How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Make Sure You Actually Contributed

Before you go through the hassle and process of calling the HR department at your old employer, or searching through databases, its a good idea to verify that you contributed to the plan.

If you are unsure if you contributed to a 401 plan, you can check your previous year tax return and old W-2. Any contribution will be in Box 12 of the W-2.

ERISA, or the Employee Retirement Income Security Act of 1974, sets minimum standards for retirement plans, and protects retirement savings from abuse or mismanagement.

Among other things, employees are required to make annual reports

Picking The Best Option

Figuring out what to do can be difficult, as there may be complex tax and investment return implications for each decision.

In many cases, unless youre ready to retire, moving the funds into a new retirement account is often a good option. If your funds are in an IRA that was opened in your name, the IRA provider may be charging high fees. And, unless the old employer offers a much better plan than your current options, consolidating your money within a few accounts can make it easier to track your investments and help you qualify for discounts or benefits from plan administrators.

The easiest way to do this is with a direct transfer, where the money never touches your hands. Otherwise, 20 percent of the money has to be withheld for taxes, and you only have 60 days to deposit the funds into the new retirement account or the withdrawal will be treated as a cash out.

Fair warning, there can still be a lot of paperwork involved with a direct transfer. However, the company that youre sending the money to will often be able to help you with the process.

No matter what option you choose, if youve got old retirement accounts floating out there its in your best interests to track that money down sooner than later. The more you know about your retirement funds, the more options you may have the next time youre faced with a major financial setback. At the very least, youll understand where you stand as you prepare for retirement.

Also Check: Can You Withdraw From Your 401k

You’ve Found Your Old 401s Now What

Once you’ve located your old 401s, you have a few options. Some come with penalties, some require taxes to be paid, and some don’t require either.

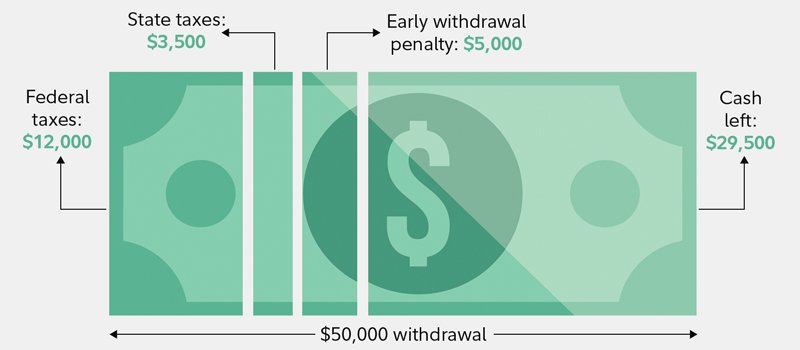

You have the option to cash out all of the funds in your old 401s. However, the IRS will charge you a 10% early withdrawal penalty. In very few cases, can this penalty be waived, so it’s best to leave it saved until you’re at least 59½.

Secondly, you can rollover your old 401s into your current employer-sponsored plan. This comes with no penalty or taxes. Because you are rolling it over into another retirement account, you won’t incur any additional costs in doing so.

Lastly, you can consolidate your 401s into an IRA. Like a 401, an IRA is a retirement account, so it’s free from any penalties and taxes. These are held outside of your employer’s 401 plan, but they’re easy to set up and come with many more investment options.

What You Can Do Next

Creating and maintaining a financial plan can help you keep tabs on all your money. If you need help, visit a Schwab Financial Consultant at your local branchor call us at .

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers are obtained from what are considered reliable sources. However, their accuracy, completeness or reliability cannot be guaranteed.

This information does not constitute and is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner or investment manager.

For informational purposes only. Third party trademarks are the property of their respective owners and used with permission. Third party firms and their employees are not affiliated with or an employee of Schwab.

© 2022 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.

Also Check: How To Take Out A 401k Loan Fidelity

How To Locate An Old 401 Plan

The first step that you should always take when trying to track down old 401 plans is to call the human resources department of each of your former employers.

They should be able to tell you whether you still have 401 plans with their companies.

If you cant find the number to the HR department, try calling your previous supervisor or boss and ask him or her to get you in touch with HR.

