The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

How Much To Save For Retirement

According to Fidelity, you should be saving at least 15% of your pre-tax salary for retirement. Fidelity isnt alone in this belief: Most financial advisors also recommend a similar pace for retirement savings, and this figure is backed by studies from the Center for Retirement Research at Boston College.

For many people, however, saving for retirement isnt as simple as setting aside 15% of their salary.

The 15% rule of thumb takes a couple factors for grantednamely, that you begin saving pretty early in life. To retire comfortably by following the 15% rule, youd need to get started at age 25 if you wanted to retire by 62, or at age 35 if you wanted to retire by 65.

It also assumes that you need an annual income in retirement equivalent to 55% to 80% of your pre-retirement income to live comfortably. Depending on your spending habits and medical expenses, more or less may be necessary. But 55% to 80% is a good estimate for many people.

Finally, the 15% rule wont provide you with a nest egg that supplies all of your retirement income. Youll most likely derive part of your retirement income from Social Security, for example. All in all, the 15% estimate should provide you with steady retirement income that lasts into your early 90s, at a rate of around 45% of your pre-retirement income.

How Many People Have $1000000 In Their 401k

Fidelity Investments reports that the number of 401 investors with a net worth of 401 accounts for $ 1 million or more has reached 233,000 by the end of the fourth quarter for 2019, up 16% from the third quarter. of 200,000 and over 1000% from the 2009 estimate of 21,000.1 Joining the ranks of

How many 401k millionaires are there in 2021?

According to Fidelity Investments, one of the largest 401k providers in the United States today, the 401k million figure reached nearly 180,000 in 2021 thanks to the expansion of the bull market.

Also Check: Can I Rollover A 401k To A 403b

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you are single and earn less than $140,000, you qualify for a Roth IRA in 2021 for 2022 youll qualify for a Roth IRA if you earn less than $144,000. If you are married and earn less than $208,000 in 2021 you qualify for a Roth IRA for 2022 youll qualify for a Roth IRA if you earn less than $214,000.

This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2021 you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here, too. You can also contribute up to $6,000 in 2022 and the catch-up contribution limit remains as it was in 2021.

How Much Should You Save

Academic retirement saving studies use the term replacement rate. This is the percentage of your salary that youll receive as income during retirement from your retirement accounts. For example, if you made $100,000 a year when you were employed but receive $38,000 a year in retirement payments, your replacement rate is 38%. The variables included in a replacement rate include savings, taxes, and spending needs, and this rate may go up and down during the course of your retirement depending on a variety of factors such as market fluctuations, and your tax bracket, which could be subject to change.

Don’t Miss: How To Cash Out 401k After Leaving Job

Putting It All Together

After youve answered the above questions, you have a few options.

The table below shows our calculations, to give you an estimate of a sustainable initial withdrawal rate. Note that the table shows what youd withdraw from your portfolio thisyear only. You would increase the amount by inflation each year thereafteror ideally, re-review your spending plan based on the performance of your portfolio.

We assume that investors want the highest reasonable withdrawal rate, but not so high that your retirement savings will run short. In the table, weve highlighted the maximum and minimum suggested first-year sustainable withdrawal rates based on different time horizons. Then, we matched those time horizons with a general suggested asset allocation mix for that time period. For example, if you are planning on needing retirement withdrawals for 20 years, we suggest a moderately conservative asset allocation and a withdrawal rate between 4.9% and 5.4%.

The table is based on projections using future 10-year projected portfolio returns and volatility, updated annually by Charles Schwab Investment Advisor, Inc. . The same annually updated projected returns are used in retirement saving and spending planning tools and calculators at Schwab.

The Average 401 Balance By Age

Lets focus on the 401 and what people should have in their 401 by age. The entire goal is to accumulate enough money in your 401 and other retirement accounts to eventually live financially free.

The average 401 balance at the end of 1Q 2022 was roughly $121,700. Therefore, what should the 401 savings by age be today? Given the median age in America is about 36 years old, the average 36-year-old should have a 401 balance of around $121,700. Unfortunately, $121,700 is still pretty low.

As an educated reader who is logical and believes saving for retirement is a must, Ive proposed a 401 savings by age recommendation table that shows how much each person should have sved in their 401k at age 25, 30, 35, 40, 45, 50, 55, 60, and 65. The amounts are much greater than the average 401k savings by age in America.

We stop at 65 because you are allowed to start withdrawing penalty free from your 401 at age 59 1/2. Meanwhile, I pray to goodness you dont have to work much past 65. By age 65, you will have had 40+ years to save and investment already!

