Third If You Choose Not To Roll Over You Can End Up With Too Many Retirement Accounts

Fewer accounts mean more than just fewer passwords its also easier to estimate your savings.

Most importantly, having your money invested across multiple accounts makes it difficult to create a coherent investment strategy.

Most financial experts advise that you invest in riskier assets like stocks when youre young and shift to more conservative investments like bonds as you get closer to retirement.

That strategy allows you to maximize growth and helps protect your wealth in case of a market downturn.

When your retirement is held across five or more plans, it is very challenging to manage your investing allocations.

These three reasons are the primary drawbacks of doing nothing with your 401 or 403 or rolling your money to your new employers plan.

Now, for the advantages of a rollover to an IRA .

Buy Bitcoin With Your 401 Savings Or Standard Ira

In as little as a few days from now, you can convert your 401 savings to buy bitcoin.

But most 401 programs dont allow the direct purchase of digital currency. So the easiest and quickest way to get the benefits weve listed above is to use a self-directed Digital IRA.

Self-directed means youre in charge. While that may sound challenging, its really simple. Plus, you get to maintain complete control of your investments. On top of that, IRS guidelines allow these sorts of IRAs to invest in a complete assortment of different assets, including bitcoin. They can include gold, silver, real estate, private equity, and more.

You May Like: How Much Does A Solo 401k Cost

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. IRAs typically offer a much wider array of investment options than 401s, unless you work for a company with a very high-quality planusually the big, Fortune 500 firms.

Some 401 plans only have a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the companyâs stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. IRA fees tend to run cheaper depending on which custodian and which investments you choose.

With a small handful of exceptions, IRAs allow virtually any asset, including:

If youâre willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

Also Check: How To Get My 401k

Cares Act 401k Withdrawal Deadline 2021

What are the withdrawal rules for a 401k? When you withdraw money from a 401k, you must include the money you withdraw as income on your federal income tax return. In general, 20 percent of the distribution must be withheld for estimated tax payments. In addition to the taxes you owe, you must also pay a 10% early withdrawal penalty.

Also Check: How To Find My Fidelity 401k Account Number

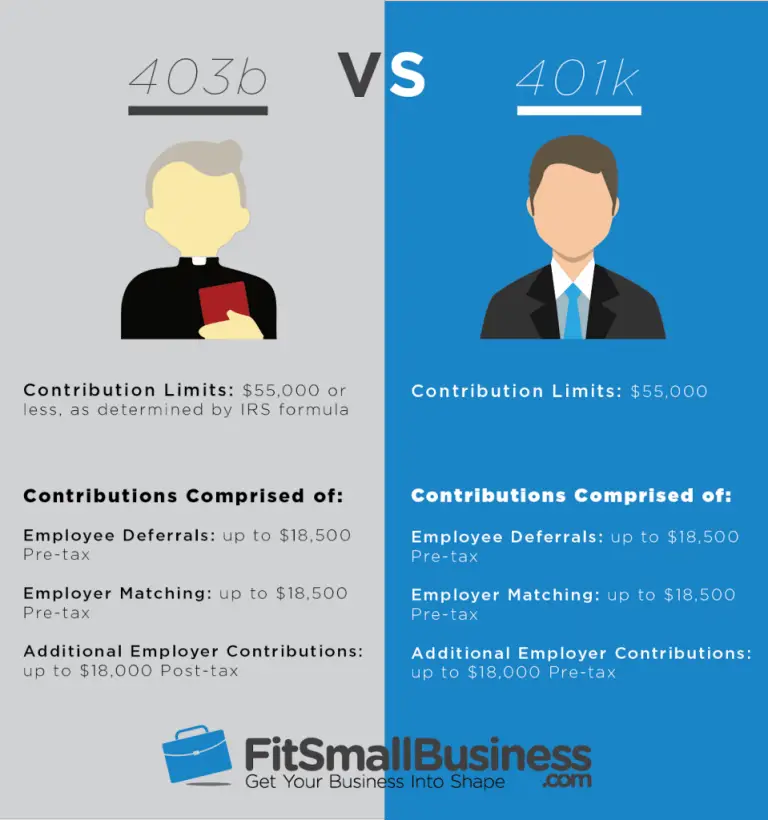

Options For Your 401 Or 403

When you leave your job, you have four options for what to do with your 401 or 403:

Before going into these options, its important to note that a 401, 403, or an IRA is an account.

Within these accounts, you can choose between various investment options with varying fees, risk profiles, and returns .

You can think of an IRA or a 401 like choosing the restaurant where you want to eat.

Once youre there, you have a variety of menu options at different price points, flavor profiles, and nutritional value.

An employer-sponsored plan offers curated investing options. When youre in an employer-sponsored plan, you dont get to choose the restaurant.

If your employer has chosen Chipotle, you can select a Carnitas burrito or a vegetable burrito bowl. But youre out of luck if youre in the mood for tomato bisque.

In contrast, choosing an IRA gives you the choice of what restaurant to go to. And what menu options to select.

You can choose to go to Whole Foods, where you can affordably eat sushi, pizza, or the hot food bar.

But you can also choose a fancy restaurant at a higher price point but with more personal attention.

Returning to the four options for your old 401 or 403, cashing it out is the worst option.

