Is Your 401 Protected If Your Employer Goes Out Of Business

If you invest in your companys 401 plan, you know that your pre-tax savings comes out of your paycheck each period and is invested in one or more investment vehicles, usually mutual funds. But you may wonder if your employer ever sees any of that money, other than any contribution it may provide. Very simply, your employer is not legally allowed to hold your 401 money. Under federal law, all 401 money must be held in a trust or in an insurance contract thats separate from your employers assets. Therefore, neither your employer nor any of your employers creditors can grab that 401 money.

That said, there are certain circumstances in which you may not receive all the funds you expected if your employer goes out of business.

Complications If You Have Employees

For start-up companies or established companies that have employees that would otherwise be eligible for the 401 plan, there are special issues that need to be addressed. The rules within the 401 world state that all investment options available within the plan must be made available to all eligible employees. That means if the business owner is able to purchase shares of the company within the retirement plan, the other eligible employees must also be given the same investment opportunity. You can see immediately where this would pose a challenge to the ROBS plan if you have eligible employees.

However, investment options can be changed which is why ROBS plans are the most common in start-ups where there are no employees yet, allowing the 401 plan to setup the only eligible plan participant, the business owner, allowing them to buy shares of the company. Once the share purchases are complete, the business owner can then remove those shares as an investment option in the plan going forward.

If You’re Saving For Retirement One Of The Cardinal Rules Is: Don’t Touch Your 401 Until You Retire

Eric Schneider followed it diligently during his 25 years selling commercial insurance. But two years ago, he emptied his nest egg to launch Headrush Roasters Coffee & Tea in Kansas City, Mo.

“I took a big risk, but I don’t regret it at all,” said Schneider, 49, who co-owns the business with his wife Nancy.

Schneider left his six-figure job in 2010 with $250,000 in his 401 and $100,000 in savings. In 2011, he found a vacant building that he thought would be perfect for his coffee shop and roastery.He hoped to lease it, but the owner only wanted to sell.

“I’m a big believer in no debt,” he said. “I had paid off my house, my cars. I didn’t want to take out a loan to buy the building.”

As he researchedfinancing options, he came across ROBS, or Rollovers as Business Startups. These allow people to use the money in their401to start a business without paying taxes on the withdrawn funds or getting hit with an early withdrawal penalty.

The process can be pretty complicated, however. First, you must incorporate a business and open a new 401 plan under it. Then you roll your existing 401 funds into the new plan. Since both accounts are tax-exempt, you avoid taking the tax hit.

As owner of the new company, you can now direct what the 401 invests in. With ROBS, the new company typically issues shares that you can purchase using money from the 401. You’re then free to use the cash from that purchase for operational expenses funds).

Read Also: How To Cash Out 401k From Fidelity

Option : Early 401 Withdrawal

In an emergency situation, taking an early 401 withdrawal can make sense. You will pay significant penalties for doing so, and it can have a noticeable effect on your retirement accounts and long-term investment returns. If you are looking to buy a business using your 401, this is the least desirable of the financing options covered in this article.

Typical reasons to make an early 401 withdrawal are if you need to make a payment immediately in order to avoid repossession, to cover a costly emergency vehicle repair, or in other emergency situations that require access to money you just dont have. If you have an accountant, they will probably advise you that taking an early withdrawal should only be seen as a last resort.

There are, however, some circumstances where you may not have to pay the early withdrawal fee. If you lose your job and are 55 years old or older, you wont have to pay the 10% tax penalty. There are sections in the CARES Act, specifically section 2202, that allows favorable tax treatment for up to $100,000 of coronavirus-related distributions from eligible retirement plans. These include individual retirement accounts , 403 plans, and 401 plans.

That being said, you need to be considered a qualified individual under the section. The list of what makes you a qualified individual can be found here. There are also adjustments to loan relief and if you qualify, may be able to take a higher loan amount if you borrow against your 401.