Also Check: What To Do With 401k When You Leave A Company

Can I Retire At 62 With $400000 In 401k

Shawn Plummer

CEO, The Annuity Expert

When it comes to retirement planning, there are a lot of factors to consider. How much money do you need to retire? What will your monthly expenses be in retirement? How long will you live? These are all important questions that you need to answer if you want to have a successful retirement. In this guide, we will explore the question of whether or not you can retire at 62 with $400,000 saved in your 401k. We will also offer some retirement planning advice for those who are looking to retire as soon as possible!

Dont Miss: Can I Withdraw 401k After Leaving Job

Don’t Forget The Match

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

Read Also: Can I Move My 401k From One Company To Another

Leveling The Playing Field

Because they arent offered through employers, IRAs are not subject to the type of nondiscrimination testing that applies to 401 contributions.

However, IRAs were developed to encourage the average worker to save for retirement, not as another tax shelter for the rich. To prevent unfair benefit to the wealthy, the contributions to a traditional IRA that are tax-deductible may be reduced if the account holder or spouse is covered by an employer-sponsored plan, or if their combined income is above a certain amount.

Also, Roth IRA contributions are phased out for people whose modified adjusted gross income is above a certain level.

Reduced contributions to Roth IRAs are allowed for:

- Single filers with MAGIs between $125,000 and $140,000 for 2021 .

Roth IRA contributions are not allowed for:

- Single filers earning more than $140,000 in 2021 .

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use the additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pre-tax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.

Recommended Reading: Can I Buy Bitcoin With My 401k

Beyond The 4% Rule: How Much Can You Spend In Retirement

Youve worked hard to save for retirement, and now youre ready to turn your savings into a paycheck. But how much can you afford to withdraw from savings and spend? If you spend too much, you risk being left with a shortfall later in retirement. But if you spend too little, you may not enjoy the retirement you envisioned.

One frequently used rule of thumb for retirement spending is known as the 4% rule. Its relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation. By following this formula, you should have a very high probability of not outliving your money during a 30-year retirement, according to the rule.

For example, lets say your portfolio at retirement totals lets say your portfolio at retirement totals $1 million. You would withdraw $40,000 in your first year of retirement. If the cost of living rises 2% that year, you would give yourself a 2% raise the following year, withdrawing $40,800, and so on for the next 30 years.

How You Can Contribute To An Ira

Each person can contribute up to $5,500 in an IRA and there are several ways you can max out an IRA if you choose to . Decreasing your 401k contributions is one way.

You can also use some of the $1,500 cash savings you accumulate monthly. Suppose you want to make the contributions all at once. In that case, you can use a portion of your emergency fund to partially fund your IRA, then set up automatic investments to using dollar cost averaging to max out your IRA over the year.

It would take $458.33/mo. per person to max out an IRA with monthly contributions. You can repay your emergency fund over the next few months.

I dont normally recommend people use their emergency funds to invest, but you can probably afford to do this as you and your husband both have stable jobs. Your excess cash flow should make it relatively easy for you to build your emergency fund back up over just a couple of months.

