What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Choose Which Type Of Ira Account To Open

A 401 rollover to an IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you wont incur taxes if you roll to a Roth IRA.

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into a new account with your new employer, or roll it into an individual retirement account , but you must first see when you are eligible to participate in the new plan. You can also take some or all of the money out, but there are serious tax consequences to that.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Dont Miss: How To Find My 401k Money

Recommended Reading: What Happens To My 401k If I Leave My Job

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Tiaa To Fidelity And/or Vanguard

Transfer funds from TIAA fund into a Fidelity and/or Vanguard fund

Also Check: Can You Transfer 401k To Td Ameritrade

Does A Ira Rollover Make Things Simpler

On the surface, having all your retirement accounts in one place seems like a good idea but there are a couple things to watch out for when converting a 401. If your income will be high enough in the future to exclude you from Roth contributions then holding a traditional IRA will eliminate the backdoor Roth option for you. Since tax law doesn’t allow people with income over a certain amount to contribute to a Roth IRA or deduct traditional IRA contributions, they’re forced to do what’s known as a backdoor Roth.

Since there’s no income restriction on converting to a Roth, the backdoor Roth strategy requires the investor to make non-deductible IRA contributions and then convert them to a Roth. If you’ve got a big traditional IRA lying around though, this backdoor method won’t work since non-dedutible and deductible contributions are all treated as a single account. This is known as the pro-rata rule and it basically prevents you from doing a backdoor Roth if you have a traditional IRA in your name.

One smaller thing to watch out for is that if you ever need to borrow from your IRA, you would only be able to do a 60-day loan. But with some 401 plans you’re often allowed to borrow for much longer periods, even after you leave the company.

Need Help With Your Rollover

Well handle the entire process for you online, for free!

- Well help you track down your 401 and initiate the rollover to Vanguard

- Customer support available if you have questions along the way

- Feel confident about your decision to move to Vanguard by answering a few questions to compare with other top providers

