How Does A 401 Earn Money

Your contributions to your 401 account are invested according to the choices you make from the selection your employer offers. As noted above, these options typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as you get closer to retirement.

How much money you contribute each year, whether or not your company matches your contribution, how your contributions are invested and the annual rate of return on those investments, and the number of years you have until retirement all contribute to how quickly and how much your money will grow. And provided you don’t remove funds from your account, you don’t have to pay taxes on investment gains, interest, or dividends until you withdraw money from the account after retirement , in which case you don’t have to pay taxes on qualified withdrawals when you retire).

What’s more, if you open a 401 when you are young, it has the potential to earn more money for you, thanks to the power of compounding. The benefit of compounding is that returns generated by savings can be reinvested back into the account and begin generating returns of their own. Over a period of many years, the compounded earnings on your 401 account can actually be larger than the contributions you have made to the account. In this way, as you keep contributing to your 401, it has the potential to grow into a sizable chunk of money over time.

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

How Much You Can Afford To Save

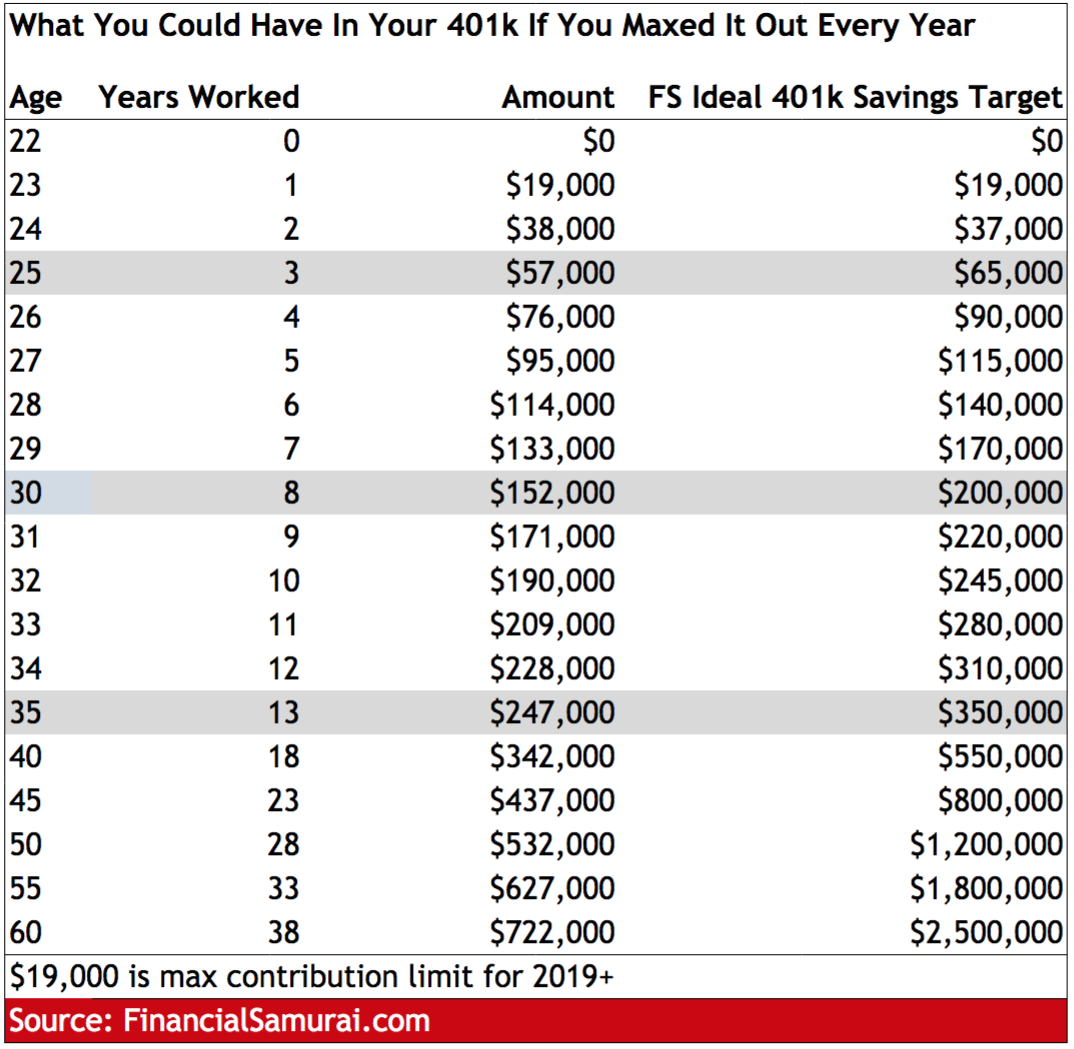

In 2021, the annual contribution limit for both traditional and Roth 401s is $19,500, plus an additional $6,500 catch-up contribution for participants age 50 or over.