Why Do Business Owners Use Robs Plans

The benefits are fairly obvious. First off, by using your own retirement assets to fund your new business, you dont have to ask friends and family for money. Secondly, if you were to embark on the traditional lending route from a bank for your start-up, most would require you to pledge personal assets, such as your house, as collateral for the loan. Doing this puts an added pressure on the new entrepreneur because if the business fails you not only lose the business, but potentially your house as well. By using the ROBS plan, you are only risking your own assets, you have quick and easy access to those funds, and if the business fails, worst case scenario, you just have to work longer than you expected.

Also Check: What Is A Safe Harbor 401k Plan

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

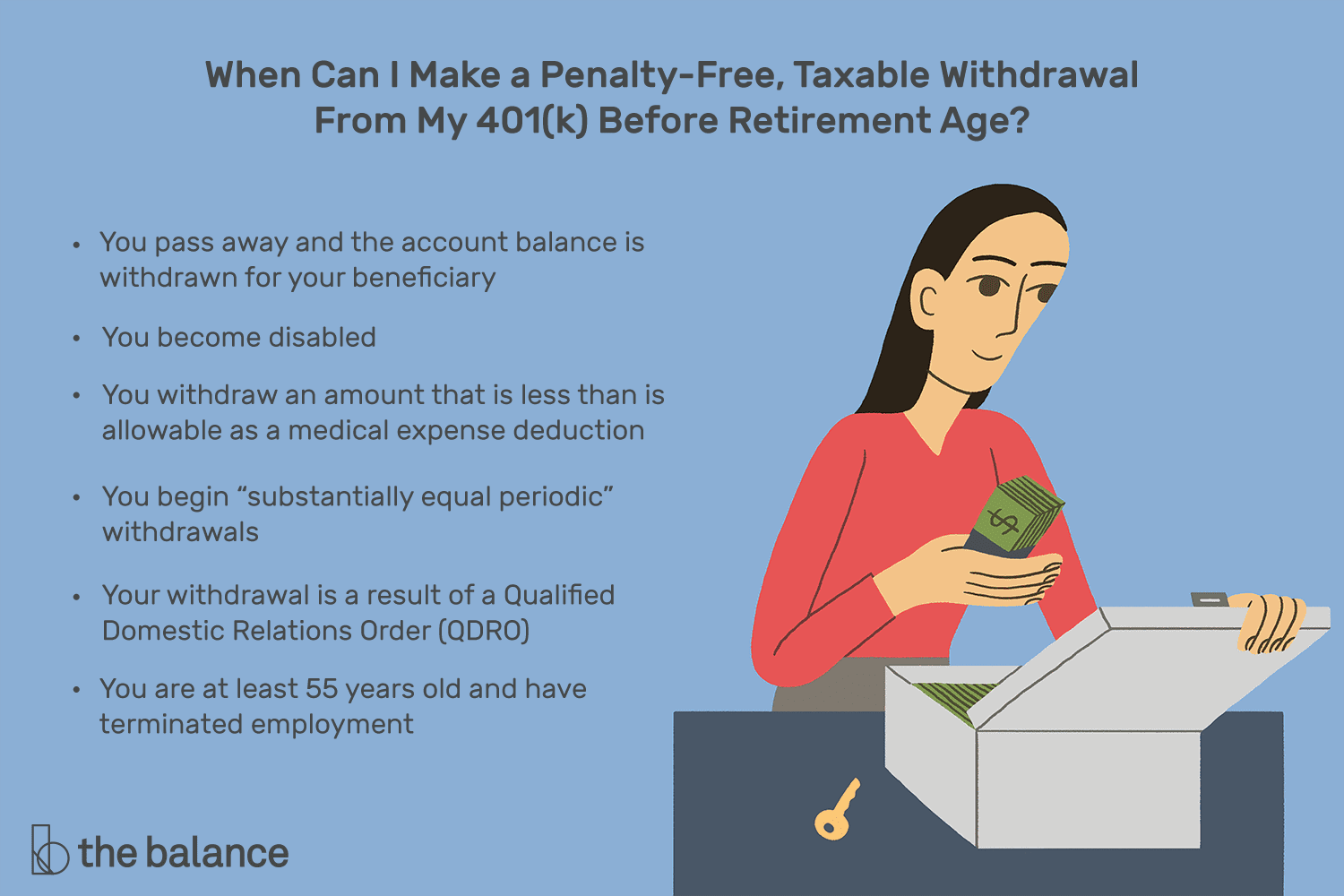

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Read Also: Is There A Penalty To Withdraw From 401k

Other Startup Funding Options

Because of the high failure rate of business startups, the Wall Street Journal points readers away from using retirement money, such as a 401 to fund a business, if other funding is available. If possible, use nonretirement assets for your startup and preserve your nest egg. For example, after setting aside a six-month emergency savings fund, use taxable savings or brokerage accounts as seed money for your startup. Other non-401 options include home-equity credit and loans.

Use A Robs To Finance Your Business

The second option you have for using a 401 to start a business is called ROBS, which, as we mentioned earlier, stands for rollovers as business startups. ROBS gives you another way to access retirement funds from a 401, IRA, or another eligible retirement account without having to pay income taxes and early withdrawal penalties.

Compared to a 401 loan, a ROBS offers more flexibility for entrepreneurs because theres no obligation that you have to remain employed in order to use this financing option. In fact, with a ROBS, you cannot use a retirement account from a current employer. This being said, however, doing a ROBS is also more complicated than taking a loan from your retirement plan.