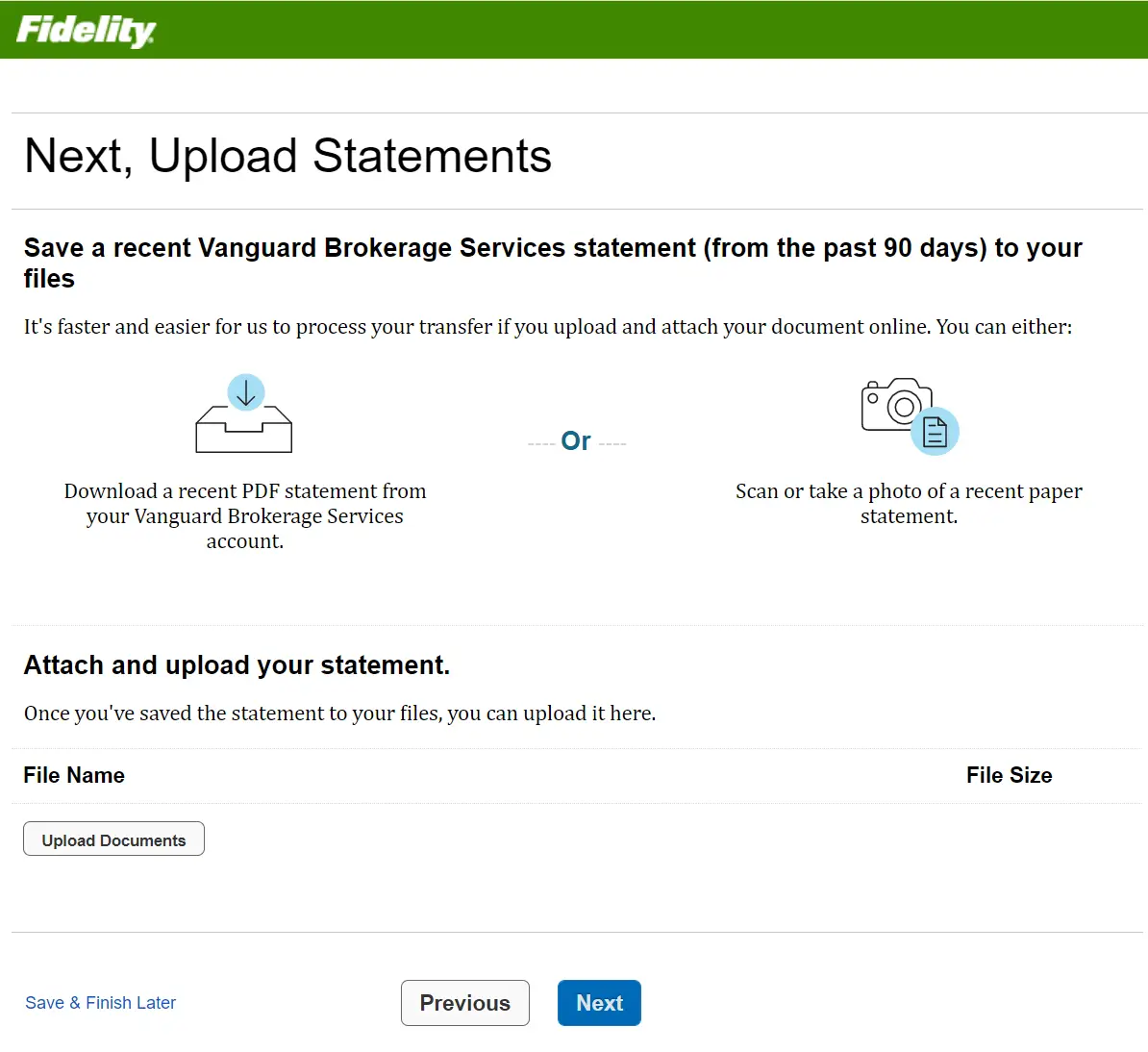

If youre looking to roll over a 401 from a previous job into an IRA, Fidelity is a popular option. They offer several accounts, catering to those who want to pick their own investments and people who want their money managed for them. Weve laid out how you can roll over your 401 into Fidelity below!

Weve laid out a step-by-step guide to help you roll over your 401 to Fidelity in five key steps:

Don’t Miss: How To Find Out How Much Is In My 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Do I Know If I Have A 401k

Invest Your Newly Deposited Funds

Youâll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

You May Like: How To Start A 401k

How The New Consortium Will Work

This is where the new consortium of plan administrators comes in. When a worker changes jobs and has $5,000 or less in their account, Fidelity, Vanguard and Alight will automatically shift 401 assets to the employee’s new workplace plan when possible. Basically, the money will follow the worker.

The worker can choose to cash out at that time, though Dave Gray, head of workplace retirement platforms at Fidelity, expects more than 90% will choose to keep the money invested.

And it’s not just 401 balances the transfers will also apply to similar workplace plans outside the private sector, including 403, 401 and 457 plans. Women, minorities and low-income savers stand to benefit most, since they disproportionately have account balances of less than $5,000, Gray said.

“This money matters and it’s critical,” he said.

One cash-out during an investor’s life raises the odds they will run short of money in retirement by 11.4 percentage points, on average, to 30.4% two or more raises the odds to 46.4%, according to EBRI.

If the participant moves outside the universe of these three firms, then you haven’t really improved the outcome.Philip Chaofounder of Experiential Wealth

As things stand, there’s a shortcoming: The firms can only facilitate the transaction if workers move to or from an employer with a retirement plan administered by Fidelity, Vanguard or Alight.

Their aim is to grow the roster of companies in the consortium to boost the number of investors who can benefit.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options arenât usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