This is much more than allowed with a Roth IRA, where contributions are limited to $6,000, plus an additional $1,000 for participants age 50 or over. That could make Roth 401s an attractive option for people who want to save more post-tax.

But its important to note that even if you choose a Roth 401, all company matches will go into a traditional 401. That means that you will owe income tax on any employer contributions, and the earnings on those contributions, when you withdraw the money during retirement.

A few other things to know: With both types of 401s, youre required to begin taking minimum distributions at age 72. And early withdrawals made before you turn 59½ are typically subject to an additional 10% penalty.

Also Check: How Much Money Should I Put In My 401k

Don’t Miss: How Much Can You Take Out Of Your 401k

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

You May Like: How To Collect My 401k Money

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Recommended Reading: How Do You Get Your 401k When You Retire

Traditional And Roth Iras

Like 401s, contributions to traditional IRAs are generally tax-deductible. Earnings and returns grow tax-free, and you pay tax on withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, meaning you dont receive a tax deduction in the year of the contribution. However, qualified distributions from a Roth IRA are tax-free in retirement.

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

Recommended Reading: Should You Use 401k To Pay Off Debt

Recommended Reading: Can You Borrow From Your 401k

Is A 401 Plan Right For Your Business

You may think your business is too small for a 401 plan, but these plans arent only for big companies. Meadows noted that this is a common misconception, saying small business owners have a few main reasons for being hesitant about implementing a 401:

- Paying for a 401 plan would affect the success of the business if it already doesnt have enough money to run.

- The plans are complicated and usually involve a lot of jargon.

- Plans are expensive. There are fees involved, such as managing fees and investment fees, that arent usually presented at the outset.

While the IRS website tells you exactly what you need to know about the plans, your employees might not have any idea what the plan actually means. Meadows advised employers to use plain language when explaining the plan to their employees.

Do you not understand the plan yourself? Do you have questions about your contributions as an employer? Consider hiring a financial advisor with plenty of experience in the industry, Meadows said.

The best financial advisors are the people who have already done it, he added.

If your business offers a 401, that can mean a lot for the talent you have and the talent you want.

Tip: Companies of any size can offer a 401 plan. If youre new to the process, connect with a financial advisor who can help you find the best option for your company.

Roth 401s Reduce Taxes Later

Like tax-deferred 401s, earnings grow tax-free in a Roth 401. However, the Roth 401 earnings aren’t taxable if you keep them in the account until you’re 59 1/2 and you’ve had the account for five years.

Unlike a tax-deferred 401, contributions to a Roth 401 do not reduce your taxable income now when they are subtracted from your paycheck. Contributions to a Roth 401 are after-tax contributions. You are paying taxes as you contribute, so you wont have to pay taxes on the funds or their earnings when you withdraw the money.

- Savers who believe their income and tax rate during retirement will be lower than while working usually opt for a traditional 401.

- Those who predict they will have more income and have a higher tax rate when they retire often prefer the Roth 401.

Among other things, the tax savings you get with a Roth 401 depends partially on the difference between your tax rate while employed and your future tax rate during retirement. When your retirement tax rate is higher than your tax rate throughout your working years, you benefit tax-wise with a Roth 401 plan.

- Taxpayers often have the option of funding both a Roth 401 and a tax-deferred 401.

- The IRS adjusts the maximum contribution amount to account for cost-of-living and announces the annual limits for each type of 401 at least a year in advance.

- Traditionally, the IRS has provided an additional contribution option for savers age 50 and older to enable them to prepare for their pending retirement – $6,500 in 2021.

Recommended Reading: How Do I Get My 401k Money After I Quit

What Happens To Your 401 When You Leave Your Job

You basically have four options when you leave your job: Do nothing and leave the money in your old 401, roll it over into an IRA, roll it into your new employers 401 plan, or cash out your 401.

Lets get this out of the way: Do not cash out your 401plan. Bad idea! Heres why: When you cash out your 401, you dont even get to keep all of the money! Youll owe taxes on the total amount as well as a 10% withdrawal penalty.

