Option : Do Nothing And Leave The Money In Your Old 401

Now, you could just leave the money in your old 401 if youre really happy with your investments and the fees are low.

But thats rarely the case. Most of the time, leaving your money in an old 401 means youll have to deal with higher fees that cut into your investment growth and settle for the limited investment options from your old plan. Most people come out way ahead by doing a direct transfer rollover to an IRA .

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Recommended Reading: How To Get Money From 401k Fidelity

Option : Leaving Money In Your Former Employer’s 401 Plan

Leaving money in your current 401 may be an option, depending on the terms of your plan. Many additional factors, such as the option to add money and make certain investment choices, will also depend on the terms of your plan. Here’s what you should know:

- Ability to add money: Once you leave your employer, you generally won’t be able to add money to your plan.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your former employer’s plan beginning at age 72.

Contact your plan administrator to learn more about fees and the terms of your plan. Your Participant Fee Disclosure and/or Summary Plan Description should have this information.

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but that could mean serious tax consequences. Make sure to understand the particulars of the options available to you before deciding which route to take.

You May Like: When You Quit A Job What Happens To Your 401k

What Is A 401 To 401 Transfer

A 401 to 401 transfer is simply the movement of your old 401 to combine it with your new 401. Once the transfer is complete, youre left with one 401 at your new employer.

An important step to remember is to check with your new 401 provider to ensure that they accept 401 roll-ins. This means that youre able to transfer outside 401 plans into the new one. Most plans do allow this, but its best to check first to make sure.

Matching Contributions And Vesting

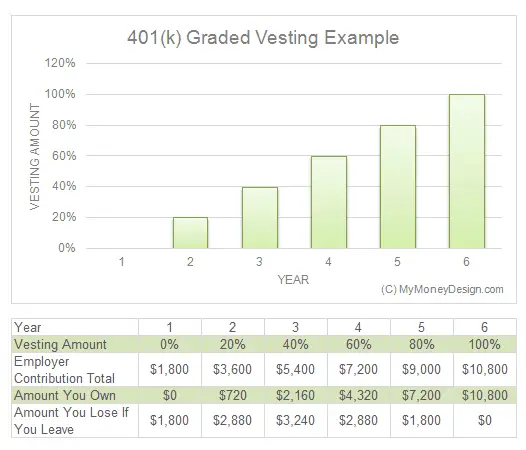

Some employers grant 401 matching contributions that vest over time. Under a vesting schedule, you gradually take ownership of your employers matching contributions over the course of several years. If you remain with the company for the entire vesting period, you are said to be fully vested in your 401 account.

Employers impose a vesting schedule to incentivize employees to remain with the company.

For example, imagine that 50% of your employers matching contributions vest after youve worked for the company for two years, and you become fully vested after three years. If you were to leave the company and take a new job after two years, you would pass up owning half of the matching contributions pledged by your employer.

Keep in mind, however, that you always maintain full ownership of contributions you have made to your 401. Vesting only involves the employers matching contributions.

Dont Miss: How To Figure Out Employer Match 401k

Read Also: How To Roll Over Old 401k

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Did You Make Traditional Contributions Roth Contributions Or Both

When determining what to do with your 401 after retirement, it’s generally wise to withdraw from Roth accounts first and keep traditional 401 contributions untouched as long as possible. Since you generally wouldn’t owe taxes on Roth withdrawals in retirement, this order of liquidation can reduce taxation over your lifetime.

Read Also: How Do I Look Up My 401k

Who Is Eligible For An In

It all depends on your plan. Not all plan providers offer in-service distributions, and for those that do, their rules and conditions may vary. One plan may limit in-service rollovers only to employees who are 59½.

Plan providers might also have special requirements for in-service rollover eligibility. You may only be eligible if only you have contributed to the plan for a minimum of five years. Meanwhile, some plans might only permit assets to be rolled over if they have been in the account for two years.

Regardless of your circumstances, youll first want to review your 401 summary plan document and then contact your plan provider to find out if you are eligible and what conditions apply.

Whats A 401 Rollover And How Does It Work

So that jobs history. But that 401 from your old employer is still your money. Choose your own adventure time: What are you going to do with it?

You could leave it where it is, but you wont be able to contribute any more to it after youve left. If you change jobs a lot, thats a lot of old accounts to keep track of. And while many employers pay at least part of your 401 plans administration fees, theres no guarantee theyll keep doing that if you leave.

You could also cash it out, but wait do not pass go, do not collect any of those dollars. This option comes with massive tax penalties. Like potentially over-50%-of-the-balance-in-your-account massive.

If youve decided that neither of those options is right for you, that leaves a 401 rollover.

Recommended Reading: How To Borrow Against My 401k

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Make A Plan Before Changing Investments

If you don’t need to make withdrawals from your 401 immediately after you retire, it’s possible that your investment mix won’t need much adjusting. You don’t want to outlive your money, so shifting too early to an investment mix that is too conservative may not be suitable for your situation. Of course, investments cannot guarantee growth or sustainment of principal value they may lose value over time. Past performance is not an indication of future results.