You May Like: How Do I Transfer My 401k To A Roth Ira

Also Check: When You Switch Jobs What Happens To Your 401k

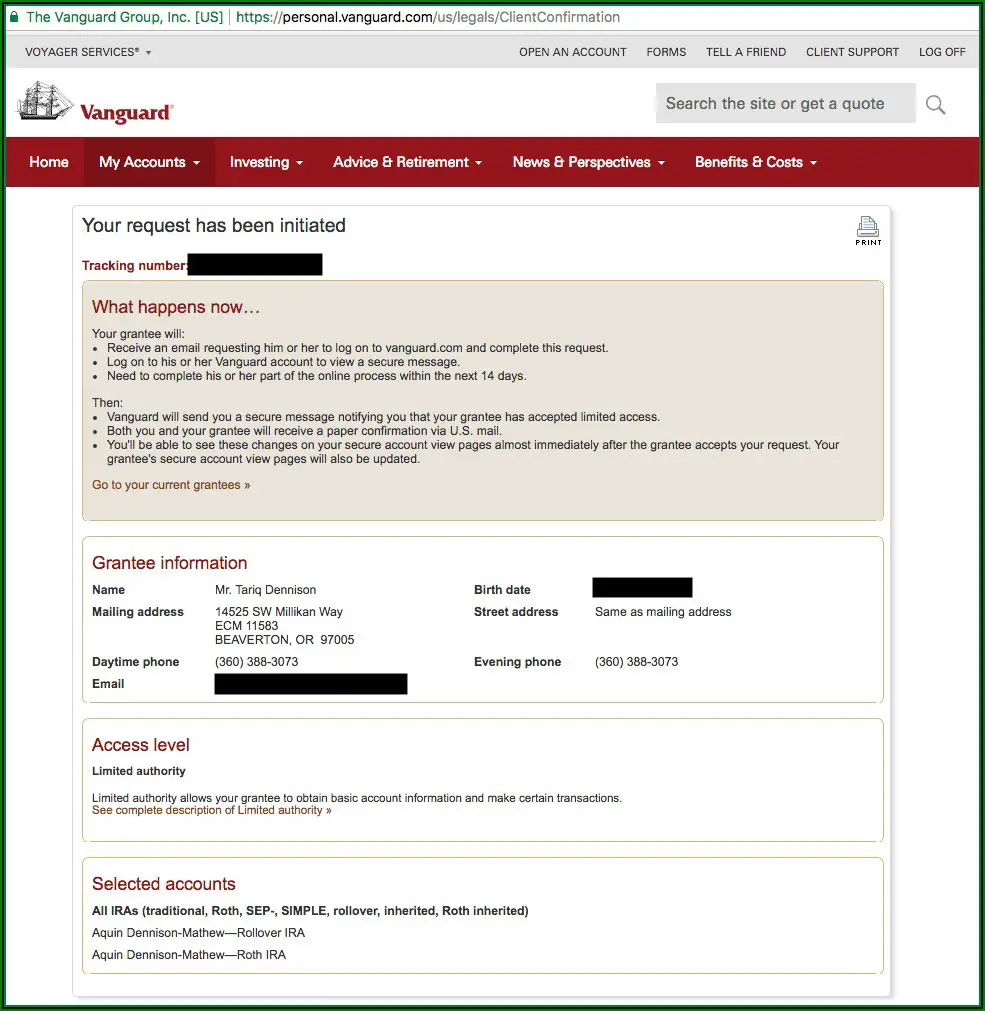

How To Rollover A 401k To Vanguard

About 5 seconds after I saw how much I would save by rolling over my 401k to Vanguard, I got to work. I called Vanguard at 888-499-970 to initiate the transfer. Although they offer instructions on how to do this online, it can be easy to make a mistake that can cost thousands. I wanted to have a professional direct the transfer so that it was done correctly.

I could have called Merrill Lynch for assistance transferring my 401k, but I find the company receiving my business tends to be easier to work with than the company Im leaving.

The representative from Vanguard had clearly been through this before. She was friendly, precise and professional. We bridged Merrill Lynch into the call, and within 20 minutes had the transfer underway. All I had to do was verify my identity by providing my SSN, employer start date, and employer termination date to Merrill Lynch to validate my account and begin the asset transfer. From there I gave permission to the Vanguard representative to handle the rest. Easy peasy.

8 days after our call the funds were deposited into my Vanguard account. All of this cost me about 45 minutes and a $26 account termination fee from Merrill Lynch. For a savings of over $260,000, the time and money were well worth it!

Dont Miss: Can Anyone Open A 401k

What Type Of Ira Should I Open

During the process of opening your new account, you may get asked which type of IRA youd like to open. You might see the following options: Rollover IRA, Traditional IRA, or Roth IRA. Heres how to pick the right one:

- If you had a Traditional 401 pick a Rollover IRA or, if thats not available, Traditional IRA or, if thats not available, just IRA. The only exception would be if youre considering a Roth conversion, but this is an advanced tax planning strategy that most people dont need to worry about.

- If you had a Roth 401 pick a Roth IRA. Youll need to match the Roth 401 to a Roth IRA for tax reasons.

- If your 401 has mixed assets youll need to open two IRAs, one Roth and one Traditional to for their respective assets.

STEP 3

Read Also: What Type Of Plan Is A 401k

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Watch Out For The Distribution Method

One thing you need to watch is how the funds are distributed. You dont want the check written out to you or the IRS will treat it as a distribution, not a rollover. Of course, the reps and Vanguard and Fidelity know all these rules and can make sure your withdrawal from your 401k is treated as a rollover. In my case, Fidelity will send me the check made out to Vanguard for my benefit. Ill then need to mail the checks to Vanguard, with my Rollover IRA account number written on the check.

Once thats complete, Ill be able to invest the money in any Vanguard fund or ETF I want.

Also Check: Why Transfer 401k To Ira

How To Fill Out The Vanguard Brokerage Ira Distribution Form

View Important Information About Our Online Equity Trades And Satisfaction Guarantee

- View important information about our online equity trades and Satisfaction Guarantee

-

1. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

2. If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. , Charles Schwab Bank, SSB , or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern. No other charges or expenses, and no market losses will be refunded. Refund requests must be received within 90 days of the date the fee was charged. Schwab reserves the right to change or terminate the guarantee at any time. Go to schwab.com/satisfaction to learn whats included and how it works.

Also Check: What Do I Do With 401k When I Retire

The Two Retirement Giants Along With Alight Solutions Are Forming A Consortium To Automate The Transfer Of 401 Accounts With Balances Below $5000 When Workers Change Jobs

Fidelity Investments and Vanguard announced a rare collaborative effort Wednesday to help employees keep their retirement savings in tax-advantaged accounts like 401s when they switch jobs.

The two retirement giants, along with benefits administrator Alight Solutions, created a jointly owned consortium to automate the transfer of millions of 401 accounts with balances below $5,000 when workers change employers. An estimated $92 billion is taken out of retirement savings each year due to cash-outs, according to the Employee Benefit Research Institute.

Auto-portability of workplace retirement plans is an idea thats been talked about for years but requires scale to make much of a difference. EBRI estimates that if auto-portability is widely adopted, it would keep an additional $1.5 trillion in retirement plans over 40 years, with Black and minority workers saving an additional $619 billion and women saving $365 billion more.

The cash-out problem is likely to worsen as people switch jobs more frequently. Workers who have less than $5,000 saved tend to be lower-income, women and minorities, according to Alison Borland, executive vice president of Wealth Solutions at Alight, who said the effort is meant to be a low-cost way to preserve savings for those who need it most.

An employer may also roll an old employees 401 of less than $5,000 into an IRA, a practice that has drawn criticism if the money sits in a money market fund being eaten away by fees.