Lets say youre in the 24% tax bracket and decide to cash out the $10,000 you have in your 401 plan when you leave your job. Even though you started with $10,000 in your 401, youll be left with only $6,600 after taxes and penalties.

Your best option is to roll over your 401 funds into an IRA because it gives you the most control over your investments and what mutual funds to choose from.

If you rolled that $10,000 over to an IRA and let it grow for 30 years, it could be worth about $267,000! Even a small cash-out has a big impact on your savings. Your financial advisorcan help you roll over any old 401s so you get the most out of your investment.

You Get A Tax Break For Contributing To A 401

The core of the 401s appeal is a tax break: The funds for it come from your salary, but before tax is levied. This lowers your taxable income and cuts your tax bill now. The term youll often see used is pre-tax dollars.

Say you make $8,000 a month and put $1,000 aside in your 401. Only $7,000 of your earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

Yes, you will have to pay taxes someday. Thats why a 401 is a type of tax-deferred account, not tax-free. Well get back to that.

You May Like: How To Rollover 401k To Ira Td Ameritrade

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Roll Over Your 401k Into A New 401 Or Ira

If your new employer offers a 401k plan with low costs and a wide variety of investment options, this might be a viable option to consider. What could be an even better option though is to roll over your old plan into a Rollover IRA. 401s can be costlier than IRAs, mostly if they come with an extra layer of fees, and can be lacking in investment options like low-cost ETFs.

You or your advisor can choose among thousands of ETFs, bonds, mutual funds or individual stocks in an IRA. By law, 401 plans can offer as few as three investment options. Mutual funds are not only expensive, but also tend to underperform the market. ETFs, on the other hand, provide a relatively low-cost, tax-efficient way to create a well-diversified portfolio. Low-cost investments help boost your retirement security without having to ramp up savings or portfolio risk.

Don’t Miss: How Much Can We Contribute To 401k

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

Also Check: How Do I Roll A 401k Into An Ira

There Are Contribution Limits For 401s

The IRS sets an annual limit on how much money you can set aside in a 401. That limit can change because it is adjusted for inflation. For 2021, you can put away $19,500. Those 50 or older by year-end can contribute an extra $6,500. Check out the Financial Industry Regulatory Authoritys 401 Save the Max Calculator, which will tell you how much you need to save each pay period to max out your annual contribution to your 401. If you cannot afford to contribute the maximum, try to contribute at least enough to take full advantage of an employer match .

Dont Miss: What Happens When You Roll Over 401k To Ira

What Is An Employer Profit

While not required, some employers choose to make a profit-sharing contribution to their 401 plan. Despite its name, a profit-sharing contribution does not have to be based on profits. Its simply an additional contribution an employer chooses to make to all eligible participant accounts to help employees save more towards retirement.

Profit-sharing contributions arent based on employee participation. In other words, an employee doesnt have to make deferrals into the plan to receive an allocation of the profit-sharing contribution. The plan may have a fixed profit-sharing formulaor it may have a discretionary formula .

For more information, check out our article on profit-sharing plans.

Also Check: How Do I Check My 401k For Walmart

How Do You Get A 401

401 plans are only offered by employers if you dont have access to a 401 at your workplace, you cant participate in one. Talk to your human resources department to find out whether your company offers a 401 plan and, if so, how you can join.

If your company doesnt offer a 401, that doesnt mean you cant reap 401-style retirement and tax benefits. You can still open an IRA on your own. IRAs offer the same opportunity to save for retirement with tax advantages.

What Are The Similarities And Differences Between 401 Fiduciary Roles

There are three types of fiduciaries for 401 plans.

ERISA 3 plan administrator: Plan fiduciary that focuses on plan administrative functions such as distributions, eligibility and providing participant notice. The plan sponsor is the 3 plan administrator unless it hires a service provider that agrees in writing to take some of the fiduciary responsibility for plan administration. Hiring a 3 plan administrator can help offset some of duties that many plan sponsors find demanding.

ERISA 3 investment advisor: Serves as a co-fiduciary with the plan sponsor with respect to choosing the plans investment line up. It can provide investment recommendations, but only the sponsor retains the authority to make investment decisions for the plan.

ERISA 3 investment manager: Fiduciary that takes responsibility for choosing the plans investment lineup. The plan sponsor retains the fiduciary responsibility to provide oversight of the investment manager, but is relieved of fiduciary responsibility for investment selection if it does so.

Learn more about the differences between 3, 3, 3 fiduciaries.

You May Like: What Percent To Put In 401k