To explain, with a ROBS, you first have to structure your business as a C-corporation. Then, you have to set up a new retirement plan under the C-corp. At that point, you can rollover the funds from your existing retirement plan into the new companyâs retirement plan. Finally, your new corporation sells stock to the retirement plan, and the company uses the proceeds from the sale as a source of capitalâwith one catchâyou canât pay ownersâ salaries from these funds.

Read Also: Does Uber Have A 401k Plan

What If You Cant Find Your Old 401 Plan

You may have money sitting in a 401 plan from an employer you worked for a long time ago. If you cant locate that employer, what else can you do? Your old employer may have listed you as a missing participant, so you may want to check the National Registry to see whether you are listed. You can also try searching the Department of Labors Abandoned Plan Database.

You May Like: When Do You Need A 401k Audit

How To Finance Your Business With A 401

Would-be business owners can take advantage of something called ROBS or rollovers as business start-ups. Through ROBS, you can use your 401 to fund a business without paying taxes or penalties.

While that may sound great, setting yourself up with ROBS is complicated. You need to form a C Corporation and then create a new retirement plan under your business. After that, you need to transfer funds to your account. Once youve done that, your retirement funds will buy stock in the corporation.

At that point, you can use the funds to invest in your business. On top of that, you typically need the help of an attorney or a CPA to facilitate the process, which can add up.

As you can see, the process isnt necessarily simple or cheap. And of course, there are risks involved.

You May Like: How To Transfer 401k From Old Employer

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

What Can A Robs Plan Be Used For

Although its called a rollover as business startup plan, ROBS isnt just for new businesses. Entrepreneurs can use a ROBS to open a new business or purchase an existing business, including franchise locations. Any type of business is fair game, with the exception of lending or factoring companies.

This doesnt mean its necessarily easy to set up a ROBS plan its likely your business will receive increased scrutiny from the IRS, which calls the plans questionable. When a plan sponsor administers a plan in a way that results in prohibited discrimination or engages in prohibited transactions, it can result in plan disqualification and adverse tax consequences to the plans sponsor and its participants.