Recommended Reading: How To Know If I Have 401k

Consider A Debt Consolidation Loan

One component of your debt reduction plan could be a debt consolidation loan , Triggs says. But thats only if you qualify for a loan with a lower interest rate than your credit card or cards are charging.

A debt consolidation loan gives you the ability to make the same payment every month at a fixed interest rate with a fixed loan term, usually between 36 and 60 months, he says.

If a debt consolidation loan isnt available, Triggs suggests seeking help from a nonprofit consumer credit counseling agency like Money Management International.

Rollovers: The Complete Guide

A 401 rollover is the process by which you move the funds in your 401 to another retirement account usually either an IRA or another 401. A 401 rollover typically happens when you leave your employer, either to retire or to start a new job. There are certain regulations you need to follow when rolling over your assets, most notably the 60-day rule. And you will also need to choose a new financial institution to house your account when you roll over your money into an IRA. If youre considering a 401, a financial advisor can help you set up a retirement plan for your nest egg. Lets break down everything you need to know about 401 rollovers.

Read Also: Is There A 401k For Self Employed

Assets May Also Be Temporarily Frozen

Access to your funds, vested or not, may also be blocked if litigation related to the plan is in process. In such instances, assets may be temporarily frozen. Similarly, short-term restricted access to your funds may happen in the event the plan sponsor is changing record keepers or there is a blackout period in which funds cannot be changed or accessed in any way. You should know about this in advance as this is legal, and notices must be provided to active participants at least 30 days prior to the blackout start date.

Recently terminated employees may also be subject to different rules regarding access to their plans. These rules are governed by things such as resolving any lingering financial issues around a workers departurean outstanding loan, for example. If youve taken out a 401 loan and leave your job, youll have a specified time period in which to pay it back.

Finally, a lock may occur due to suspected fraudulent activity on the account. While fraud alerts are meant to protect account holders, sometimes they may be unaware of the alert and will need to call customer service to release the hold.

Read Also: Where To Move 401k Money

How Much Income Do You Need To Retire

Hopefully, you’ve already done some retirement planning in advance of making your decision to retire. But if you’re currently in planning mode, a great place to begin is with a retirement savings calculator, which can be a quick way to know if you have enough savings and income to retire. For help determining how much you might need, you could also try a retirement cost of living comparison calculator.

Recommended Reading: Can I Open My Own 401k Account

How To Break The Cycle If Youre On A Second Balance Transfer

Although doing multiple balance transfers might be a good approach to chipping away at high-interest debt, they also might be masking a deeper problem with your finances.

You cannot borrow your way out of debt. Moving balances for better interest rates may be helpful temporarily, but it will not solve your debt challenges if you are dealing with too much overall debt, Triggs says.

So, how can you get the cycle of second, third or fourth balance transfers?

Triggs recommends putting together a plan to pay off your high-interest debts that may involve a balance transfer but doesnt necessarily depend on it.

A consumer is never guaranteed the ability to open a new line of credit to transfer balances to. If the economy gets worse and credit tightens further, new lines of credit, especially for struggling consumers, may be harder to come by, he says.

Kelly says you must prioritize debt reduction in order to escape the cycle of balance transfers. If youre not aggressive about paying down a transferred balance, the debt will just continue to grow, she says.

What If You Have An Existing 401 At Your Previous Employer

If you have a 401 at a previous employer, youll want to consider whether a rollover makes sense for you. You may want to consult with a tax professional to make sure that you are making a decision that is best for your unique circumstances.

As youre thinking about what to do with your old 401, here are some options to consider:

Also Check: Where Is My Fidelity 401k Account Number

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Its Your Money And Your Choice

When it comes to what to do, there are advantages and disadvantages to all options so theres no one right answer for all. You need to review your options and choose whats best for you and your retirement. Retirement savings is one of the most important and long-lasting investment decisions youll ever make. If youre not sure what to do, you always have the option of talking to an advisor. Whether you need a bit of advice or a comprehensive financial plan, a Certified Financial Planner can help guide you in the right direction.

Don’t Miss: Can I Roll My Old 401k Into A Roth Ira

S To Roll Over 401k To Ira

The process is simple:

Decide Where To Open Your New Ira

When opening an IRA, most people will look towards a brokerage, and for obvious reasons. 401 accounts are notorious for their relatively limited investment selections. But by rolling your funds into an IRA at a brokerage, youll get to choose from a significantly larger pool of potential investments. In fact, many offer some combination of stocks, bonds, exchange-traded funds , mutual funds, options and more.

Managing your own retirement funds takes a lot of time and energy, but a financial advisor can do it for you. Many financial advisors specialize in retirement planning and investing, which is exactly the combination youll need. If you go this route, your advisor will manage your investments in an IRA according to your needs and current savings situation.

If you prefer an even more hands-off approach to investing, a robo-advisor could be a good option. When you open an IRA with a robo-advisor, an asset allocation profile will be created for you based on your age, risk tolerance and proximity to retirement. The robo-advisor will then invest and manage your assets for you according to this plan.

Regardless of which way you go, make sure you understand any account, investment or advisory fees you may incur. An overbearing fee structure can have an extremely negative effect on your portfolio, so keep an eye out for this.

Read Also: What Should I Contribute To My 401k