If you have an old 401 plan statement available, then you can contact your previous plan administrator and they should be able to tell you where your plan is now.

Or you can contact a former co-worker who still works at your old company and ask him or her to give you your plans current contact information.

Contact Your Old Employer

When you cant locate an old 401, your prior employer is the first entity you should contact. Reach out to human resources and they should be able to point you in the right direction.

Be prepared to provide the dates you worked for them, your full name and your Social Security number.

Note that if there was more than $5,000 in your 401, your funds are likely to still be in your old workplaces account. If your balance was $1,000 or less, however, its possible that your employer sent a check for the total amount to your last known address.

You May Like: How Should I Roll Over My 401k

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

Also Check: What Can You Do With A 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

You May Like: Should You Use 401k To Pay Off Debt

Reinvesting In Stable Funds

The word stable is subjective when the market is constantly changing. We can make assumptions about what will remain stable during a recession by observing past performance or current trends.

Many investors consider bonds to be a very safe haven during economic downturns. This does not include certificates of deposits or the enormous amount of commercial paper that many individuals have become acquainted with for the first time in 2008.

In contrast to stocks, the other type of security, bondholders lend money rather than invest it. As a result, bankruptcy laws favor lenders rather than part-owners . In the event of bankruptcy, you will be able to liquidate your assets before other creditors.

Although some experts believed that dividends in the most stable firms might be secure for 401 investments because of natural economic growth, the severity of the current financial crisis has made this market significantly riskier than it has been in a long time, with few firms capable of generating dividend profits to share in either stock offerings or cash payments.

One needs to be sure they do not trade stability for actually falling behind the rate of inflation, which is a losing proposition as far as the relative value of that money. In early 2008, when the inflation rate was around 3%, many 401 funds had returns at the same rate. After administrative costs and other fees, many people were losing money on their plans but were unaware because they had not liquidated them yet.

What Are Your Options For Old Retirement Plans

You generally have four options for dealing with money thats in an employer-sponsored retirement account when youre no longer working at the company:

- Leave the money where it is: Although you might not be able to contribute to the account any longer, you may be able to leave the money in your former employers plan. Sometimes, you may need to meet a minimum account balance to qualify, such as $200 for a TSP or $5,000 for some 401s.

- Transfer funds to a new employer-sponsored plan: If you have a new job with a company that sponsors a retirement plan, you may be able to roll over the money into your new employers plan. When this is an option, compare the previous and new plans fees, terms, and investment options to see which is best.

- Roll over to an individual retirement account: You can also move the money into an individual retirement account . An IRA may give you more control as you can choose where to open the account and invest in a wider range of funds. Its also fairly easy to move from one IRA to another as the account isnt tied to your employer. However, IRAs could have more fees, especially if you dont have a lot of assets and dont qualify for lower-cost investment funds.

- Cash out: You can also take the money out of retirement accounts completely. But unless youre 59½ or older , you may need to pay a 10 percent early withdrawal penalty in addition to income taxes on the money.

Also Check: How Do I Transfer My 401k To A New Job

How To Find Old 401 And Pension Accounts

The challenge will be finding that money and claiming it. If youve worked a dozen jobs and are now in your fifties and looking forward to retirement, theres a good chance youll struggle to remember everywhere you worked. But how do you find old 401 and Pension Accounts?

You might remember carrying bags in a hotel one summer but you might also struggle to remember the name of the hotel or when exactly you were there.

The good news is that you dont have to try to remember every place youve ever worked and that might have given you pension payments.

Look For Contact Information

If you don’t know how to contact your former employer — perhaps the company no longer exists or it was acquired or merged with another company — see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Also Check: How To Roll My 401k Into A Roth Ira

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Recommended Reading: What Happens To My 401k When I Change Jobs

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Searching The National Registry

Another place to try is the National Registry of Unclaimed Retirement Benefits . This is an online database you can use to search for an unclaimed 401k that you may have left with a previous employer. Youll need to enter your Social Security number to search for lost retirement account benefits.

In order for your name to come up in the search results, your former employer must have entered your name and personal information in that database. If they havent done so, its possible you may not find your account this way.

Don’t Miss: How To Start A 401k For My Small Business