Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

What May Be The Cons Of Rolling The Money Over To An Ira

- Money in an IRA isnt as well-protected against lawsuits as money in a 401

- Money in an IRA is never eligible for Rule-of-55 withdrawals

Again, if you choose this option, a direct rollover is almost always your best option.

If your old plan was a Roth, you can do the rollover into a Roth IRA to preserve its tax-free status. If you do this, its best to roll it over into an existing Roth IRA if you have one, since the 5-year clock until you can withdraw your contributions tax- and penalty-free has already been ticking for a while, potentially past the 5-year mark.

If your old plan wasnt a Roth, you may still want to consider converting it by rolling over into a Roth IRA, especially if you expect your income to be lower than usual this year, especially if this places you in a lower tax bracket.

Roll It Over Into An Ira

If youre not moving to a new employer, or if your new employer doesnt offer a retirement plan, you still have a good optionyou can roll your old 401 into an IRA. Youll be opening the account on your own, through the financial institution of your choice. The possibilities are almost limitless. That is, youre no longer restricted to the options made available by an employer.

If you have an outstanding loan from your 401 and leave your job, youll have to repay it within a specified time period. If you dont, the amount will be treated as a distribution for tax purposes.

Read Also: How Much Can You Take Out Of Your 401k

Make Sure You Do Something With Your 401

Your 401 money represents an important component of your retirement savings. It’s critical that you manage this money effectively both while you are working for an employer and when you leave.

You have several choices for this money when you leave your job. It’s important to make an affirmative decision for this money whenever you leave a job. This can be the difference between achieving your retirement goals and falling short.

So You Want to Learn About Investing?

Investing With A 401 K

With a 401 k, you have plenty of investment options. If you plan your investments wisely, you may avoid paying excessive tax on your investments, too. One way of doing this is spreading out your distributions. If you take all of the funds from your 401 k at once, you might be subject to hefty penalties. Just because you have access to the money doesn’t mean you should use it immediately.

Instead, we recommend that you take the money from your 401 k gradually and use it for investing conservatively. This is a great way for you to build up a passive income for your retirement. You don’t have to plan this much in advance, either. If you don’t have much experience in investing, you can even work with a broker. A broker or trader can help you come up with plans for your trading and how they can help you retire more comfortably. Plan to have a source of passive income in your retirement, and you’re unlikely to regret it. It can totally transform your retirement and doesn’t require much effort on your part. What’s more, you can continue investing once you’ve retired. Plan out a strong portfolio now, and the rewards can speak for themselves later.

Don’t Miss: Should I Have An Ira And A 401k

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Read Also: How To Start My 401k

Transfer The Money To Your New Employer’s 401

If your new employer’s plan allows it, you may transfer your old 401 savings into your new 401 plan.

In Lester’s view, “rolling your old account into your new employer’s 401 plan should be your default unless there’s a good reason not to.”

But you’ll only want to do that if the new plan offers solid, low-cost investments or at the very least, low-cost target date funds.

The benefit of consolidating your retirement savings into one employer-sponsored plan is that it will be easier for you to track and manage the money.

