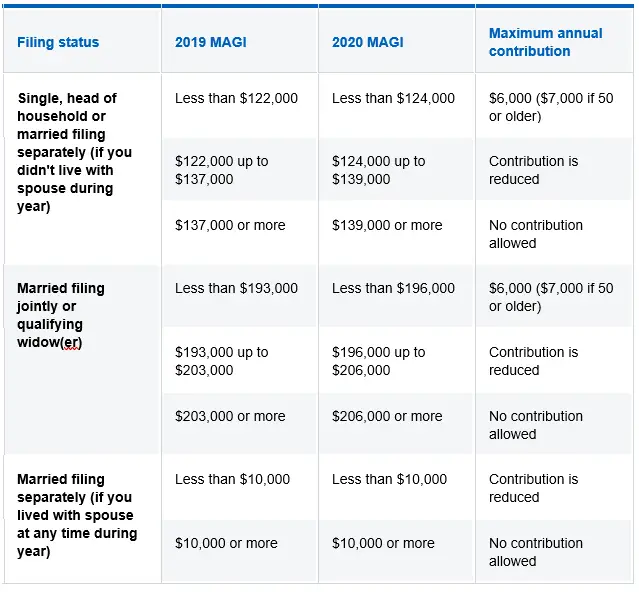

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Read Also: How Does 401k Work In Divorce

What Are The Benefits Of A Roth Individual Retirement Account

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

What About The Roth 401k

If your employer offers a Roth 401k and you were savvy enough to take part, the path to a rollover will be much easier. When youre converting one Roth product to another, there is simply no need for conversion. You would simply roll the Roth 401 directly into the Roth IRA with the help of your plan provider.

Roll Your 401 by Following These Steps

You May Like: How To Roll Over Your 401k

Can I Convert To A Roth Ira Even If I Earn Too Much To Contribute

Yes, there are no income limits on conversion. Also, if you and/or your spouse have high income levels and are not eligible to contribute directly to a Roth IRA, and you do not already have a traditional IRA, you may want to consider opening a traditional IRA and making a nondeductible contribution, then converting it to a Roth IRA. This strategy is sometimes called a back-door Roth contribution.

Read Viewpoints on Fidelity.com: Do you earn too much for a Roth IRA?

Your Income Is Low This Year

It could even make sense to do a conversion during a year when your income is unusually low.

We have seen millions of people quit their jobs to take time to consider new career moves, says Keihn. If you have opted to take a few months off before starting a new career, a Roth conversion could be a great option for you this year due to temporarily lower income.

Recommended Reading: How To Figure Out Your 401k Contribution

Can I Pay The Taxes From My Conversion From The Retirement Funds

While it is possible, it generally does not make sense to use the retirement assets to pay the taxes. If you are under age 59 1/2, the amount distributed to pay taxes may be subject to an IRS 10% additional tax for early or pre-59 1/2 distributions . Plus, those funds would no longer be potentially growing tax-free within the Roth IRA. Its suggested you use assets outside of retirement accounts to pay any taxes resulting from the conversion.

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Don’t Miss: How To Take A Loan Out On Your 401k

Roth 401 With A Match

Theres one important thing to remember about the Roth 401: Only your contributions grow tax-free. If your company offers a match, youll have to pay taxes on retirement income from the match side of the account.

Still, the Roth 401 is an amazing deal. It could literally save you hundreds of thousands of dollars in retirement. And yet, only 26% of workers are making contributions to their company plans Roth option.5

If youre just starting out with a company and they give you this option, take the ball and run with it!

But if you still have debt to pay off and dont have a fully funded emergency fund, pump the brakes. You need to get your financial house in order before you start saving for retirement.

If youd like a specific, step-by-step plan to becoming a millionaire by the time you retire, weve got one. Theres a whole group of millionaires called Baby Steps Millionaires whove followed Ramseys 7 Baby Steps to hit the million-dollar mark. By following the Baby Steps, they were able to pay off all their debt and reach a million-dollar net worth in about 20 years.

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but you’ll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

Read Also: How To Get Out Of 401k Without Penalty

How To Do A Roth Ira Conversion

The actual process for converting a 401 or traditional IRA to a Roth IRA is simple. In fact, its so straightforward that you can create problems before youre aware that youve done so.

Here are the three basic steps to convert your retirement account to a Roth IRA:

If you manage your own funds, you should be able to find steps to do a Roth conversion on your investment platforms site, says Kerry Keihn, financial advisor at Earth Equity Advisors in the Asheville area, noting that each institution has a slightly different process or forms.

Within a couple weeks and often sooner the conversion to the Roth IRA will be made.

When it comes time to file taxes for the year you made the conversion, youll need to submit Form 8606 to notify the IRS that youve converted an account to a Roth IRA.

Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRAâs tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount youâd like to convert. Hereâs a closer look at how 401 to Roth IRA conversions work and how to decide if theyâre right for you.

Recommended Reading: What Happens To Your 401k If You Quit Your Job

Also Check: Should I Roll Over 401k To Ira

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

Recommended Reading: How To Transfer 401k After Leaving Job

Find Out If Youll Be Able To Convert Your 401

According to the IRS, in order to be eligible for a 401 conversion, the money must be vested .6 All the money you put into your 401 is immediately vested, but your employers contributions might be vested over timemeaning the money isnt yours until its been in your account for a while. Depending on the vesting schedule set up by the company and how long youve been there, your existing 401 might not be fully vested yet.

Companies sometimes have their own additional restrictions on who can convert their 401, so ask your employer if youre eligible.

You May Like: How Should I Roll Over My 401k

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

The Ins And Outs Of Opening And Contributing To A Roth Ira

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401. In fact, it’s an ideal retirement savings scenario to contribute the maximum to both. And it’s something I highly recommend if you can afford it.

For 2022, you can contribute up to $20,500 to a 401 with a $6,500 catch up if you’re 50 or over. You can contribute up to $6,000 to a Roth IRA with a $1,000 catch up . Together, that’s a sizeable savings.

So on the surface, it would appear you’re good to go. However, although there are no income limits for contributing to a Roth 401, there are yearly income limits for contributing to a Roth IRA, and that could throw a wrench in your plan. For 2022, if your adjusted gross income is $144,000 or over for single filers you wont be eligible to make a Roth IRA contribution.

You May Like: How To Switch 401k To Roth Ira

What Is A Roth 401

The Roth 401 is a workplace retirement savings account that combines the convenience of a traditional 401 with all the benefits of a Roth IRAplus a few more. Its the best of both worlds!

A traditional 401 and a Roth 401 are similar. You can get your company match by contributing to either type of account, and both have a $20,500 contribution limit for 2022.2 But thats where the similarities end.

The biggest difference between a traditional 401 and a Roth 401 is how your contributions are taxed. When you put money into a traditional 401, youre using pretax dollars. That means the money goes into your 401 before you pay taxes on it. Those taxes are then deferred until you make withdrawals from your 401 in retirement.

On the other hand, your contributions to a Roth 401 are made with after-tax dollars, meaning you invest that money in your Roth 401 after you pay taxes on it. Its a little more expensive on the front end, but its worth it. Why? Because you get the benefit of tax-free growth on your contributions. So when you start withdrawing money in retirement, you wont have to pay a single penny in taxes.

Whenever you can make tax-free growth part of your investment strategy, do it!