Also Check: Can I Transfer My Work 401k To A Roth Ira

Maximize And Automate Contributions

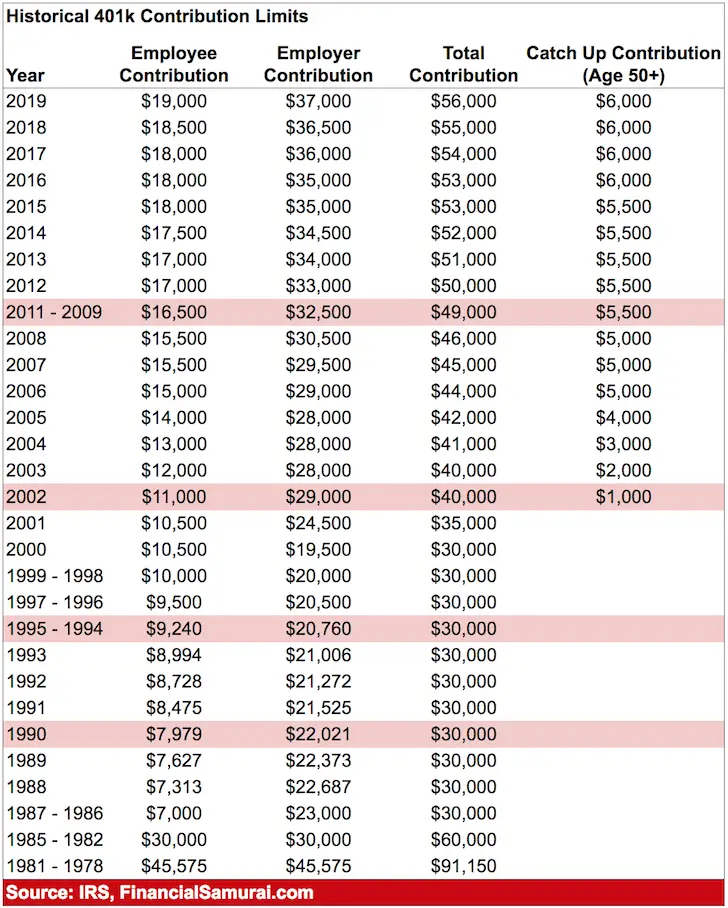

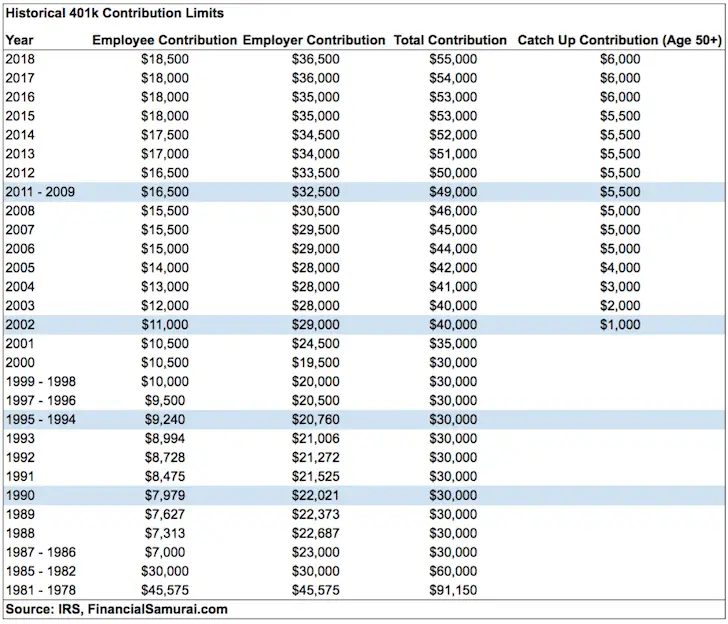

Knowing how much to contribute to your 401 in your 20s can be challenging since your salary in the early years of your career may not be that high. If you are able, it is a good idea to put away as much money as possible into your 401, up to the maximum amount allowed by the IRS. For 2021, the annual limit on your own contributions is $19,500. This amount has increased to $20,500 for 2022.

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

Don’t Miss: Can I Move Money From My 401k To An Ira

Plan To Replace About 80% Of Income

When you stop working, aim to replace about 80% of pre-retirement earnings from all income sources combined, such as 401s and IRAs, Social Security, and pensions.

You can anticipate spending less because youll no longer be paying payroll taxes or making 401 contributions. You may also spend less on things like gas and clothing because youre no longer working. The actual amount youll need in order to replace your working income depends on how frugal or luxurious you want your retirement to be.

Withdrawing From Your 401

You cant withdraw money from your 401 before a certain age without incurring a financial penalty .

The age when you can begin withdrawing is 59-1/2 for most people, 55 in some exceptional cases .

Even though you arent paying taxes on your contributions now, you will pay them eventually, as you withdraw money during retirement.

You May Like: How To Close Vanguard 401k Account

The Cost Of Medical Expenses In Retirement

In the brief, researchers used data from the 2018 Health and Retirement Study to see how much of retirees’ Social Security benefits and total retirement income was going toward medical-related expenses such as Medicare premiums, prescription drugs, surgeries and doctor visits. And while it may seem like having Medicare means paying lower medical costs, this was not the case.

The study found that, in 2018, 12% of the median retiree’s total retirement income went toward medical expenses. For the median retiree, 25% of their Social Security benefits went towards medical costs. In total, the median retiree spent $4,311 on medical expenses, with most of that money going toward Medicare premiums.

In 2022, the monthly premium for Medicare Part B, which is medical insurance, was $170.10.

“With out-of-pocket health expenditures eating away at retirement income and Part B premiums on the rise, it is understandable why many retirees likely feel that making ends meet is difficult,” the researchers noted.

It also turns out that people preparing for retirement aren’t great at forecasting how much they’ll spend on medical expenses later in life, as another recent study by the Center for Retirement Research at Boston College found.

According to the 2022 Fidelity Retiree Health Care Cost Estimate, the average retired couple at age 65 can expect to spend around $315,000 on health care expenses in retirement.