Recommended Reading: Should I Buy An Annuity With My 401k

Can You Lose Your 401 If You Get Fired

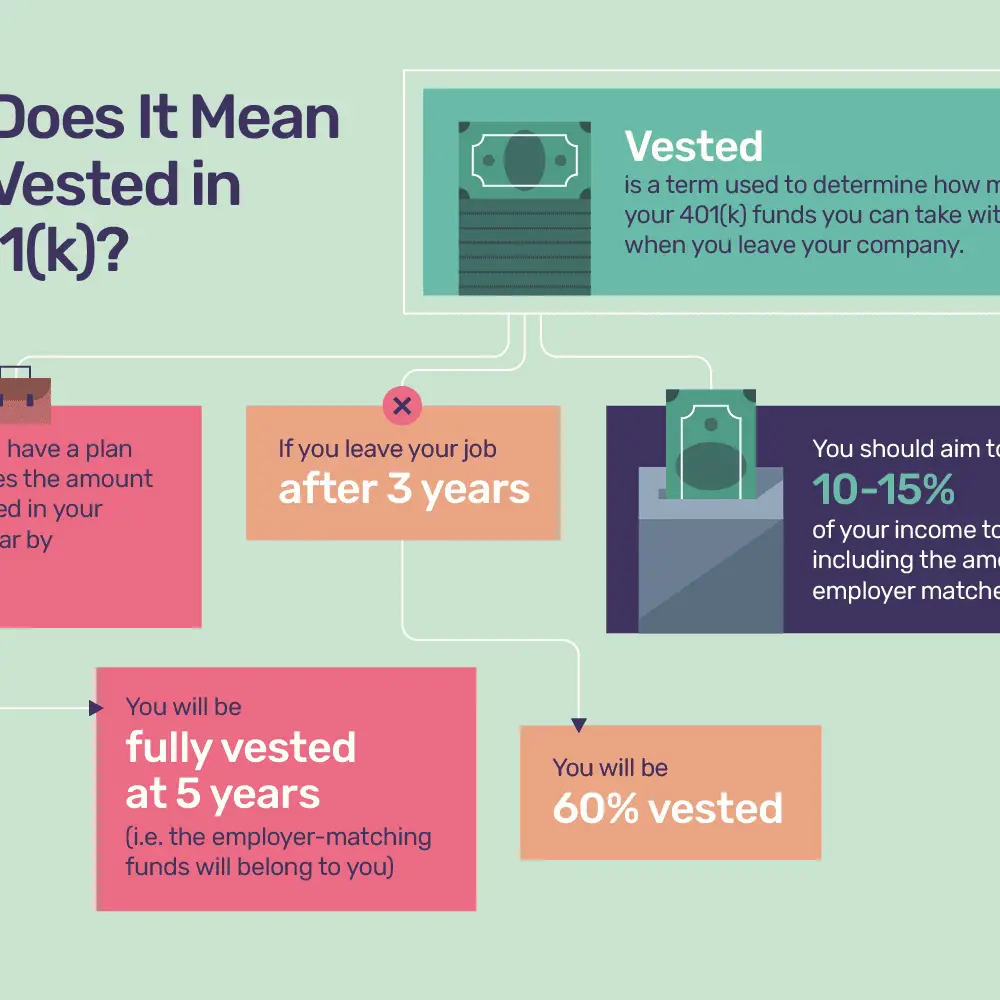

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

Limited Access To Your 401 After You Leave

Although your former employer cannot refuse to give you your 401 funds without just cause after you leave, you can find yourself unable to access them.

As mentioned before, if you have an outstanding 401 loan when you leave your job, you may be required to pay back the full balance of the loan within 60 days.

Employers can refuse access to your 401 until you repay your 401 loan.

Additionally, if there are any other lingering financial discrepancies between you and your former employer, they may put on your 401 hold.

Read Also: How To Find 401k From An Old Employer

Also Check: What Do You Do With Your 401k When You Quit

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement-related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or, if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash-out at age 24 leads to $23,000 less in your projected account balance at age 67 a total of 5 percent. Even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Your 401 Account May Be Frozen

The IRS sets the basic guidelines on 401s, but employers can set further limitations with their plans.

One of the powers 401 administrators have is placing âfreezesâ on the 401 plans they manage.

An employer can freeze your 401 for many reasons. Pending litigations against the plan, company mergers, or changes in who manages the 401 plans can all cause your 401 to be frozen. Legally, your plans administrator must provide a 30-day notice beforehand to give participants enough time to make arrangements.

You will be unable to contribute new funds and will be unable to withdraw any funds. However, if you are already receiving required minimum distributions, you are required to receive them. If you are not, document your requests for them to avoid any IRS penalties.

Don’t Miss: How Do I Transfer My 401k To A New Job

K And Your Tax Burden

One of the best things about a 401 k is that the money in these accounts is not subject to tax. With an IRA, you can save and invest money without having to worry about the tax burden. However, this only applies while the money remains in your IRA. It is also not uncommon to have more than one IRA, so it may help to learn how many IRA you can have and how it affects your 401k. If you remove the money or roll it into another account, it becomes part of your taxable estate. This is why it’s important that you make decisions regarding your 401 k wisely and don’t rush into anything.

It’s crucial that you educate your beneficiaries on how your 401 k works, too. If you pass away before you’ve retired, the company you work for ensures that your beneficiary gets access to your 401 k. However, you have to make sure that your beneficiary understands how this works. Your 401 k money may be subject to income tax if it’s removed from your IRA. If the balance in your account is substantial, a lump distribution could result in substantial income taxes for your beneficiary.

If your beneficiary wants to avoid paying tax on all of your 401 k at once, it’s important that they take this into consideration. You have to make sure they understand all of the options that are available. It’s not necessary to transfer all of the money in an IRA at once, for example. Distribution can be spread out into multiple distributions over an extended period.

How To Use Your 401 Fund Your New Business

If your business requires less than $50,000 to start and you have a solid repayment plan, borrowing your businesss startup funds from your 401 may prove a viable option.