You May Like: Where To Invest 401k Now

What Is A Plan Offset Amount And Can It Be Rolled Over

A plan may provide that if a loan is not repaid, your account balance is reduced, or offset, by the unpaid portion of the loan. The unpaid balance of the loan that reduces your account balance is the plan loan offset amount. Unlike a deemed distribution discussed in , above, a plan loan offset amount is treated as an actual distribution for rollover purposes and may be eligible for rollover. If eligible, the offset amount can be rolled over to an eligible retirement plan. Effective January 1, 2018, if the plan loan offset is due to plan termination or severance from employment, instead of the usual 60-day rollover period, you have until the due date, including extensions, for filing the Federal income tax return for the taxable year in which the offset occurs.

Donât Miss: Can I Withdraw My 401k If I Leave My Job

Include The Rollover Check Ira Deposit Slip And Send It To Tastyworks

Recommended Reading: How To Change 401k Contribution Fidelity

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

What Are The Rules For Rolling Over A 403

The plans that youre allowed to roll over your savings into depend on the type of 403 that you have either traditional or Roth. A traditional 403 is pre-tax meaning, the money you contribute to the plan isnt taxed until you start making withdrawals. Contributions to a Roth 403 are taxed at the time you make them but your withdrawals are not subject to income tax.

You can only roll a traditional 403 plan into a traditional IRA or other pre-tax retirement plan. And you can only roll over a Roth 403 into another Roth-style account.

Don’t Miss: What Happens To A 401k When You Leave A Company

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

You Can Invest With A Wider Choice Of Funds Tailored To Your Goals Interests And Risk Appetite

Unlike the typical 401, an IRA comes with the ability to select asset typesand possibly additional investment guidance individually. A broader range of available assets and types may include individual stocks and bonds, CDs, index funds, target-date funds, goal-specific mutual funds, and real-estate investment trusts . âPick what types of investments make sense for you and your future, says Markwell.

Donât Miss: How To Rollover 401k To Ira Td Ameritrade

You May Like: Should I Rollover 401k To New Employer

Pros Of Converting Your 401 Assets Into A Roth Ira

The advantages of a Roth IRA include all of the benefits of a traditional IRA listed earlier. In addition:

You decide when to withdraw money.

Roth IRAs have no but beneficiaries are subject to distribution rules.

You may worry less about taxes.

All future earnings grow tax-deferred and may be tax-free if the account is at least five years old and you are older than 59½.2

Con #: You Have No Choice In What Funds Your Former Employers Choose

Since your former company administrates the retirement plan, youll only be able to select funds from the options they provide. For example, if youve read some great information about a mutual fund that focuses on sustainable agriculture but your plan doesnt offer it, youll need to go elsewhere to invest in it. You’re losing the flexibility that you could have with a traditional or Roth IRA, adds Markwell.

Read Also: When You Quit Your Job Do You Get Your 401k

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

You May Like: When Can I Withdraw From My 401k

Can I Bring My 401 Funds To The Plan At My New Job

Yes. You can transfer your current assets from your old 401 plan or your transitional IRA without having any tax consequences, provided the new employers plan allows for rollovers. This is called a direct rollover. Its another way to continue enjoying the benefits and ease of a 401 plan. Consider these pros and cons of transferring these assets to your new employer’s plan:

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

You May Like: How To Take Money Out Of 401k Fidelity

Rollover To Traditional Ira

This is the most common option for self-employed individuals. One of the biggest benefits of rolling a 403 plan to a traditional IRA account is the expanded investment options. By nature, traditional 403 plans are limited in their investment options. A traditional IRA offers flexibility with where you invest your money. Once your rollover process is all set, you can allocate your funds into:

- Mutual funds

- Individual stocks

Traditional 403 plans mainly to allow you to invest in specific mutual funds and annuities. Rolling over into a traditional IRA will provide you with more investment options that can enhance your returns. Its important to note that there are a few disadvantages to a 403 rollover to a traditional IRA.

A traditional IRA tends to have higher fees and will have transaction costs that may not have been charged with a 403 plan. However, if you invest money into funds that have low management fees this shouldnt be much of an issue. In addition to this, if you ever happen to file for bankruptcy or be part of a lawsuit, the funds in your IRA are not subject to protection by ERISA. In contrast, funds in a 403 account are subject to protection by ERISA and would not become part of a bankruptcy or lawsuit.

How To Rollover Assets Out Of A U

Contact TIAA or Fidelity Investments. Certain rollovers may be done via telephone on a recorded line or online at the vendor website.

If you are using a rollover form return it to TIAA or Fidelity. The form will ask which U-M plan you want to rollover assets from. Refer to the Plan Names and Numbers for the plan types and their record keeping number with TIAA and Fidelity.

Also Check: How To Pull Money From 401k

Open Your Rollover Ira In 3 Easy Steps Were Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Also Check: How Do You Repay A 401k Loan

Rolling Over To A New 401

The first step in transferring an old 401 to a new employers qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

Read Also: How Do You Get Money From Your 401k

What Happens To My 401 Or 403 If I Change Jobs

Fortunately, if you change jobs, you wont have to worry about losing your retirement plan. You have the option to roll over your 401 or 403 into a traditional IRA. If your new employer offers a 401 or 403 of their own, you can also transfer your retirement savings from your old plan to your new one.

Why Is This A Restriction On Most Plans

401 record-keepers often make money by how much asset charges and more as assets are in the plan. Sometimes business owners or HR want to help the plan by building up plan assets, as this can lower fees for all employees and the business.

This default option is sometimes picked for a plan without the business owner or the HR even knowing about it.

Read Also: How To Get 401k Money After Quitting