Here are some other things to keep in mind when considering a ROBS plan:

Recommended Reading: How To Open Your Own 401k

Risking Your Future Retirement

Your 401k is likely one of the only portions of your financial portfolio thats meant to be used once youve retired. Although starting a business can be a worthwhile investment, it also comes with considerable risk. In fact, nearly half of all businesses fail within their first five years. Due to this, its important to remember that starting a business could lead to financial failure.

If you withdraw from your 401k to start a business, youll have less money set aside for your retirement and it could limit your future growth. Even if your business is ultimately successful, by the time youre able to return your 401k to its original level, youll have willingly foregone a significant amount of compound interest. Depending on your age and the amount youve already saved, withdrawing from your 401k can potentially cost you millions of dollars in your much-needed retirement savings.

Consider The Tax Implications

Lets talk about the tax implications of borrowing from your 401 to start a business.

When you borrow from your 401, youre borrowing pre-tax money.

However, when you start paying back the loan to the 401, you pay back with after-tax money.

Thats not all.

The money is then taxed again when it comes out of your 401.

Basically, when you borrow from your 401 to start a business or for another purpose, you will be taxed twice.

Don’t Miss: How Can I Apply For 401k

You Can Still Grow Your Nest Egg

ROBS is also a tool for building your retirement assets. While using ROBS does mean youre taking money out of your retirement accounts, it also means putting cash back in. As you work within your business and pay yourself a salary, youll also be contributing a percentage of that salary into a 401, just like you do when youre an employee at any other company. This means your retirement assets will continue to grow as you build your business.

How Borrowing Against A Traditional Ira Works

Neither traditional nor Roth IRAs allow loans like a 401 plan may. Both account types permit penalty-free distributions in some circumstancessuch as paying for educationbut there is no penalty-free distribution for starting or buying a small business.

You can withdraw funds from your IRA for up to 60 days without penalty. If you cannot pay the money back within that 60-day window, it will count as a distribution from your account, and you will be taxed as if you cashed it out . Each IRA account only allows you to do this one time within a one-year period. In this case, borrowing from a traditional IRA is very much like a short-term loan, provided funds are paid back within 60 days.

Recommended Reading: How Do I Pull Money Out Of My 401k

Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Robs Compliance & Audits

ROBS plans are held to compliance standards with the IRS and the United States Department of Labor, and ROBS plans may be audited. Those plans not in compliance with government regulations could face tax penalties and fines.

While the risk of an audit is rather low, an audit by the government will check for the following:

- That the retirement plan was set up correctly: Also, that your business is set up in the correct corporate structure .

- All annual filings have been completed and submitted: Among these is IRS Form 5500.

- You meet all employee requirements: This means you are an employee of the organization, providing eligible employees access to the companys retirement plan, and all necessary plan documents are provided to your employees.

Using a ROBS provider will provide you the needed support in ensuring you are meeting compliance requirements.

Read Also: What To Do With Old 401k Account

Starting A Business With Your 401 Be Careful

As an aspiring entrepreneur, you may have a good idea, but tread lightly before using retirement savings as capital.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

Renee Edwards has wanted to be her own boss since she first heard the name Warren Buffett.

Ive been following him for a long time, she said of the Berkshire Hathaway chief executive and revered investor. And the thing that always stuck out for me is him saying something like, Youll never live comfortably unless you work for yourself.

In October, Ms. Edwards, 45, made the jump: After 18 years as a clinical researcher at the Roskamp Institute, a pharmaceutical testing company in St. Petersburg, Fla., she quit her job to start Saturday Morning Shoppe, a monthly outdoor market featuring vendors who are women and people of color. Mr. Buffetts prognostications aside, not everyone would have encouraged her to bet on herself. Especially because she made the bet by emptying her 401.

Her financial adviser, Toriano Parker, provided a measure of comfort. Instead of talking me down about using my 401, he said, You should do it, she said. Her age, which afforded her time to replenish her retirement savings, was a factor in his approval. So was her research into Saturday Morning Shoppes potential profitability. Renee had a very solid business plan, Mr. Parker said.