Borrowing money from your 401 to start a business may be a useful and effective option, as long as you understand the risks and implement a repayment plan.

Considering using your 401 to start a business? According to Fidelity Investments, the average retirement account balance is at an all-time high, and the number of 401 millionaires continues to grow. Thats a lot of cash invested in the markets. For some entrepreneurs, financing a business launch is an equally savvy way to grow those retirement dollars.

Depending on the amount of money youve put aside and the amount you need, there are two ways to leverage your retirement savings and bootstrap your business.

Borrowing from your 401 may be the answer if:

Also Check: How To Get Money Out Of Fidelity 401k

How Long Does A Payout Take

The amount of time it can take for your 401 k payout to come to you varies depending on the type of retirement plan you have. If your situation is uncomplicated, you can expect to receive the check within days. However, a more complex case might mean it takes up to 60 days if you request to receive the money via check.

Circumstances When You Can Withdraw From A 401k If You Have An Outstanding Loan

Each 401 plan has different rules on 401 loans and 401 withdrawals. If your employerâs 401 plan allows employees to tap into their retirement money, you may be required to provide some proof to document that you are in an urgent financial need to get approved. The approval process is rigorous since allowing frivolous withdrawals puts the 401 plan at risk of losing its tax-favored status.

Some of the circumstances when you could withdraw money from your 401 plan if you have an unpaid loan include:

Roll Over 401 If You Have an Outstanding Loan

If you terminate employment with an outstanding 401 loan, you can rollover the money to an IRA or new employerâs 401. As long as the loan repayment was in good standing, the employer will rollover your retirement money net of the outstanding 401 loan. You will have until the tax due date to pay off the 401 loan balance.

For example, assume that you have a $50,000 vested 401 balance, including an outstanding 401 loan of $15,000. If you quit your job and request the plan sponsor to rollover the retirement savings to your new IRA, the plan sponsor will reduce the vested 401 balance by the $15,000 outstanding loan, and disburse the remaining $35,000 to your IRA. You will then have until the tax due date to come up with the $15,000 outstanding loan, after which you can rollover the $15,000 401 balance to your IRA.

Cash out 401 with an Outstanding Loan

Take a Second loan with an Outstanding Balance

Tags

You May Like: Can I Roll My 401k Into An Annuity

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once you’ve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. It’s important to consider the other options you have.

If you’re changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. You’re unlikely to get much out of rushing into a decision that you aren’t completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Make Sure You Have A Financial Plan Before Quitting Your Job

Considering the penalties, you don’t want to withdraw early from a 401 if you can help it, especially if you’re quitting your job without something else lined up.

“The labor market is in a position right now where there’s a lot of power on the employee, so they should be able to get another job sooner rather than later,” says Rob Greenman, a certified financial planner and chief growth officer at Vista Capital Partners. “But that’s not a sure thing.”

Greenman suggests putting some “guardrails” in place before leaving your current job to prevent you from needing to make withdrawals. These include a topped-up emergency fund worth three to six months of your expenses, including monthly health insurance payments, and some sort of health insurance while unemployed.

He also recommends seeking out jobs that offer “happiness and purpose,” not just more money. By ensuring that a new job is a good fit, you’ll be less likely to quit the role because it makes you unhappy.

“The problem with 401s is that you can withdraw from them a little bit easier. For example, you can’t easily take $10,000 or $5,000 out of your house,” says Greenman. “I think that’s why we hear about that happening more frequently.”

Don’t Miss: How To Get 401k Money From Old Job

Rollover To A New 401

If you quit your job for another employer, you should check if your new employer has a 401 plan and when you are eligible to participate. Some employers may require new employees to complete a certain period of service to be eligible to join the plan. Once you are eligible, you should request a direct rollover from your former employer to the new 401. You will be required to fill out some paperwork with the former employer, and provide your new 401 details for the transfer to be effected.

What Happens If You Took Out A 401 Loan From Your Old Plan

It used to be that if you had an outstanding balance on a 401 loan and left employment, you had very little time to pay it all back, or the remaining balance would become a de-facto early withdrawal, with all the negative consequences mentioned above.

Following the 2017 Tax Cuts and Jobs Act, if you took out a 401 loan from your old plan and are leaving employment for any reason before paying it all back, you can continue making payments to a rollover IRA.

This new tax law gives you until your tax filing deadline to finish paying back the loan in full before considering the unpaid balance an early withdrawal, subject to all the consequences of such a withdrawal.

Don’t Miss: How To Use 401k To Pay Off Debt